Updated over 4 years ago on .

Economic Update (Monday, June 21, 2021)

Economic Update

(Monday, June 21, 2021)

Fire has always been part of Southern California’s ecosystem, but today’s wildfires are more intense, more frequent, and more dangerous than ever. The memories of massive blazes like the Woolsey, Camp, and Thomas fires are still fresh in our minds, leaving many of us wondering how to prepare for the next inevitable wildfire. While many experts say “fire season” is now almost year-round, it’s clear that incidents spike during the dry, hot months of summer and fall. In fact, this year’s projections call for a wildfire potential outlook of “above average” starting in July, with the most recent report from the National Interagency Fire Center noting that “drought is expected to persist if not worsen across much of the West.” The report indicates the San Joaquin Valley may be at greatest risk for increased summer fires. Preparing for a wildfire means first doing everything you can to prevent one from ever starting through choosing the right plants for your area and maintaining your property with a mind for fire safety (“hardening”). The second prong is developing an evacuation plan and being ready in the event you need to evacuate. So with summer wildfires on our mind, let’s get into the weeds…

Housing Starts Increased 3.6% in May. Housing starts increased 3.6% in May to a 1.572 million annual rate. Starts are up 50.3% versus a year ago. The gain in May was due to both single-family starts and multi-family starts. In the past year, single-family starts are up 49.8% while multi-unit starts are up 51.4%. Housing construction rebounded in May, continuing a recent volatile ride as builders try to find their footing in a post-pandemic economy. Supply chain constraints for key materials such as lumber – paired with difficulty in finding qualified workers – have moderated the pace of building since late 2020. That said, the 12-month moving average, which sifts through the recent volatility, shows construction now stands at the fastest pace since 2007. The monthly pace of activity will ebb and flow as the recovery continues, but expect housing starts to remain in an upward trend. Why my confidence? Because permits for future construction have now outpaced new construction for fifteen consecutive months. This has resulted in a backlog of projects that have been authorized but not yet started (which stands at the highest reading since the series began back in 1999). As I’ve mentioned before, there has been a long running deficit in new home construction in the US, which needs roughly 1.5 million housing starts per year based on population growth and scrappage (voluntary knockdowns, natural disasters, etc.). However, we haven't built that many new homes in any calendar year since 2006. But now, with plenty of future building activity in the pipeline and builders looking to boost inventory of homes (as well as meet consumer demand), it looks likely construction in 2021 will finally surpass the 1.5 million unit benchmark.

Fed Leaves Interest Rates Alone - But. The Federal Reserve on Wednesday raised its expectations for inflation this year and brought forward the time frame on when it will next raise interest rates. However, the central bank gave no indication as to when it will begin cutting back on its aggressive bond-buying program (though Fed Chairman Jerome Powell acknowledged that officials discussed the issue at the meeting). As expected, the policymaking Federal Open Market Committee unanimously left its benchmark short-term borrowing rate anchored near zero. But officials indicated that rate hikes could come as soon as 2023 (after saying in March that it saw no increases until at least 2024). Though the Fed raised its headline inflation expectation to 3.4%, a full percentage point higher than the March projection, the post-meeting statement continued to say that inflation pressures are “transitory.” I sure hope they’re right because it comes amid the biggest rise in consumer prices in 13 years! The Fed is now signaling that rates will need to rise sooner and faster, with their forecast suggesting TWO hikes in 2023. Even with the raised forecast for this year, the committee still sees inflation trending to its 2% goal over the long run. Powell said progress toward the Fed’s dual employment and inflation goals was happening somewhat faster than anticipated. He particularly noted the sharp rebound in growth that now has the Fed seeing GDP at 7% in 2021. The unemployment estimate remained unchanged at 4.5%. Recent indicators show that in some respects the U.S. is expanding at the fastest rate since World War II. But that growth also has come with inflation, and the central bank is facing pressure from various sources to at least start curtailing the $120 billion in bond purchases it is making each month (which will ultimately raise interest rates).

How Bad is the Drought Really? With the summer solstice still a week away, combined with a crushing drought, maps from the U.S. Drought Monitor (the government’s official drought-tracking service) reveal a parched landscape the likes of which the American West hasn’t seen in decades. Scientists that are tracking drought conditions believe conditions are worse than they’ve been in decades. According to Drought Monitor’s June 8 data, “extreme” and “exceptional” drought conditions (i.e. the worst drought conditions are afflicting states from Washington down through Utah, California, Nevada, and as far south as Texas), with both short- and long-term impacts. As the New York Times reports, things haven’t been this bad in 20 years, and there is no reprieve in sight with the real summer months still ahead. The news is especially bleak here in California, where outdoor watering restrictions are already in place in many Cal Water districts after an unusually dry winter and unseasonably warm spring. California and Nevada experienced an extreme dry spell from 2012 to 2016. But now, as reservoir levels hit new lows and mountain snowpack from California’s Sierra Nevada Mountains—which normally releases water through spring and summer—already nearing depletion, the exceptionally parched soil is also putting the region at increased risk for fires. Experts say that the only reprieve before October could be the late summer monsoons that normally supply about half of the Southwest’s yearly rainfall, but there was barely one last year and the National Inter-agency Fire Center predicts precipitation will be below normal this summer as well. Consider this: last year’s West Coast fire season was the worst on record, and yet California has already seen twice the acreage burned this year than during the same period in 2020. Bottom Line: most of the West is at increased risk of large, severe fires this year. That may sound like a broken record, but maybe that’s the point. Get ready…

LA County’s Rebound is a Must for California’s Economy. Los Angeles County has been a huge drag on the state’s overall recovery that has, by several measures, been well behind the national pace. Consider: L.A.’s unemployment rate was 11% in May compared with 4.7% in February 2020 (just before the pandemic hammered our life and businesses). That’s a stomach-churning 6.3 percentage-point increase — even after 2021’s economic uptick. Now, look at the rest of California. My trusty spreadsheet calculates unemployment in 57 other counties at 7% in May vs. 4.2% just before coronavirus hit. That’s just a 2.8 point jump. California’s “official” reopening last week should provide L.A. County — home to 1-in-4 workers statewide — a huge opportunity to return our economy to somewhere near its pre-virus status. But why? Because L.A.’s underperformance in the pandemic era largely can be tied to the county’s strict mandates that throttled many businesses and shuttered numerous others. Another factor is L.A.’s heavy reliance on industries that were smacked hard by the pandemic. Just ponder Hollywood’s plight. The L.A. region averaged 1,435 days of TV and movie filming per month in 2019. But between April and June of 2020, as coronavirus fears were soaring, there were just 55 shoot days. Conditions haven’t improved much. The industry is still down 60,000 jobs. And don’t even get me started on tourism. Let’s ponder how much catch-up L.A. requires, looking at unadjusted state employment data derived from a survey of households. Remember, we are talking about a big slice of California’s economy. L.A.’s 4.55 million employed residents in May was larger than all of the workers in 47 of the state’s 58 counties. L.A.’s employment was down 424,400 — April vs. February 2020 (a 9% drop in the pandemic era). Yes, that’s not significantly worse than the rest of California where 12.7 million were employed, a 7% drop or 953,000 jobs lost. But look at how many jobless L.A. residents have yet to return to work. There were 316,400 more unemployed Los Angelenos in April 2021 than February 2020 (a stunning 129% increase even after the recent recovery). Elsewhere in the state, the 957,600 jobless represent an increase of 359,400 jobs lost — a 60% surge.

Home Flipping Rate Declines. Our friends over at Attom just released their first-quarter 2021 “Home Flipping Report" showing that 32,526 single-family homes and condominiums in the United States were flipped in the first quarter. Those transactions represented only 2.7 percent of all home sales in the quarter (or one in 37 transactions – the lowest level since 2000). As the flipping rate dropped, both profits and profit margins also declined. The gross profit on the typical home flip nationwide (the difference between the median sales price and the median price paid by investors) declined in the first quarter of 2021 to $63,500. That amount was down from $71,000 in the fourth quarter of 2020. The gross flipping ROI was down from 41.8 percent in the fourth quarter of 2020, to its lowest point since the second quarter of 2011 (when the housing market was still mired in the after effects of the Great Recession). Homes flipped in the first quarter of 2021 were sold for a median price of $231,500, down 3.9 percent from $241,000 in the fourth quarter of 2020. That marked the largest quarterly decline since the first quarter 2011. The drop in flipping and profits in the first quarter occurred amid our ongoing housing boom that spiked housing prices but created conditions less favorable for investors. For example, median values of single-family houses and condominiums shot up more than 10 percent across most of the nation last year as a rush of house hunters jumped into the market, chasing an already-tight supply of homes squeezed further by the Coronavirus pandemic that hit early in 2020. The glut of buyers came as mortgage rates dipped below 3 percent and many households sought houses as a way to escape virus-prone areas and gain space for developing work-at-home lifestyles. That price run-up also raised the danger that home values during the current housing boom (now in its 10th year), have increased to the point where they could flatten out suddenly during the roughly six-month period most investors need to renovate and flip homes. It's too early to say for sure whether home flippers have wisely gone into an extended "holding pattern,” but it sure looks like it. The first quarter of 2021 certainly marked a notable downturn for the flipping industry, with the big drop in activity suggesting that investors may be worried that prices have simply gone up too high. In other words, sitting on the sidelines (at least for the next 6-12 months) seems advisable.

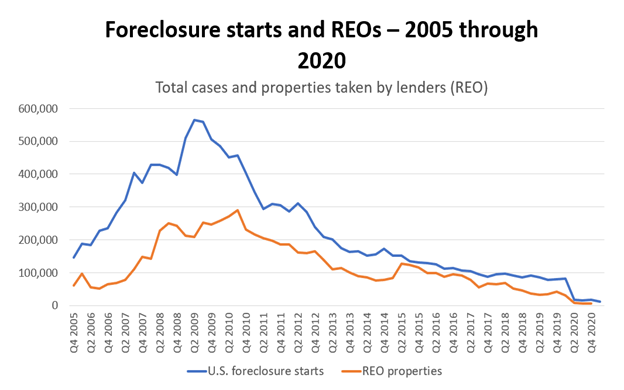

Foreclosures Growing Annually. While foreclosure numbers treaded near historic lows (blanketed by CARES Act moratoriums), filings spiked from the year before, according to Attom Data Solutions. Foreclosure filings (inclusive of default notices, bank repossessions and scheduled auctions) totaled 10,821 in May, up 23% from 8,767 the year before. A total of 5,909 properties started the foreclosure process, surging 36% annually from 4,356 properties in May 2020. Even though the annual growth in both categories marked the first during the pandemic, the overall figures are still relatively small, explains Rick Sharga, executive vice president of Attom's consumer-facing business, RealtyTrac (and our guest speaker on September 9th). “While the increase in foreclosure activity is significant, it’s important to keep these numbers in perspective,”

Sharga said in the report. “Last year’s numbers were extraordinarily low due to the implementation of the foreclosure moratorium and the CARES Act mortgage forbearance program, so the year-over-year numbers look a lot more dramatic than they are." One in every 12,700 U.S. mortgaged properties sat in a stage of the foreclosure process in May, compared to one in every 15,556 the year before. Nevada usurped the highest foreclosure rate at one in every 5,535 units. Delaware fell to second at one in every 5,854 units, followed by Illinois at one in 5,903. Broken down by metro areas with populations above 200,000, Champaign, Ill., had the highest foreclosure rate at one in every 2,420 units. Next came Peoria, Ill., at one in every 3,030, followed by Cleveland’s one in every 3,715.

Eviction Crisis in L.A. County? Buckle up. California is speeding towards a cliff, and its last chance at avoiding disaster is about to disappear. On June 30, the statewide eviction moratorium enacted by the California Judicial Council last April is set to expire. If Los Angeles County’s renters are left without any further protection, experts believe a worst-case scenario could be on the horizon, with 295,147 renters facing eviction come July 1, with a larger group (512,000) reporting little-to-no confidence they will be able to pay their next month’s rent. That’s about 15 percent of L.A. County renters who may face eviction, and over a quarter who don’t think they can pay August’s full sum, says Gary Blasi, professor emeritus at UCLA Law. Last May, Blasi released a report predicting 365,000 renters would face eviction if the moratorium was lifted. In the year since his report, Blasi was able to incorporate U.S. Census survey data, unemployment figures, and other factors to reach his revised 295,147 number—a clearer (and lower) total, yes, but still within the margin of error of his original prediction. It’s a precarious situation, and one that would send the state’s already-extreme homeless crisis into hyperdrive. L.A. County currently estimates that over 66,000 people are living on the streets and in shelters. A swell of thousands more is unimaginable. So what’s to be done? Tackling this potential eviction tsunami requires a very quick fix. Yet, the reality is that renters are suddenly being made to go back to normal when their economic circumstances haven’t improved much since the start of the pandemic. But Blasi sees a glimmer of hope. The good news, he says, is that Governor Newsom is facing a recall election. This political pressure bodes well for an extension of the moratorium or some sort of stop-gap measure in the short-term. But really, how much longer can we stem the tide? We are absolutely “kicking the can down the road.” And unfortunately, it needs to be kicked down the road more until we can come up with some better policy solutions.

Miami is Sinking. If you think we’ve got problems, consider Miami, Florida. As the climate crisis worsens, and sea levels rise, Miami is slowly sinking into the ocean! Officials in Miami-Dade County (where climate models predict two feet or more of sea-level rise by 2060), have released an upbeat strategy for living with more water, one that focuses on elevating homes and roads, more dense construction farther inland and creating more open space for flooding in low-lying areas. This blueprint, made public on Friday, portrays rising seas as mostly manageable, especially for a low-lying area. Climate experts, though, warn that the county’s plan downplays the magnitude of the threat, saying it fails to warn residents and developers about the risk of continuing to build near the coast in a county whose economy depends heavily on waterfront real estate. What happens in Miami will very likely become a case study for other cities and counties facing climate challenges. Among major U.S. metropolitan areas, Miami is perhaps the most exposed to sea-level rise, the result of its low, flat geography. And, with some of the most expensive coastal real estate in the world, it has an ample tax base to experiment with solutions — and also enormous economic incentive to dissuade buyers and investors from leaving. Local officials say that doing nothing is untenable. By 2040, more than $3 billion worth of Miami property could be lost to daily tidal flooding without action to reduce the threat, according to a report by the Urban Land Institute. By 2070, that figure is projected to increase to $23.5 billion. The strategy also calls for building denser housing on higher land away from the ocean. But those areas — which until recently were in lower demand than coastal property, are now attracting more interest — are home to many of the county’s low-income families and people of color. The document warns that these families could be pushed out of their homes by rising costs, a phenomenon some call “climate gentrification.”

Jeffree Star Seeks $20 Million for Hidden Hills Mansion. Jeffree Star

bought the house barely 1.5 years ago, paying $14.6 million for the wildly extravagant premises. Who is Jeffree Star? Jeffree Star is the 35-year-old onetime Myspace celeb-turned-cosmetics mogul and influential YouTuber. Star apparently no longer needs or wants his colossal Hidden Hills mansion (which weighs in with over 25,000 square feet of living space). In a YouTube video released over the weekend to coincide with the home’s listing, Star details the reasons for selling, denying his critics’ assertions that the move from California to Wyoming is simply all about the tax benefits for his businesses, as has been the online chatter. While the tax benefits are nice, the controversial internet sensation admits the last year has been rough. Star’s longtime boyfriend Nathan Schwandt ended their relationship shortly after the move to Hidden Hills, and Star was subsequently “cancelled,” amid drama with other controversial internet personalities. Since the summer of 2020, Star has lost millions of social media followers. Perhaps more damning, however, longtime business partner Morphe Cosmetics dropped his brand from their stores and website. While he enjoyed showing off his mansion in a YouTube video that has since racked up more than 26 million views, the reality of being “a single person living in a 25,000-square-foot house” is not fun, and he’d like to see a real family enjoy the property. And so Star, a lifelong California resident who was born and raised in Huntington Beach, is leaving us — for now, at least. As for the Hidden Hills house, the elephantine property is located in a guard-gated community perhaps most famous for being home to numerous professional athletes, hip-hop music stars and the Kardashians. Built in 2007 and located at the end of a quiet cul-de-sac atop Ashley Ridge — arguably Hidden Hills’ most exclusive neighborhood pocket — the nearly three-acre compound is described as a “French Normandy estate” in the listing. Altogether, the property includes duel staircases in the foyer, 7 bedrooms and 12 bathrooms. Nevertheless, you know how I feel about a seller who buys a property for $14.6 million and less than a year later (without any improvements) tries selling it for $20 million. Don’t get me started!

This Week. Looking ahead, investors will continue watching global Covid case counts decreasing and vaccine distribution increasing. Beyond that, it will be an important week for real estate data. Existing Home Sales will come out on Tuesday (6/22) and New Home Sales on Wednesday (6/23). Also, the core PCE Price Index, the inflation indicator favored by the Fed, will be released on Friday (6/25).

Weekly Change:

10-year Treasuries: Rose 005 bps

Dow Jones: Fell 900 points

NASDAQ: Fell 100 points

Calendar:

Tuesday, 6/22: Existing Homes Sales

Wednesday, 6/23: New Home Sales

Friday, 6/25: Core PCE

For further information, comments, and questions:

Lloyd Segal