All Forum Posts by: Patience Echem

Patience Echem has started 4 posts and replied 52 times.

Post: How to account for Cap- Ex

Post: How to account for Cap- Ex

- Posts 53

- Votes 35

Quote from @Eric Fernwood:

Hello @Patience Echem,

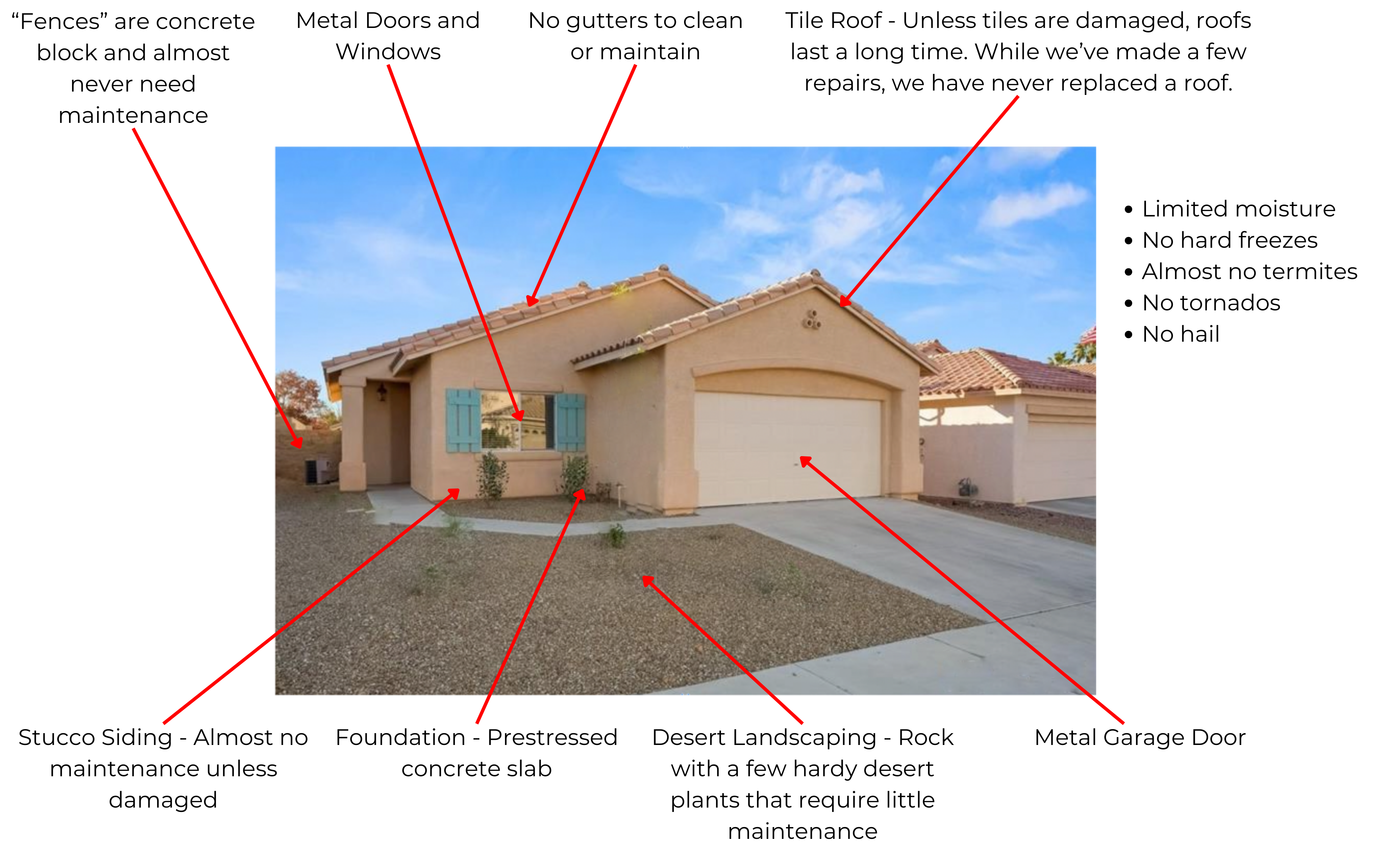

A comment on how much you should set aside for maintenance. The amount depends on the property, local climate, and the type of construction materials used. While I can’t give you an exact number for your property, I can walk you through how to estimate it. The figures I’ll use here come from averages of the 570+ rental properties we’ve delivered in Las Vegas. Because Las Vegas is in the Mojave Desert, with less than four inches of rain a year and no hard freezes, our maintenance costs are much lower than in other parts of the country. Below is typical of our rental properties (click to enlarge).

Provisioning for Major Costs

To calculate a maintenance provision, the standard approach is to base it on the remaining life of major cost components. For example, water heaters in Las Vegas typically last about 12 years on average. However, I've seen them fail as early as six years or continue working beyond 18 years. Useful life is only an educated guess. Use national averages as your guide when making estimates.

In our market, the two most significant costs are air conditioner compressors and water heaters. Tile roofs typically last decades, and in more than 17 years across 570+ properties, we’ve only had to replace the underlayment once. The rest are all minor repairs.

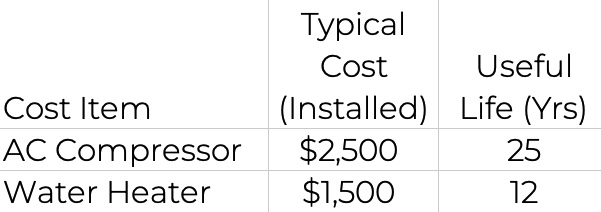

Here are typical costs (for Las Vegas) and useful lives:

Water heater age is easy to determine, since the manufacture date is stamped on the unit. Keep in mind it may have sat in a warehouse for a year or two before installation, so the date isn’t exact but the best we have in most situations. Air conditioners are harder because some parts may have been replaced, but using the manufacture date is usually a good starting point.

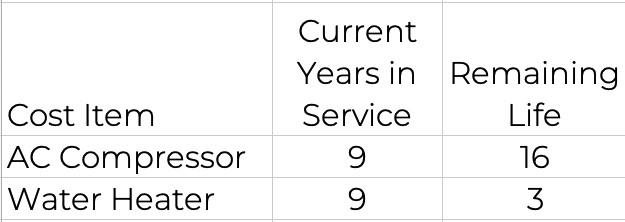

Calculate the remaining useful life by subtracting years in service from the useful life:

Calculate monthly provisions as follows:

- AC compressor: $2,500 ÷ 16 years ÷ 12 months ≈ $14/month

- Water heater: $1,500 ÷ 3 years ÷ 12 months ≈ $42/month

Total monthly provision: about $56

You may have more high cost items, like roof replacement.

Base Maintenance

In addition to major components, you should plan for routine repairs—things like dripping faucets, slow drains, or minor fixes.

Across the properties we manage, the five-year average for these base-level repairs is about $400 per year. It won’t be exactly $400 each year—one year could run $1,000, while another might be nothing.

In my experience, monthly cash flow is usually enough to cover these base repairs, so a separate provision often isn’t necessary.

Patience, I hope this helps you calculate a maintenance provision.

This has been most helpful. I like the details and the specificity to the individual property. This is good since my rentals are at different ages and levels of maintenance. Until now I was just using the 10% of the rent as capex.

Post: Too good to be true

Post: Too good to be true

- Posts 53

- Votes 35

Quote from @Ewka Kawecki:

Hi BiggerPockets,

In my search for a hard money lender I found someone who in return for %100 financing is only changing me 4%, on a 30 year term loan. 1% down payment. No points. No early repayment fees. No POF, no taxes. He only wants my ID and proof of residency. I've attached a screenshot of the letter of approval and a link to their website. Please tell me this is a legitimate lender. I'm usually very optimistic, but my scepticism is of the chats on this lender. Thank you in advance everyone.

https://quickfinancialsolutionsllc.com/

I can't help but wonder how it works if it is a scam. Are they scamming you your 1% downpayment or are you scamming them for the 160K? I agree it reads like a non-English speaker, like me, made the document. From their country of origin making 4% is probably a big deal. That said, the scam may be in all the required documents you have to provide for the loan. Tread carefully.

Post: How to account for Cap- Ex

Post: How to account for Cap- Ex

- Posts 53

- Votes 35

Quote from @Patience Echem:

I am looking for guidance on how to account for the Cap-Ex on my rental properties. Unlike the rental deposit that is required to be on a separate account, I am not sure what to do with the cap-ex. I know I should account for this, but do I actually pull it out of the account and hold it separately? How does it, if at all, show up on taxes: is this part of profit, expenditure, or can it go unrecorded just like the rental deposit? I will greatly appreciate if someone can share best practice with the money I am saving for capital expenditure.

Thank you to all the fine men that contributed answers to my questions. Here are the things I learned from Michael through Basit. Please correct me if my assumptions are wrong. Funds allocated for capital expenditures in real estate are reported as income until spent, after which they are capitalized and depreciated over 27.5 years according to IRS guidelines. These funds do not need to be held in a separate account, though separation can aid in managing future high-cost replacements like roofs or HVAC systems. My tax professional should know how to account for this in my taxes and how to expense it over time through depreciation.

Thanks again for helping me gain knowledge and feel a little more confident in my real estate journey.

Post: How to account for Cap- Ex

Post: How to account for Cap- Ex

- Posts 53

- Votes 35

I am looking for guidance on how to account for the Cap-Ex on my rental properties. Unlike the rental deposit that is required to be on a separate account, I am not sure what to do with the cap-ex. I know I should account for this, but do I actually pull it out of the account and hold it separately? How does it, if at all, show up on taxes: is this part of profit, expenditure, or can it go unrecorded just like the rental deposit? I will greatly appreciate if someone can share best practice with the money I am saving for capital expenditure.

Post: Financial advice on saving money to invest in RE

Post: Financial advice on saving money to invest in RE

- Posts 53

- Votes 35

Quote from @Dylan Villano:

Looking for a financial advisor to talk to. I need advice on making an investment plan. I have 95k in retirement funds. I have 65k in stocks, 25k in cash. Currently put 18K annually into employer retirement, 10.5k annually into savings. I want to invest into RE. Does it make sense to back off on employer retirement contributions and save more cash? I can't use a self-directed IRA, as I am still employed with company that holds that bucket of money. There would be tax implications as my retirement lowers my taxable income. Any advice or recommendations on whom I could talk to.

Thanks

This is not the kind of question I will ask strangers. You need a certified financial planner who is required by law to protect your best interest. The one you consult with should preferably be paid by the hour. This person can work you through your options based on your financial situation and your goals. The best part is that you do not have to continue using him/her. You can pay for initial consult and set up. it will be worth the price, because this person will be speaking directly to your situation. Here you are going to get a very general advice, and some of which will work against you. Perhaps people who live in Denver and use a planner can refer you to one.

Post: If the seller's inspection report does not contain the crawl space, is this fishy?

Post: If the seller's inspection report does not contain the crawl space, is this fishy?

- Posts 53

- Votes 35

Quote from @Jacky Johnson:

I'm considering purchasing a home, but the seller's inspection report did not include the inspection of the crawlspace (which I think is important) because the access was locked at the time of the inspection, is this something that is fishy for buyer's to watch out for? Thank you.

Does the house have a crawlspace? My primary is built on a slab so not every house has a crawl space. If it does have a crawlspace, I would expect that to be included in a good inspection report. If it is missing then, that would be red flag for me. As Patrick and Ned already stated: Yes, it is preferable to get your own inspection.

Quote from @Jay Hinrichs:

Quote from @Amarri Persley:

Quote from @Jay Hinrichs:

Quote from @Amarri Persley:

Quote from @Jay Hinrichs:

Quote from @Amarri Persley:

Quote from @Mike Grudzien:

Have you purchased the property already?

How much "skin in the game" do you have?

Great questions I’m currently under contract on the property with closing lined up once I finalize the gap funding. The hard money lender has already approved $152,200, which includes the full rehab budget and most of the purchase price.

On my side, I’ve got skin in the game through holding costs and I’m personally guaranteeing the hard money loan. I’ll also be managing the rehab directly with my contractor team, so I’m fully committed to getting this project completed on time and on budget.

The numbers are strong with plenty of margin — purchase + rehab = $186k vs. ARV of $235k leaving projected profit in the $30k range.

I see this math all the time.. I fear your 30k is going to turn into 10k or break even

my math would be

235k exit 10% for sales commish and buyer credits ( almost always need buyer credits at these price points) interest on HML and gap funder for 6 month hold 15k or so. Utls prop taxs and closing costs to title company on the resale 5k

so 235 ( 23,500) (15,000) (5,000) = 43,500 235k - 43,500 = 191,500 - 186,000 = Total Profit of 5,500.00

Now if you sell it yourself with no commish and no seller credits you can get to the 30k.. but that is rare in the extreme in most markets.. I fund these deals for a living and have been for 40 plus years.. this is what I see the numbers shaking out time and again.. 186k all in needs an exit at 250k to ensure some profit.. Unless your 186k is including the 15k in gap and HML fees and rates . U may want to explain this in more detail if your going to get an investor to take the huge amount of risk being behind a HML .. Just sayin.

Thanks for the breakdown I really appreciate your perspective. Just to clarify, my $186k all-in does include the HML fees and interest reserves, and my closing timeline is projected at 3 months, not 6. With that structure, my projected profit is closer to $25–30k at a $235k exit. I do underwrite conservatively, though, so I definitely see why you'd run it your way. Appreciate the insight!

Ok thats better but 3 months unless you basically have it pre sold is pretty tough to do you may want to run 4to 6 to be realistic also are you adding in seller credits for the buyer.. virtually every deal I fund that gets sold in this price range will have seller credits as these generally are first time home buyers on limited cash on hand situations. I would do both of those also to see how it flush's out.. How much are you penciling in to pay for a gap funder ?

Absolutely, the rehab is cosmetic, that’s where the tight timeline comes in. We don’t want to sit and let interest pile so 3-4 months is where 30k reach is. I have did my due diligence with closing costs especially with buyers, as a realtor I’m fully aware that is the hardship sellers end up paying. I won’t pay anymore than 3% to a realtor. My profit is still floating 25-29k after all of the expenses.

so no listing fee your listing fee is rolled into the 25k . Let us know if you get a gap funder to go for this.. these are in the lending world the most risky loans an investor can make a small loan behind a large HML first.. My suggestion is to jump on Pace Morby's facebook he teach's this stuff and has a bunch of beginners who dont really realize the risk in gap funding.. BP tends to have some investors that might be to new to the game to realize the risk but most are experinced enough to know there is not enough profit on such a small gap fund loan to equate to the risk of the deal in total.. this is the type of thing you really need to do on your own to prove your bona fides or family friends that want to help you or CC advances Just sayin

Any way if you pull it off please post a success post and lay out all your numbers for others to learn from.. good luck.

Thanks to you both Jay and Amarri. Your civil back and forth interactions are a tread that one can learn from. Before this, I am not such I understood gap funding, but your explanations and advice are helpful. Best of luck to you Amarri.

Quote from @Amarri Persley:

I’m currently working on a fix & flip project in Danville, KY and I’m seeking a gap funding partner to cover the down payment and closing costs.

Amarri,

How many flips have you completed before this one? How reliable is your team of contractors? Have you worked with them or they for you in the past? If Jay's math is right and there is a high chance of breaking even as opposed to making $30k, would looking for a better deal be an option especially if you don't have down payment or closing costs?

Post: Does risking 90% to 100% of your investment with passive investing make sense?

Post: Does risking 90% to 100% of your investment with passive investing make sense?

- Posts 53

- Votes 35

Thanks, Bryn, for sharing. That is a hard lesson to learn. Hope you did not risk a large percentage of your wealth in the deal. I agree that just reading that one can lose up to 100% of one's investment is often not believable, but in you case it looks like it possible. Buying and maintaining control of one's properties appear safer than relinquishing control to an operator. I agree that with stock, when a stock loses its value beyond what one can tolerate, one is allowed to sell, but not with syndications. Your advice is a good one. The risk vs reward may not be worth it for some of us. it must be why syndications is meant for very high net worth individuals and sophisticated investors.

Post: Does risking 90% to 100% of your investment with passive investing make sense?

Post: Does risking 90% to 100% of your investment with passive investing make sense?

- Posts 53

- Votes 35

Quote from @Bryn Kaufman:

I was shocked to learn that I might lose 90% of my passive investment with Open Door Capital, run by Brandon Turner.

I did not realize passive Real Estate investing is so much riskier than the stock market.

I was foolish enough to think it was safer when I made my investment.

For stock market investing, one is always looking at the risk vs. reward for every investment, every trade.

In the stock market, if you lose 1%, or 10% or whatever percent makes you uncomfortable, you can always pull your money out and wait until conditions are more favorable, unlike passive Real Estate investing.

In the stock market, if you are in an index fund, you know it will eventually recover. Unlike a passive Real Estate investment that goes bad, there might be no hope of recovery.

Also, the risk-to-reward ratio of simply putting your money into an S&P index fund seems much better. As a comparison, even if you held on through the COVID crash, you lost 34% (not 90% or 100%), and 8 months later, you recovered.

Also, you can put in the exact amount of money you want, so things like dollar cost averaging can help mitigate risk if you think the market is high. Compare this to passive Real Estate investing, where your entire investment has to be made at one time.

Summary of passive investing: You can lose all your money, you can't pull out your money if you feel things are not going well, you can't control the size of the loss, your money is gone for many years with no access, you have to put in a large fixed amount of money at one time, and you are counting on perhaps one or two people, rather than relying on the strength of the best businesses in America.

So my question is, does passive Real Estate investing make sense with such a huge risk?

In my opinion, as I go through this experience, I would say no. I would never put money into a passive Real Estate investment again.

Maybe there are others who disagree, but that is my opinion.