Updated about 5 years ago on . Most recent reply

Corona Virus Impact to Las Vegas Market

Today we sent our investors a special update on the impact of Coronavirus to the Las Vegas market. I thought it would be helpful to share it here.

There are multiple canceled events and conferences. Hotel occupancy is defiantly down. When I drive by the casinos on my way to places, the parking lots are not as full as I would expect. Also, for some strange reason, toilet paper is in short supply in the stores, but Kleenex is readily available. So, we are seeing the same panic we read about in other cities.

As to the impact to our segment of the Las Vegas real estate market, we have seen NO (zero) changes. If anything at all, we are seeing an increase in activity. More about this later.

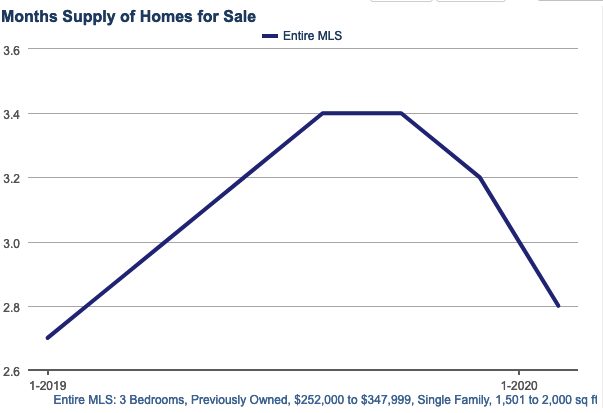

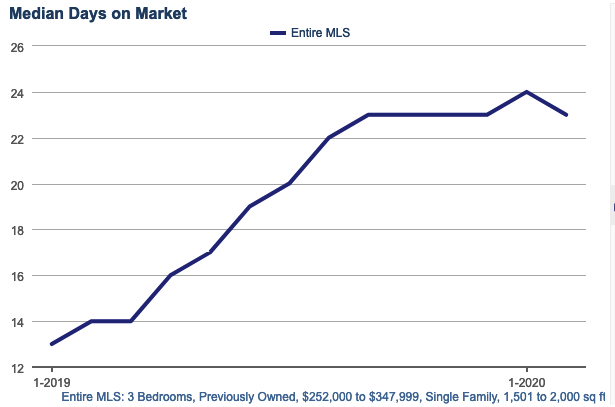

Good properties are still going under contract in 1 to 5 days. Inventory levels continue to fall. Below are some charts for single-family homes from the MLS as of yesterday.

As you can see, demand has not decreased, prices are increasing and inventory continues to decline. However, if the panic caused by the Corona Virus continues for an extended period, I believe it will impact every real estate market. But we are not seeing any impact at this time.

For example, we listed a property for sale yesterday (2020-03-12) morning and had six showings for the day, including three in the first 4 hours after it hit the market. We received a full price cash offer in the evening. We made offers on two properties in the last two days and both are competing with multiple offers (one property had 9 offers and the other an unknown number of offers.) The Las Vegas real estate market today seems to be unaffected by the general panic over the Coronavirus.

On rents and such, we are seeing increases, not decreases. We had a single family home listed 4 days ago and received two rental applications yesterday. And, while the stock market is going crazy, we are not seeing any rent turbulence. Tenants sign one year leases, and they have to have a place to live. Even during the 2008 crash, our clients saw no decrease in rent or vacancies. We target a tenant pool that remains employed in good times and bad.

I think the fear is summarized on the chart below.

As always, the disadvantage of real estate is the lack of liquidity. The advantage is a very stable and reliable income stream with tax advantages and inflation protection combined with appreciation (assuming you buy in a good location). What we are seeing is more interest in a stable and reliable income stream by potential clients. So, if anything, the stock market turmoil is increasing the sales of investment real estate. We think that now is actually a great time to buy investment real estate in a growing market to add stability to your investment portfolio.

Agents, please share what you have been seeing.

- Eric Fernwood

- [email protected]

- 702-358-8884

Most Popular Reply

Sinclair Lewis said, "Never expect a man to understand something when his job depends on him not understand it." That's definitely true here. While it does provide some Twilight Zone-esque dark comedy, it might also convince some of the younger, less experienced investors to act on it and ruin their lives. While the best buying opportunities of this century are about 18 months away, the worst opportunities are right now at full price.