All Forum Posts by: Jovanny Espinal

Jovanny Espinal has started 1 posts and replied 5 times.

Post: WWYD? Buying a home cash!

Post: WWYD? Buying a home cash!

- Pflugerville, TX

- Posts 5

- Votes 2

@Marcos Torres

Newbie here, but why would you be opposed to bringing in a partner?

Post: Pay Off 3.5% Car Loan vs Save Up For REI

Post: Pay Off 3.5% Car Loan vs Save Up For REI

- Pflugerville, TX

- Posts 5

- Votes 2

Originally posted by @Moises R Cosme:

If you payoff the car, can you use that money to make you more money? The key thing here is opportunity cost & the future value of your money.

If you take $20,000 and payoff the car, that is the end - car is paid off & it will depreciate, without making you any money.

Our average return on investment is 87%, that means that if we put $20k in, we get the $20k plus an average of another $17,400 back...

Your decision hinges on opportunity cost & future value of your money.

Sheesh, if I know my investment would return me that much, I'd definitely wait to pay off the car loan, but as a newbie investor, I'm not sure yet. Hopefully, I can educate myself by then to be able to run the numbers with enough confidence to make such a decision. At the moment, I feel like paying off the loan is like a guaranteed 3.5% return.

I'll definitely run numbers as I come across deals at the moment to get more comfortable with analyzing properties! Man, if I could get 80% ROI...ha. I'd quit my job in a heartbeat to focus solely on this lol

Post: New investor interested in out of state RE. Any advice?

Post: New investor interested in out of state RE. Any advice?

- Pflugerville, TX

- Posts 5

- Votes 2

Originally posted by @Eric Fernwood:

Hello @Issac Chang,

I believe that if the property does not generate a positive cash flow from day one, do not buy it. If you do, you just paid a lot of money to lose money in the hope that in the future you might make money.

“Live where you like but invest where you can make money.” …David Lindahl

The next question is where to invest. I believe every location/property must meet the following criteria.

- Sustained profitability - The property must generate a positive cash flow today and into the foreseeable future.

- Likely to appreciate - Unless the price and rent increase at or above the rate of inflation, your present value return and income are actually declining.

- Located in an area where you can make money and business risks are low.

Below is a diagram showing the process I would follow:

There are a lot of topics covered in the above diagram that it’s impossible to discuss them all here. So I will narrow my comments to the location, the Investment Team, and buying turnkey.

Location

With an almost infinite number of places you could invest, I recommend narrowing your location search based on the following criteria.

- Population > 1M - Smaller cities may be too dependent on a single industry or employer. Here is a list from Wikipedia.

- Crime - High levels of crime and long term profitability do not go together. NeighborhoodScout publishes a list of the 100 most dangerous cities in the US. I recommend excluding any city on this list because they are unlikely to get new jobs or grow in population.

- Appreciation - Unless properties consistently appreciate at or above the rate of inflation, your actual income is declining over time. Google for the areas you are considering. NeighborhoodScout generally has good information.

- Rising per capita income - If per capita incomes are rising, job quality and quantity are increasing. The St Louis Federal Reserve is a good source of such information. For example, here is the per capita income for Las Vegas.

- Increasing population - If the population is increasing, it is very likely that the location is doing well overall. The Census Bureau has good data.

- Finally, choose a place that you would like to visit. You may need to go there at some point and it would be nice if it is a desirable location.

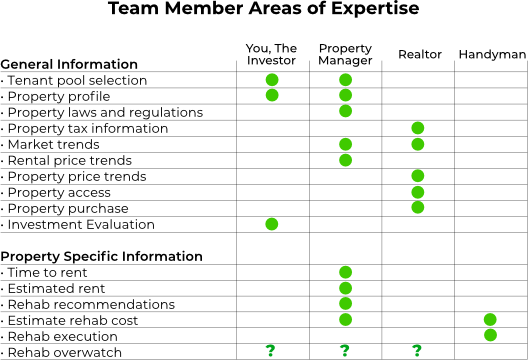

Investment Team

With the right investment team in place it does not matter where you invest. However, it is important that you have the right expectations as to what the team members can provide. Below is a table showing what expertise you want team members to have.

The most important team member is the property manager.

Wow. This is exactly the type of information and advice I'm interested in. Do you have any resource/book recommendations to learn more about how to develop systems like this?

Post: How Many RE Investors are Engineers?

Post: How Many RE Investors are Engineers?

- Pflugerville, TX

- Posts 5

- Votes 2

iOS software engineer here! Gotta put these earnings to good use! 💪

Post: Pay Off 3.5% Car Loan vs Save Up For REI

Post: Pay Off 3.5% Car Loan vs Save Up For REI

- Pflugerville, TX

- Posts 5

- Votes 2

Hey, y'all. Long time lurker here. I'm currently in a pickle and need some advice on how to approach my goal of getting into real estate investing. I would love additional perspectives to make sure I'm thinking of all possible scenarios.

Personal Financial Situation

Income: $140,000/yr

Emergency Fund Status: Six Months of Expenses at $20,000

Car Loan Balance: $25,000

Monthly Cash Flow: ~$4500

Now that I've reached my first financial benchmark of saving up for an emergency fund of 6 months, I'm at a crossroads. I can spend the next 5-6 months aggressively paying off the car loan and be completely debt-free or I can jump right into saving for my first REI property.

From my perspective, paying off the car loan would put me in a great personal financial position. Positive net worth, free up the car payment which would push my cash flow to ~$5,000 a month, and be a great burden off my financial shoulders. Who doesn't want a completely paid off nice car? The only negative I see with this approach is that it'd delay my entrance into the real estate investing game.

On the other hand, because the interest rate on the car loan is only 3.5% and my cash flow is already at a decent amount, I'd only have to find a property whose returns could beat that percentage, right? It would probably take me close to two years from today to reach the amount necessary to buy a distressed property in cash and begin the BRRRR process. Otherwise, it'd take me an extra year or so (because you know, I'm sure life will do its thing and throw a wrench into my plans).

I'm currently leaning towards paying off my car because of the psychological benefits of being completely consumer debt free and increasing my cash flow by nearly $500.

What are your thoughts? What moves would you take if you were in my financial position?