All Forum Posts by: Alex Forest

Alex Forest has started 12 posts and replied 235 times.

Post: Need a contractor near Henrico, VA

Post: Need a contractor near Henrico, VA

- Rental Property Investor

- Henrico, Va

- Posts 236

- Votes 140

@Harry Burgos I just messaged you the contact info.

Post: Need a contractor near Henrico, VA

Post: Need a contractor near Henrico, VA

- Rental Property Investor

- Henrico, Va

- Posts 236

- Votes 140

@Harry Burgos. What kind of contractor and what type of work, general for overall residential renovations? I know someone that just started a company for this type so may have availability.

Post: Real Estate Price Adjusted by Gold Ratio

Post: Real Estate Price Adjusted by Gold Ratio

- Rental Property Investor

- Henrico, Va

- Posts 236

- Votes 140

The gold seems to dominate. I think with the decoupling of the USD to gold decades ago, the relationship for the metric you posted doesnt hold up. We wont go back to a gold standard. Why not use the CPI inflation to measure the effect (real prices)?

Take a couple scenarios. First, what if a, hypotheticallyspeaking, massive new source of gold were discovered for mining....of a new technique allowed for more extraction than before. Price of gold would go down, along with that ratio but it would have nothing to do with housing.

Second, take an example of where median house value today is $200k with gold at say $250 and ounce. Say in 5 years, the median value becomes $170k with gold at $100. Your ratio goes up considerably nearly doubling. That isn't inflation though. In 5 years, you can buy the same amount of gold for less, that's increased purchasing power and deflationary pressures. That's when folks start waiting to buy and put off buying to see if it will be cheaper in a year or two. Becomes harder to sell and prices drop. So this metric alone doesnt inform well enough is my take. Still interesting to see though. :)

Post: Real Estate Price Adjusted by Gold Ratio

Post: Real Estate Price Adjusted by Gold Ratio

- Rental Property Investor

- Henrico, Va

- Posts 236

- Votes 140

@David Song Interesting plot. I dont know, but wonder if you have ideas :)

Is it as relevant now, with the decoupling of the currency from gold decades ago? The graph may speak more to fluctuation of the gold to USD conversion rate, with housing mixed in. This graph below is real prices including inflation (as opposed to nominal)

It seems without the attachment to gold, everything is relative. Housing prices depend on a number of factors, including inventory, but also the ability of folks to pay...on purchasing power and incomes to service housing loans and rents. This relationship of price to rent Ive always found interesting. It says something about long term baseline housing costs for homeowners and renters.

It seems without the attachment to gold, everything is relative. Housing prices depend on a number of factors, including inventory, but also the ability of folks to pay...on purchasing power and incomes to service housing loans and rents. This relationship of price to rent Ive always found interesting. It says something about long term baseline housing costs for homeowners and renters.

Post: Property Management in Weymouth, Ma

Post: Property Management in Weymouth, Ma

- Rental Property Investor

- Henrico, Va

- Posts 236

- Votes 140

Originally posted by @Antoine Martel:

Hi Alex,

The best way that I have found property management companies is just cold calling these property management companies on Google. Type into google "property management city" and then just start calling. Once you find a few that are interested in helping you, schedule some face to face meetings with them to learn more about their business model.

After you go through this process, it should be clear who the correct company is for you!

Post: Property Management in Weymouth, Ma

Post: Property Management in Weymouth, Ma

- Rental Property Investor

- Henrico, Va

- Posts 236

- Votes 140

Hello, I am looking for recommendations for a property manager in Weymouth, Ma. It is for a relative who currently lives there but is looking to move somewhere else nearby and doesnt have experience with Anybody in that area have good experiences or recommendations? Thank you.

Post: How Much Inventory is there in Your Market?

Post: How Much Inventory is there in Your Market?

- Rental Property Investor

- Henrico, Va

- Posts 236

- Votes 140

@Andrew Syrios

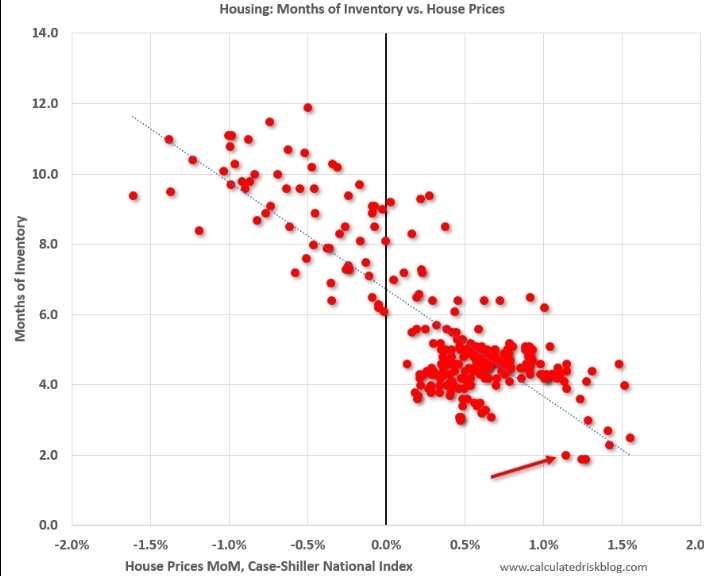

I don't have specific local inventory to share, but thought you might find this graph that plots months of inventory against home price changes interesting. Its on a national level, with current around 1.9 months. The last 2 months were lowest on record. Arrow is pointing to the latest.

Post: Rent Trends compared to 1 year ago for 100 Cities

Post: Rent Trends compared to 1 year ago for 100 Cities

- Rental Property Investor

- Henrico, Va

- Posts 236

- Votes 140

Yeah, in my state, I noticed Chesapeake was down a lot (-29%) for 1 and 2 bdms, but Va Beach, immediately adjacent was up (+15%). And Norfolk, also contiguous, was up more modestly (+6%). I don't know that region well enough to know if there was a real factor that caused migration from one locality to the adjacent or if it is a blip and temporary anamoly.

A couple other observations that strike me are the number of double digit changes. NYC is not surprising, but there are many with large swings. That's a lot of volatility, I think of rent prices as somewhat 'durable' and stable for the most part with mostly low to middle single digit changes over time. The price for a 1 bdm and 2bdm in general nationally somehow strike me as high too, perhaps they shouldn't though, as these are specific to the largest cities.

Post: Rent Trends compared to 1 year ago for 100 Cities

Post: Rent Trends compared to 1 year ago for 100 Cities

- Rental Property Investor

- Henrico, Va

- Posts 236

- Votes 140

Here's a rent report by Apartment Guide showing trends compared to one year ago for 1,2,3 bdms nationally, by state, and for the 100 most populous cities. Interesting to look through the trends and cities. I wonder if it resonates true with folks. There are quite a few with double digit changes.

Post: Sending introduction letter to new tenants.

Post: Sending introduction letter to new tenants.

- Rental Property Investor

- Henrico, Va

- Posts 236

- Votes 140

Originally posted by @Michael H.:

Originally posted by @Tim Herman:

@Michael H. Do you have copy of the leases? You will have to honor any agreement. Do you have an estoppel agreement signed by the tenant and verified by the landlord that everything is correct. Monthly rent, deposits, any verbal agreements, etc.

If I owned this property I would not want you contacting my tenants. There is always a chance you won't close. When you close you can then send your letter.

I do have a copy of the leases. 4/5 are expired. We didn't do estoppel agreements, partly because we have the leases, partly because the other agent sucks. Rent's are verified, there were no deposits, no verbal agreements.

Michael,

I generally agree with Joe S. comments. You have a copy of the Leases, several of the units you mentioned the term expired. Do they convert to month to month? That is a big question, if not, there is no written agreement and you have very limited arrangements..cause to bail before closing.

I agree with comments that sending welcome letters before closing is premature. Perhaps contrary to this though, you can include a condition in the offer contract that requires an existing lease is accepted by the buyer (provided by a certain time ), or to schedule a meeting with existing tenants, facilated by realtors, to establish a new Lease acceptable by buyer. And if the latter, it can be clear to everyone involved that it is contingent on sale being closed (with contingency attached). Usually the seller is there too. My experience so far is this has actually worked out quite fine with everyone on board.

I understand this is probably contrary to what several folks may suggest here, but I like to meet the tenants in person and go through this process before closing. If something really doesnt feel right, its before closing. Especially in these times with the moratoriums. I wouldnt worry so much about logistics (use of Tenant Cloud), I'm just wondering if what you described, there is something hidden.