All Forum Posts by: Michael Gansberg

Michael Gansberg has started 7 posts and replied 376 times.

Post: "New" NY Tenant Protection Laws - Still Worth Investing in NY?

Post: "New" NY Tenant Protection Laws - Still Worth Investing in NY?

- Investor

- New York City, NY

- Posts 388

- Votes 563

@Wesley W. - yes, that's correct, these apartments are not rent-controlled. My understanding on rent control(and definitely consult a lawyer before taking my word for it) is that in order for rent-control to come to your neighborhood, a local board must be convened, and then they can only put apartments under rent control if they've been vacant for at least a year. So far, I haven't heard of any such local board being convened in the Capital District.

This is part of the new laws, unfortunately, but I'm not worrying about it(I have schools of bigger fish to fry.)

Post: "New" NY Tenant Protection Laws - Still Worth Investing in NY?

Post: "New" NY Tenant Protection Laws - Still Worth Investing in NY?

- Investor

- New York City, NY

- Posts 388

- Votes 563

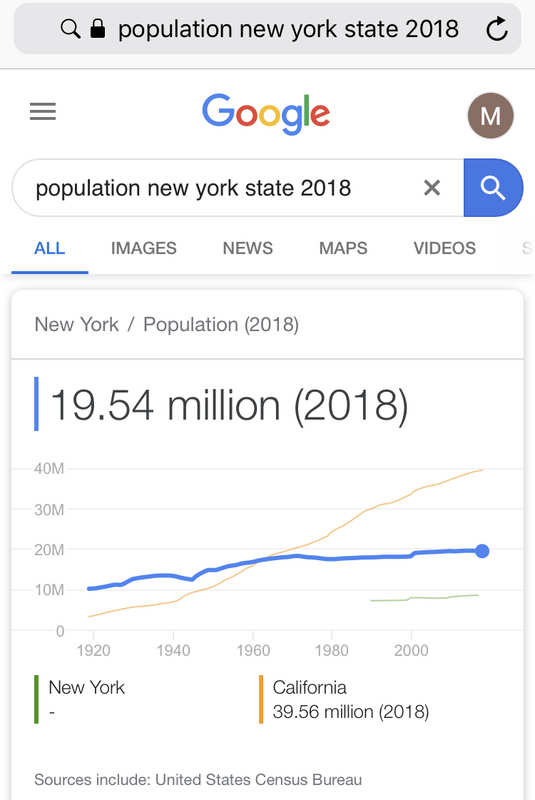

@Wesley W. - thank you, interesting perspective. Census.gov shows about 19.3 million New Yorkers in 2010, and 19.5 million in 2018. I'd say one could pick any two years to make the trend appear a certain way; but the population appears to be stable, and a ~50k loss of population in a state of almost 20 million is nearly a rounding error. Though I'm totally with you on the new laws being more onerous, I'm in the middle of a handful of evictions and will update this thread when they're done(I started on 4 in July and 2 in August, normal course of business.) Hopefully my experience will give everyone a sense of costs and timing regarding evictions in NY state, though it still varies widely by local government, apparently.

Post: "New" NY Tenant Protection Laws - Still Worth Investing in NY?

Post: "New" NY Tenant Protection Laws - Still Worth Investing in NY?

- Investor

- New York City, NY

- Posts 388

- Votes 563

@Cory Finniss - I can’t find any data to back up that claim, can you include a link? All the data I find points to population growth(I think any 2019 data is too preliminary to rely on.) I’ve attached two screenshots substantiating the recent population growth(though it’s admittedly tepid.)

@Cory Finniss - I can’t find any data to back up that claim, can you include a link? All the data I find points to population growth(I think any 2019 data is too preliminary to rely on.) I’ve attached two screenshots substantiating the recent population growth(though it’s admittedly tepid.)

Post: Buying/Starting a business vs investing in rental properties

Post: Buying/Starting a business vs investing in rental properties

- Investor

- New York City, NY

- Posts 388

- Votes 563

@Heval O. I think rental income is safer than business income, generally. If the business you’re buying sells mousetraps, you risk someone coming along with a better mousetrap. I recently read a story about geodesic domes as a new form of housing(a better version than was created in the 60’s/70’s.) Supposedly it’s 40% cheaper to build and way more energy efficient than legacy housing. But it hasn’t been proven yet, and who knows if it ever will.

Rental housing has a built-in moat around it. Zoning prevents wild development(in many places,) houses which can be acquired well below replacement cost prevents wild development as well, and even if those factors didn’t exist, capital, time, and material constraints would prevent the market from being flooded with housing units. In short, rental demand will exist for longer than we will. Will your new business have that kind of staying power?

Post: First Deal Flopped...Now What?

Post: First Deal Flopped...Now What?

- Investor

- New York City, NY

- Posts 388

- Votes 563

@Renee Yarbrough - move on to your next deal without a second thought. If there's something to be learned about why your prior deal fell apart, learn it and use that knowledge to prevent a recurrence. Beyond that, be careful not to jump on the next thing that comes along without proper due diligence. I've made that mistake- don't lose your patience on your next deal because of the recent bad outcome. Apply your benchmarks with the same stringency you used for your last deal.

MG

Post: Wise to create new Mobile Home Park on 5 acres?

Post: Wise to create new Mobile Home Park on 5 acres?

- Investor

- New York City, NY

- Posts 388

- Votes 563

@Carrie Collyer - have you considered prefab housing? I expect you'd spend somewhat more than on building a MHP, but I'm pretty certain you could get a much better product in the end. Plus- right or wrong- it may be easier to get through zoning, as I believe there is some stigma attached to MHPs. It would be more challenging to sell off the properties if you did it this way, but it could make for a great multifamily rental property.

You might also take a look into passive house standards. Some prefab builders are building to this standard, lessening the need for heating and cooling. This translates into lower operating costs for residents, which makes for happier residents.

Post: Purchasing a 20 unit former hotel

Post: Purchasing a 20 unit former hotel

- Investor

- New York City, NY

- Posts 388

- Votes 563

Hi @Kyle Pepple - sounds like an interesting project. If I read it correctly, it appears that the rent is about $10k-$11k per month. Do nicer units in the area(with kitchens of course) rent at substantial premiums to the subject property's units? Or is the spread somewhat small? I'd analyze it this way: if a 3-bedroom goes from $650 without included kitchen to $850 with(and the tenant quality rises as well,) then that'll net you $2400 annually to make that change. A decent rule of thumb is you need to be paid back in 3 years or less on your investment, so if the cost is $7200 or less, you're doing fine. If vacancy decreases as well, maybe that would justify a greater investment.

Is it possible to incorporate the existing kitchen into any of the units? For example- try to empty a whole floor at once(or ask those residents to use the kitchen on another floor.) Then build a wall and punch a whole in an existing wall to incorporate the existing kitchen into one of the units. After that, you'd only need to build two more kitchens on that floor and you'd be good.

Post: "New" NY Tenant Protection Laws - Still Worth Investing in NY?

Post: "New" NY Tenant Protection Laws - Still Worth Investing in NY?

- Investor

- New York City, NY

- Posts 388

- Votes 563

Interesting discussion. @Alan Grobmeier, there are plenty of 5-6 unit brownstones in NYC. I wonder if owners will be able to dodge part of these regulations by combining 2-3 units and turning their brownstones into 4-unit buildings? If so, I’d expect a wave of such conversions, reducing unit counts and raising apartment sizes/rents.

Rent control laws, meet the law of unintended consequences.

Post: condos or multifamily

Post: condos or multifamily

- Investor

- New York City, NY

- Posts 388

- Votes 563

@Albano Fatigati - I’d vote multifamily(in general.) With condos, you risk an incompetent Condo Board who could decide at any moment to invest your hard-earned common charges into a gold-plated Cherub peeing water into a fountain in the courtyard. Not saying that this has happened to me, but it could. With multifamily, you are in charge, and your dollars go where you tell ‘em to go.

Post: I feel like this is a no brainer... but maybe i have no brain

Post: I feel like this is a no brainer... but maybe i have no brain

- Investor

- New York City, NY

- Posts 388

- Votes 563

@Logan Reinard - I'd probably grab it. Things to look at:

1. Can you verify that the building can be converted to mixed-use prior to purchase? It would suck if you couldn't turn the upstairs into apartments. Can you walk through it with a trusted GC to verify your assumptions?

2. Will the building's value be(comfortably) more than what you've invested?

3. Check for large structural issues(plus asbestos.) It almost certainly has lead paint, but that can be managed. A bit of asbestos can too. A ton of asbestos could be a problem.

4. Would you get a higher return investing that money into your coffee shop? If so, that would be a better idea.

5. Are the demographics in your favor, or in your face? (meaning- are people moving into town, or moving out? Or is the population stable?) Nothing depresses rent like mass exoduses.