Market Trends & Data

Market News & Data

General Info

Real Estate Strategies

Landlording & Rental Properties

Real Estate Professionals

Financial, Tax, & Legal

Real Estate Classifieds

Reviews & Feedback

Updated about 2 months ago on .

Multi-Generational Homebuying Hit a Record High – Here’s Why

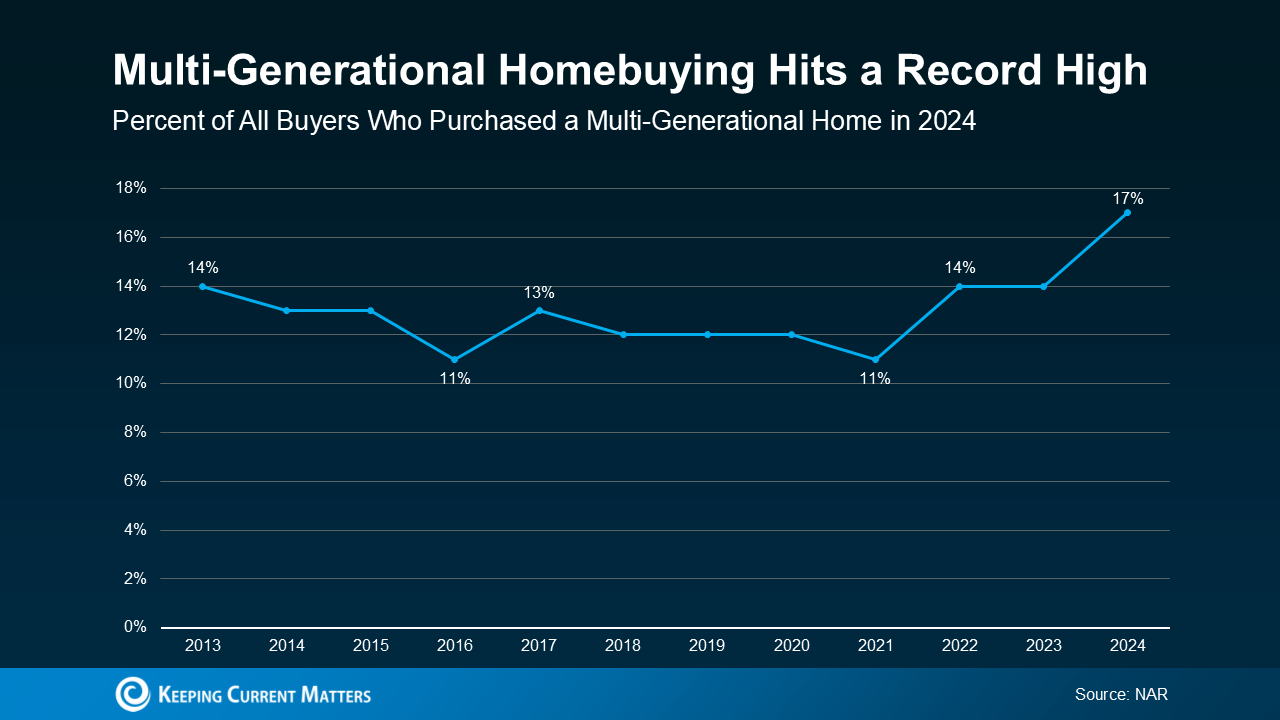

Multi-generational living is on the rise. According to the National Association of Realtors (NAR), 17% of homebuyers purchase a home to share with parents, adult children, or extended family. That’s the highest share ever recorded by NAR (see graph below):

And what’s behind the increase? Affordability. NAR explains:

In the past, caregiving was the leading motivator – especially for those looking to support aging parents. And while that’s still important, affordability is now the #1 motivator. And with current market conditions, that’s not really a surprise.

Pooling Resources Can Help Make Homeownership PossibleWith today’s home prices and mortgage rates, it can be hard for people to afford a home on their own. That’s why more families are teaming up and pooling their resources.

By combining incomes and sharing expenses like the mortgage, utility bills, and more, multi-generational living offers a way to overcome financial challenges that might otherwise put homeownership out of reach. As Rick Sharga, Founder and CEO at CJ Patrick Company, explains:

But this strategy doesn’t just help with affordability. It may even allow you to get a larger home than you’d qualify for on your own and that gives everyone a bit more breathing room. As Chris Berk, VP of Mortgage Insights at Veterans United, explains:

And momentum may be growing. Nearly 3 in 10 (28%) of homebuyers say they’re planning to purchase a multi-generational home.

Maybe it’s a solution that would make sense for you too. The best way to find out? Talk to a local real estate agent who can help you decide if this option would work for you.

Bottom Line

If your budget feels tight, buying a multi-generational home could be a smart solution.

Would you ever consider buying a home with a family member? Why or why not?

Connect with an agent to talk through your options.