Updated over 6 years ago on . Most recent reply

Live-In Flip On The East Side. Did We Buy Too High?

My wife and I are under contract on a duplex in the rapidly developing* east side of Austin, TX.

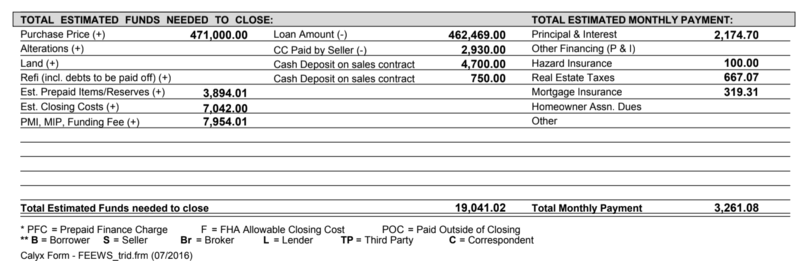

We made a $471,000 offer and are approved for a 3.5%

The current rent for the front and back units are $1,450 and $1,535 respectively. Rent-o-meter says the average rent is $1,765 for the area, so there may be some room for raising the rent (especially after the first round of updates we plan on making). AirBNB-ing our place when big events come into town could further subsidize our holding cost (#gettingpaidtocamp!).

The plan is to move into the back unit. Renovate for a year. Move into the front unit. Renovate for a year. We'd like to do the renovations ourselves so we can:

- learn how the guts of a house work to become better investors

- capture more of the equity with our sweat

- pay for the project as we go

- save money on material costs w/ CraigsList and Restore purchases

- become more flexible, capable humans

We also think it would be fun.

After 2 years, we will try to sell each unit individually as a condo. The units are already metered separately so this should only run us an extra $3,000 to $4,000 in legal/survey fees + a fence.

We technically have the lot space to increase the size of the structure and turn these small 2/1 houses into 3/2s. Comps show that could give us a very high after repair value:

$900,000 https://matrix.abor.com/Matrix/Public/Portal.aspx?...

However, the plan is to keep the units as 2/1s. Do a full interior exterior remodel. Landscape. Take care of some deferred maintenance. Add an HVAC system to the front. And possibly add a nice screened in porch to make the back unit feel bigger.

$700,000 https://matrix.abor.com/Matrix/Public/Portal.aspx?...

I can't imaging the reno costs on the less ambitious 2/1 route going over $100,000 with us doing 50% or more of the work. That would leave us with a potential six figure profit/earnings as long as the market doesn't turn on us or interest rates get too high. If the market does go down, we can hold the duplex as a primary residence or full (breakeven) rental while we wait for things to bounce back.

After J Scott's big post on inflated prices in primary and secondary markets, I'm a bit nervous. Especially since the Austin's supply of rentals seems to growing so fast... our back up rental plan might have us loosing money every year.

What do you think Austin Investors? Are we setting ourselves up to buy high and sell low? Or could this be a good real estate learning experience for me and my wife?

Thank you for any insights you may have.

Sincerely,

Zack

Most Popular Reply

- Real Estate Consultant

- Summerlin, NV

- 65,078

- Votes |

- 44,042

- Posts

careful of taking an owner occ property and turning it into inventory.. talk to your tax person.

you want to keep that 500k tax free in play.. the fact that your renting half maybe you only get half the tax treatment.

and usually if you do less than 7 sales in a year your not considered a dealer..

but do check.. makes a difference on tax's

- Jay Hinrichs

- Podcast Guest on Show #222