Updated over 3 years ago on . Most recent reply

Invest in Las Vegas or Los Angeles

Hello everyone, I am a newbie to investing and to Bigger Pockets. I have a question and would like to hear your opinion about whether it is better to invest in buy and hold in Las Vegas or Los Angeles. Las Vegas real estate is growing but not at such a fast rate as Los Angeles. One single family house will cost half a million and I can get two in Las Vegas. Los Angeles is too expensive at the moment. But with the dollar being so strong, many foreigners are coming to invest in the US. That being said, do you feel it's better to invest in Las Vegas or Los Angeles for the long term (10 years). Thank you so much for your input.

Most Popular Reply

Thank you @Jean G. for the kind reference. I wrote a updated post below for @Tina Chen.

Hello Tina,

I am a Las Vegas Realtor and our practice is almost entirely investors. A large percentage of our clients live in California but invest in Las Vegas. The reasons they choose to invest in Las Vegas is all about the balanced current return and long term profitability and probable appreciation:

• Return / Cash flow

• Long Term Profitability and Appreciation

I will explain each of the factors below:

Return / Cash Flow

Our clients tell us that it is exceptionally hard to find properties with a positive cash flow in Los Angeles. This is quite different than what they experience in Las Vegas. Median price for our class A investment properties in Las Vegas is about $200,000 and rehab costs are typically less than $5000. Our clients are typically seeing +5% return on class A properties. This rate of return includes all typical recurring costs including:

• Debt Service - 20% down, 30 year fixed.

• Management Fee - 8% of collected rent

• Landlord Insurance - Typically $500/Yr

• Property Tax - Between 0.72% and 0.86%

• Periodic Fees - Most of our class A properties have association fees ranging between $20/Mo. and $45/Mo. We tend to get a higher return in such subdivisions due to their desirability.

• Maintenance - Maintenance costs average about $600/Yr. This is due to the nature of Las Vegas home construction which I will describe later.

• State income taxes - Nevada has no state income tax.

Long Term Profitability and Appreciation

ROI and similar calculations are only predictions of how the property is likely to perform today. Such calculations provide no sight into how the property is likely to perform over the next 10+ years. Long term profitability and appreciation are a function of the following items:

• Business risk - Nevada is a business friendly state. Its pro-business laws apply to rental properties as well. There are no rent control laws in Las Vegas and evictions typically take less than 30 days and usually cost less than $500. In comparison, in California it can take up to one year to evict a knowledgeable tenant and cost thousands not even considering lost rent.

• Rental Market Stability - The Las Vegas rental market is extremely stable. We did a study on the rental income during the 2008 to 2014 period and discovered that return on investment was not impacted during the crash. You can see the actual data in this BP post.

• Population Growth - Market demand is what determines the value of an investment property. Population is one component of market demand. If the area has a stable or increasing population, demand will remain stable or increase. If people are moving out of an area (either to other cities or other locations within the metro due to urban sprawl) property values and rents will fall. Las Vegas' population is expected to continue growing at approximately 1-2% per year for the foreseeable future.

• Sustained Job Quantity and Quality - The second component to market demand is job quality and quality. Nevada is aggressively recruiting businesses to move to Nevada many of whom were based in California. One of our clients moved their business from California to Las Vegas and reduced operating costs by more than 20%. Plus, Las Vegas tourism continues to do well due to its adaptability. For example, today Las Vegas hosts millions of Chinese tourists each year. Before the Chinese it was the Japanese. And, in the future it will be another group. Las Vegas has always been excellent at adapting to the changing world.

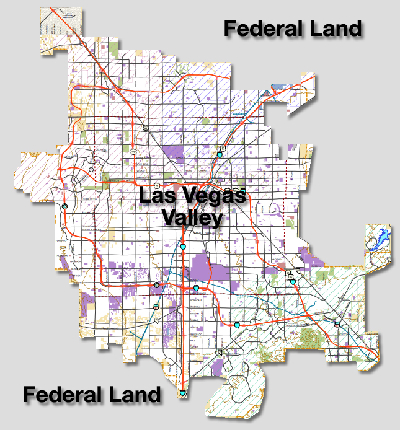

• No Urban Sprawl - Urban sprawl can be devastating to investment properties over the long term. People tend to want newer floor pans and newer areas so, if they have the money, they will move to newer areas even if they have to commute significant distances. The result is that areas that were once desirable for investments become less desirable over time. As people with money leave an area, property prices, rental rates as well as property tax revenues fall. Falling tax revenues force city governments to reduce services and school funding. This results in more people vacating the area. Las Vegas, even more than San Francisco, is land locked. People can commute from Daily City, Oakland or Berkley to jobs in San Francisco but Las Vegas is a virtual island. The map below shows the Las Vegas metro area. The gray area is federal land. In fact, only about 11% of the entire state of Nevada is privately owned.

Below is a map showing the closest alternative cities. As you can see, there is little development within commuting range outside of the Las Vegas metro area. Also, most properties in Las Vegas are still selling at below replacement cost so prices in the few surrounding cities are not significantly less so commuting does not make economic sense.

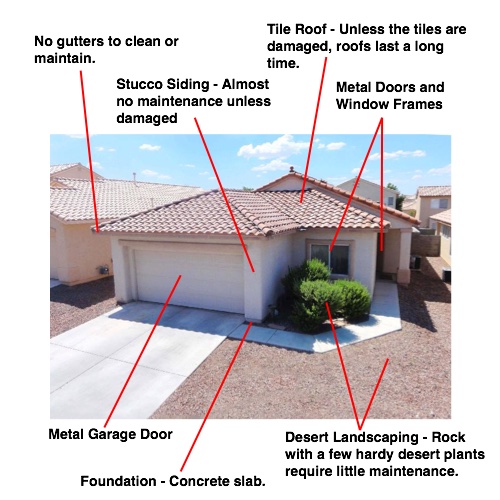

• Maintenance costs - Las Vegas property maintenance costs on class A properties tend to average about $600/Yr. or less. The reason maintenance costs are so low is the climate. Typical construction materials which you find in milder climates do not survive the high temperatures in Las Vegas. Below is a graphic shows typical Las Vegas construction:

Tile roofs, stucco, metal doors, windows, concrete block fences and rock landscaping require little maintenance.

Tina, I hope the above helps you evaluate whether Los Angles or Las Vegas makes the most financial sense for you. For more information on investing in Las Vegas and investing in general, please see my profile or contact me.

- Eric Fernwood

- [email protected]

- 702-358-8884