Updated about 6 years ago on . Most recent reply

Dave Ramsey Is Misleading The Public

I wanted to address this to educate people who have been mislead by the financial services industry...not just Dave Ramsey

Step 7 - Build wealth and give. This is where he want's you to "invest in mutual funds," and to be fair real estate (all cash and 5% of your investments). So let's assume the other 90-95% goes into mutual funds. Just go to his website and it's obvious he's drank the mutual fund koolaid. Again, not sure whether he knows how bad his advice is and is lying or is completely ignorant. My guess is it's the former because of the mental gymnastics required for articles like this from his blog.

And if you read the blog post it becomes obvious why I tend to believe he's blatantly lying to his audience and his whole schtick is a rouse. see below

Notice he brushes off the lost decade by saying you have to look at the bigger picture and you can't cherry pick time frames. But that's exactly what he does to make his claim about the 12% average returns. The whole basis for for the blog post and a big part of what he sells to his audience.

But it goes from a subtle white lie to blatant fraud when you look at how he's selling a "12%" return.

Meaning, most of his listeners are unsophisticated, they don't know a 12% drop one year and a 12% gain the next doesn't put you back at zero. They think that their money will just compound at a 12% clip annually. Let's look at reality.

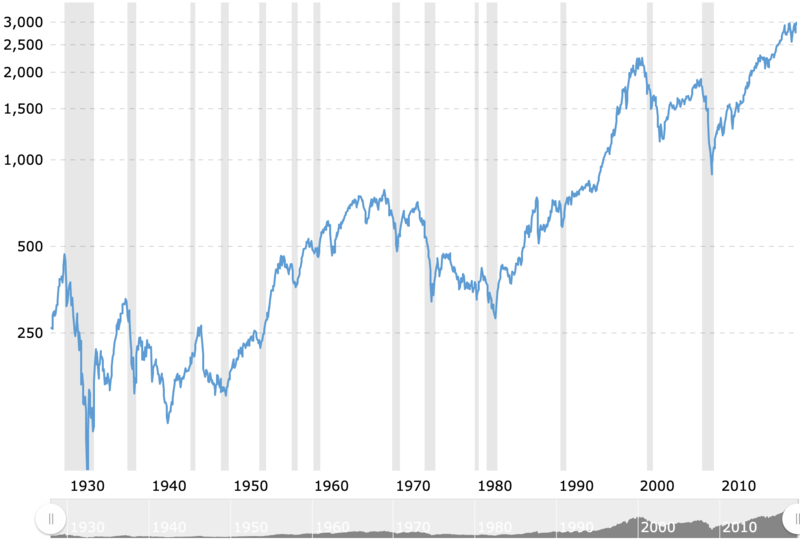

If we took what DR says at face value, the market goes up on average of 12% a year going back to 1923, we should be able to type the value of the 1923 S&P into a compound interest calculator, input 12%, and we should have roughly 3000 (where the S&P is today). I only have data from 1928 on, but I think you'll still get my point. The S&P was 17 in 1928. Let's see what happens...

If what DR says is true, the way he sells it to his audience, if S&P would have to be at 512,000 right now!!! It's at 3000!!!

And I'm not even adjusting for inflation. Adjusted for inflation (meaning 12% annual increases in purchasing power) the S&P would be at over 7,500,000!!! YES, 7.5 MILLION.

You maybe saying to yourself, "what George is saying can't be true" DR would never get away with that much of a lie. Here's why DR can get away with his claims. They're true in literal terms but they're wildly false in the way he presents it to his audience and how his audience perceives what he's saying.

DR presents this 12% claim as though, over the long haul, your money will grow by 12% a year. FALSE! Why? Because when a number is reduced by 10% and then increased by 10% you're not left with the same number...it's lower.

As an example. Take $1000 and decrease it by 50%, you now have $500. Increase that $500 the next year by 60% and you now have a total of $800. A $200 (20%) loss but a 5% average return (-50 + 60 = 10/2 = 5%).

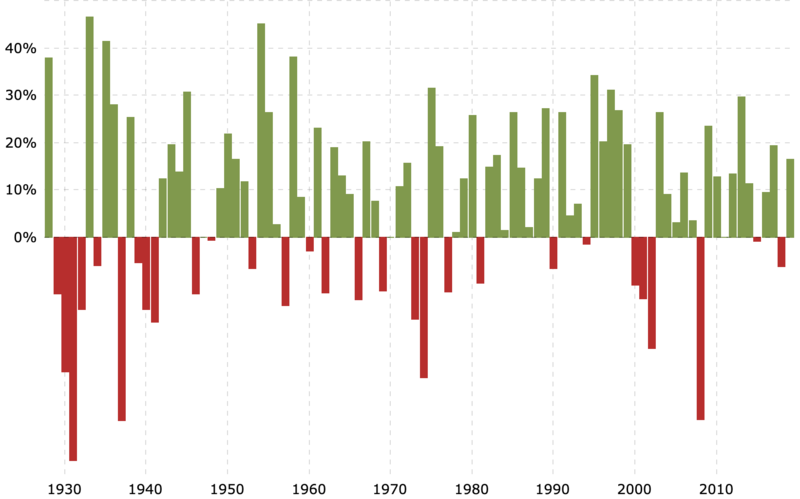

This becomes very clear when we look at graph of annual S&P returns.

Or better yet, look at an inflation adjusted chart. Please notice how much you'd make if you invested in 1928 and left your money in for 52 years, until 1980.

You would've made zero (adjusted for inflation). Dave Ramsey what happened to 12% per year??

What infuriates me the most is he targets people in the south and people who go to church, in other words people with traditional values who are more susceptible to his "be prudent, save money, no debt, invest in mutual fund" snake oil.

To be clear, 10% of what he says is spot on, have a rainy day fund and don't take on consumer debt, but the other 90% is so bad it's completely inexcusable.

If you're one of the millions of Americans, not just DR fans, who have drank the koolaid of the financial services industry and invested into the "safety" of mutual funds, I apologize, I don't relish being the bearer of bad news. But as I said in my first post on this thread, I feel a moral obligation to set the record straight.

Please note: I didn't even hit the tip of the iceberg of why mutual funds are quite possibly the worst investments on a risk/reward basis. I understand I exclusively focused on S&P and mutual funds typically contain bonds. I did this because interest rates have been driven down so low by the Fed, mutual funds no have to overweight equities because they can't get a return from bonds. This problem will be exacerbated if/when US bonds go into a negative yield like Europe and Japan.

I realize this is complex stuff. It's why DR can dupe so many, including maybe himself. I'd like to point out I learned none of the above in college. ;)

If you have any questions don't hesitate to reach out, all my contact info is on my profile.

Good luck,

Most Popular Reply

I see Dave's advice as being good for those who have problems balancing their checkbooks and generally accumulating money. For those of us who are taking more control of our financial situations, we need to massively upgrade our knowledge and our level of thinking.