Hi all,

I've just recently started looking into real estate investing and wanted to go ahead and start posting the deals I analyze daily. I’m currently not looking to buy this home (you’ll see why if you read) but I am looking to improve my deal analysis skills!

If anybody wants to make an offer on the analyses I make now and in the future, please free to do so, but give me updates on how it went! By no means do you have to but I'd love to know what price you got it for, and how you were able to negotiate the price for whatever return it is that you got! Otherwise, it's just a free deal analysis for people to take a look at and point out any mistakes I may have made.

I’ll (try to) be posting every weekday! *Overview at the bottom*

Deal Analysis

This is my first deal analysis so I’m sure there’s a lot of things I didn’t take into account, if you notice anything I could do differently please let me know.

The deal I’m looking at right now is actually currently pending, but here is the address if anyone wants to look it up on Zillow. 244 13th St NE APT 217, Atlanta, GA 30309

Pricing

It’s a condo currently listed for $375,000 but condos in the same area sold for at most $350K so I’d put it’s actual home value at $340-350k. On the higher end because it looks like the renovations here are catered more towards a trendy modern style.

Listing Price: $375,000

Estimate HV: $350,000

Rent

The condo itself is a 2Bd/3bth (2 full baths and 1 half bath). It’s two stories with bedrooms on the second floor, large living room, kitchen, and half bathroom + laundry room on the first floor. Around 1300 SqFt, right next to Piedmont Park (which is great for the active folks!)

I’ve talked to a few of my friends and most of them said that they’d be perfectly happy paying about $1000-1100 a month but most of them are college students/recent grads. Based on the apartment I’m living in right now, the rent I’m paying, and the amenities I get for what I’m paying, if I were to look at that property as somewhere I myself would want to find rent in, I’d be willing to pay $1100 at most. This is a 2Bd/3Bth home with no master bedroom. I don’t expect rent prices to be increasing too much soon since I’ve heard of a lot of development occurring near GT housing and ITP in general. There’s been quite a lot of construction happening in Atlanta for the past few years.

Has the following Amenities:

Swimming pool

Parking + Gated community

Small gym

Rent Estimates: $2000-2200/month (both rooms)

Rent appreciation estimate: 2% a year? (I’m not sure about how to calculate this)

Location

In terms of location I’d say it’s an B+ to A class neighborhood as it’s right next to piedmont park and a very short walk to the Marta Station. This leads me to speculate that in the far future when Atlanta becomes the big city I think it’ll be, this Condo will probably be worth a lot more in the future, so this is actually an ideal unit for a long term buy and hold (if you have other cashflow to deal with the expenses).

Expenses

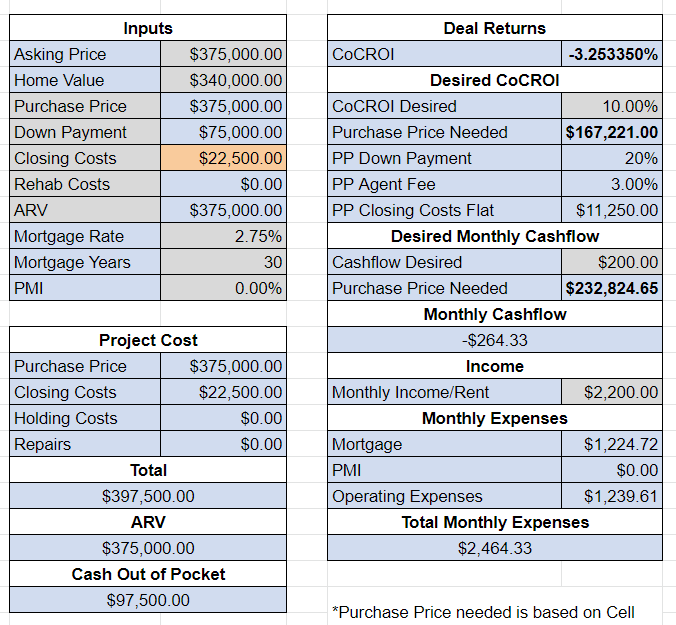

I’m just going to post a picture of the spreadsheet I used for this.

Operating Expenses + CapEx Assumptions

The three main expenses here are the HOA fees, Property management fees for when expansion occurs, and taxes. Taxes are actually a huge expense most likely due to how high the housing prices in Midtown Atlanta have become. This leads to the actual returns of this property

Returns

If we bought the house for the asking price and put a down payment of 20%, then our monthly cashflow would actually be negative and our CoCROI is -3.25%. In terms of a rental property this is a pretty bad deal. In order to get a CoCROI of 10% you would need to buy the property for $167,221 which is less than half the asking price of the seller.

Closing costs are pretty high since I’ve read that closing costs for legal documents getting signed are somewhere around 3% of the home value and then lately, it is no longer custom for the seller to pay for the buyer’s REA fee, which adds another 3% to the closing cost. This would mean you would need to pay $97,500 Cash just for this negative return.

To at least break even on the expenses you would need to pay $294,062.96 which is 80% of the asking price.

To make at least some cashflow ($200/month) you would need to pay $232,824.65 which is around 60% of the asking price, which I highly doubt the seller would agree to.

Due to the expenses and the HOA fee, this property looks to be a pretty bad investment without completely slashing the prices of the home, which the seller is unlikely to do.

Deal Overview

Listing Price: $375,000

Home Value: $350,000

Assumptions

30 year mortgage

2.75% interest rate

20% down (no PMI)

Purchase Price for

10% CoCROI: $167,221

Break Even: $294,062.96

$200 Monthly Cashflow: $232,824.65

Rent: $2200/month

Location: B+ to A

House: B+ to A

Operating Expenses: $1,239.61

As is, the numbers to make this deal work are pretty improbable and while this would be great to buy and hold it just doesn’t look like it’d be worth it. At least not to me. If anybody has any feedback on the deal analysis, or what I could do better/differently, please let me know!

Thanks,

Damien