All Forum Posts by: Brandon Hayes

Brandon Hayes has started 4 posts and replied 13 times.

Post: Newbie Investor in South Florida Ready For First Deal!

Post: Newbie Investor in South Florida Ready For First Deal!

- Rental Property Investor

- Lighthouse Point, FL

- Posts 13

- Votes 2

Post: Newbie Investor in South Florida Ready For First Deal!

Post: Newbie Investor in South Florida Ready For First Deal!

- Rental Property Investor

- Lighthouse Point, FL

- Posts 13

- Votes 2

@Arvi Carkanji

Hi Arvi! And thank you for your response! I equated an extra $10k in the purchase price during my analysis to account for closing costs and holding fees. I’ve reached out to a realtor in the area that my current realtor referred me to. She seems to be in the top 1% in the area and has a team to help me along the way. I’ll keep you posted on how this deal turns out. How did your first deal turn out? What lessons did you learn during your first investment deal that made your second and third deal easier? What kind of property was it and what condition was it in? How is it performing now? Thank you in advance for your insight.

Post: Newbie Investor in South Florida Ready For First Deal!

Post: Newbie Investor in South Florida Ready For First Deal!

- Rental Property Investor

- Lighthouse Point, FL

- Posts 13

- Votes 2

Hello BP!

My name is Brandon Hayes. I moved to South Florida from Fairbanks Alaska 3 years ago for an occupational opportunity to build Race Cars! I've been a mechanic all my life and have a background in construction. I've always been curious of property investing to achieve financial independence (like many of us here), so I read David's "BRRRR" book, Brandon's "No (or low) Money Down", listened to dozens of hours of the BP Podcast, sat in on several webinars, went PRO, spent hours in the archive...

Brandon Turner always says “if information was the answer, we’d all be billionaires with perfect abs”. Meaning that action, is what sets the dreamers apart from the do-ers. My goal is to build a portfolio of 10 doors (to start) and I’m ready to dive into my first deal and start my journey.

I've analyzed dozens of multi-family properties in South Florida, and they leave very little room for equity upon purchase. The asking prices are above market value, and that's before dumping money into rehab. I know deals aren't found, but made, but I'm starting to doubt the South Florida market is the best for my first BRRRR. And I've read a foreclosure probably isn't the best idea for a newbie either.

After analyzing dozens of deals, I've found an intriguing property in northern Florida. It's a 4-Plex with 800sq ft 2/1 units. Asking price is $90k. It's completely gutted, no appliances, windows are boarded, cabinets are destroyed, might need HVAC/Roof, etc. I've estimated $60k in rehab, but will have a contractor/inspector walk the property for hard numbers if I decide to move forward. What's interesting about this 4-Plex, is there are 3 other 4-Plex buildings on the same street, with the same floor plan, built by the same builder, and they are valued at $240k and they are all have tenants. So that takes the comp work out of this deal. And after a rehab, the ARV might even be slightly higher.

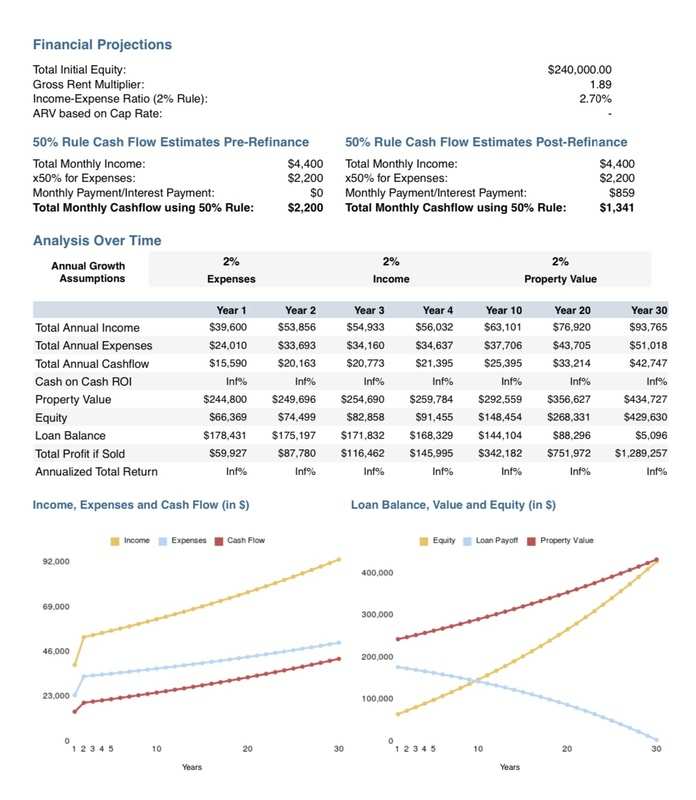

So let's say $100k purchase price after closing costs/fees, $60k rehab, $240k ARV, rentometer is showing $1100 per unit, so income of $4400, and can refinance for ~75% of $240k ($180k). I'll pocket about $17k from the refi to put toward my next deal, and will have a Monthly Cash Flow of $1870.82 after the refinance, plus will have added a $240k property to my net worth. I've researched the area and the market seems pretty hot. High demand for rentals, property values are rising, and the city is building more developments.

Any fellow investors have any tips or is there anything else I need to consider before contacting an agent in the area and lining up a hard money lender? It’s about a 3.5hr drive from where I live.

Thanks in advance! And sorry if that seemed long-winded. It’s my first post/member introduction/first deal post. :)