All Forum Posts by: Scott Po

Scott Po has started 5 posts and replied 33 times.

Post: Would you spend 90K to cashflow?

Post: Would you spend 90K to cashflow?

- New to Real Estate

- Washington D.C.

- Posts 33

- Votes 4

Thanks everyone. Unfortunately, I can't just put down 20%. The assumption gap is $67500 and I want to do approximately 20k of reno to it so that 90k is pretty set in stone.

My mortgage with piti is $1900. I have 5 bedrooms, two of them currently being rented out for 950 a piece. If I rented out the other rooms I would have a decent cash flow. Worse case scenario, if I can't rent the other rooms, I can rent the whole thing out for 2400 per month, giving me a 500 dollar cashflow.

You guys have some good points so I think I'm going to stay in the deal. I was just reluctant to do so because I'm essentially wasting my VA benefit by assuming a VA loan and still having to put down 67500.

I'd also have to redo the already "finished" basement with that 20k so that is going to be wasted money because I'm buying it as a 5 bed even though the two downstairs bed rooms need to be redone.

The 2.7% interest rate is too good to pass up I suppose.

Post: Would you spend 90K to cashflow?

Post: Would you spend 90K to cashflow?

- New to Real Estate

- Washington D.C.

- Posts 33

- Votes 4

Quote from @Kyle Tusing:

Are you planning on renting out the property? What would the rent for the property be? Additionally if you do not plan on renting it immediately how soon do you plan on renting it, because when you go to make it an investment you will have to convert it from a VA loan which will require you to have 15 to most likely 20 percent equity in the property. The other financing option may make it easier to make it an investment in the future. Also for the 900 a month you are saving in a year that difference is $10,800 which can be looked at as a 12 percent return on your 90k.

Yes, I'm trying to do by the room. I am renting the property until I close because assumptions are a lengthy process. I already have two tenants for two of the rooms. They are renting at 950 each, so I'm virtually breaking even already with 2 rooms still available. I could rent the entire place for 2600, my mortgage (1300) with piti is 1900.

Since I'm putting 90K into the deal, I'd already have that equity.

Post: Starting out in DC, any advice?

Post: Starting out in DC, any advice?

- New to Real Estate

- Washington D.C.

- Posts 33

- Votes 4

Quote from @Joaquin Camarasa:

First of all, I would like to compliment you on taking the responsibility of taking care of your family. It is not easy at such young age, I have a similar story and I am impressed you managed to save 45k. I understand the overthinking that comes with making sure your family is safe at all times.

You are in a good position to househack as mentioned above. This is what I did with all my properties. I bought my first one at 27 in Denver Colorado, second and third ones with my wife in Springfield Virginia. The market is a lot tougher than it used to be but I still think househacking is the best bet as mentioned in the prior comment.

I would add that the market is very competitive with very little inventory. Also, do not only count with the closing costs and downpayment as usually the ideal househack requires some type of minor renovations. I'd be happy to chat more if you have any questions.

Joaquin, would you spend 90K to cashflow in Fort Washington? I'm starting out too and I'm about to close and I wonder if it would be better to go VA loan with no money down and high monthly mortgage. Or I spend 90k and get a monthly mortgage 1000 less than the comps because I'm doing an assumption. I'm near natl harbor. Thanks

Post: Would you spend 90K to cashflow?

Post: Would you spend 90K to cashflow?

- New to Real Estate

- Washington D.C.

- Posts 33

- Votes 4

I have a leverage question, would you spend $90k to get a property with a $1300 mortgage when comps in the market would be closer to $2200?

If I go VA, I could get a similar property for no money down but have that $2200 mortgage. Or I go $90k down and get a $1300 mortgage.

Post: How are the rents for investors in the Northern Virginia area ?

Post: How are the rents for investors in the Northern Virginia area ?

- New to Real Estate

- Washington D.C.

- Posts 33

- Votes 4

Quote from @Jennifer Hoyer:

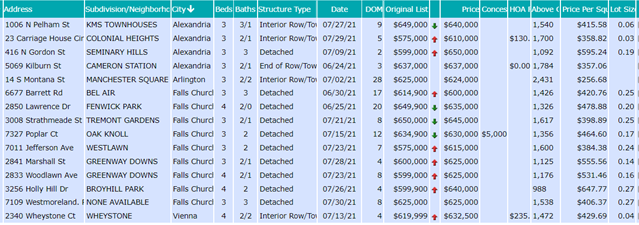

I'm a professional property manager in NOVA. Here's a link to MLS rental prices in the last 60 days in Arlington/Falls Church/Alexandria centers for townhomes/detached w/ 3-4 BR & 2-4BA. Rental prices went up at least 10% this year. I also ran a sales search for 600-650K homes sold in the past 60 days in corresponding areas to give you an idea of size comparisons. In my experience, homes with 3-4 BR and 3-4 FullBA are highly desired by young professionals and they will pay more, especially near a metro. Many PM companies are no longer listing on Zillow btw. It's not cost-effective so its data is less accurate.

RENTED (183)

SOLD (15)

Let me know if you need an agent.

Post: How do I calculate this deal?

Post: How do I calculate this deal?

- New to Real Estate

- Washington D.C.

- Posts 33

- Votes 4

I'm assuming a mortgage which will enable me to actually cashflow in today's market, which is what peaked my interest in the deal to begin with. Here's the deal;

Sales price: $407,500

Mortgage I'm assuming: $340,000

Interest rate: 2.7%

Assumption gap: $67,500

Monthly mortgage (no piti): $1,300

Market: Fort Washington, Maryland

Property: 5 bed/ 2 bath

The issue is that I have to come out of pocket on the assumption gap (difference between current sale price and old mortgage that I'm assuming). So I'm wondering if getting an extra $1,000 in cashflow per month is worth depleting my cash, especially if I'd like to do some improvements to the property. These improvements would be in the neighborhood of $20,000. The alternative would be using my VA to get a better property with no money down, but having that extra monthly payment because of the current interest rates. Doing this would allow me to save that $67,500.

Post: Ask your favorite BP podcast host trending questions!

Post: Ask your favorite BP podcast host trending questions!

- New to Real Estate

- Washington D.C.

- Posts 33

- Votes 4

Quote from @Isaac Lane:

Why do you do real estate investing and what is your end goal?

End goal is to have enough properties to retire on passive income.

Post: Ask your favorite BP podcast host trending questions!

Post: Ask your favorite BP podcast host trending questions!

- New to Real Estate

- Washington D.C.

- Posts 33

- Votes 4

I'm assuming a 340k VA loan at 2.7% on a 407k property. The property is a 5Bd/2Ba. The assumption gap is 67k. I have the cash to pay this outright but my question is would it be wise to leverage that assumption gap or pay it outright? If I paid it, I'd deplete most of my savings. I have financing to leverage the gap if I so choose. My options are;

Leverage the gap- 2800 monthly payment

Pay outright- 2250 monthly payment

I'm single and work a W2 in Washington DC with an 80k salary.

Post: Help with my assumption loan

Post: Help with my assumption loan

- New to Real Estate

- Washington D.C.

- Posts 33

- Votes 4

Thanks for the heads up. Seller is ok with me renting from him during that period.

Post: Help with my assumption loan

Post: Help with my assumption loan

- New to Real Estate

- Washington D.C.

- Posts 33

- Votes 4

Quote from @Nathan Grabau:

Quote from @Scott Po:

Quote from @Eliott Elias:

Do not assume the loan if this is an investment property. Take it over subject to.

why?

If you can do subto, it keeps it off your credit. That being said if you can assume a 2.7% loan and it is smooth, the advantages of subto are not as extreme.

With regards to your original question, I would prefer to hold onto the cash. Everyone likes to see cashflow as their front line of defense, but in my mind, cash is the true first line of defense. A/C and hot water heater goes out and you have a 5000 bill, I would rather have 70k than a 800/ month lower payment.

The 800 is a pretty big swing though, typically when people are talking about 70k it is for a sub 500 monthly payment swing, so that is the only thing that creates a gray zone for me in your specific example

The seller wants assumption because that is what was advertised. In regard to the 800 difference I actually miscalculated, thanks for highlighting that! I didn't include expenses in my monthly figure for if I paid cash.

So if I paid cash and just took on the mortgage, I would be looking at $2250 (Mortgage + expenses).

If I leveraged the assumption gap, my monthly would be $3500 (mortgage + expenses + 2nd loan).

If I took the best of both worlds and was able to pay half cash and leverage the other half, I would be looking at the $2600 figure I told you about in the original post (mortgage + expenses + second loan). Obviously I'd be out $30k ish but I'd still have $ in the bank.