All Forum Posts by: Brady Potts

Brady Potts has started 5 posts and replied 60 times.

Post: Closing credit to buyer

Post: Closing credit to buyer

- Developer

- Missoula, MT

- Posts 60

- Votes 28

@Alec Frasier The title company will take the full purchase price from them (their down payment and loan) and "give" you the full amount. Then, they will turn around and give them back the credit amount. This all happens instantaneously. In reality, its like reducing the purchase price on your end, but its a creative way for tenants to "pay" the full price but get cash back out to fix the items. Does that help?

Post: Contractors in Fort Bragg

Post: Contractors in Fort Bragg

- Developer

- Missoula, MT

- Posts 60

- Votes 28

I actually flew down to Fayetteville this past weekend and met with both Chris and William. Both are great guys and know their business. William actually walked me through a couple projects of different types/scope and was very helpful in understanding the process.

Post: The Price of Appreciation

Post: The Price of Appreciation

- Developer

- Missoula, MT

- Posts 60

- Votes 28

@Dan DiFilippo Thank you for sharing. What would you say to an investor that rehabbed a property, replacing all the capex items upfront, and then only intended to hold the unit for 7ish years, exiting before the useful life of Capex items expired?

Post: Title vs Deed question

Post: Title vs Deed question

- Developer

- Missoula, MT

- Posts 60

- Votes 28

@James Krell

Hey James,

I work as a title examiner in MT. Im not sure where you are located but this is the difference:

Manufactured homes come with a title, which is often treated the same as a car. The deed, or title to the real property (land) is completely separate. In some cases, the title of the MH can be merged with the real property and there would be recorded docs to show this. So, the owner of the land and the manufactured home could be different.

Contact a local title company and ask for a listing report/package. Most are free, some are a nominal fee. It will show you who owns what, and what liens currently encumbered the property.

Feel free to reach out with any more questions.

Post: How can I get started with RE if I'm in NYC?

Post: How can I get started with RE if I'm in NYC?

- Developer

- Missoula, MT

- Posts 60

- Votes 28

@Anders Ramsay

If the high cost of entry in your local market is your barrier, and you have good income, credit, etc., have you considered out of state investing? The returns could be great in terms of cashflow and overall return in other markets. If you're making NYC wages, you could leverage them into other markets where SFH have ARVs of less than 120k and still cashflow anywhere from $100-300. I just flew down to a market this week to meet a new team and get the ball rolling. It seems like a big step, but managed in little bites its not so bad.

Feel free to reach out, I'm happy to share my experience.

Post: Help Analyze Denver Duplex for Cash Flow/House Hack Potential

Post: Help Analyze Denver Duplex for Cash Flow/House Hack Potential

- Developer

- Missoula, MT

- Posts 60

- Votes 28

Hi Katie,

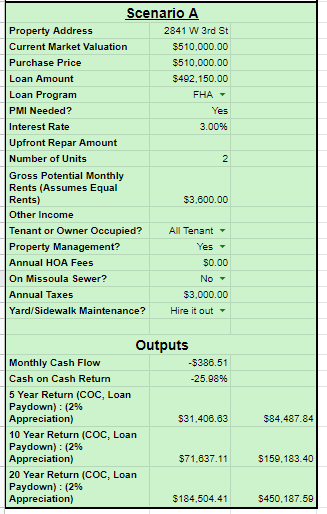

I ran those numbers through a personal calculator with the following assumptions:

5% Cap ex

5% Repairs

10% Property Management

$75/month for lawn/snow

Also, this does not include any owner-paid utilities or HOA fees.

All that being said, I see a negative cashflow of $386/month. Are you familiar with any of the calculators here on BP? I would recommend checking them out to help analyze some properties. If you have any questions feel free to reach out.

Best.

Post: Fayetteville, NC Rehab Costs

Post: Fayetteville, NC Rehab Costs

- Developer

- Missoula, MT

- Posts 60

- Votes 28

@Robert Shortsleeves Thanks for sharing. Looks like a great rule of thumb. I'm actually on my way home from Fayetteville right now. I met with some agents, PM's and contractors preparing for a BRRR. I walked through a couple of rehabs with a local contractor and it seems like those number matched right up with what he was doing that type of work for.

Post: Missoula Montana Meet Up

Post: Missoula Montana Meet Up

- Developer

- Missoula, MT

- Posts 60

- Votes 28

Hey @Benjamin Savage

I haven't heard much surrounding meetups in Missoula. I would be up for a lunch/beer one-on-one to talk shop.

Shoot me a message if you're interested.

Hey all, saw a lot about refinancing a VA loan here. I just talked with a mortgage broker who told me the VA changed their seasoning time to 7 months, with additonal requirements. I also read that you need to be able to get a least a 0.5 percent better rate, and your closing costs need to be recouped through monthly savings within 18 months.

Anybody seeing something different?

Post: Newbie; trying to invest while working a PART TIME job; opinions

Post: Newbie; trying to invest while working a PART TIME job; opinions

- Developer

- Missoula, MT

- Posts 60

- Votes 28

Hey @Evelyn Castillo,

Congrats on jumping into the REI world. Speaking from personal experience, I wish somebody would have told me the following starting off:

1) You're more than likely going to need to traditional banks. You need to set yourself up to play by their rules. What does that mean?

- Finding a stable, well-paying W2 job, that you can see yourself in for a significant period of time. Ideally a company you can grow within. Why? Because the banks are going to look at this to qualify you as a borrower.

- Take extremely good care of your credit, and start building it now. Get a couple of credit cards now, and manage them wisely forever (keep your balances below 30%, pay on time every time, and never put anything on the card you couldn't pay cash for). Why? Your creditworthiness is going to be another critical part of obtaining financing, sometimes even outside of traditional lenders. This is an easy step towards building credit. The longer you have these cards open and reporting positive history, the better.

- Do not over-finance things in your life. The more monthly payments you have, the less you can borrow - plain and simple. Things that affect this; car payments, credit card payments (which is why you keep them low, so you can pay them off before applying for a home loan), store-financed anything, etc.

All that being said, sometimes the best option is to save as much as you can now while you are building these other areas. You could, of course, could invest with others in a partnership, but be wary and do all of your homework. You should know as much as humanly possible about the people you do business with, specifically as a first-time investor.

Best of luck moving forward, and feel free to reach out if you have any questions.