All Forum Posts by: Duane Richards

Duane Richards has started 3 posts and replied 62 times.

Post: Getting Started with Short-term Rental

Post: Getting Started with Short-term Rental

- Cedar Hills, UT

- Posts 64

- Votes 43

@Dallin Jolley, when we first started looking at REI, it was because of a trip to St. George, where a bunch of condos were for sale in the location we were staying. We returned to Utah County with the bug, wanting to know more. We later took a trip back down and talked to some property management groups (we got their information off the different "for rent" signs). Some will manage STR's for 25% while others require 40% or more. I believe AirBNB would be an easy way to manage renting your unit, but handling the cleaning, code lock changes, etc. would be difficult remote. From our discussions, targeting a 30% occupancy is what most people use for numbers and income predictions.

Post: Utah County Rental Market

Post: Utah County Rental Market

- Cedar Hills, UT

- Posts 64

- Votes 43

@Ray Loveless I'm guessing it's because multi-family units seem over priced and sell so quickly here. I know you mentioned picking one up 5 years ago, but my wife and looked and looked and after failing to find ones that would meet our criteria, opted for SFH (townhomes in particular) for now. Our next step, we want to move towards multi, so we continue to scout for deals.

@Kristyn Morgan good luck in Vineyard! I'll be interested to get your update once it's all said and done!

Post: Advice for House Hacking in Salt Lake City

Post: Advice for House Hacking in Salt Lake City

- Cedar Hills, UT

- Posts 64

- Votes 43

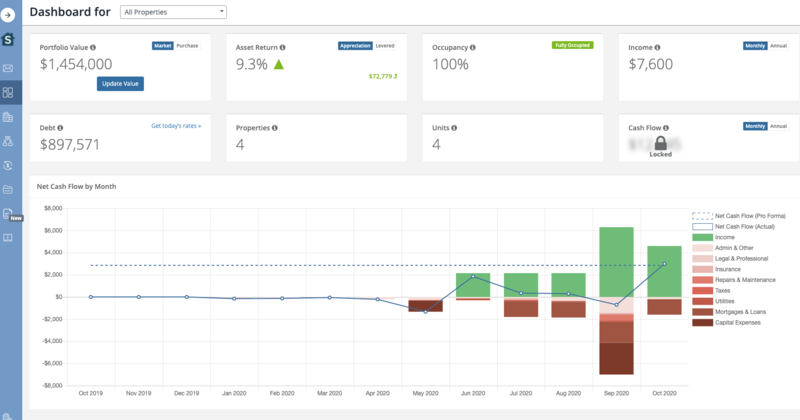

@Lindsay Wolfgramm I was tracking all mileage and expenses through a spreadsheet on my Google Drive until I found Stessa.com - free for landlords (so far) from a sponsored ad on one of the BP podcasts. I love it and it makes my expense management so much simpler. I can scan in receipts, use the app for mileage at the time of my trip, setup portfolios, and link bank accounts so it will automatically import transactions. Each transaction can be linked to a specific property, portfolio, etc. and its dashboard shows me a great running trend of cash flow, expense, etc. I've even made sure I track leases in there as it's so easy to do! Screenshot of my dashboard below - let me know if you have any questions about it!

Post: How I achieved $100K annual cash flow in 2 years

Post: How I achieved $100K annual cash flow in 2 years

- Cedar Hills, UT

- Posts 64

- Votes 43

I second Cameron's recommendation of Rentler and Stessa - I had always planned on Rentler when we started our journey, but was tracking mileage and expenses using spreadsheets. Found Stessa from a BP sponsor on one of the podcasts and threw away my spreadsheets afterwards. Both tools have been totally free for me so far, though on Rentler, for $25 you can gain access to all kinds of legal docs for your state, I recommend them!

Post: Advice for House Hacking in Salt Lake City

Post: Advice for House Hacking in Salt Lake City

- Cedar Hills, UT

- Posts 64

- Votes 43

@Lindsay Wolfgramm, We are pretty new investor landlords and just finished closing on our 4th unit in Utah County this year (0 to 4 units in 8 months, yikes!). We love Rentler.com and use their forms for the basis of our Lease agreements, sprinkled with things from the BP Utah forms you can get on this site. We find that listing a rental on Rentler is all we've needed to do to get things moving. It sends the listing to KSL.com and Facebook marketplace. I placed one of our properties on Craigslist but I find that KSL and FBM are much more popular in Utah, and got a much higher response from these, especially with younger families and college students.

Post: Local Real Estate Investing Advice in Ogden,UT?

Post: Local Real Estate Investing Advice in Ogden,UT?

- Cedar Hills, UT

- Posts 64

- Votes 43

Hello Justin,

Welcome to to the real-estate market in Utah! My wife and I started research and education just a bit over a year ago. As part of that process (BP forums, articles, books podcasts), we took a few trips around our beloved Utah to see where we might want to invest. One trip took us to Ogden where we interviewed a great property management company (Reeder Asset Management) and scoped out a lot of multi-family units. We found most of the multi units were converted homes, many of them pretty old. Buy in was much lower than Salt Lake or Utah county properties and rents came closer to the 1% rule. We eventually stuck with our "familar" areas for our first investment, but I still believe Ogden is a great place to look as prices are still lower, but appreciation is sure to rise with the other Wasatch Front areas.

If you're looking to do long-distance, it wouldn't hurt to reach out to Reeder or another PM group as they were very helpful in pointing us towards the "good" neighborhoods to narrow our search.

Good luck with your real estate ventures!

Post: How I achieved $100K annual cash flow in 2 years

Post: How I achieved $100K annual cash flow in 2 years

- Cedar Hills, UT

- Posts 64

- Votes 43

@Cameron Lam our goal is actually cash flow for passive streams and diversification (all our previous investments were in the stock market). We liquidated some and sold some stock from my company to get 25% down on the two in Highland. CoC ~ 9% the first year, but between the two units, we pull in about $1000/mo. For the Provo units, we actually put almost 40% down (lower price point), as the more we put into the OZ, the bigger the tax break was. CoC is lower for those, but monthly cash flow after expenses between the two is around $1200.

For Highland: https://www.calculator.net/ren...

For Provo: https://www.calculator.net/ren...

Just one more quick question for you - our Provo units are in an LLC (setup as an OZF), and we had to fund them commercially for the OZF qualification to stick (found a great lender, btw, if anyone needs one in Utah), our Highland ones in another. We looked at land trust structuring with single LLCs per property in the beginning and consulted with a few companies - one we almost went with (Anderson Consulting I believe) wanted $1500 for setup and $500 a year. Is that comparable to what you paid Fortune Law Firm? And I'm assuming you retroactively did this after getting started?

Post: Utah County Rental Market

Post: Utah County Rental Market

- Cedar Hills, UT

- Posts 64

- Votes 43

@Kristyn Morgan, welcome to the Utah market. My wife and I are newbies, and have gone from 0 to 4 SFR's this year in Utah County. We put money down on a new townhome in Sept 2019 (after doing a ton of reading on BP, using rental calculators, etc.), supposed to close in March 2020, but COVID pushed it to May. With the quarantine, we worried about the whole thing and probably listed our unit at too low of a rental price point. However, because of the area (Highland), we had tenants lined up for 45 days waiting to move in. The area was so popular, we put earnest money down on a second one (being built) from the builder in April, which just closed in September. Also had a renter lined up for 30 days waiting to move in.

We are about to close on two more (invested in an OZ at the end of 2019) in a different area (Provo), all while COVID is in full swing in Utah. We've had tenants lined up on these as well for almost 30 days now. If the seller would just get their stuff in order, we would have closed in July LOL!

Would love to connect! Good luck with everything and your continued REI successes!

Post: Funding Properties (personal vs com) while maintaining OZ status?

Post: Funding Properties (personal vs com) while maintaining OZ status?

- Cedar Hills, UT

- Posts 64

- Votes 43

If anyone is following me - we found a GREAT lender partner in Altabank (formerly Bank of American Fork in Utah). Willing to give us great rates while lending through our LLC. Highly recommend them - if anyone is looking for something similar, I'm glad to provide a referral (nothing in it for me, but I need to pay it back for the great work they did for me!).

Post: How I achieved $100K annual cash flow in 2 years

Post: How I achieved $100K annual cash flow in 2 years

- Cedar Hills, UT

- Posts 64

- Votes 43

@Cameron Lam, welcome to the Utah market - I'd love to get some details on your deal (Vineyard seemed to have some pretty steep HOA's when we looked at some multi-family units there). My wife and I put money down on a new townhome in Sept 2019, supposed to close in March 2020, but COVID pushed it to May. Had tenants lined up for 45 days waiting to move in. The area was so popular, we put earnest money down on a second one (being built) from the builder in April, which just closed in September. Also had a renter lined up for 30 days waiting to move in.

We are about to close on two more (invested in an OZ at the end of 2019) in a different area, all while COVID is in full swing in Utah. We've had tenants lined up on these as well for almost 30 days now. If the seller would just get their stuff in order, we would have closed in July LOL!

Would love to connect! Good luck with everything and your continued REI successes!