All Forum Categories

Market News & Data

General Info

Real Estate Strategies

Landlording & Rental Properties

Real Estate Professionals

Financial, Tax, & Legal

Real Estate Classifieds

Reviews & Feedback

All Forum Posts by: Lloyd Segal

Lloyd Segal has started 216 posts and replied 247 times.

Post: Economic Update (Monday, May 10, 2021)

Post: Economic Update (Monday, May 10, 2021)

- Real Estate Coach

- Los Angeles, CA

- Posts 273

- Votes 159

Economic Update

(Monday, May 10, 2021)

Are you making love less? I thought so. Apparently you’re not alone. According to the National Center for Health Statistics, the number of babies born in the U.S. dropped by 4% in 2020 compared with the previous year. In fact, the general fertility rate was a disastrous 55.8 births per 1,000 women ages 15 to 44, reaching yet another record low. What is happening? You would have thought that the birthrate would have increased during a pandemic as everyone stayed home (and looked for “creative” things to do), right? But the reverse happened! Was it an issue of performance anxiety? By the way, this is the sixth consecutive year that the number of births has declined after an increase in 2014 (down an average of 2% per year), and the lowest number of births since 1979. The U.S. total fertility rate (which estimates how many babies a hypothetical group of 1,000 women would have during their life based on data from a given year), remains far "below replacement" – meaning there wouldn't be enough babies born for a generation to replace the people who died during the same period. The rate has generally been below replacement since 1971. The statistical replacement rate is 2,100 births per 1,000 women. But in 2019, it was just over 1,700 births. And in 2020, the total fertility rate fell to just 1,637.5 births per 1,000 women. Bottom line: we need MORE lovemaking. Do I have your support on this? If I do, let’s wash our hands, put on our face masks, social distance (unless you’re making love), get vaccinated, and let’s dance…

Friday’s Employment Report is Disappointing. The U.S. created only 266,000 new jobs in April on a seasonally adjusted basis even as our economy gained strength, suggesting companies might be struggling to fill open jobs even with millions of people still unemployed. The official unemployment rate, meanwhile, notched-up to 6.1% from 6%, the U.S. Labor Department reports. Yet this first increase in 13 months stems from more people entering the labor force in search of jobs — a good sign for our economy. The small increase in new jobs belies mounting evidence that companies are eager to hire more workers in response to soaring demand for goods and services. Job openings have surged, for instance, and a survey of small businesses showed that 60% tried to hire people in April. The momentum in our economy is unlikely to fade anytime soon, either. Rising vaccinations and falling coronavirus cases have allowed states to lift business rules and encouraged Americans to resume normal activities. We are going out to eat again, traveling, and taking our first vacation in more than a year. At the same time, the government is pumping trillions of dollars of stimulus into the economy in a bid to restore growth as quickly as possible. So-called leisure and hospitality businesses — hotels, restaurants, theaters, amusement parks — added the most new jobs in April. These companies were hit the hardest during the pandemic and are now benefiting the most from a more open economy. Americans are itching to get out after being most stuck at home for the past year (but without sufficient love-making). But limited job options for adults, especially women, because they are still taking care of young children or older relatives. And they might not be able to return to work full time until day care centers, schools and nursing homes fully reopen. These issues likely contributed to the relatively small increase in hiring. But don’t be discouraged. The U.S. is still set up for a summer of strong economic growth, especially if the coronavirus is mostly squelched.

Unemployment Benefits Are Not Creating A Worker Shortage. As our economy bounces back from the COVID-induced downturn, some employers complain they’re having a hard time finding workers, blaming overly generous unemployment benefits. But that’s a simplistic interpretation of a more nuanced predicament. Economists say generous unemployment benefits are NOT the cause. After all, workers understand that unemployment benefits do not last forever (the federal benefits will expire in the fall). Further, a series of academic studies confirmed that extra benefits aren’t stopping people from going back to work. After all, if demand for workers were exceeding supply, the price of labor would be shooting up. But as Federal Reserve Chairman Jerome Powell said last week, overall wage growth increased. In reality, there are several more fundamental factors at play here. First, the normal hiring networks that employers previously relied on were blown up by the pandemic. Yes, some employers who received forgivable government loans were able to keep their workers on the payroll, but most firms simply let them go during lockdown. A year later many of those workers have taken other jobs, moved on, or even died. Second, employers may be reluctant to pay the “market clearing wage” ― the pay necessary to attract workers to available work, especially at a time when many jobs have become more difficult and stressful due to the pandemic. For example, restaurant (where owners are objecting the most), notoriously don’t pay very much, with median wages around $11 for servers in 2020, compared to more than $20 across all occupations. Third, don’t underestimate workers who are still wary of virus exposure, or are running into other obstacles to returning to work. In other words, there’s still a plague going on (scaring away workers from returning to work). Finally, one obvious factor would be schools aren’t fully opened as yet. So there are people (overwhelmingly mother) who are still at home taking care of their children that would like to be back in the workforce, but can’t. In summary, with fewer people in the workforce, worker safety concerns, the need for caregivers to remain at home, and much greater competition with other industries for workers are keeping workers away.

Judge Vacates CDC Eviction Moratorium. Last week a federal judge ruled that the Centers for Disease Control and Prevention (“CDC”) overstepped its authority when it issued a nationwide eviction moratorium. The moratorium (implemented under the Trump administration and extended to June 30 under President Biden), aims to protect the millions of Americans unable to pay rent amid the economic downturn triggered by the COVID-19 pandemic. As of March, 15% of adult renters have yet to catch up on payments, according to the Center on Budget and Policy Priorities. But it also created a backlog of rent owed to landlords, with estimates in the tens of billions. Landlords have repeatedly challenged the CDC order, saying it creates an undue financial burden. But Federal courts have issued conflicting rulings. In Wednesday’s decision, U.S. District Court Judge Dabney Friedrich, a Trump appointee, ruled that the CDC moratorium must be vacated. But landlords, don’t get too excited. The Department of Justice received a stay on the judge’s decision until an appeal has been decided by a higher court. So the Judge’s ruling does not take effect as yet. Regardless, many states and local governments have enacted their own eviction bans. For example, the judge’s ruling does not affect moratoriums in Los Angeles or California. In January, Governor Newsom extended until June 30 evictions protections for tenants affected by the pandemic. A similar Los Angeles rule gives tenants within city limits extra time to pay the rent they owe. Nevertheless, landlord groups welcomed the judge’s decision. The fundamental problem is there was no targeted help for mom-and-pop property owners who provide much of America’s affordable housing. For these landlords, mortgage, maintenance and tax bills have been piling up, putting them in danger of losing their property or being forced to sell to wealthier investors (hunting for distressed deals). Some property owners have argued that eviction bans leave them saddled with tenants who were delinquent even before the pandemic.

Buyers Squeezed in Bidding Frenzy as Prices Vault Up. In Lake Arrowhead’s 92352 ZIP code, sales of homes increased 117% last month from the year before, the biggest sales jumps in California, according to DQ News/CoreLogic. Prices rose almost 52% from the year before. So if you own a cabin in Lake Arrowhead congratulations! Within Southern California, fierce completion over a limited supply of homes fueled strong sales and drove prices to record highs during this year’s busy spring homebuying season, all but erasing the memory of the market’s coronavirus crash a year ago. The median price of a Southern California home — or the price at the midpoint of all sales — climbed 14.5% to a record $630,000 in March. It was the region’s seventh record median in the past 13 months. Los Angeles, Orange, Riverside, San Bernardino, Ventura and San Diego counties also posted record-high prices in March. In L.A. County, prices jumped $110,000, or 17.2%, from March 2020 to last month’s median of $750,000. Sales, meanwhile, rocketed to 24,885 transactions, up 32.2% from March 2020 to the second-highest level in almost three years — and the most for a March in 15 years. Much of today’s demand stems from the pandemic-induced desire for more indoor and outdoor space as well as millennials’ accelerated timeline for buying their first or larger home in a suburban location. Low mortgage rates also boosted a home shopper’s buying power. At the same time, the number of homes for sale remains at the lowest level in years. About one in five Southern California homes sold in 2020 was bought by an investor looking mainly for rental properties, and the pace of investment buying probably remains about the same this year. Unlike other parts of the nation (where institutional buyers like pension funds dominate) most of the investor competition in Southern California comes from smaller, mom and pop ventures because of the region’s high home prices. The number of investor purchases ranged from 18% in Orange County to 21% in Los Angeles and 23% in the Inland Empire (exceeding the share of investor sales during the speculative bubble years of 2005-08).

Flippers Selling to Owner-Occupants: While the broad outlines of the current inventory shortage are generally understood (i.e. there’s more demand for housing than there is supply), a number of lesser-understood factors are also making the situation more extreme. One of those factors, according to economists, is investors. In other words, landlords, flippers, startups and other entities come in and outcompete retail buyers for houses. However, a March survey of more than 200 rehab-and-resell investors from Auction.com found that rehabbing and flipping to owner-occupants was the primary investing strategy for the majority of respondents. The report additionally reveals that the vast majority of investment buyers (78 percent), purchased properties within driving distance of their own homes. Moreover, 87 percent purchased five or fewer properties in 2020 — which was up from 76 percent in 2019. Only 3 percent of survey respondents purchased more than 10 properties. The implication from these numbers is that despite a massive influx of venture capital in recent years (as well as the rise of professional iBuying startups such as Opendoor), a significant amount of investment is still taking place at the local, mom-and-pop level. Which, of course, is good news for all of us.

FAA Reports "Off the Charts" Spike in Unruly Passengers on Flights. If you were thinking it was finally time to catch a flight somewhere (anywhere), maybe think again. I say this because the Federal Aviation Administration is warning air travelers about what it describes as a dramatic increase in dangerous behavior aboard passenger airplanes. In a typical year, the FAA sees 100 to 150 formal cases of bad passenger behavior. But since the start of this year, the agency reports, the number of reported cases has jumped to 1,300! An even more remarkable number since the number of passengers remains below pre-pandemic levels. The behavior in question includes passengers refusing to wear masks, drinking excessively and engaging in physical or verbal assault (including what the agency describes as political intimidation and harassment of lawmakers). In Fort Lauderdale, Florida, for example, a fistfight broke out amid a dispute over mask-wearing. In Washington, D.C., a passenger was escorted off a flight after arguing with flight attendants over the mask rule. In recent days, Alaska Airlines banned an Alaska state senator for refusing to comply with mask requirements. In another case, a flight bound for Los Angeles was diverted to Denver and forced to make an emergency landing after a passenger allegedly tried to open an emergency exit. Sara Nelson, president of the Association of Flight Attendants union, said airline employees have reported a wide range of troubling incidents. “What we have seen on our planes is flight attendants being physically assaulted, pushed, choked,” Nelson said. “We had a passenger urinate. We had a passenger spit into the mouth of a child on board,” adding that the physical and verbal abuse that flight attendants have allegedly experienced this year has been “off the charts” compared to the last 20 years. The FAA is now taking a “zero-tolerance” approach to poor behavior: Unruly passengers face potential criminal charges, fines up to $35,000 or lifetime bans on certain airlines, and no more peanuts. So much for the friendly skies.

Tiny-House Village. Like so many of the parks in Los Angeles County’s San Fernando Valley, Alexandria Park is little more than a sliver of grassy land along a concrete-lipped embankment of a freeway onramp. Today, though, local officials are pointing to it with pride, as 103 tiny homes to be used as transitional housing for local homeless residents opened in the park. At a press conference last Thursday, where Alexandria Park was called the “biggest tiny-home village in the state,” city leaders milled about this mini-neighborhood, which has been laid out with the precision of a suburban subdivision, with a dozen or so homes painted in neon yellow, hot pink, and red diagonal stripes to create a disarmingly charming effect. It is the second such site in L.A.; another tiny-house village opened in February two miles to the southeast, and a third is under construction near Echo Park Lake, with several more to come. But unlike the other tiny-home villages, which are located in parking lots, the Alexandria village has retained its parklike attributes, including large mature shade trees. L.A. city councilmember Paul Krekorian said this project would serve as a citywide model for turning a public space that had been a “significant problem” into housing solutions. The village manages to strike a visual note somewhere between a summer camp and those temporary field offices that crop up for years at major construction sites, with modular buildings and portable trailers providing accessible shared bathrooms, showers, and laundry facilities; the all-important dog run (pets are welcome and will receive their own suite of services); and common spaces for meetings with caseworkers and meals (three per day are provided). But the tiny homes themselves were the one element the architects couldn’t spec: The eight-by-eight-foot shelter made by a Washington-based company named Pallet was preselected for them by city contractors. The buildings are made from insulated plastic and feature four windows and a pitched roof, a heater, an AC, lights, outlets, and two fold-down beds (although current COVID restrictions will keep them single-occupancy unless couples or family units want to share).

Pitcher Hope Trautwein Throws A Perfect Game. I don’t normally write about our “National Pastime” in these Economic Updates. But let me “catch” you up on the latest news. It’s a rare feat in baseball or softball to pitch a "perfect game." That happens when no opponent reaches base — not by a hit, or a fielding error, or a walk. But pitcher Hope Trautwein of the University of North Texas made history last Sunday by pitching a game more than perfect against the University of Arkansas. What she did was amazing! Through all seven innings, she struck out every single one of the 21 batters she faced! The NCAA said Trautwein, who hails from Pflugerville, Texas, is the first pitcher in NCAA Division I history to strikeout every single batter in a seven-inning perfect game. Every batter! It's also the first perfect game in the history of the North Texas team. Trautwein said her "poor team just had to watch me throw over and over and over again every inning. So it might have been boring for them. But I guess they were excited in the end." The perfect game was just another to add to Trautwein's long record of accomplishments. She's pitched two no-hitters before, in 2018 and 2019. And Sunday was the third time she's struck out 21 batters in a single game, her team noted. As for what to call the feat — the coach has an idea. "I mean Hope did it, so maybe we call it a Hope-a-Dope." Congratulations Hope! Hey Dodgers, are you listening?

This Week. Looking ahead, investors will continue watching global Covid case counts and increasing vaccine distribution. Beyond that, the Bureau of Labor Statistics will report the Consumer Price Index (CPI) on Wednesday (5/12). CPI is a widely followed monthly inflation report that looks at the price change for goods and services. Producers Price Index will be released by the same BLS on Thursday (5/13). Retail Sales will be released on Friday (5/14) by the Census Bureau. Since consumer spending accounts for over two-thirds of U.S. economic activity, the retail sales data is a key indicator of growth.

Weekly Change:

10-year Treasuries: Fell 0.07 bps

Dow Jones Aver: Rose 800 points

NASDAQ: Fell 100 points

Calendar:

Wednesday, 5/12: Consumer Price Index

Thursday, 5/13: Producers Price Index

Friday, 5/14: Retail Sales

For further information, comments, and questions;

Lloyd Segal

President

Post: Economic Update (Monday, May 3, 2021)

Post: Economic Update (Monday, May 3, 2021)

- Real Estate Coach

- Los Angeles, CA

- Posts 273

- Votes 159

You're a very lucky guy if you've already bought in Coeur d'Alene!

Post: Economic Update (Monday, May 3, 2021)

Post: Economic Update (Monday, May 3, 2021)

- Real Estate Coach

- Los Angeles, CA

- Posts 273

- Votes 159

Economic Update

(Monday, May 3, 2021)

Here’s some fun facts. According to University of California Davis’ “Road Ecology Center,” Los Angeles traffic patterns changed dramatically during the pandemic. In March of 2020, as the region locked down, traffic congestion (that symbol of Southern California life) disappeared overnight. For many Californians, the suddenly empty roads were a discomfiting novelty—simply further evidence that life as we knew it had changed. From early March through the summer, driving in California dropped over 60 percent, as measured by vehicle miles traveled. Not surprisingly, traffic speeds went up. On once-gridlocked freeways, for example, cars were moving at a steady clip not seen in over 50 years. But they also found “fast and furious want-to-be” drivers hurtling along irresistibly empty SoCal freeways at over 120 mph. By mid-April of 2020, in fact, the California Highway Patrol reported an 87 percent increase in citations for drivers exceeding 100 mph. Fortunately, most drivers didn’t indulge their Fast and the Furious fantasies. Traffic patterns on surface streets were also upended. In Los Angeles, speeds on some city corridors increased by up to 30 percent. Officials urged drivers to slow down, especially because more pedestrians and cyclists were out. To curb speeding, officials turned some daytime traffic signals to nighttime settings so drivers would encounter more red lights. Analysts also discovered that driving patterns varied markedly by neighborhood. In the first weeks of the shelter-in-place order, the number of crashes on California roads and highways dropped by about half. But when heavy rains hit Southern California in April 2020, crashes shot back up. And by mid-May of last year, fatal crashes on L.A. streets were on par with previous years. So let’s fasten our seatbelts, put on our face mask, social distance, get vaccinated, and peek under the hood…

Gross Domestic Product. The U.S. economy charged ahead in the first three months of the year thanks to more Americans getting vaccinated, fewer people catching the coronavirus and Washington approving another gargantuan $1.9 trillion stimulus. Gross domestic product, the official scorecard for our economy, rose at a 6.4% annual pace in the first quarter, the Commerce Department reports. Growth would have even stronger if supply bottlenecks and shortages of key materials didn’t curb production. Economists predict even faster growth in the months ahead if the bottlenecks ease, coronavirus cases keep falling and government restrictions fall by the wayside. Consumer spending surged 10.7% early in the new year, helped by a combined $2,000 in stimulus checks that the government sent to most Americans in January and March. More generous unemployment benefits and the creation of 1.5 million new jobs also spurred higher spending. Americans spent more on autos, home furnishings, recreational goods, clothing and takeout food, among other things. The private sector also ramped up spending, especially on new equipment and software. Business investment jumped 10%. Yet the value of stockpiled goods, or inventories, declined by a whopping $147.5 billion in the first quarter because companies could not keep up with demand. GDP would have risen 9% if the level of inventories had been unchanged. There’s a silver lining, though. The speedier recovery of the U.S. economy along with generous government aid has enabled Americans to spend more on imports as well as domestically produced goods and services. The economy was bound to speed up again once the vaccinations did their job and coronavirus cases fell. About 43% of the population — and 55% of all adults — have received at least one coronavirus shot. Low interest rates and government stimulus on a unprecedented scale have also push the economy into overdrive. Much of the stimulus has yet to be spent, what’s more, and the Biden administration is aiming to spend even more money.

Mortgage Rates Remain Under 3%. Investors still have a chance to lock in ultra-low interest rates on their mortgages. How long that opportunity will last could depend on the action the Federal Reserve takes to address potential inflation in the coming months. The 30-year fixed-rate mortgage averaged 2.98% for the week ending April 29, up one basis point from the previous week, Freddie Mac reports. The rate on the 30-year loan is down roughly 20 basis points since reaching the highest level since June of last year at the end of March. The 15-year fixed-rate mortgage, meanwhile, increased two basis points to an average of 2.31%. The 5-year Treasury-indexed adjustable-rate mortgage averaged 2.64%, down 19 basis points from the previous week. Mortgage rates have fallen in response to the movement on long-term bond yields, including the 10-year Treasury note, which they roughly track. In light of the rising COVID caseloads globally, U.S. Treasury yields stopped moving up a month ago and have remained within a narrow range as the market digests incoming economic data. The Fed is poised to keep rates low for the foreseeable future. Also relevant to mortgage rates: The central bank plans to maintain its pace of asset purchases, which include mortgage-backed securities. By buying those securities, the Fed pumps liquidity into the mortgage market that allows lenders to dole out more loans with lower interest rates. Of course, the low rates are welcome to home buyers and existing owners alike. Lower rates ease the affordability constraints for buyers, which is especially important in a competitive spring housing market where prices are rising rapidly. And for homeowners, the extended period with sub-3% rates give them yet another opportunity to refinance their home loan if they have not already.

Southern California’s Home Prices Are Still Rising by Double Digits. According to data released Wednesday by real estate firm DQNews, median home sale prices in SoCal’s six counties jumped by 14.5 percent since the same time last year, hitting a record $630,000. The number of houses, condos, and town homes sold in that period rose 32.2 percent. The upward trend predates the pandemic, but it took off with renewed vigor as the rest of our economy faltered. In December, when the median price reached $600,000, housing experts credited the surge to people whose earnings remained largely untouched by the crisis as shuttered work places left them craving more space. These lucky customers continue to drive the surge, along with plummeting mortgage rates and millennials who are entering their early 30s. Across the region, there wasn’t a single county that didn’t see a double-digit leap in the media price of homes in March. San Bernardino County saw the biggest increase—18.3 percent to $429,500—but Los Angeles County wasn’t far behind with a 17.2 percent increase to $750,000. While that sounds outrageous, Orange County remains the county in the six-state region with the highest media home price, $835,000, which represented a 10.6 percent jump last month.

Is the U.S. Housing Market Heading for a Crash? That’s the question a lot of Americans appear to be asking themselves (see storm clouds forming below). Data from Google underscore the concerns that many people have about the state of the housing market. Searches for the phrase, “When is the housing market going to crash,” are up 2,450% over the past month. Similarly, Americans are searching in droves for explanations about why the housing market is so hot and why home prices are rising, Google reports. Americans’ concerns are perhaps a natural by-product of today’s extremely competitive market. For some, today’s real-estate market might feel eerily similar to the market conditions that preceded the Great Recession. Given that the last housing boom triggered a global economic meltdown, these concerns are certainly understandable. But housing experts argue that Americans don’t need to get themselves too worked up — yet. A year ago, when COVID-19 cases first skyrocketed across the U.S., the home-buying market came to a screeching halt as people were advised to stay home to avoid getting sick. At the time, it seemed the housing market was poised for a downturn. Instead, the opposite occurred. When real-estate transactions were allowed to resume, Americans flocked to buy homes. With jobs turning remote and schools becoming virtual, families sought more space in the suburbs. Some city residents tired of their cramped apartments and decided to make a permanent move to more rural areas, while others merely opted to purchase second homes to escape to amid the stay-at-home orders. With the sudden crush of people seeking to buy homes, prices skyrocketed. The demand for housing also triggered a building craze. Last year saw a 12% gain in the construction of single-family homes. The sudden increase in home-building activity has since caused a surge in the prices for lumber, driving up the prices of new homes even higher.

Coeur d'Alene is the Hottest Emerging Housing Market. The picturesque lakeside city of Coeur d’Alene, Idaho (with the wonderfully romantic name), tops the list of the country’s hottest emerging housing markets, according to a new ranking launched Tuesday. The Wall Street Joournal/Realtor.com Emerging Housing Market Index identifies the top metro areas for home buyers seeking an appreciating housing market and appealing lifestyle amenities. After Coeur d’Alene, the top metro areas in the ranking are Austin, Texas, Springfield, Ohio, Billings, Mont., and Spokane, Wash. (just across the state border from Coeur d’Alene), ranks fifth. Buyers from other Western states are moving to northern Idaho in droves, seeking a more rural and less expensive place to live. The median sales price in the Coeur d’Alene region rose in March to $476,900, up 47% from a year earlier, according to the Coeur d’Alene Association of Realtors. Finding a home to buy in the metro area of about 166,000 is getting tougher: Inventory of homes for sale shrank by 71% to just 337 homes. That amounts to less than a month’s supply. Over 70% of page views on Coeur d’Alene property listings came from outside the state in the first quarter, up from about 66% a year earlier. The top metro areas for interest in Coeur d’Alene listings were Seattle, Spokane and Los Angeles. Coeur d'Alene has a small-town feel. Some buyers have been drawn to Coeur d’Alene’s more relaxed Covid-19-related restrictions. Students in Coeur d’Alene public schools have been able to attend school in person at least part-time all year. Kootenai County, where Coeur d’Alene is based, had 105.6 Covid-19 cases per 1,000 people as of April 19, in the top half of counties in the U.S. Coeur d’Alene is also a popular second-home and luxury market owing to the area’s natural beauty and access to outdoor activities, such as skiing and water sports. That has helped boost the number of high-end sales. In the first two months of the year, 67 homes in the area sold for $1 million and above, up from 12 sales in that price range in the first two months of 2020. New residents who recently sold homes in more expensive markets such as Seattle and Los Angeles are often able to buy homes in Coeur d’Alene in cash. That threatens to price out professionals the city needs.

Becerra Joins Lawsuits Challenging Housing in Wildfire Areas. Attorney General Xavier Becerra has joined lawsuits against two proposed developments in San Diego County, in the hilly scrublands east of Chula Vista. “ have become the norm in recent years, with dozens of deaths and whole towns forced to evacuate,” Becerra said in a statement. “That’s why local governments must address the wildfire risks associated with new developments at the front end.” Specifically, Otay Ranch Village would place more than 1,100 homes on a two-lane road within five miles of 68 recorded blazes (including the Harris fire in 2007). Otay Ranch Village would construct more than 1,880 homes on a site that’s repeatedly burned (including the 2003 Otay fire). Becerra’s move to quash rural developments in San Diego follows similar efforts in Lake and Monterey counties. The intervention of the attorney general is a fascinating escalation of power, effectively to force counties to do what they’ve rarely done — which is to rethink their greenlighting of developments in wildfire prone areas. The San Diego County Board of Supervisors approved both Otay Ranch projects with the support of local California Department of Forestry and Fire Protection officials. During public hearings, politicians, such as former Supervisor Greg Cox, stressed the need for more housing, while San Diego County Fire Chief Tony Mecham testified that residents could be safely evacuated in a large blaze. Building industry officials also touted the support of local fire authorities for many rural housing projects. Jutting into chaparral and other scrublands, the development proposals have drawn the ire of environmental groups concerned about habitat destruction, wildfire and greenhouse gas emissions from long car trips. Such legal challenges against suburban development received a significant boost in 2018 when the state updated the California Environmental Quality Act to, among other things, tighten the rules around approving housing developments in wildfire-prone areas.

Restaurants Line Up for Drive-Thrus. Once largely the province of fast-food brands, drive-thrus have been embraced by quick-service restaurants over the past year as consumers sought out socially distanced, contact-free food options. For local developers and property management companies who build and lease locations to these chains, the scramble is on to create stand-alone drive-thru restaurants or to increase drive-thru capabilities at existing properties. Demand was already accelerating for drive-thrus even pre-Covid because a lot of these tenants (whether it’s Starbucks or Chipotle or Habit Burger Grill), their drive-thru restaurants were already doing significantly higher volumes than their non-drive-thru restaurants. Covid has really been an accelerant to that trend, and a big accelerant. When Covid hit, it became all the more apparent to them that this is how they have to expand moving forward. Business at restaurants before the pandemic was generally 70% dine-in and 30% drive-thru. Now, that has reversed, and restaurant chains are eager to take advantage of the trend. 70% of Chipotle’s new locations in 2021 will have a “Chipotlane,” the company’s version of a drive-thru. In locations where a drive-thru is impossible, the company will install walk-up windows. Orders at drive-thru locations have been increasing. Drive-thrus saw a 25% to 35% increase in sales during the pandemic. As a result of that, concepts that had drive-thrus absolutely were Covid compliant and thrived. The sales that they were ringing up were phenomenal. All these companies started to say to themselves, ‘Why do we need stores that have sit-down dining or outdoor dining when we’re making a boatload of money though our drive-thrus?’” Drive-thru-only locations have a much smaller storefront than a dine-in restaurant. They also have lower expenses, with fewer paper products needed, no refills and less table cleaning. But adding a drive-thru lane is not always easy. It often means multiple entrances and exits to a property, enough room for a line of cars and city approvals (which developers and experts agree can be tricky to get). Locations are often leased on a triple net basis. In that case, the tenant can be responsible for everything from utilities to roof repair to taxes. The tenant is able to use the location without having to buy it, and a landlord is able to collect rent without having to do much work. Experts see demand for drive-thru properties continuing.

Remember the Office? Once upon a time the office would have seemed an unlikely object of nostalgia. Whether you were working in an office that was depressing because it tried too hard to be fun or an office that was depressing because it was depressing, going there meant submitting to various forms of low-level irritation (at the very least). Air-conditioning cold enough to make your fingers ache. Elevator small talk. Mediocre salads from that place downstairs. Yet somehow, a year’s absence from that HVAC terrarium has felt like a loss. The confines and routines of the office turned out to be its charm. They’re what allowed its “occupants” (in all their eccentricity) to shine. Perhaps your office had a view of cubicles and more cubicles, or maybe a window as a bonus. Cramped quarters mean sustained acquaintance with colleagues’ habits, moods, smells, and snacks. More than that, offices encouraged a collective effort to figure out how the workplace works: They encourage gossip (which can be as much analysis as breaking news). I miss collapsing on a couch to dissect a meeting that finished five minutes prior. I miss ducking into empty conference rooms to debrief. I miss being told to shut the door. All those warrens of office chatter! During the pandemic, it was startling to realize I didn’t need the office and even more startling to miss it anyway. Especially after a year of staring at each other’s heads on Zoom. The office environment we find when we return will no doubt be different from the one we used to know. But what better time to ask how the office might be remade to serve the people who spend their days there? Business as usual will never be acceptable this time around.

Nixon’s Western White House Re-lists for $65 million. The Casa Pacifica compound dates to 1926 and comprises a stately home and other structures totaling 15,000 square feet, including an entertainer’s pavilion with a bar, guest suite, den, and four terraces. The listed price is 13% more than the $57.5 million sought before the nine-bedroom, 14-bathroom Spanish Colonial Revival-style estate known as the “Western White House” fell off the market a year and a half ago. President Richard Nixon and Frist Lady Pat Nixon bought the secluded coastal bluff estate in 1969 and dubbed it “La Casa Pacifica.” He was the second of only three owners in its nearly 100-year history. Nixon also welcomed notable guests. Soviet leader Leonid Brezhnev, Lyndon B. Johnson and Frank Sinatra are among those who once crossed the threshold of the oceanfront home. When the 37th President of the United States resigned from office in 1974, he and the former First Lady moved in full time. The very same Casa Pacifica where Nixon rationalized his actions during Watergate by telling David Frost “well, when the President does it, that means it is NOT illegal.” They sold the property in early 1980 and relocated to the East Coast. There’s an ocean-view pool terrace, a lighted tennis court with a spectators’ area, a catering facility, expansive lawns, edible and ornamental gardens, and 480 feet of beach frontage on this nearly 5.5-acre parcel subject to a historic property preservation agreement to keep it intact. And it’s all shielded from prying eyes, tucked away in an exclusive community that requires passing through three gates to reach it. The current owner is Allergan co-founder and retired CEO Gavin S. Herbert.

This Week. Looking ahead, investors will continue watching decreasing Covid case counts and increasing vaccine distribution. Beyond that, the Institute of Supply Management’s “National Manufacturing Index” will come out today (5/03), and their “National Services Index” on Wednesday (5/05). But the main event will occur on Friday (5/07) when the monthly Employment Report will be released by the Bureau of Labor Statistics. These figures on the number of jobs, the unemployment rate, and wage inflation will be the most highly anticipated economic data of the month. So fasten your seat belts.

Weekly Changes:

10-year Treasury: Flat 000 bps

Dow Jones: Fell 200 points

NASDAQ Fell 050 points

Calendar:

Monday, 5/03: ISM Manufacturing

Wednesday, 5/05: ISM Services

Friday, 5/07: Employment

For further information, comments, and questions;

Lloyd Segal

President

Post: Economic Update (Monday, April 26, 2021)

Post: Economic Update (Monday, April 26, 2021)

- Real Estate Coach

- Los Angeles, CA

- Posts 273

- Votes 159

Economic Update

(Monday, April 26, 2021)

While the nation was focused on a Minneapolis courtroom last week, there was also history emanating from a Los Angeles courtroom. A federal judge overseeing a sprawling lawsuit about homelessness in Los Angeles courageously ordered the City and County to offer housing to the ENTIRE homeless population of skid row (approximately 4,600 people) no later than October 18th. Judge David O. Carter granted a preliminary injunction ordering the city and county offer single women and unaccompanied children on skid row a place to stay within 90 days, help families within 120 days and finally, by Oct. 18, offer every homeless person on skid row housing. The city and county will challenge the order, which also calls for the city to put $1 billion into an escrow account. Yes, $1 billion! The ruling argues that L.A. city and county wrongly focused on permanent housing “knowing that development delays were likely while people died in the streets.” Carter’s 110-page brief is sprinkled with quotes from Abraham Lincoln and an extensive history of how skid row was first created. As real estate investors we focus on “homes.” But we also have a moral obligation to focus on the “homeless.” No question what happened to George Floyd in Minneapolis was horrific. But what is happening to our burgeoning homeless population is no less deplorable.

Existing Home Sales Suffer Decline. Closed sales of existing homes fell 3.7% in March to a seasonally adjusted annualized rate of 6.01 million units, according to the National Association of Realtors. That is the slowest sales pace since August and the second straight month of declines. Still, sales were 12.3% higher than March 2020, when transactions were falling due to the Covid pandemic. Realtors say the monthly numbers are dropping due to limited supply. The demand is there. Homes are selling in an average of just 18 days, which is considered an extremely fast rate. But the supply of homes for sale fell 28.2% from a year ago. There were just 1.07 million homes for sale at the end of month, representing a 2.1-month supply at the current sales pace. Low supply continues to push prices ever higher. The median price of an existing home sold in March was $329,100, a 17.2% increase from March 2020. That is the highest price on record and the fastest pace of appreciation. Some of that gain is due to the fact that there are more homes selling on the higher end of the market, therefore skewing the median higher. Overall, however, prices are significantly higher. These closed sales represent contracts signed in January and February. More homes have been coming on the market in the past few weeks, but the market is still incredibly lean, especially on the low end. Higher-end home listings are more plentiful.

New Home Sales Soared 20.7% in March. New single-family home sales soared 20.7% in March to a 1.021 million annual rate. Sales are up 66.8% from a year ago. The months' supply of new homes (how long it would take to sell all the homes in inventory) fell to 3.6 in March from 4.4 in February. The decline was due to a faster pace of sales. Inventories remained unchanged in March. New home sales surged in March, beating even the most optimistic forecast by any economics group as buyers excitedly re-entered the market following a temporary pause in activity in February (due to severe winter weather across the US). New home sales are now up 31.9% from the pre-COVID high and currently sit at the highest level since 2006. Keep in mind that sales of new homes are counted when contracts are signed rather than being counted at closing (like existing home sales). This means they are a timelier indicator of the housing market, so it's not surprising that March new home sales posted such a strong rebound from February's weather-related weakness (20.7%) while existing home sales yesterday did not (-3.7%). Looking ahead, new home sales will continue to face headwinds related to affordability and low inventories. The bigger issue for new home sales, though, continues to be the lack of finished homes available for purchase. In the past year, the only portion of the new homes inventory that has increased are homes where construction has yet to start. Meanwhile, the inventory of completed new homes available for sale is down a massive 50.7% over the same period, illustrating just how strong demand was in 2020. The good news is that builders are responding to the inventory shortage, with the number of single-family homes currently under construction at the highest levels since 2007. As more homes become available, expect demand will remain strong and help maintain a rapid pace of sales in 2021.

Mortgage Rates Drop Below 3% Again. Mortgage rates slid below the 3% mark once again, giving investors, existing homeowners and prospective buyers the chance to lock in historically low interest rates in a competitive housing market. The 30-year fixed-rate mortgage averaged 2.97% for the week ending April 8, down seven basis points from the previous week, Freddie Mac reports. The rate on the 30-year loan has fallen 20 basis points since reaching the highest level at the end of March. The 15-year fixed-rate mortgage, meanwhile, fell six basis points to an average of 2.29%. The 5-year Treasury-indexed adjustable-rate mortgage averaged 2.83%, up three basis points from the previous week. The drop in rates reflect a shift back toward long-term bonds (as the stock market volatility increased). Mortgage rates roughly follow the direction of long-term bond yields, particular the 10-year Treasury note. Continuing a recent trend, yields showed little regard for strong economic data reports released last week, trending downward despite strong readings on retail sales and consumer confidence. The decline in rates offers another lifeline, particularly to homeowners who were unable to take advantage of last year’s record-breaking low mortgage rates. Research from Freddie Mac indicates that minority households and households with lower incomes were less likely to refinance their mortgages. Homebuyers, too, are welcoming the drop in interest rates. And the timing perhaps couldn’t be better. Rates are falling just as the spring home-buying season is kicking into full gear. Buyers still have to grapple with fast-selling homes and rising prices. This should help home sales maintain recent momentum.

Some Landlord are Ignoring Eviction Moratoriums. With millions of renters staring down evictions during the global health crisis, the Centers for Disease Control and Prevention extended its nationwide ban on evictions until June 30. The order is meant to shield families from being pushed out of their homes. But while tenant advocates praised the moratorium, they said the program’s implementation hasn’t been equal in practice. Many renters are still being displaced from their homes. Interviews with renters, legal aid attorneys, housing experts and affordable housing advocates at the state, local and national level show a process that can be subject to the whims of local politics or geography. Depending on the courtroom, a judge hearing eviction cases might ignore the ban, questioning the federal government’s authority to implement it. Other judges have questioned whether the order applies to tenants on month-to-month leases. Across the country, landlords are continuing to find ways to get tenants out, in some cases by declining to renew their lease or claiming that tenants broke the lease’s terms. While the federal policy bans evictions based solely on nonpayment of rent, it allows evictions for other issues, such as damaging property or engaging in criminal activity. Since the pandemic began, 284,490 evictions have been filed across the five states and 28 cities tracked by The Eviction Lab at Princeton University. More than 163,700 of them were filed since the federal government’s ban went into effect Sept. 4, 2020. The Consumer Financial Protection Bureau and the Federal Trade Commission announced March 29 that both agencies would monitor and investigate eviction practices. Just as the pandemic has disproportionately affected communities of color, racial disparities in the ability to afford housing influence families’ vulnerability to evictions now. Black, Hispanic and Asian households were more likely to be behind on rent than white households, according to an analysis of U.S. Census Bureau Household Pulse Survey data. Many states have ordered their own eviction bans, providing additional protection on top of the federal order. And some renters may misunderstand the moratorium, thinking it offers a blanket immunity without understanding the steps involved.

More than Half of LA Homes Sold Above Asking Price. Do you think this housing market is hot? How hot? Well, consider this: March saw more than half the listed homes in L.A. sell for more than asking price, as market demand continues to rise. More than half of homes in the city that sold in March closed for more than their listing price, according to DQNews. L.A.’s housing market is historically one of the most expensive and competitive in the country, but the numbers make it clear that this year is different. Out of 565 sales in the city in March, half closed above the listed amount. In March 2020, 44 percent of homes sold above asking, and in March 2019 just 36 percent of homes sold above the listed price. Competition within the city of L.A. is strongest at the lower end of the market. Around two-thirds of homes listed under $1 million sold for above their asking price, compared to nearly 44 percent of homes listed above $1 million. A shortage of listings since the pandemic has been driving up pricing and fueling competition. The median sales price in L.A. County in February was $708,500 — 14 percent higher than February 2020. The number of sales were up 19 percent year-over-year. Similar trends are playing out across Southern California. The median sales price across the six-county region was up 15 percent year-over-year to $619,750 and sales were up 17.6 percent compared to February 2020. The national market as a whole is also extremely competitive. Around six of 10 homes that sold in March nationwide sold within two weeks of listing.

Climate-Change Lawsuit Nixes Tejon Ranch Development. When you’re driving north from Los Angeles, just before the 5 Freeway drops into the Central Valley, the 270,000-acre Tejon Ranch property is clearly visible to the east, miles of rippling grasslands that bleach to a crisp golden-blond in summer. For decades, the owners of this property that straddles Los Angeles and Kern Counties have attempted to build a residential development 70 miles from downtown Los Angeles: a 6,000-acre, 20,000-home master-planned community named “.” Earlier this month, however, an L.A. County judge essentially blocked the development after a lawsuit challenged the developer’s environmental-impact report, claiming it didn’t accurately consider wildfire risk or greenhouse-gas emissions. Although the ruling doesn’t stop the development outright, it will make it significantly harder for the project to move forward without major changes. At first glance, a development like Centennial sounds like the ideal antidote to California’s housing shortage. Here’s a developer offering to contribute 20,000 homes to the region’s shortfall — 18 percent of which would be designated affordable — on what is currently the largest piece of private property in California. But Tejon Ranch is an especially egregious place to put a brand-new mini-city. Here in the foothills, the risk of wildfire is already very high, and adding humans makes a spark more likely, meaning the state will be forced to mount a costly defense of people and property. And then there’s the challenge of supporting 60,000 people essentially in the middle of nowhere — at least 30 miles from any major job centers or public transit — along with all the cars needed to haul them around and maintain their daily lives.

$20 million Newport Coast Mansion with Indoor Basketball Court. An ocean view Mediterranean-style mansion in Newport Coast is for sale where you can shoot hoops whenever the mood strikes. This unique estate has hit the market for $19.995 million. The indoor basketball court isn’t the only amenity to get your pulse racing. Completed in 2003, the 12,525-square-foot, four-story residence with six bedrooms and eight bathrooms that sits on nearly a half-acre lot is “an incomparable recreational retreat,” said Tim Smith of Coldwell Banker Realty, the listing agent. A custom slot car and a racing simulator outfit the 12-car garage designed to look more like a showroom. There’s a 1,068-bottle wine cellar, gourmet kitchen with blue Esmeralda countertops and top-of-the-line appliances and a wellness area with wet and dry saunas. Other amenities include a billiards room with a wet bar, a state-of-the-art home theater and a salt-water pool. A spa, custom stone fountains, limestone walkways with mosaic inlays, Mediterranean-inspired landscaping and multiple verandas contribute to the resort-style grounds. Inside, antiqued mirrored ceilings, marble floors, stone walls, ironwork, and Venetian plaster and JP Weaver molded ceilings with 24-karat gold complement the classical architecture. The expansive top-floor master retreat contains a fireside sitting area and a master bathroom that leads to a huge wardrobe featuring shoe display cubbies and rows of closet space. It opens to a large view terrace with a fireplace. Views of the ocean, harbor and golf course abound from throughout the property. And, yes, it is the former home of you know who…

New Book on L.A.’s Historic Buildings. If you’re a real estate investor, you spend your time dealing with (a) people, and (b) properties (and not always in that order). With respect to people, there are plenty of books for you to enjoy. With respect to properties, I’m excited to tell you about Ken Bernstein’s new book, “Preserving Los Angeles: How Historic Places Can Transform American Cities” (published by Angel City Press). For the last 15 years, as head of the city’s Office of Historic Resources, Bernstein in his new book shows off some of L.A.’s 1,200 designated Historic-Cultural Monuments and explains how preservation has propelled the city forward while respecting its past. Bernstein’s office teamed up with the Getty to survey almost 900,000 addresses, The effort revealed 50,000 pieces of astounding architecture and many hidden histories. With hundreds of photos, the book is also a treasure map of classic L.A. places you can get out and visit. Almost half the book is a field guide with 400 new photographs showcasing 35 communities and their places of deeper social and cultural history that had long been ignored or hidden in plain sight. Los Angeles is 470 square miles so there’s plenty of stories to tell. The Getty started the program for a massive citywide survey in 2000. This is the largest, most ambitious municipal survey of any city in the country. Bernstein researched the historic themes that shaped the development of the ethnic and cultural communities and geography. Bernstein did groundbreaking work with the first LGBT historic context statement for any large city in the nation, he did a Latino context, one for African Americans, and five Asian groups. This helped him identify the themes and forces that shaped those communities. Bernstein believes there is an important story to tell about how historic preservation has become a tool for community transformation. Downtown has seen so much change since the adaptive reuse ordinance was adopted in 1999. Bernstein talks about how a site like CBS Columbia Square has been preserved and reused as creative office space. Historic places can accommodate change and new growth, and his book explores these issues.

Ellen DeGeneres Flips Houses. Who needs a television show (with disgruntled employees and disillusioned viewers) when you can flip houses. Obviously, Ellen DeGeneres took my 2-day Flipping Boot Camp seriously. According to Los Angeles Magazine, since 2003, Ellen, and wife Portia de Rossi, have flipped more than 20 properties. Here’s a quick snapshot of nine properties they’ve flipped:

1. The Tree House. This midcentury modern bungalow on a wooded lot in Laurel Canyon, was purchased by DeGeneres for $1.3 million in 2004. She gave it a Zen makeover and sold it to director David Weissman the following year for nearly a million dollars more.

2. The Ogilvy House. DeGeneres and de Rossi lived in this lavish Montecito estate for less than a year before selling it for $20 million in 2007 to Google’s then-CEO Eric Schmidt.

3. Malibu Beach House. Once home to Brad Pitt and Angelina Jolie, this oceanside mansion boasts a private beach cove and stunning views of the Pacific Ocean. DeGeneres bought the newly renovated property from Pitt for $12 million in 2011, selling it for $13 million shortly thereafter.

4. The Laurence Harvey House. DeGeneres and de Rossi purchased adjoining properties in Beverly Hills for a total of $48 million and sold them as a combined estate to Ryan Seacrest for $37 million in 2012 (losing over $10 million), proving they are only human.

5. Brody House. Designed by architect A. Quincy Jones, this Holmby Hills residence is a masterpiece of modernist architecture. DeGeneres snagged it in 2014 for $40 million and sold it for $55 million six months later to Napster cofounder Sean Parker.

6. Rancho San Leandro. In 2017, DeGeneres and de Rossi purchased this equestrian compound in Montecito (next door to Oprah Winfrey’s estate). They sold it the following year to Sean Rad, founder of Tinder, for a profit of $4 million.

7. The Villa, Montecito. This Tuscan-style villa was built in the 1930s by architect Wallace Frost and restored years later by designer John Saladino. The home was purchased by DeGeneres and de Rossi in 2013 for $26.5 million. Netflix executive Ted Sarandos bought it from the couple in 2018 for $34 million.

8. Salt Hill House. DeGeneres and de Rossi purchased a Montecito estate for $27 million in 2018. The Balinese-inspired compound, which includes a koi pond, fitness cabana, and infinity pool overlooking the ocean, was sold for $33.3 million in late 2020.

9. Porter House. This English Tudor was bought and renovated by DeGeneres and de Rossi in January 2020 for $3.6 million. The new buyer, Ariana Grande, paid $6.75 million in 2020, a quick profit of at least $3 mil.

10. Beverly Hills House. In 2019, the couple purchased a 10,400-square-foot, ivy-covered mansion north of Sunset for $42.5 million from Maroon 5 frontman Adam Levine. Last month they sold it for $47 million, the second highest price sale in BH.

Don’t Worry, the Cinerama Dome Won’t Get Demolished. Designed in 1963 by Welton Becket — who also designed the cylindrical Capitol Records building a few blocks away — the Cinerama Dome was the world’s first all-concrete geodesic dome, made from 300 precast panels. A Buckminster Fuller–inspired geodesic dome with its signature red-and-blue Googie marquee has displayed the titles of premiering films for five decades. Beyond its space-age glamour, rising like a cratered moon from the Sunset Boulevard sidewalk, the form carried function; the theater was engineered for films made in a special format designed to be shown on its extra-wide curved screen. Hundreds of domed Cinerama theaters were planned across the country, only a handful were built, and this is the only one left in the world. Owing to its iconic history and design pedigree, the Cinerama Dome was declared a historic-cultural monument by the city of Los Angeles in 1998, which means it can’t be demolished — at least, not right away. Its protected status will delay any proposed demolition or alterations for at least one year. Just weeks after Los Angeles County movie theaters were cleared to reopen at 50 percent capacity, Pacific Theatres and ArcLight Cinemas announced that their more than 300 screens at 16 locations in and around L.A. were going dark for good, including one of the most famous movie theaters in the world: the Cinerama Dome. Pacific Theatres was the original developer of the dome, and remarkably, it has stayed in the same company’s hands all along. Local moviegoers, industry stars, and mid-century design enthusiasts are all distraught over its fate. A petition launched last week is well on its way to 21,000 signatures — it floats the idea that is not too far-fetched. The petition suggests that one of the streaming studios (whose business has boomed so dramatically during the pandemic), could buy it? Netflix, are you listening?

This Week. Looking ahead, the main events on the economic calendar this week will be the Federal Reserve’s monetary-policy decision and Chairman Jerome Powell’s post-meeting press conference on Wednesday afternoon (4/28), and Thursday’s (4/29) advance estimate for first-quarter Gross Domestic Product from the Bureau of Economic Analysis will be the highlights. On average, economists are forecasting that the U.S. economy grew at a 5.6% annualized rate in the first three months of 2021, versus fourth-quarter 2020’s 4.3%. Other data out next week include the Census Bureau’s March durable-goods report on Monday (4/26), the Conference Board’s Consumer Confidence Index for April on Tuesday (4/27), and the Bureau of Economic Analysis’ personal income and expenditure figures for March on Friday (4/30).

Weekly Changes:

10-year Treasury: Flat 000 bps

Dow Jones: Fell 200 points

NASDAQ Fell 100 points

Calendar:

Wednesday, 4/28: Fed Meeting

Thursday, 4/29: Gross Domestic Product

Friday, 4/30: CORE PCE Price Index

Post: How to Invest in Self-Storage Facilities

Post: How to Invest in Self-Storage Facilities

- Real Estate Coach

- Los Angeles, CA

- Posts 273

- Votes 159

Post: Real Estate Basic Training Boot Camp

Post: Real Estate Basic Training Boot Camp

- Real Estate Coach

- Los Angeles, CA

- Posts 273

- Votes 159

Basic Training Real Estate Boot Camp

"Everything you ever needed to know about

real estate investing…but were afraid to ask”

Everyone dreams of becoming a real estate investor, but very few actually do it. Why is that? Investing is fun and challenging, and the profits are fantastic. Plus, compared to other investments, you receive your profits in days (wholesaling), months (fix & flip), or years (rentals). So why don’t more people do it? The answer is simple; people don’t know how to get started. They don’t know what to do, where to turn, or who to trust. Well, if this is your predicament, our upcoming LIVE (and virtual) Basic Training Real Estate Boot Camp is for you! At the Boot Camp you will learn everything you need to know to get started as a real estate investor.

Our Boot Camp is scheduled for Saturday, June 26, 2021, 9:00 am to 6:00 pm. If you've been dreaming of becoming a real estate investor, but didn't know how to get started, this Basic Training Boot Camp is for you! This Boot Camp is hosted by the Los Angeles Real Estate Investors Club and will be taught by the worst military drill sergeant in the Western Hemisphere, Lloyd Segal.

Good News! This Boot Camp will both live and virtual. If you're ready to attend in person (with appropriate safety protocols in place) the Boot Camp will be LIVE in West LA. And for those that still prefer online in the comforts of your home, you will be able to attend through the miracle of Zoom.

In this intensive 8-hour Boot Camp, you will learn how to find deals, how to evaluate the market value of the property, how to submit offers, find the financing, and how to deal with escrow, title insurance, due diligence, and inspections, as well as the following:.

* How to find deals

* Foreclosure

* How to wholesale (Assignments)

* Deeds

* Title Insurance

* Promissory notes

* How to finance your deals

* Deeds of trust

* Mortgages

* Easements

* Purchase contracts

* Probate

* Escrow

* Structuring deals

* Realtors

* Submitting Offers

* Lease-options

* Leases

* Trusts

* And much much more!

There has NEVER been a more exciting time to become a real estate investor (either full-time or part-time). And your time is NOW! This Boot camp is also a prerequisite to other LAREIC University classes.

COST: The Boot Camp costs $149.00 per person if paid before June 19th. After June 19th, the price jumps to $1 million per person! So don't wait to register!

REGISTRATION: If you want to attend this Boot Camp, please register (and pay) at www.LAREIC.com. The registration process is very simple. Let's get started!

Post: How to Invest in Self-Storage Facilities

Post: How to Invest in Self-Storage Facilities

- Real Estate Coach

- Los Angeles, CA

- Posts 273

- Votes 159

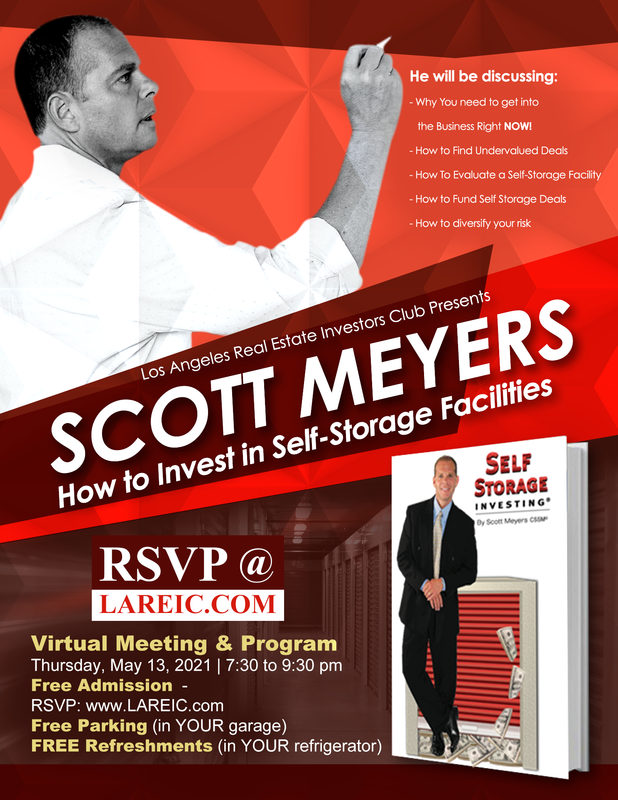

May General Meeting. Please join the Los Angeles Real Estate Investors Club and Ventura County Real Estate Investors Association for our joint May 13th (7:30 to 9:30 pm) virtual meeting:

Guest Speaker: Scott Meyers is known as the nation’s leading expert in Self-Storage. Scott is the principal in 16 facilities totaling over 5,000 units and approximately 1 Million square feet of storage. His company was started in 2006 for the purpose of acquiring, developing and operating self-storage facilities, and has raised over $30 million in syndicates and private equity partnerships to fuel their growth.

Scott is also the founder and president of SelfStorageInvesting.com, a leading self-storage education company that offers courses, live events, mentoring, and coaching. Scott is committed to helping individual investors launch their own self-storage business to enjoy a lifestyle free from “tenants, toilets, and trash”!

At this self-storage presentation, Scott will discuss:

* The Reason Self Storage is Booming

* Why You need to get into the Business Right NOW!

* How to Find Undervalued Deals (where nobody else is looking!)

* How To Evaluate a Self-Storage Facility

* How to convert Distressed Commercial Properties into Self-Storage

* How to Evaluate a Good Market for Self-Storage

* $0 Down Development techniques

* How to Fund Self Storage Deals

* Utilizing Management Practices and technology to Maximize Cash Flow

* Using Private Capital to Explode your Growth and lower your risk

* How to diversify your risk by spreading it out over many tenants

As Scott will explain, investing in self-storage needn’t be complicated. It Is actually easy to get started. It is a matter of understanding the deal. Knowing how to complete the due diligence properly. Then obtaining the necessary funding to close the deal. Once you understand these three steps, you can successfully acquire self-storage facilities anywhere in the country. Join us on Thursday night, May 13, 2021 for Scott’s presentation.

FREE Admission. Admission to our monthly meetings is always free (complimentary), but reservations are recommended.

RSVP: Please RSVP directly on our website: www.LAREIC.com so that you can receive your complimentary Zoom login and password. Be sure to RSVP as soon as possible because these virtual events sell out.

LAREIC. Founded in 1996,Los Angeles Real Estate Investors Club is the oldest and largest investor organization in California. Our Club helps people invest in real estate by offering education, networking, and mentoring. If you need help with any of our services, please let us know.

Post: Economic Update (Monday, April 12, 2021)

Post: Economic Update (Monday, April 12, 2021)

- Real Estate Coach

- Los Angeles, CA

- Posts 273

- Votes 159

|

Post: Economic Update (Monday, April 5, 2021)

Post: Economic Update (Monday, April 5, 2021)

- Real Estate Coach

- Los Angeles, CA

- Posts 273

- Votes 159

True! And thank you!

Post: Economic Update (Monday, April 5, 2021)

Post: Economic Update (Monday, April 5, 2021)

- Real Estate Coach

- Los Angeles, CA

- Posts 273

- Votes 159

Thank you for your support and vote.