Updated almost 6 years ago on . Most recent reply

What happens to income from non-conforming units?

Property is zoned duplex, but has an additional mother in-law situation that is rented. So three tenants with three leases, but only zoned for a duplex. Very unlikely the city will care. Is there any creative way the income from that extra "sublet unit" can be applied towards my own?

Most Popular Reply

@Noah P Bonds As a lender we would look at the income differently based on the transaction, this answer assumes a traditional loan product such as conventional, FHA, VA, or USDA there are portfolio products that would treat this income differently.

The distinction would be if the income would not be used at the purchase of the property, lenders on traditional products will not use the income from legal units, because that income can not be relied on. For example, the city could prevent you from renting it in the future and in extreme cases, a repeat offender could lose the rental license. That is not common but it can happen and lenders have no incentive to take on the risk that a borrower must use the uncertain income to qualify. They will not prevent you from receiving the income just from using it to qualify.

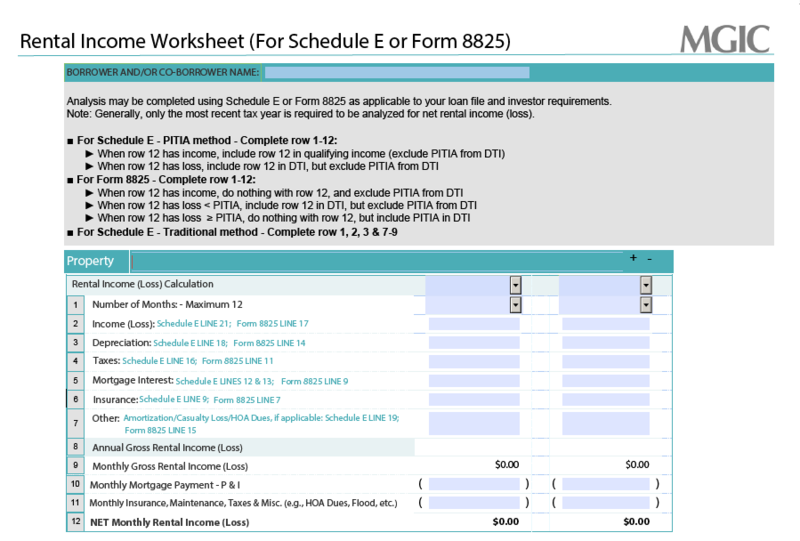

The other situation is how this income will be used for future qualifications. The simple answer is the lender will use the income that you claim on your schedule E + the depreciation which loan guidelines do not consider a true expense (this is good for investors). To be correct we use the following form. If you were to look at your schedule E and put the info into this format it will show you the exact calculation. if the Net Monthly Rental income is positive the income will help you, a loss will be deducted from your employment income.

- Tim Swierczek