All Forum Posts by: Stephan Kraus

Stephan Kraus has started 6 posts and replied 129 times.

Post: BP is for beginners, BRO

Post: BP is for beginners, BRO

- Rental Property Investor

- Las Vegas, NV

- Posts 134

- Votes 93

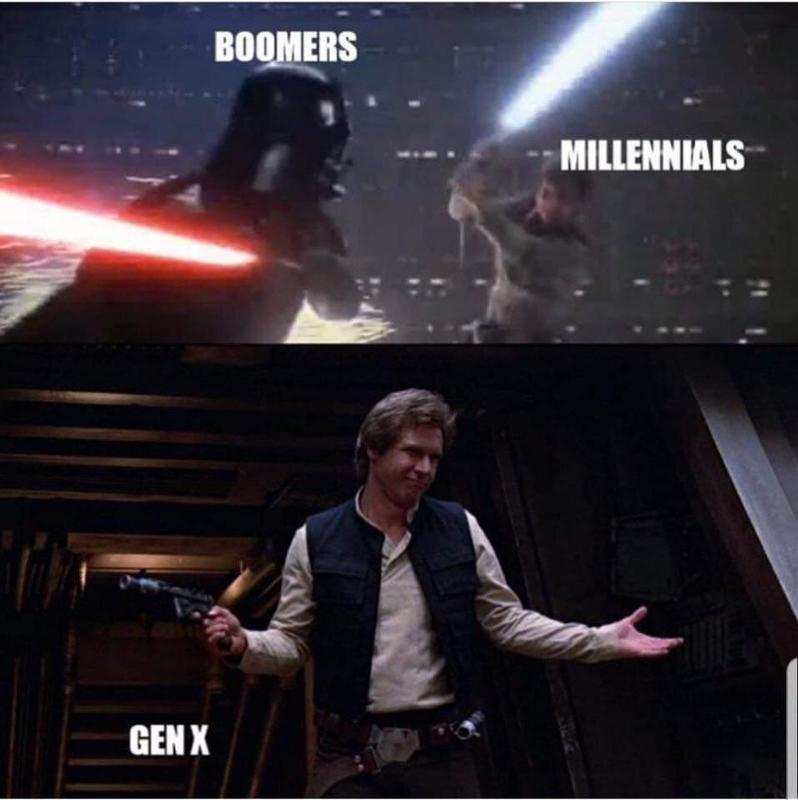

Originally posted by @Jonathan Greene:

@Stephan Kraus ultimate Bro move to tell someone not to do something in an Internet forum. Nice memes. It doesn't lash out against anyone, that's snowflake mentality. Sorry that you want pats on the back and someone to hold your hand and tell you that you are pretty, but that's not how you get far in real estate. You cut the BS and focus on what you can do better and if someone has sarcastically tell you, so be it. There's no cover of anything. I am still here responding, I don't get anything for it, and all the points are correct and based on daily interactions. Every single person who reacts unfavorably to a post about a fictitious Bro is just deciding that the post is about them. Thanks, Bro.

If YOU are a Pro, i`d rather be a Bro, Bro :)

You must have a lot of free time on your hands (probably because all the "retail buyers and novice investors ruined your business"). You're responses consist of mocking people who disagree with you and buzzword BS bingo (which is just as cringeworthy as your belief, everyone on here wants an older gentleman like you to be "patting them and telling them they're pretty")

Now that being said, i dont even disagree with you on certain key points, and dont think your post was meant against new investors in general, but the way you try to bring your points across just sound like an angry old white dude yelling at the damn kids to get of his lawn. You seem to be smart enough NOT to have to act that way, so at this point im assuming you're just trolling- and as we all know, you're not supposed to feed the trolls! I`m taking your advice at face value here and cut your BS, in the only language you seem to speak:

ok boomer :)

Post: BP is for beginners, BRO

Post: BP is for beginners, BRO

- Rental Property Investor

- Las Vegas, NV

- Posts 134

- Votes 93

@Jonathan Greene

Don't Bro me if you don't know me 😉

I find it funny when someone who's throwing around phrases from the first page of the millenial dictionary book gets offended by (incredibly accurate if i may say so) meme's - and i can't help but wonder, who exactly peed in your coffee? In your other recent post You're mad at retail buyers who are 'impossible to work with', the Bro post lashes out against inexperienced investors who 'ruin your market' (hence the 'they took'er jobs' meme)

..maybe you should focus on improving your own game instead of trying to find a demographic you can blame under the cover of giving satiric advise? 🤔

@Jay Hinrichs

Yes! Just let me know when you're in town! Im not out on the track too often these days, but happy to make it happen when you're back in the desert!

Post: BP is for beginners, BRO

Post: BP is for beginners, BRO

- Rental Property Investor

- Las Vegas, NV

- Posts 134

- Votes 93

Post: BIG HELLO FROM GERMANY

Post: BIG HELLO FROM GERMANY

- Rental Property Investor

- Las Vegas, NV

- Posts 134

- Votes 93

Hey Ben, Gruss vom Exil-Münchner - live and und invest in the US sice 2016, mostly in Las Vegas due to being local in the market, but also explore and analyze in other markets like the midwest, az, nm fl, ga, in etc - its vastly different then real estate in europe / germany, but i guarantee you one thing: if you're successful over there you can crush it here! [Solicitation Removed by Moderators]

Post: Estimating 4-plex value and deal analysis

Post: Estimating 4-plex value and deal analysis

- Rental Property Investor

- Las Vegas, NV

- Posts 134

- Votes 93

Hey Josh, i've analysed quite a few small MF properties in Vegas over the last two years, if you've read previous posts you will know most onvestors steer clear of the triplex / 4plexes that are for sale close to downtown and in the NE - which is where the majority of those properties for sale are located. You'll find plenty of the reasons for this general advise in other posts, so i wont get into that, but assume you have done your due diligence in terms of area / neighborhood, tenant pool and building classes etc.

I dont know of too many 3bed units, this is what i would prefer over a 1 or 2 bed in general, but would depend on the individuals property.

900/ unit sounds reasonable, but may not leave much upside for future rent increases, depending on the property and its condition / location, a asking price of 420k suggests that its in one of the not-so-desireable areas, probably a C - Class?

I think 3600/rents for a 400k plus 4plex is tight, but kind of the "norm" in Vegas is acceptable, it really highly depends on the property and location if i would ad it to my portfolio.

What are your goals with this? long term hold? remodel and increase rents? what's the general location? (send a pm if you dont want to answer publicly)

Post: [Calc Review] Help me analyze this deal

Post: [Calc Review] Help me analyze this deal

- Rental Property Investor

- Las Vegas, NV

- Posts 134

- Votes 93

@Account Closed, congrats on taking action and analysing! What are your assumptions that led to the percentages for vacancy, capex, repairs etc?

I think a lot of people on here will tell you to allocate these differently based of some arbitrary numbers they keep hearing on the podcast and in the forums -while those can give you a good general idea, all markets are different though, so i believe it makes sense to dissect and analyze based on real numbers - how much is a roof replacement, water heater, plumbing repairs etc in your area / for your house? How long do systems last? you can break it down and get a pretty good estimate that way, and can plan a bit more intentionally.

In general, without knowing your market, i dont think theres enough meat on the bone for you -its not terrible, but im sure you can get a better deal that leaves you with more equity / cashflow, but it all depends on your Strategy and goals..

Keep analysing, and maybe make a lowball offer - worst they can say is no ;)

Post: 0% Seller financing - for WAY MORE than the property is worth? 🤯

Post: 0% Seller financing - for WAY MORE than the property is worth? 🤯

- Rental Property Investor

- Las Vegas, NV

- Posts 134

- Votes 93

@Brett Tvenge

i wish people would actually read before commenting.. this is the last time i will respond to a comment that has been answered before:

I have long decided NOT to move forward with this deal as is - not because the deal is necessarily bad though, for more explanation see comments above.

"passionate" is absolutely the wrong term in this context, as i try to never make emotional business decisions - Im trying to be as dilligent as possible though, and came to a conclusion that a lot of other investors see not seem to give much thought, and thats the "real cost of acquisitions" - more on that: see above 🤙🏼

Post: 0% Seller financing - for WAY MORE than the property is worth? 🤯

Post: 0% Seller financing - for WAY MORE than the property is worth? 🤯

- Rental Property Investor

- Las Vegas, NV

- Posts 134

- Votes 93

Originally posted by @Joe Splitrock:

@Stephan Kraus did you run numbers on the tax implications? Paying higher asking price means you start with a higher basis, so it will increase your depreciation (good). On the flip side, there is no mortgage interest deduction. Early in the life of a loan, mortgage interest deduction often forces a property into a tax loss situation.

Just rough numbers that don't include taxes, insurance or other expenses:

$350K depreciation per year $12,727

Mortgage interest year 1 is $12K so total expense with depreciation is $24,727

Mortgage interest year 2 is $11K so total expense with depreciation is $23,727

$435K depreciation per year $15,818

No mortgage interest so $15,818 per year

Lets say your rent is $1600 per month, that is $19,200 worth of income. In situation one, you have a good tax loss on this property. In situation two, you probably break even after taxes, insurance and other expenses.

One other detail is would the contract have any loan demand stipulations? For example, what happens if the person dies before 17 years is up? Who do you make the payment to? You want to want to watch out for any situation where they could force you to prepay the loan.

It sounds like you decided against the deal for now, which seems like the right decision. I like the use of creative terms and buying A class properties is a solid strategy. I just think this one is a little too pro-seller.

I only scratched the surface on tax implications, the assumptions alone were complex enough and didn't want to confuse even more 😂

But you are absolutely correct, this is an important factor and needs to ne looked at as well!

Post: 0% Seller financing - for WAY MORE than the property is worth? 🤯

Post: 0% Seller financing - for WAY MORE than the property is worth? 🤯

- Rental Property Investor

- Las Vegas, NV

- Posts 134

- Votes 93

Originally posted by @Noah Mccurley:

@Stephan Kraus

I am always against anything that is cash flow negative. ALWAYS!!!

ALWAYS? so if i offer you a million dollar property that rents for 10k a month for $100,000, but demand you pay me back 10k a month you would say no?

See what the problem with generalisations is?

Of course im against no / low, or absolutely worse negative cashflow. who isn't? But its not just black and white. or at least it shouldn't be 😉

Post: 0% Seller financing - for WAY MORE than the property is worth? 🤯

Post: 0% Seller financing - for WAY MORE than the property is worth? 🤯

- Rental Property Investor

- Las Vegas, NV

- Posts 134

- Votes 93

@Cara Kennedy Gotcha! Thanks for pitching in! I agree, 17yr term is an odd number - but i never understood why humans tend to round up/ down to the closest 5 or 10, 15 years or 30 are such arbitrary numbers as well.. The seller originally offered 15, i tried to stretch it a bit more, but since he has a certain monthly number that is his primary goal, you identified the only other variable the down payment, that he gave his best and final, so i walked - for now :)

@Jay Hinrichs

you are correct on the imputed interest that lies on the seller as far as i know, i dont like the markup either, but as i mentioned - in a longterm play, it ends up being less than what i would have paid on a regular rental loan even at 20-25% below market. But we could not agree on the terms for now, will follow up with him mid december and see if his stand changes, before the year ends. We came a long way from "i dont want to sell" already :D