All Forum Posts by: Dominick Ator

Dominick Ator has started 1 posts and replied 3 times.

Post: Mortgage Loan Estimate Review

Post: Mortgage Loan Estimate Review

- Posts 3

- Votes 0

Thank you for the response this for a Single Family - Primary Home - Conventional Loan. I really would like to know I'm getting the best deal I can get on such huge purchase.

Originally posted by @Nick Belsky:

Looks like a UWM LE.

Your rate depends heavily the occupancy type. Are you purchasing a primary residence, vacation, or investment property?

Is this a conventional loan, FHA, VA, etc...

I can price it on my side to see if it's similar. I use UWM for residential all the time. PennyMac is better pricing, but UWM has an amazing back office. Some of the fees on the LE I would question, but if its the initial LE, then it's for compliance. You are not locked into this pricing and terms. Believe me, it will all change as you go through the process.

Cheers!

Post: Mortgage Loan Estimate Review

Post: Mortgage Loan Estimate Review

- Posts 3

- Votes 0

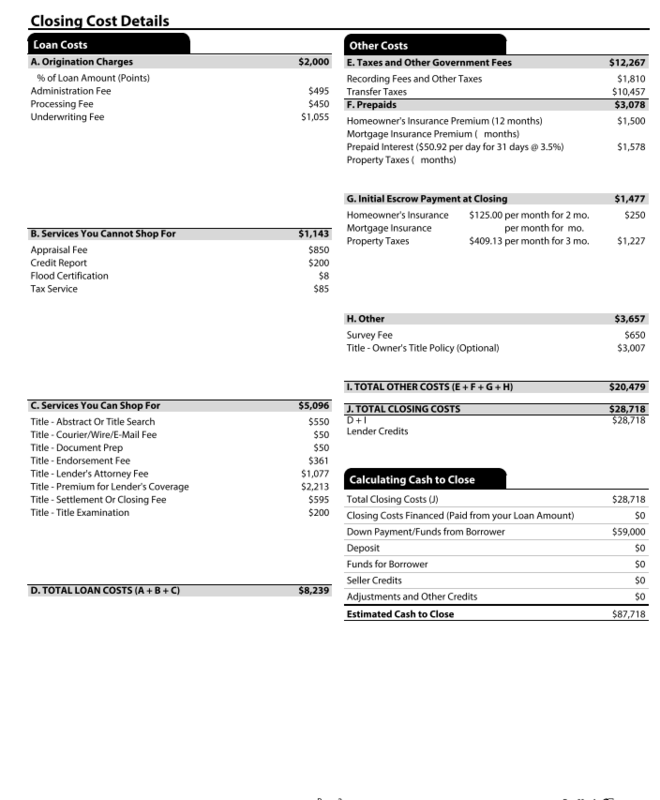

Hi guys, so I'm working with a lender that provided me with a Loan Estimate and since it's my first time home purchase I would like someone with experience to take a look at it and give me their opinion. Red flags came to my mind, when he put on the estimate a 3.5 Interest rate and me being extremely well qualified I should be getting market rate. He then hit me with "Don't worry about it". Like can you please give me a good answer and ballpark?

I just don't want to be screwed on this first time home purchase.

LOAN AMOUNT: $531000

HOUSE PRICE: $590K

Interest Rate Quoted: 3.5% (Credit Score 792, Debt/Income Ratio: 38%)

Please chime in I would really love the help.