All Forum Posts by: Erin Wicomb

Erin Wicomb has started 21 posts and replied 52 times.

Post: I bought this 8 unit multifamily off market and its amazing

Post: I bought this 8 unit multifamily off market and its amazing

- Rental Property Investor

- San Diego, CA

- Posts 57

- Votes 62

@cliffordpaul Thanks bud for positive vibes what are some of your goals?

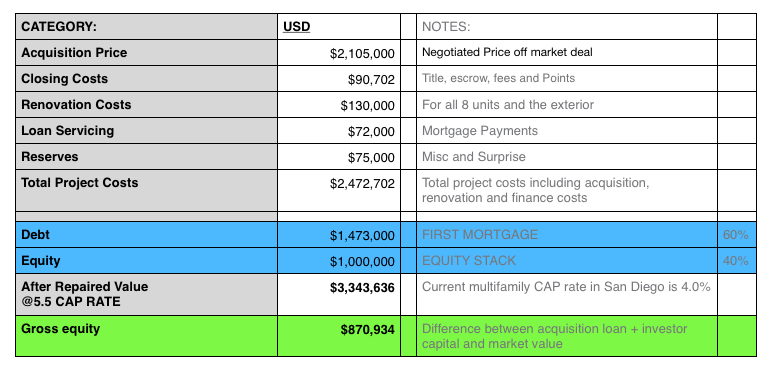

Post: 17% ROI 8 Unit Multi-Family Syndication Investment Opportunity

Post: 17% ROI 8 Unit Multi-Family Syndication Investment Opportunity

- Rental Property Investor

- San Diego, CA

- Posts 57

- Votes 62

Hi Investors and Friends,

We only have 2 more investment units for this great 8 Unit multifamily investment which we recently signed a 4-year lease with a corporate and military housing firm - essentially eliminating all lease-up risk and guaranteeing cash flow.

In addition, the corporate-backed lease also allows us to refinance our equity in less than a year. Which means you as the investor will be able to receive 50-60% of your capital back tax-free and will retain your ownership position in the asset while receiving monthly cash flow distributions.

If you have an interest in looking at the full deck and the lease please email or PM me letting me know you are interested and I will send it over to you

Thank you

8 Unit Multifamily

8 Unit Multifamily

Post: I bought this 8 unit multifamily off market and its amazing

Post: I bought this 8 unit multifamily off market and its amazing

- Rental Property Investor

- San Diego, CA

- Posts 57

- Votes 62

Hi I am Erin, I fix and flipped over 200 houses bought and sold land, I currently own or have owned duplexes, fourplexes and single family rentals, office buildings and retail units and I can honestly say mult-family is my favorite.

Only over the last few years have I started to get serious about multifamily investing.

My experience from flipping houses has really translated well into renovating these smaller apartments:

When I transitioned into commercial real estate investing in 2012 from starting with zero nada (infact I dropped out of business school to get into real estate but found myself waiting tables instead) in 2008 it was a whole new world. Getting into commercial real estate felt like I was starting from scratch.

However, multifamily value add deals were vary familiar or similar to flipping houses - where I can pick something up where the seller is motivated, where the property is off market and doesnt have a ton of sharks circling the deal and most importantly the seller has not increased or not aware of the current market rents has allowed me to make more money in this space/asset class on one multifamily (this 8 unit) property than I would have made on 10 fix and flips. Crazy.

I feel quite upset with myself for not getting into apartments sooner. Dont get me wrong I am appreciative and its been quite a journey to get here and i'm happy with my diversified portfolio but dam I cant help but think about what things would look like if I got into this in 2008 - hide sight is 2020. (actually next year is 2020) It's motivating.

#newgoals

So I currently I have 40 multifamily units. I decided I am going to focus on this category and set an aggressive goal of building my multifamily portfolio up to 400 units in the next 2 years. I have been following guys like @Joe Fairless, @Grant Cardone and @James Randal who have really been quite inspirational and I want to thank them for sharing their knowledge.

So to clarify my goal is to get up to 400 units by the end of 2020 - I hope you guys can keep me accountable

If you can share when was a time you missed a goal or an opportunity and then worked your butt off to make up for it I'd love to hear about it.

Below is a drone shot of the 8 plex and a motivating quote that resonated with me. Crush it in 2019

Post: 8 Unit Multi-family passive investment opportunity SAN DIEGO

Post: 8 Unit Multi-family passive investment opportunity SAN DIEGO

- Rental Property Investor

- San Diego, CA

- Posts 57

- Votes 62

Looking for 1 or 2 investment partners to completely fund this 8 Unit apartment deal.

Only 200k remaining min investment 100k

Here is a link to the walkthrough with our property manager and our cristina who runs our investor relations:

https://www.youtube.com/watch?v=hKMO1tbbRXI&list=PLw4Z93sOlCQxpRKIXoDine8NVvGCX7FPi&index=4&t=91s

Post: How many investors went straight into Multi Family?

Post: How many investors went straight into Multi Family?

- Rental Property Investor

- San Diego, CA

- Posts 57

- Votes 62

@Andrew Neal I did not - I started in single family cut my teeth doing that flipping a couple of 100 homes then transitioned to commercial real estate doing multi family, office and retail deals now after about 4 years in residential - why you ask ? What are your goals ?

Post: Should I participate in a real estate syndication investment?

Post: Should I participate in a real estate syndication investment?

- Rental Property Investor

- San Diego, CA

- Posts 57

- Votes 62

@Troy Larson there are both some syndicates are deal specific some are strategy specific as in they only focus on multi-family deals but that is called a fund where they have many deals in the same investment vehicle. There are also funds that have a blended strategy within their fund protocol in other words 50% core investing 30% value add 20% opportunistic investing

Post: 4 Unit Multifamily investment opportunity 12% - 18% ROI

Post: 4 Unit Multifamily investment opportunity 12% - 18% ROI

- Rental Property Investor

- San Diego, CA

- Posts 57

- Votes 62

2 investment units still available

Downtown San Diego - time sensitive

Direct message me if you have interest.

or email me [email protected]

Post: INVESTMENT OPPORTUNITY: Single Family "Fix & Flip" in San Diego

Post: INVESTMENT OPPORTUNITY: Single Family "Fix & Flip" in San Diego

- Rental Property Investor

- San Diego, CA

- Posts 57

- Votes 62

Mavrik Investing currently has a Single Family "Fix & Flip" Investment Opportunity Available!

- Location: Logan Heights - San Diego, CA

- Purchase Price: $325,000

- Renovation Cost: $75,000

- After Repair Value: $475,000

- Projected Return: Debt option- 12% / Equity option- 17.2%

- Projected Timeline: 6 months

$150,000.00 Investment Still Available, Closing Soon

Deadline to invest is June 22nd, or if the deal is 100% funded, first.

We would like to invite you to invest alongside us in this excellent opportunity. If interested in receiving the comprehensive investment deck on this deal, simply reply and ask for the deck.

Other investment opportunities are available, from single-family "fix and flip" projects to long-term, cash flowing commercial property. Contact us to learn more about our investment opportunities.

Thank you,

Erin

Post: INVESTMENT OPPORTUNITY - 8 Unit Mult-Family San Diego California

Post: INVESTMENT OPPORTUNITY - 8 Unit Mult-Family San Diego California

- Rental Property Investor

- San Diego, CA

- Posts 57

- Votes 62

Hi

@Marquis Buchanon thanks for reaching out - potentially lets chat

Post: INVESTMENT OPPORTUNITY - 8 Unit Mult-Family San Diego California

Post: INVESTMENT OPPORTUNITY - 8 Unit Mult-Family San Diego California

- Rental Property Investor

- San Diego, CA

- Posts 57

- Votes 62

Mavrik Investing currently has an 8-unit MultiFamily Equity Investment Opportunity!

Location: Normal Heights/North Park, San Diego CA

Purchase Price: $1,970,000.00

Renovation Cost: $215,000.00

Stabilized Value: $2,681,927.00 @4.15% Cap Rate

Projected Return: 29.22 %

$370,000.00 Equity Investment Still Available

Deadline to invest is May 22nd, or if the deal is 100% funded, first.

We would like to invite you to invest alongside us in this excellent opportunity. If interested in receiving the comprehensive investment deck on this deal, simply reply and ask for the deck.

Other investment opportunities are available, from single-family "fix and flip" projects to long-term, cash flowing commercial property. Contact us to learn more about the 8-unit MultiFamily investment above or to learn about our other investment opportunities.

Thank you

Erin