All Forum Posts by: Dave G.

Dave G. has started 3 posts and replied 340 times.

Post: Inspection missed HUGE defect-- what now?

Post: Inspection missed HUGE defect-- what now?

- Investor

- Phoenix, AZ

- Posts 349

- Votes 418

@Ryan Swigart I think this is just a case of bad luck for you. Not sure what else you could have done if you agreed that the termite inspection addressed what you could physically see. If you thought the inspection came up short somehow and now you think the inspection deficiency could be linked to the damage found, well maybe you could try pursuing that. But I think you're probably SOL. Sorry.

Post: Next door house for sale but wife and I just purchased! SOS

Post: Next door house for sale but wife and I just purchased! SOS

- Investor

- Phoenix, AZ

- Posts 349

- Votes 418

I bet you're excited from your 1st home purchase. I was too (I get a rush every time I even write an offer). And now you see the house next door to you every time you depart or arrive to your new home, driving you to think about how you can acquire it when it comes up for sale soon.

Make sure your emotions are settled, and you're looking at numbers, or mistakes will occur that cost you a lot of $$. And don't risk your personal residence in the effort to acquire rentals. Protect your personal housing by not taking excessive risk with your RE investment acquisitions.

What if the home next door for sale was a mile away, everything else equal? Would you still be drawn to it, trying to figure out how to acquire it?

Post: 6-Plex Home Run Deal

Post: 6-Plex Home Run Deal

- Investor

- Phoenix, AZ

- Posts 349

- Votes 418

Other than the prison there, where is the demand coming from for housing? Been awhile since I've been thru Florence, but seemed like a tired, old forgotten town last time I saw it. Is it the new Nikola factory? Or?

Thanks,

Dave

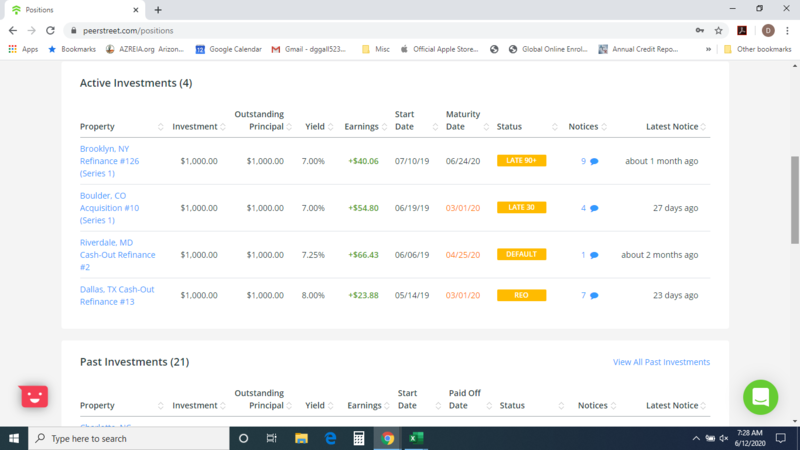

Post: Investing with Peerstreet?

Post: Investing with Peerstreet?

- Investor

- Phoenix, AZ

- Posts 349

- Votes 418

Post: Investing with Peerstreet?

Post: Investing with Peerstreet?

- Investor

- Phoenix, AZ

- Posts 349

- Votes 418

@Kelly S.I started with PS in late 2018, getting up to 10 positions @ $1k ea by ~mid-2019. At that point I was disappointed with their performance and communication. I don't believe they do a good job with comps or risk assessment. I starting withdrawing my $$ by 3Q2019 as loans paid off. I have 4 remaining positions now, one is REO listed on the MLS for less than the value of the PS loan, another is in default and the last 2 are ~90 days late, on the cusp of default. Note also that I was selective in where I chose to invest, avoiding CA, NY, NJ, IL, etc, trying to pick areas with a net-population influx and non-judicial foreclosure laws. This apparently has not helped much. I will close my account as soon as I can get whatever comes from these last four positions.

You've been warned.

Post: How Much Do You Have In Reserves?

Post: How Much Do You Have In Reserves?

- Investor

- Phoenix, AZ

- Posts 349

- Votes 418

I have reserves to cover about 6 months of expenses. I also have enough W-2 income to cover these expenses beyond that in my current employment situation.

I learned the hard way at an early age of the importance of reserves. 30 years ago as a 22 year old with 3 rentals, I had zero reserves and lasted only 18 months before giving away all three properties due to the unsustainability of the situation. Not gonna make that mistake again.

Post: Calling all CPAs - Depreciation Recaputure Tax Rate

Post: Calling all CPAs - Depreciation Recaputure Tax Rate

- Investor

- Phoenix, AZ

- Posts 349

- Votes 418

Like talking to a politician. Ask an extremely specific question 3 different ways and still get jello for a response.

Post: Calling all CPAs - Depreciation Recaputure Tax Rate

Post: Calling all CPAs - Depreciation Recaputure Tax Rate

- Investor

- Phoenix, AZ

- Posts 349

- Votes 418

Ok, so my Property B from above:

- $44k capital gains

- $18k depreciation recapture

- No other income or gains whatsoever

- Married filing jointly

- So AGI = $44k (ignore exemptions) ?

Then the marginal tax rate will be 12% ($19,751 - $80,250) and I will have a tax liability for depreciation recapture of 12%*$18k = $2160

Is this correct?

And what would the capital gains rate be? 12% or 15% or ?

I know I'm asking this in a vacuum, but just trying to understand the nuts and bolts before considering it within the bigger context of my finances.

Post: Calling all CPAs - Depreciation Recaputure Tax Rate

Post: Calling all CPAs - Depreciation Recaputure Tax Rate

- Investor

- Phoenix, AZ

- Posts 349

- Votes 418

@Christian D. Exactly! These are the details I am exploring.

Post: Calling all CPAs - Depreciation Recaputure Tax Rate

Post: Calling all CPAs - Depreciation Recaputure Tax Rate

- Investor

- Phoenix, AZ

- Posts 349

- Votes 418

@Natalie Kolodij Thank you for the response. These are not big-dollar properties. Maybe I can provide some specifics and see where it goes. I have two scenarios I could choose from.

Property A

- Sale proceeds - $140k

- Cost basis - $55k

- Capital gain - $85K

- Depreciation recapture (10 years) - $20k

Property B

- Sale proceeds - $140k

- Cost basis - $96k

- Capital gain - $44K

- Depreciation Recapture (5 years) - approx $18k