All Forum Posts by: Henry Clark

Henry Clark has started 209 posts and replied 4083 times.

Post: Self Storage Day to day Constructing a new facility

Post: Self Storage Day to day Constructing a new facility

- Developer

- Posts 4,159

- Votes 4,130

Well guess what. While I was putting up our "OPEN" signs out front we got our first customer. Paid a full year for the next size lower price. About 329 more units to go.

Marketing:

Got our wall signs up.

"OPEN" signs up.

Sparefoot turned on.

Have one Bus Stop Bench advertisement. Will try to get more in that area.

To do:

Need to install our road side Monument sign this week.

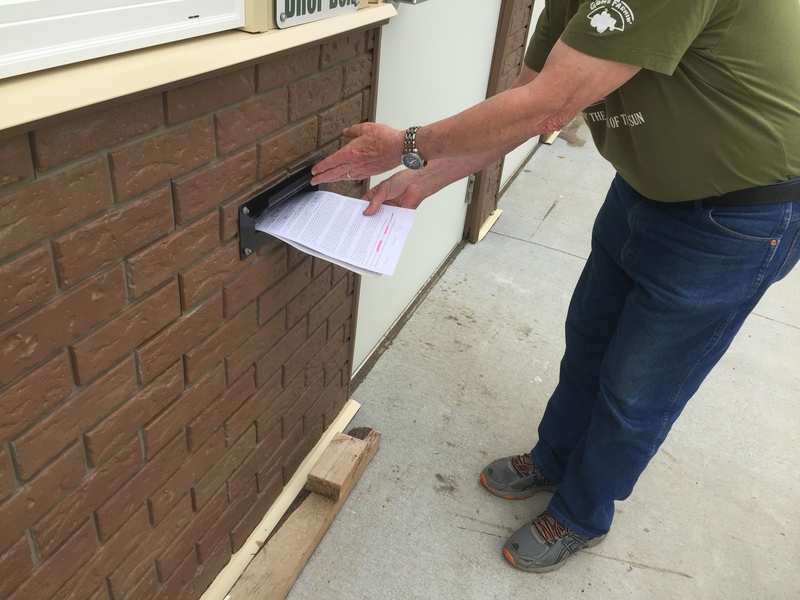

Need to get our Google business listing and map location set up. To do this we have to set up a mailbox at this location. They will send a postcard to confirm the location.

For now, will see how our 5,000 Vehicles per day, I believe and the OPEN signs do.

Go to Sparefoot and type in zip code 51503 and then switch ranking to based on Distance. We are at the top. Sparefoot measures from the post office. So we beat our closest competitor by our 2.2 and their 2.8 miles distance. Will have to start working on getting to the top ranking by Price, Reviews and Recommendation over the next 12 months.

Post: Self Storage- Deal 11, No Zoning?

Post: Self Storage- Deal 11, No Zoning?

- Developer

- Posts 4,159

- Votes 4,130

We were in a rush to get the Office/living space completed, so we did not order from the Storage Manufacturer. Ordered from a local builder. He had to pull out due to his experienced workers leaving. Got quotes and two of them are at house prices around $165 per square foot. This wont do on a 1,200 square foot structure for us. My friend just got a quote for a Bolt up metal building package for $23,000. Probably we will go with that. My son and I will go down and help him erect the building. Don't want to wood since it is so expensive.

Post: Self Storage- Deal 11, No Zoning?

Post: Self Storage- Deal 11, No Zoning?

- Developer

- Posts 4,159

- Votes 4,130

The valuation we are discussing is based on the sale/purchase of similar units in the area and not "building cost" as I had mentioned.

Post: Self Storage Day to day Constructing a new facility

Post: Self Storage Day to day Constructing a new facility

- Developer

- Posts 4,159

- Votes 4,130

Well its Monday and got sign off on the last inspection items for Phase 1 of our new facility. We won't have the security fence and gate in, they are supposed to be in over the next 2 weeks. But security cameras are functioning.

My son and I put our sign up. Always wait till ready to open. Our first location I put it up before we were open and had to deal with phone calls for 3 months, that we couldn't help.

The handicap and parking lines, waited till my son got back from College. Couldn't bear to think getting down on concrete to put the masking tape down and do the painting.

Tomorrow will put up to "OPEN" signs up along the road. Tonight turning on our Sparefoot new location listing. More calls, but hey, that's great.

Putting down the concrete sealer in the office. This will help to keep it cleaner and less stains. Waited till all of the inspectors were done. Will let it dry tonight and start moving in office equipment.

Yahoo.

Tomorrow is day 1 of renting.

Post: Self Storage- Deal 11, No Zoning?

Post: Self Storage- Deal 11, No Zoning?

- Developer

- Posts 4,159

- Votes 4,130

You should visit sometimes and I will walk you through it.

Got great deal on the land and existing contractor building.

Got great deal since it was a corner lot on a major road and side road.

We did about $50,000 of the cleanup/clearing work ourselves. Plus no GC, we will do that.

The appraisal compared us against Metro locations and we are in the country. Land prices and cost to build are lower where we are at.

Key to Texas market is there is no Zoning in the counties. This is dangerous from a Risk standpoint. But makes it easier to find a cost effective and good location.

Plus markets outside major Texas towns are charging what we would charge in our cities up here. Without having to do Concrete roads, frost free footings, inspections, etc.

The Appraiser also kicked it up due to all of the Californians moving in both needing Storage and increasing the price for storage locations. Just funning.

Post: Self Storage- Subdivision as Collateral

Post: Self Storage- Subdivision as Collateral

- Developer

- Posts 4,159

- Votes 4,130

We have continued to grow in the last 7 years with our Storage business. We are now up to 8 locations. Most are at 100% occupancy. 4 have land to expand, and we will next year. Focusing on our last locations 7 and 8. Our last piece of purchased ground should go on line this month, subject to inspections which are almost complete.

As you grow, you use up either your liquid assets or your Assets that can be collateralized. You could stop and pay down on your existing Storage locations and build up equity for your collateral. We have chosen to push forward, and our locations have gotten larger with each addition. Other funding solutions could be to get partners, hard money lenders or to syndicate. We have chosen not to go down these routes since we have decided "Enough is Enough" with Self Storage and are winding down our "Growth" mode. Our son is 20 and not ready for Real Estate Development, so no need to keep growing.

Realize most posts are talking about how do You invest with Zero Cash. How do I start in real estate. Is now a bad time to get into Self storage or Real Estate. Thought I would show you some back end logic for a business reaching its peak investment target/levels.

Based on the need for more funding, we decided to take some of our non-liquid Assets and use as collateral. We have taken our 80 acres where we live and set up a Subdivision. More of a country subdivision with lots in the 2 to 21 acre sizes. This is just road entrances. We did the numbers and it was a lot riskier if we did a true Subdivision with concrete driveways installed. Also the lots would have to be 1 acre and smaller to make the math work.

After we laid this out and did the Subdivision work, we were able to use this "increased value" as a subdivision versus farm acres as the collateral for our latest expansion in Self Storage. Most families would never sell off the ground around their house; and would say let their children deal with that. We decided to keep 20 acres for our house and sell "now". Probably the same in your area. Housing shortage, builders can't keep up with demand, not enough lots are available and Interest rates are low. Being in Iowa, you wouldn't think it, but we are getting a lot of buyers from out of state. Decided to sell now. Can't tell when in the future all of these data points (low interest rates, housing shortage, Builder shortage, Lot shortage, migrating investors, migration from city to country, family RE knowledge) will come together.

The process of subdividing created value from $6,000 farm ground per acre to $50,000 per acre for the 2 acre lots. This really helped with the appraisal and the banker giving 65% collateral value. Thus we did not have to come up with Cash on our latest project, using this subdivision as collateral.

As we sell a "lot", the cash is transferred directly to the Bank, since they have a lien on the property. We are allowing them 100% of the cash since we are doing Early Depreciation write offs on our new locations, which is helping to offset the Capital Gains on the land sales. Them getting the 100% versus the 65% collateralization will help relieve our debt burden really fast. Basically we are taking farm ground that earns about 1% and converting into both high yielding and Value increasing Self Storage.

On part of the land we are exiting a prior 1031 sale/purchase. We had a separate 48 acre spot we sold and then bought part of the 80 acres about 15 years ago. Decided to exit into cash, versus doing another 1031 sale/purchase so we can use the funds for a more valuable asset, Self Storage. Key is to keep your transaction documents on file and document the transaction path for your CPA tax preparer.

4 of the lots have sold in the last 2 months. We actually don't need to sell all of the lots to cover our last Self Storage funding needs, since the cost versus sales price on the lots is so great. Not getting into details, but the location is great. We put "stupid" money price on the lot next to us, since we don't want anyone to buy it. But you never know.

To increase both the property value even further and to speed up the sales, we are currently building a two acre pond and will do some large boulder landscaping at the entrances on some of the lots. There is only so much you can do to a bare lot to increase its value, prior to the house site being determined. We installed concrete driveway entrances, versus leaving as dirt. 10 to 15 years ago we planted a lot of evergreen and oak trees. Took these and transplanted them next to the lot property lines, along road ways for sight and sound barriers, and around the lots, where they would not be in the way of the home sites. Transplanted about 150 trees. Did not cost that much since we owned the trees and the Tree Spade did not have to travel far.

Realize everyone doesn't have additional assets to collateralize, but wanted to show you a different path.

Below are some of the actions we have taken.

Lot 5 which is not shown is our house, which isn't for sale. Did a youtube for each lot noting its special features. Really helped with people at home due to Covid, online shoppers and from out of state.

Putting Tube or culvert into one of the lots. Wanted it in place so the potential buyers could visualize the entrance, versus waiting for them to pay. Had my son dig out and put in culvert. Can do a lot of work with a skidsteer.

Creek behind our house, between most of the lots. We are clearing trees and will dam for the pond. It has eroded about 8 feet since we bought the place. This actually helps out, since the dirt is drier and we can dig further down, prior to hitting the creek level. You will note how large the dam is relative to this creek. Only once, but I have seen it 200 foot wide after about 2 months of rain and then we got 5 inches of rain in an hour.

There is very little "valley" here. Thus it is a "dug out" pond which is very expensive. To help reduce the cost, my contractor waited till he had a buyer for the rich top soil. About 5 miles away there is a Miracle Gro dirt bagging center. You might be buying some of our dirt. This is dug extra deep so we could get Clay for the "key" way part of the dam.

The dam is in place. Still need to put the drain tube in. A smaller plastic tube is in the creek allowing the water to flow through. When all of the dirt and pond has been excavated we will tear out the mouth of the tube and plug up. Allowing the dam to fill.

Supposed to rain tonight. Worked till about 10 pm getting the grass seed spread. My son is rolling out and pinning the grass mat with staples.

Just back from his first year in college. Has three job applications at local stores to work. Until then working on Self Storage. Hopefully he learns 8 to 5 and no control; versus Self Storage and freedom over his schedule. Something we are all learning the difference at 30 to 60 years old.

This pond project will help sell the two larger and more expensive lots. Just called the realtor and increased the price. Three of the lot sales prices have been increased and will pay for the pond. Plus I finally get my fishing pond.

Basic decision was to take a non-liquid asset and convert to funding for our Self Storage growth. Another option if it fit your lifestyle would be to sell your house and make a larger than normal office/home as part of your self storage location. If we were at our "downsizing" stage, that is what we would do.

Start small and Make Your Big Mistakes Early.

Post: Triple threat Strategy: Cash, Terms and more terms.

Post: Triple threat Strategy: Cash, Terms and more terms.

- Developer

- Posts 4,159

- Votes 4,130

I missed something.

Option 3 and 4 are not options. The Guy wants to walk away.

Option 3 is Seller financing, no bank will do interest only for 5 years.

Option 4, timing. If through a bank loan, will take a month. They will want an Appraisal which is taking 3 weeks where we are at, plus you need to close. Guy wants to walk away with no conditions.

Option 1 is your only option from two standpoints. A. He gets to walk away., B. You haven't identified your financial objectives. But 1, gives you an asset for $260k with value at $320 to $330. The other options don't leave enough meat on the bone, unless you have some Rent revenue calcs.

Plus you have to put in $20,000 to $30,000 without seeing the property.

Need more info, what your valuing.

Post: Self Storage- Deal 11, No Zoning?

Post: Self Storage- Deal 11, No Zoning?

- Developer

- Posts 4,159

- Votes 4,130

Forgot to get pictures. Just visited site.

Totally cleared and levelled. Building sites and roads are established and hard packed clay and rock are covering the sand.

Met with Banker and friend. Our total all in cost for the entire project should be $1.5mm. Had an appraisal done, came in at $2.4mm when filled from a revenue stream standpoint and $2.3mm from a cost perspective. Friend was really happy. Now that the banker has seen the cleanup and costs estimates and appraisal, they are now willing to look at 25% collateral versus the 40% mentioned above. We used below market rental rates, thus we have significant upside potential since we can raise the rents, plus all other locations are full and "Land Locked" with no expansion capability. Also my friends location is at the outlet for all of the housing to the schools, jobs, and shopping.

The building in the picture above is a contractor building 40 x 80 or 3,200 square feet. Already rented for $3,000 first month we took possession. Great tenant, who spruced up the interior and already started getting clients in. Said he will never leave, just too great of a location. His customer base will also be good for the Storage business.

Will start concrete pads and roads in 30 days. Buildings are scheduled for delivery, believe around July/August for erection. Hope to catch Fall rent up.

Will start setting up Security systems to use, Sparefoot account, Rental Operating software, Insurance and banking.

Guess we will still be friends. They are already financially good. But this project with a payback of 6 years will give a significant cash flow and revenue stream, significantly increasing their wealth, but more importantly giving them an earlier Retirement date option.

Start small and Make Your Big Mistakes Early. Or get your friend to help you.

Post: Laundromat Value / Date Extrapolation / Investing / Calculations

Post: Laundromat Value / Date Extrapolation / Investing / Calculations

- Developer

- Posts 4,159

- Votes 4,130

Send me a pm. I will give you the number of my friend who runs a laundromat.

Just the machines are worth $150k, let alone the building.

Don't need a response to the below. Be prepared to give him info.

Clarify the 13,000 gas/water/sewer. You already noted gas at 15,000.

If you can get the water usage in gallons.

Age of equipment.

Break down of equipment- Dryers- Big/little; Washers- s/m/l

Is this a cash operation or credit card/ Does it pick up-send out dry cleaning/ Does it wash/dry/fold service?

Will you manage, Open or close? Are you mechanically handy and will this be your job also?

Be prepared to answer these questions.

Post: Hey everyone, I am new to this.

Post: Hey everyone, I am new to this.

- Developer

- Posts 4,159

- Votes 4,130

Leverage what you know, Trucking.

One of the greatest products out there, that few people are breaking into is Semi Truck and Trailer parking. You already know all of the answers around this, from a Trucking standpoint. Except for the Real Estate end.

1. As your driving look for areas of needs. Overnight, home, large company needs, etc. Product- Semi/ Semi Trailer/ Trailer parking/plug in services/etc.

2. Or develop Pony Express model transfer stations, just like the old west. With E Log, you can't keep pushing the clock, thus switch drivers.

3. Key to this investment is Cheap ground and preferably an existing hard surface. 10 Acres or more.

4. Set the table for the future of Driverless truck sites.

5. Add services, such as Electric charging, bathrooms, food, security, fuel, etc. Start small first though with few services. Leave room for expansion of services.