@Mike A. I'm in Gloucester City, NJ. Blue collar down about a stone throw away from Philly over the Walt Whitman. 2-bedrooms rent for about 1000 per month, 3-bedrooms are about 1300 per month. You can pick up SFH distressed around 40k, mid-range for 60k, and perfectly rehabbed for 100k. Duplex prices are in-line with SFH, making them excellent long-term buys for cash flow.

Here's the thing with your analysis -- respectfully (and I do mean that, I'm not trying to be a jerk in an online forum), I just disagree with almost every number you've input in the calculator.

- Are your closing costs really 5k? I doubt it. Even a modest closing cost percentage like 2% would be about $13,600.

- Have you confirmed your interest rate on a 25-year loan? 3.9% seems like something a SFH "forever home" buyer would get. Investors typically pay a premium on the regular rate. 4.5% and upwards is probably where you will be.

- Again -- you've accounted for no real expenses in your analysis. If a unit goes vacant, that takes away from your income. If you have to replace a heating unit, that's an expense. I understand you do the work yourself, but you are managing this with your time, fixing it with your time/money...it seems like you put a gigantic black hole over the real costs of your property.

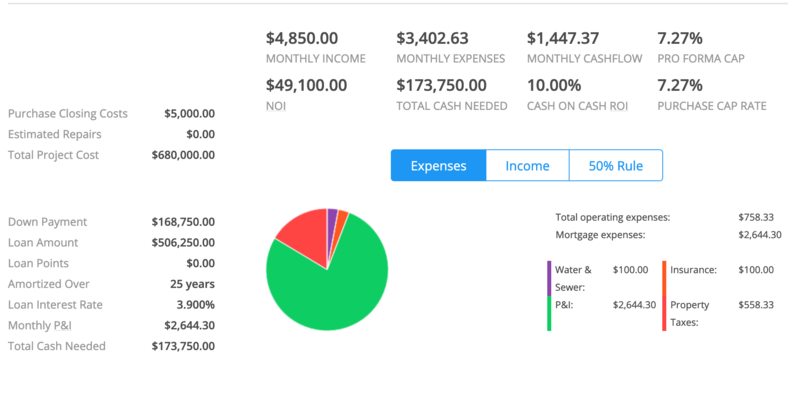

On my duplex in 2019, I had a rough year. My income was about 22,000, but my expenses were almost 12,000 -- a little over 50% of my income, not including PITI. And when you did your calculations in the BP calculator, I KNOW for a fact it gives you a category called "50% Rule Cash Flow Estimates" -- taking your income, and subtracting 50% for expenses and your PITI. It's a more realistic way of estimating actual cash flow on a deal like this. Some years you'll do great, and some years you won't, so having that 50% baseline is your "middle ground". Dollars to donuts in the report you snapshot that from, it's an extremely negative number in your calculator.

We all have different risk profiles -- I want to make money even in down years, or difficult years, when I have big CAPEX items to pay for (you will, roofs, appliances, turnover...they all need to happen and cost time, money, or both), tough vacancies to fill, etc. So my risk profile is extremely conservative.

I continue this discussion with you,because you may be an experienced investor with the means and knowledge to handle a property in this risk valuation. However, a newbie investor (or even myself -- I'm not a "handy" person so I have to outsource maintenance and CAPEX) would see this and think its a great deal. In my opinion, based on my limited experience both on the ground and theoretical, this property would cost an investor like me money every year, or perhaps show a false income before needing to take care of serious CAPEX issues, vacancies, or turnover costs.

If I can put a real world application in place, which is where I think you are headed, let's say you cash flow about $1500 per month, or 18,000 per year. If you had ZERO expenses other than the categories you indicated, you would get your money back on your initial investment in 10 years. And that's accounting for NOTHING going wrong or ever spending a single dime on any aspect of the house, and having FULL tenancy for the length of that time period. Say that sentence out loud -- does that make any sense or sound realistic to you? You won't have to replace or even fix part of a roof in 10 years? You won't have to deal with a vacancy for a month? You won't have something requiring a fix-up, tenant turnover, an eviction, a trashed unit, etc., that would cost you time and money? If you don't think anything like that would happen in 10 years, you're lying to yourself AND you are not prepared for it. Which means your cash flow that you think you are getting is actually far less than that.

I also encourage you to tag other very serious and experienced investors (try Brandon Turner, Russell Brazil, Jay Hinrichs, et al) to see if they will respond to this thread and offer their experience on your analysis. My parallel point to warning other investors with your analysis is to warn you -- I think you are headed for a rude awakening at some point. You aren't supporting this property with real dollars -- again, in my humble and very respectful opinion -- and I'd hate to see a fellow investor hit a wall.