All Forum Posts by: Dee Jay

Dee Jay has started 4 posts and replied 6 times.

I'd try to fix it for them - or instruct them what to do.

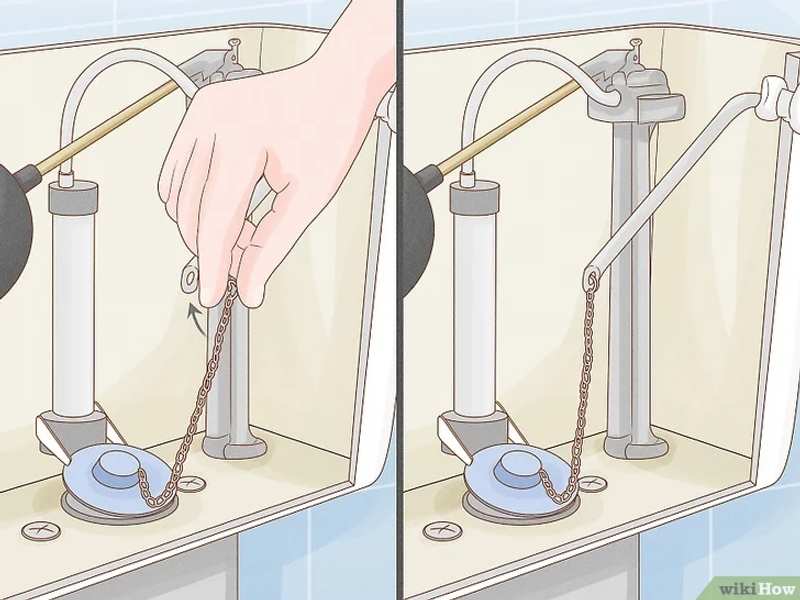

I'd ask them if the handle just jiggles around completely loose, and if that is the case, the wire clip just needs to be re attached - 2 second fix and then wash your hands. The replacement handle costs about 10 bucks on amazon if truly broken but still only takes like a couple minutes to fix. Definitely save your battles for more expensive issues.

-- Good Luck!

Post: Inherited condo, renovate and rent, or sell

Post: Inherited condo, renovate and rent, or sell

- Posts 6

- Votes 2

I am very grateful and thankful to a parent who recently passed away and left us with an owned condo (no mortgage) . My question is renovate and rent, or sell. Not a real estate professional for tax purposes, but currently have experience with 1 other rental.

Current redfin estimate is around 750k but would likely sell for 650k. The condo is in pretty rough shape and would require about 60-70k in renovation costs to make this rentable/desirable. Heavy HOA/assessment fees bring down estimated net collections around 20k per year after ALL fees/taxes/insurance/realtor/potential-repairs etc. With depreciation, taxable profit would be close to zero.

I realize we are extremely fortunate under any circumstance, but the thoughts I am balancing are if you could only return ~3 or 4% via renting out after a thorough renovation, would you consider just selling outright. Around what percentage annual net collections makes renting out worth it versus just selling and money market/interest.

Thank you very much in advance!

Post: Tax implications: using rental property in LLC for family

Post: Tax implications: using rental property in LLC for family

- Posts 6

- Votes 2

We have a rental property owned by our partnership LLC that has been rented out for the past few years. We plan to use this property for our family at no charge/no formal lease for the next few years with the potential of renting out again in the future. We are not real estate professionals (tax purposes)

This move will generate a large loss for tax purposes - I understand as non Real estate professionals we can only deduct up to a certain amount of losses each year ~3k with carryforward.

Is there any benefit of "collecting" rent on paper up to this maximum loss threshold or would it be better to report the maximum loss?

Also can you stop or pause claiming "depreciation" on tax returns if we started 3 years ago? As it won't benefit us to keep depreciating the value of this property during this max loss timeframe.

Also any other advice on this situation is appreciated.

thanks in advance!

Post: Best route to borrow for a new rental additional property in LLC

Post: Best route to borrow for a new rental additional property in LLC

- Posts 6

- Votes 2

Thank you Mark

Post: Best route to borrow for a new rental additional property in LLC

Post: Best route to borrow for a new rental additional property in LLC

- Posts 6

- Votes 2

I am looking to borrow 250k to buy a 300k rental property which would be in a new LLC.

I currently own 1 rental property (250k) in an LLC and current home with no mortgages.

what would be the most recommended borrowing route for this situation? Would it be a equity loan of current owned rental, home equity loan, or a new LLC business loan?

thanks in advance

Post: Which lawyer best to help start LLC for asset protection?

Post: Which lawyer best to help start LLC for asset protection?

- Posts 6

- Votes 2

I am looking for an attorney in the tampa bay area who could help start a multi member LLC (husband/wife) to put 1 rental property into. The sole purpose of this LLC will be to protect non real estate assets from a future potential lawsuit related to the rental property.

We are not interested in using legal zoom or filing directly on the florida website ourselves in this case. Guidance is also needed for to ensure the LLC is operated cleanly and independently to reduce risk in a potential future lawsuit.

Also, which type of attorney would be best for this help (real estate/asset protection etc). Some report using CPA's. Any thoughts here?

thanks in advance,

Dee