CPA's: 1 LLC, Multiple, or DBA's under 1 LLC?

I plan on breaking into the real estate industry with rental properties. I hope to acquire multiple properties. Doing so, I'd like to know what is the best way to go about registering these properties.

Should I:

- Register all my properties under a single LLC

- Have an LLC for each property.

- Establish just one LLC then put each property as a DBA

And if possible, please explain why this would be the best option.

@Justin A Edmonds - neither. You have yet to break into rental properties and to have some equity and/or cashflow to protect with LLCs. Concentrate on getting that first - a few deals under your belt, build some equity and cashflow past your risk threshold, build some wealth - before you complicate your life with the expenses and maintenance of LLCs.

@Costin I. Thank you. So you are saying, acquire wealth that needs top be protected prior to actually protecting anything?

Yes. Have something to protect, prior to worrying about how to protect. Those LLCs do not come free of expense and effort - that money, time and effort will be better spent at this time in acquiring and building wealth. There might be situations where you would want that LLC protection first, but even then it's because you have already some other personal wealth to protect prior to getting exposed to additional risks from rentals.

@Costin I. Understood. Is there a rule of thumb for when I should start seeking out an LLC? Also, should I open a separate personal account in order to separate the funds acquired from rentals?

@Justin A Edmonds what a headache to maintain all of that. Your attorney or cpa will love you though for all the fees you pay them.

If you’re worth 10-15M one day I’d say worry about this stuff but if that’s not the case, don’t worry about it

@Caleb Heimsoth lol. How should I separate the funds that I receive from rental income?

Originally posted by @Justin A Edmonds:@Caleb Heimsoth lol. How should I separate the funds that I receive from rental income?

I guess I don’t understand what you’re trying to do

So my ultimate question is, the rental income that would be accumulated from the properties, should I commingle into my regular account or should I open a separate personal account just to make it easier when it comes to be tax time?

Originally posted by @Caleb Heimsoth:Originally posted by @Justin A Edmonds:@Caleb Heimsoth lol. How should I separate the funds that I receive from rental income?

I guess I don’t understand what you’re trying to do

@Justin A Edmonds - There is no absolute answer and unique tool/strategy in anything real estate. You need to learn how to use all the tools available to you (financing, insurance, management, etc.) and to understand how they fit together in your toolbox, as none will give you everything (e.g, insurance is required and it will cover you for many situations, but not always; asset protection (LLC) is litigation insurance and complements regular insurance, by minimizing the target and making it unappealing).

So, there is no rule of thumb for when one should start seeking out an LLC. I guess, when you are past of your risk threshold and comfortable with the cost/value ratio you'll be getting from that level of protection for the time, money and effort it will require.

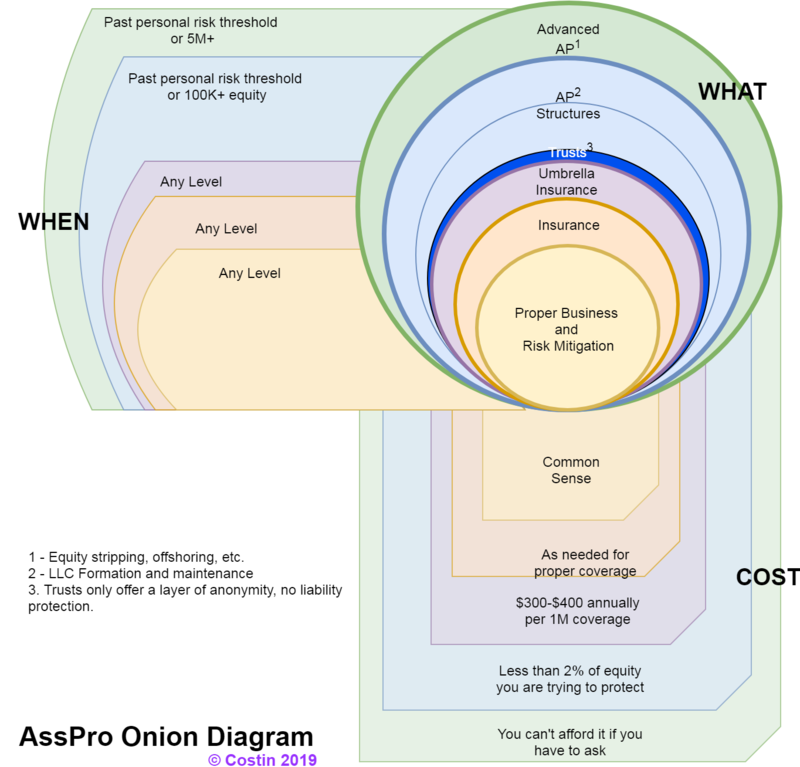

My suggestion, apply the "Asspro rule of 2%" © Costin 2018 - the cost of setting up and maintaining your asset protection should be less than 2% of equity you are trying to protect. Let's say, it costs you 1.5K to get your structures in place (holding LLC or Series-LLC, with or without land trusts, with or without separate operations LLC) and 0.5K per year (for maintaining the LLC properly, bookkeeping, lawyer and CPA, etc.) for a total of 2K. You should have 100K or more in equity (!) to protect before it makes sense to spend that money - compare that with how much you spend in annual insurance for the same property/equity (on the same FEAR - False Evidence Appearing Real - principles, just in case your property might burn down).

Here is another diagram I made special for you:

Separate accounts are not required unless you are implementing asset protection structures (LLCs), but you'll want clear accounting of expenses and income. I suggest to learn to use Quicken and have all personal stuff separate from rentals (which is very easy with Quicken categories and subcategories).

Originally posted by @Justin A Edmonds:So my ultimate question is, the rental income that would be accumulated from the properties, should I commingle into my regular account or should I open a separate personal account just to make it easier when it comes to be tax time?

Originally posted by @Caleb Heimsoth:Originally posted by @Justin A Edmonds:@Caleb Heimsoth lol. How should I separate the funds that I receive from rental income?

I guess I don’t understand what you’re trying to do

Separate account is easiest. You don’t need a llc for that though

Originally posted by @Caleb Heimsoth:Originally posted by @Justin A Edmonds:So my ultimate question is, the rental income that would be accumulated from the properties, should I commingle into my regular account or should I open a separate personal account just to make it easier when it comes to be tax time?

Originally posted by @Caleb Heimsoth:Originally posted by @Justin A Edmonds:@Caleb Heimsoth lol. How should I separate the funds that I receive from rental income?

I guess I don’t understand what you’re trying to do

Separate account is easiest. You don’t need a llc for that though

Good. That was what I was looking for. I want it to be made as simple as possible when it comes to taxes.

Originally posted by @Justin A Edmonds:@Costin I. Understood. Is there a rule of thumb for when I should start seeking out an LLC? Also, should I open a separate personal account in order to separate the funds acquired from rentals?

Every property and llc has it's own operating account and account for security deposits. Don't mix anything together

Originally posted by @Justin A Edmonds:@Costin I. Understood. Is there a rule of thumb for when I should start seeking out an LLC? Also, should I open a separate personal account in order to separate the funds acquired from rentals?

Justin,

It is prudent to have an operating account setup for each rental, at least in the beginning. Keep your personal funds separate. We typically recommend having a separate account for each property initially and up to a certain number of properties.

Christina

Originally posted by @Justin A Edmonds:@Costin I. Understood. Is there a rule of thumb for when I should start seeking out an LLC? Also, should I open a separate personal account in order to separate the funds acquired from rentals?

Justin,

It is prudent to have an operating account setup for each rental, at least in the beginning. Keep your personal funds separate. We typically recommend having a separate account for each property initially and up to a certain number of properties.

Christina

- Tax Accountant / Enrolled Agent

- Houston, TX

- 5,262

- Votes |

- 4,693

- Posts

The absolute minimum that you need is:

- Separate bank account designated for the business income and expenses

- Umbrella insurance policy

- EIN - an IRS-issued tax ID for the business

Everything else is optional and can grow as complicated as you allow it. It would depend on many factors, including:

- how much equity do you have in your properties

- how large is your portfolio

- how much assets do you have overall

- what is your risk exposure

- what is your risk tolerance

- do you have partners

- do you have helpers

- where do you live and invest (state law varies)

I agree with @Costin I.: focus on building your portfolio before worrying about your entity structures

@Justin A Edmonds as other have said, no need to start with an LLC. First work on building your net worth. As far as banking goes, open a new checking account for each property and don't co-mingle the funds with your personal account. It will make life a lot easier come tax time.

@Justin A Edmonds I suggest you look up bigger pockets episode 109 with Scott Smith. I think it will give you the answers you seek.

@Justin A Edmonds Hey Justin, I would say that this is a fair question.

That said, you definitely don't want to be bogged down by the technicalities at this point in your journey.

I think start buying some properties and maybe do a touch base after 3 deals to see where you are...

@Ola Dantis thank you for the consensus. Seems that the professionals agree upon the same thing. Im going to do just that. Retain about 3-5 properties then see what I should do.