Updated over 1 year ago on . Most recent reply

My first ever 44 Unit MF apartment closed in Dec. 2020

I’m sharing a great news! My Real Estate Journey made at night and weekend, allowed me to close my first deal!

December 2020, I officially closed my first investment real estate deal with my partners. It’s a 44 Unit Multifamily Apartment in Lawrence, KS.

I feel like I can write a book about it, but will try to keep it as simple as possible.

Little Intro of myself: Late 30’s, Full time W2 Lawyer in NYC. Father of 2 girls. Did not own any investment property prior to this 44 Unit. (Not even a single, never done any flipping)

Limiting beliefs I crushed: No way I can invest outside of my back yard, How can I trust others, You need lots of money to start, I should start small like single or duplex before going to multifamily. Education is a cost.

How I crushed these limiting beliefs: Through right education, Not listening to the naysayers. Surrounding myself with like minded people. Being connected with mentors and right partners, Relentless action taking. Griding persistently, Trying to add value to the team, Falling in love with the process.

Some of the milestones

Late 2019: I set a goal that I’ll close my first RE deal in 2020. I joined Bigger Pockets.

Self-education through Bigger-pockets and found David Greene's Out of state investing book. Now I felt more confident about investing out of state. By listening to Michael Blank saying he was considered as a newbie when he started MF despite his single family flipping experience, now I decided to go to MF directly skipping single/duplex. By listening to Grant Cardone saying "look at a bigger deal that justifies scalability, now I decided to look at more than 10 Unit as my first deal.

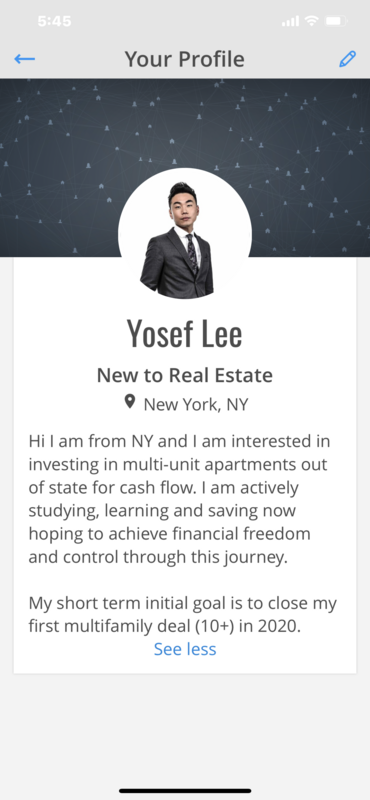

In the begginng I was little ashamed to call myself a Multifamily investor without having any, and didn’t know how to put myself out there and get connected with like minded people. - I sought advice from Bigger Pockets, and somebody encouraged me to be just transparent (Thank you John Casmon). I decided to believe in myself and to just be myself.

March 2020 - Realized Self-education is not equivalent to taking actions. I was passively absorbing the information. Joined a Mentorship Community / Mastermind Group, Started Real Education, Started self-reflection as to who I am and how I can add value, Started putting myself out there looking for partners. This is when Pandemic shut down happened.

May 2020 - Connected with my current partners and started analyzing deals

June 2020 - After reading Joe Fairless' Syndication Book, Started co-hosting a bi-weekly Virtual Meetup in NY regarding multifamily investing, and massive virtual networking started. Covid couldn't stop me.

July 2020 - Became a Co-Host of Multifamily and More meet up - KC chapter with my partner.

August 2020 - 68 Unit Apartment LOI Accepted

September 2020 - 68 Unit under Contract / 44 Unit LOI Accepted

October 2020 - 44 Unit under Contract

December 11, 2020 - 44 Unit closed (JV). (68 Unit closing got pushed a little - Syndication)

Feb. 2021 - 68 Unit expected to be closed within this month.

A few things I learned: Right education. This is critical. But to get the right education, you need to be guided by people who are more experienced than you are. It can be people from bigger pockets, or mentorship program. Right partnership. You need to surround yourself with highly motivated like minded people. Stay away from people who drain your energy and positivity. Make sure you work with those who's interests are aligned with yours. Those who share same work ethic and philosophy. Massive Action Taking. I can't emphasize this enough. Do it. Meet people. Underwrite deals. Talk to the brokers and lenders. Practice your pitch. Last but not least by no means. Fall in love with the process. It's a long process. So enjoy it and be persistent, and patient. You will see the result.

Yosef

Most Popular Reply

Yosef!!!!! The part about "self-education is not equivalent to taking action" .... Man!!!! Not enough people realize that, just take that first step bc otherwise you'll never progress and your story symbolizes just that! Great way to lead by example and I'm so proud to say I know you and am part of your extended fam! Great job and can't wait to see what the rest of this year holds for you!