All Forum Posts by: Adam L.

Adam L. has started 28 posts and replied 82 times.

Post: 1031 exchange, LLC and buying out partners?

Post: 1031 exchange, LLC and buying out partners?

- Posts 82

- Votes 16

Originally posted by @Dave Foster:

@Adam L., The LLC is the taxpayer for that current property. So it would need to be the seller and buyer in your 1031 exchange. But that is the entity itself that matters for the 1031. It doesn't matter who the members of the entity are. So you actually have a few options.

Thank you for the input. Here's some more details I received from the main LLC that owns the investment property:

----------------------------------------------

I want to first assure you that the responsibility to execute the 1031 correctly is ours at [ParentLLC], and something we’re both experienced with and utilize several very talented outside legal and tax advisors to successfully execute. From the Limited Partner (LP) perspective, you will not realize the difference or have any unusual tax work on your side required. We do all of that for you and you’ll get a K1 form for taxes like before.

The {ParentLLC] entity is going to become a TIC ownership entity with title. You as an LP are shielded and not listed on any public documents or individually listed on anything. If an investor doesn't participate in the exchange, we pay them out and it won't impact the ability for other investors (will be the majority, if not all investors) to successfully participate in the exchange. We did this same process in June 2019 when we sold our first property.

I hope you are not overthinking the situation here. It is seamless/simple/painless and totally passive for you.

Your LLC on its own, where you're a non-title holding Limited Partner within a larger LLC entity, cannot effectuate it's own 1031 exchange. The 2 real options are to pay long-term capital gains on any tax liability you have from this sale and get paid out, or to participate in our 1031 exchange. Two good options though fortunately!

-------------------------------------------------------------

So we/[my small LLC] needs to decide to reinvest into the parent LLC or cash out. The question about divorce and internal assignments will be totally separate.

Post: 1031 exchange: investment property into your primary residence?

Post: 1031 exchange: investment property into your primary residence?

- Posts 82

- Votes 16

So I am about to cash out a large investment from the sale of an investment property and am facing 1031 exchange options.

I also recently sold my homestead and moved, now looking to purchase a new primary residence.

Is there an option to roll this RE investment $$ into the downpayment of my primary residence or is that not "in kind"?

Post: 1031 exchange, LLC and buying out partners?

Post: 1031 exchange, LLC and buying out partners?

- Posts 82

- Votes 16

So curious if anyone else has experienced this and how the dealt with it.

Myself and 2 friends created an LLC to pool our $$ to invest in an apartment complex. The General Partners of the larger investment are closing on the planned sale of the property after holding/fixing it up for the last 3 years. This is all great news and we're making a lot of money (24.73%IRR, MOIC 1.67x, 67% total return, 23% annual return) and now are looking at what to do w/ this 1031 exchange. We have found a new offering to roll this into, as an LLC, but one of the members may want to cash out.

One of my LLC members is getting divorced. His name is on the LLC. He wants to either cash himself out completely or transfer his ownership to his wife and walk away. Any advice on how to do this? At the end of the day, the LLC needs to either cash out or 1031, right? so internally, the 2 remaining partners could put forward more $$ to cover the 3rd person who wants out?

Post: evaluating a multiplex? and then how to leverage?

Post: evaluating a multiplex? and then how to leverage?

- Posts 82

- Votes 16

Originally posted by @John Warren:

@Adam L. you don't want to buy that and leverage it to buy more. You don't even want to buy that most likely unless you are just parking cash. This property smells like negative cash flow to me...

Yea, it seems the price is way high....1% rule puts it at $800k.

Post: How to leverage a MFH after you invest?

Post: How to leverage a MFH after you invest?

- Posts 82

- Votes 16

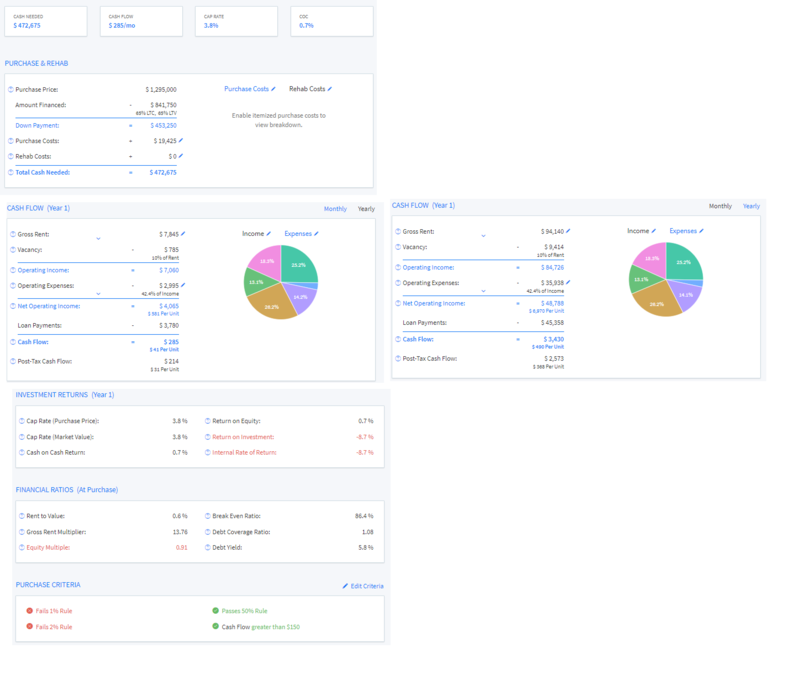

So I am looking at this proforma and I'm still new trying to figure it out.

- 7 units

- $1.3M asking price.

- $94k/yr rent currently

- well maintained w/ recent capital upgrades in last 7 years.

- appears to be nicely maintained.

What do you think of the numbers? It seems over priced for the rental income.

And another question: assuming I buy this and do a mortgage...What could a strategy be to leverage this to purchase and buy other properties? Is that something you need to wait years and years to appreciate in equity?

Post: evaluating a multiplex? and then how to leverage?

Post: evaluating a multiplex? and then how to leverage?

- Posts 82

- Votes 16

So I am looking at this proforma and I'm still new trying to figure it out.

- 7 units

- $1.3M asking price.

- $94k/yr rent currently

- well maintained w/ recent capital upgrades in last 7 years.

- appears to be nicely maintained.

And another question: assuming I buy this and do a mortgage...What could a strategy be to leverage this to purchase and buy other properties? Is that something you need to wait years and years to appreciate in equity?

Post: just sold homestead: buy new home first or investment prop first?

Post: just sold homestead: buy new home first or investment prop first?

- Posts 82

- Votes 16

So I may have found a house hack opportunity. Not really a duplex or triplex, but a house that has potential to rent the basement studio space.

Can I ask you how you would evaluate this deal and how you would go about figuring out a bigger mortgage to get this bigger property? How do include the potential cashflow into your calculations for buying a larger than expected homestead?

Post: just sold homestead: buy new home first or investment prop first?

Post: just sold homestead: buy new home first or investment prop first?

- Posts 82

- Votes 16

Originally posted by @Brett McManus:

Go for the house hack dude!

Best of both worlds. Homestead the property for the funding advantages while kicking off your Real Estate portfolio as well. Find a 2-4 unit property that can meet some of your personally needs while having it paid for by tenants. Not sure where you are headed but there are many agents on here (likely one in your local area) familiar with the process who can get you setup.

I would if I could, but I don't think there's many MFH options in the city I'm moving to, and also not in the quality and type of primary house we are looking for.

Post: rookie: analyzing 10-unit vs SFH? reading the proforma?

Post: rookie: analyzing 10-unit vs SFH? reading the proforma?

- Posts 82

- Votes 16

So I've read a lot about SFH calculations and worksheets and trying to figure out if they are good deals, but I'm thinking I want to jump into a larger project. I've come across a 10-unit building in a nearby close city asking $1.6M. Curious if anyone could help and earn some good karma?

It's a stand-alone building with 10 units..

Asking price: $1.6M: 35% downpayment, 30yr term, 4%: -$58,650/yr

Gross Rental: $112,200/yr

Net rental w/ 2% vacancy: $111,156/yr

Total Operating Cost: $33,227/yr (utilities, maintenace, taxes, 6% management, etc)

Net Operating Income: $77,929/yr

Less Mortgage: $19,278/yr

Post: just sold homestead: buy new home first or investment prop first?

Post: just sold homestead: buy new home first or investment prop first?

- Posts 82

- Votes 16

So I'm about to close on sale of my primary residence (due to a job transfer, corporate relocation) and about to be debt free w/ an extra $400k in my account. It seems to me that this would be a great time to qualify and invest in a large multi-unit property. Any thoughts or advice on doing this first before buying a new homestead or should I be doing this the other way around?