Updated almost 4 years ago on . Most recent reply

Alabama, Georgia, Tennessee, Kansas, Nevada - looking to network

Hi Everyone, I’m looking to network with property manager / agents in Alabama, Georgia, Tennessee, Kansas, Nevada. I’d like to get the sense of some of the markets there. I’m looking for groups and people who already invest and manage. Experience with maintenance and repair crews a must.

Most Popular Reply

Hello Dennis,

We are in Las Vegas and below are performance charts for the property segment we target.

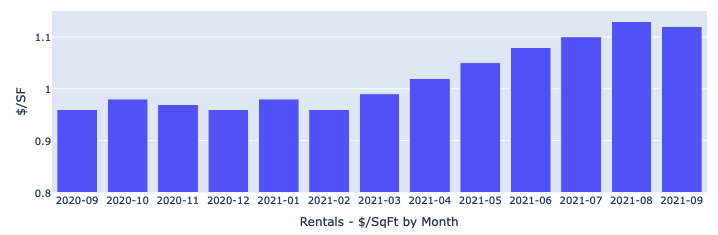

Rentals - Median $/SF by MonthYoY rent growth: 18%!

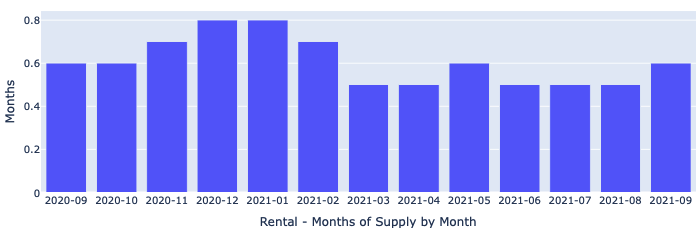

Rentals - Months of Supply

Three to four months is normal at this time of year. We are currently at about 0.6 months.

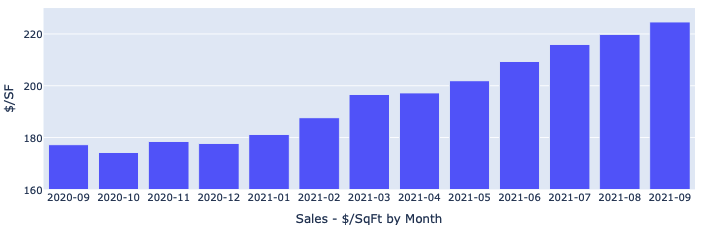

Sales - Median $/SF by Month

YoY appreciation: 28%!

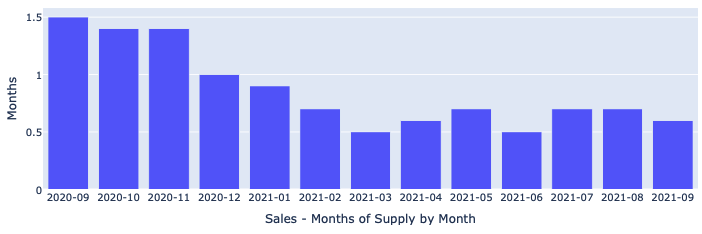

Sales - Months of Supply

6 months supply is considered a balanced market. We are at 0.6 months.

What is driving housing demand in Las Vegas?

- Jobs - Everywhere you look in Las Vegas there are help wanted signs. The shortage of labor is driving up income and attracting people from other states. Currently we have $22B in new projects under development with another $7B announced. The large number of good paying jobs and the relatively low cost of living is attracting a lot of people to Las Vegas.

- Limited Supply of Buildable Land - Las Vegas is an island surrounded by federal land. At the end of 2019, the amount of vacant buildable land in the Las Vegas Valley was less than 28,000 acres, of which 5,000 to 7,000 acres is not viable for residential development. (87.5% of Clark County is federally owned. 85% of the entire state is federally owned.) Consumption rate is about 5,000 acres/year. See the animated GIF below. The areas in brown are federal land. The time-lapse only goes through 2018 and there was a large amount of development in 2019 and 2020. The shortage of land combined with the increasing population almost guarantees property prices and rent will continue to increase.

- California - California's government seems committed to driving people and companies out the state. Las Vegas continues to receive a part of this exodus. Las Vegas is very attractive to people and companies because of the following:

- Pro-business government

- Low property taxes - The average property tax rate is 0.55%. According to MortgageCalculator.org, Nevada has the 9th lowest property tax rate in the nation.

- Low cost insurance - The cost of property insurance is a good indicator of the risk of a major natural disaster. Nevada has the 10th lowest average insurance cost in the nation.

I can provide more specifics, but I believe the above should give you an idea as to what is happening in the Las Vegas investment market. There are other factors that make Las Vegas attractive to investors:

- Landlord friendly - Time and cost to evict a nonperforming tenant: less than 30 days and $500. Also, the laws allow lease agreements to place much of the cost for damages on the tenant. Plus, the ability to deduct any damage beyond reasonable wear and tear from the tenant's security deposit. The lease agreement terms are the major reason why our target properties' average tenant turn cost is under $500.

- Low property taxes - The average property tax rate is 0.55%. According to MortgageCalculator.org, Nevada has the 9th lowest property tax rate in the nation.

- Low cost insurance - The cost of property insurance is a good indicator of the risk of a major natural disaster. Nevada has the 10th lowest average insurance cost in the nation.

- No state income tax - Pro business government and low cost of operations.

- Low maintenance cost - Las Vegas properties have low maintenance costs due to the construction materials required by the Mojave Desert climate.

In summary, Las Vegas is performing well and likely to do so well into the foreseeable future.

You asked about property management, renovation, and maintenance. We have an investment team and provide all the services you mentioned and more.

Ping me if you have questions.

- Eric Fernwood

- [email protected]

- 702-358-8884