Building Business Credit

Greetings everyone! This is my first blog here on BP, in fact, this is my first blog ever! so feedback is appreciated! Let me start off by explaining a little bit about the blog.

I have decided that after each seminar, consultation, class, etc... I attend, that I will compile my notes into a blog. The idea is for me to help solidify the information through my brain by reprocessing it, as well as open up discussions of fellow users to bring additional prospective.

Yesterday I had the pleasure of attending Eric Counts’s “Establishing Corporate Credit & Credit Competency!” seminar. Eric is the founder of creditnerds.com and an expert in anything that has anything to do with credit. Here is my take home from the seminar.

-Eric started out the seminar by asking everyone in the room to raise their hand as high as they could. And then, he asked everyone to raise it an inch further. Coincidentally, just about everyone rose it about an inch higher. His point was: “nobody does things to the full extent”. With that in mind or that philosophy, we know that we can ALWAYS do more and should always be able to ask ourselves if we really are doing it (whatever it may be) to the fullest extent… or is there still an inch or two left that we can reach. Furthermore, “What can I possibly do more here?”. That extra moment you take to ask yourself that question I feel will prove to be invaluable.

-We learned the difference between a Vantage and a FICO credit score. To name a few: Vantage based on a point system from 501-990. Most places that provide “free” credit checks use the vantage system. Now FICO is what about 90% of lenders will use. The FICO point system is based on 300-850. So a lot of people will say they have a great credit score of 750 ( most likely used an online service to check it). Now in the eyes of a lender their 750 could actually be as low as a 680 on the FICO system!

-We learned for personal credit score consists of several things:

1) 35% Payment History

2) On time/late payments

3) 30% Utilization Ratio or indebtness ( I believe he made up that word)

• An optimum utilization ratio is an average of 30% or less for all of your lines of credit. Say you have 3 lines of credit that have the following utilization rates (or balance/limit) 12% balance, 40% balance, 25% balance] they all average out to about a 25.7% (now in the eyes of a business lender, they want to see ALL lines under 30% not just the average)

4) 15% Age of File

• Again, this is an average taken from all of your open lines of credit. I.E. you have 2 lines of credit, one is a year old and one is 11 years. Your “Age of File” or file age will be 6 years.

5) 10% Mix of Credit (types)

• Credit cards, car loans, mortgages, etc..

• Lenders will often pull a “weighted” report. For Example if you are getting a loan for a car your history of car loans will have a bigger impact on the score.

6) 10% Inquiries/Obtaining New Credit Lines

-You can sum up good practices to establish a good credit rating into 5 items:

• Pay your bills on time

• Keep debt below 30% of your max credit available

• Multiple Accounts

• Only apply for credit when you need it

• ….wait

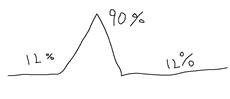

-Here is a sketch Eric used to illustrate an investors’ utilization rate.

•This would represent an investor using “90%” of their limit to fund a real estate transaction, say repair costs. Although the ratio is really high, its only really high for a short period of time. This is not necessarily a bad thing. Your credit score will pretty much look like:

The problem is that most people that max out their credit cards and never pay them off. In this example the balance is really high but only for a short period of time. It will affect your credit score, but only for that period of time SO IT’S OKAY.

-After we got back from lunch we talked about Business Credit. We started off by discussing proper use of credit. It reminded me of Rich Dad and I ended up sketching this in my notebook…

In another words don’t EVER use credit to pay your expenses. If you need credit to cover your expenses you seriously need to evaluate the efficiency of your business.

-We learned about Dun & Bradstreet (D&B)

• D&B has a number scale that is based on numbers 0-100. A very simple system really, and recommended to use when just starting out. If bills are paid on time you would receive an 80 sore. If they are paid late you get a lower score and if paid early vice versa.

• D&B also grants you the opportunity to report your own credit! Yes, sounds wacky but they will call the person you borrowed the money from to verify. This is an excellent way to build your credit by being able to report the credit relationships you may have with your private lenders.

-Then learned about Experian, and that it's the system that most lenders use when pulling a credit file.

• Experian will use a combination of your “Intelliscore” and “Intelliscore Plus” (an Intelliscore Plus is your personal credit profile)

• Experian determines your score by splitting it into two separate items: 35% of your past and 65% of your present.

-The last section was in Building your Business Credibility so that lenders will take you seriously. For example if a business doesn’t even have a license its hard to find a lender that would be willing to give you money. So really the section was all about legitimizing your business. The more legitimate your business the more seriously a lender will take you.

-A few extra nuggets I picked up and would like to share:

• 80% of business don’t have a credit file. Of the 20 % that do have a credit file only 10% of them actually use it.

• Authorized Users of credit cards are a great way for someone to add to boost their credit score.

• For example, someone like me that doesn’t have the best “Age of File” can be granted an authorization of someone else’s credit line or credit card. This credit card ideally you would want to have been a very old credit card. So I can call a parent and ask them to make me an authorized user on their oldest credit card and now all of a sudden that specific credit line is now a part of my profile. Essentially we are sharing that particular credit line. My parents wouldn’t even have to give me the physical credit card with my name on it that they receive, I would never use it. But by me being an authorized user and sharing that credit card, my average age of file goes up, therefore boosting my credit score. Easy! And easy way to leverage other peoples’ credit for your own benefit.

Thanks for reading! let me know if you have any thoughts, opinions, or anything to add.

Comments (6)

Awesome @Ethan Bowen - I especially like the thing about raising your hand just an inch higher. I think i'll use that in the future!

Brandon Turner, about 11 years ago

Great! thanks Brandon, and thanks for the comment!

Ethan Bowen, about 11 years ago

very interesting. Did you pay for the seminar?

Jimmy Moncrief, about 11 years ago

Ethan Bowen, about 11 years ago

Great post my friend!

Jaren Barnes, about 11 years ago

Thanks Jaren!

Ethan Bowen, about 11 years ago