All Forum Posts by: Alex Forest

Alex Forest has started 12 posts and replied 235 times.

Post: Fannie Mae tightens lending standards on Investment Homes

Post: Fannie Mae tightens lending standards on Investment Homes

- Rental Property Investor

- Henrico, Va

- Posts 236

- Votes 140

Originally posted by @Chris Martin:

Originally posted by @Paul Sofia:

Originally posted by @Joe Splitrock:

Originally posted by @Paul Sofia:

Originally posted by @Joe Splitrock:

Originally posted by @Paul Sofia:

Originally posted by @Justin Thorpe:

There is an article today which says certain 'hot' states saw a net decline in population but a double digit increase in home sales and prices and no that state is not California. What I deduce is there is an investment frenzy like 2007 / 2008 where people where gobbling up investment properties with a speculation mindset. Of course lending standards were different. Or rather there were no standards at all. I am not sure how tight they are today. They used to be tighter for sure.

I wonder if hedge funds are buying in those areas. I wouldn't doubt it. Makes no sense but it wasn't their money to begin with. Perfect storm is brewing, posted some quotes almost a year ago in regard to the crash that's coming. Commercial and residential, not to mention car loans, student loans and revolving credit....This is not going to be pretty.

I am not sure I see a comparison to the housing crash. Prices in most markets peaked back in 2006 and started falling in 2007 and 2008 as foreclosures were increasing those years. The hedge funds acquired most of their homes between 2011 and 2012 at the height of the foreclosures. Compare that to today and prices are still going up as inventories are down. The conditions are just not the same as then. Hedge funds have been making a killing in the stock market through the pandemic. Hedge funds are looking for upside, not to buy at the top.

My market is the Charlotte metro area....hedge funds are buying up new construction and existing construction which have been pumping the prices up. Foreclosures are at a minimum due to the forbearances I have been at this game for over 20 years. I have done well over 100 flips and done plenty of new spec homes.

I develop, have a retail manufactured and modular home operation and never have I seen such madness. Materials are skyrocketing like never before while wages stay flat. When the forbearances are lifted, guess what....remember these are not loan modifications. They will have the ability to call the past due payments with interest and penalties. The average joe does not have the resources to do so. The math ain't adding up...

I am not saying hedge funds don't invest in real estate, just not houses in mass like they did during the housing crash. A hedge fund is just a private investment fund focused on riskier endeavors to produce higher returns. They generally buy short term, so if they are buying in your market, it is probably a pump and dump strategy. That could be an endorsement of the Charlotte market, not a sign of a coming crash. They buy things that go up in value. Hedge funds can also be confused with syndications or private equity. All of these groups use private investments, they just all invest a little differently.

Both the foreclosure moratorium and forbearance are keeping foreclosures to a minimum. The majority of people in forbearance will not end up in foreclosure. Forbearance does not require immediate repayment of outstanding balance. There are several ways out of forbearance, including loan modification which is what I expect the majority of borrowers to end up doing. Banks have no interest in foreclosing, so they are motivated to work out agreements. Here is a great summary from Fannie Mae:

https://www.fanniemae.com/here...

It really comes down to housing inventory and demand. Looking at historic data, you can see our inventory has been down towards 2004 levels. Inventory levels increased from 2004 to a peak in 2009. The foreclosures peaked later. We are near record low supply, so even if we were on a path towards a crash, it will take years.

https://fred.stlouisfed.org/se...

I appreciate your perspective. We won't know what we are facing until forbearance ends. Also realize the government is willing to spend unlimited money to prevent foreclosures. Don't underestimate that effect.

Fannie is a GSE. I do not trust them as far as I can throw them. They can throw out all of the "facts" they want. A forbearance is a far cry from a loan mod. Nobody will be guaranteed a loan mod. I don't have a crystal ball, so I do not know when it will crash but in no way, shape or form, should we be seeing the current "values" where they are. I'll grab the popcorn and take a seat on the couch......I will buy in again when there's blood in the street.

Interesting perspective.

Regarding "I will buy in again when there's blood in the street" I have the same thinking. I tasked myself this past week along with some current and former partners/managers to 'gear up' for the (perceived) coming foreclosure boom as idle money prepares for 'something'. So I looked at as much data as I could find; SEC filings, county records, demographics, loan data, commercial lender disposition, etc.

In the end, I find that I disagree with my initial thinking, which if I read you correctly was consistent with your sentiment.

I do, though, believe in facts (referring to "They can throw out all of the "facts" they want".) Without facts, I am just speculating and speculation complicates investment decisions. I know you say you don't trust the GSEs, but their 10-K provides tremendous insight into the 2020 lending environment.

Of the 1.1M loans that received a forbearance in 2020, 337,086 were "Reinstated" and 167,388 were "Liquidated" (paid off). Only 13,277 are classified as "Modification" and 83% of loans that received a forbearance and subsequently received a completed modification were current. The bottom line is loan modifications (statistically) have worked. This is all on Fannie Mae 2020 Form 10-K page 112.

But here's a key data point. While there are 524,555 loans in active forbearance, only 62,144 have an "Estimated mark-to-market LTV ratio > 80%". This is the critical marker for "Higher-Risk Characteristics of Single-Family Loans." Reference: FNMA 10-K, also on Page 112.

Based on the facts I see, I just don't anticipate a massive deluge of foreclosures on the horizon. County data supports this position. Historically, county data (Wake, NC) for my company's major investments by value has been a reasonable proxy for trends in other parts of the county. While not iron-clad, I feel comfortable with the premise that my analysis should represent many other regions in the US.

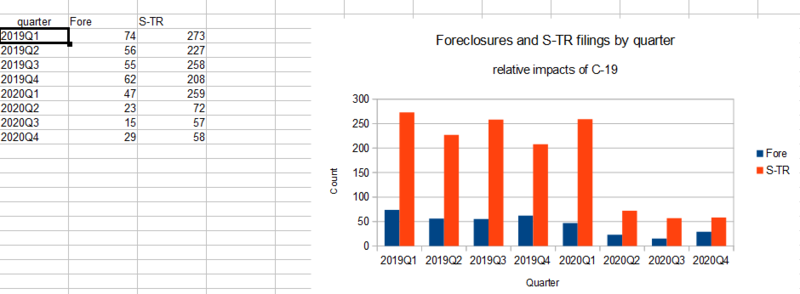

The chart below, based on Wake county NC courthouse filing data, shows that we were already in a period of low recorded defaults and foreclosures. (The substitute trustee filings are a marker/indicator for defaults.) The number of foreclosures in Wake county so far for 2021 is just 12, and S-TR is 500.

My summary: For the foreseeable future, property owners who remain in default who are unable to pay will just sell on the open market without significant systemic financial implications. The event induced recession does not compare to the systemic financial distress of the Great Recession.

Nice analysis and observations Chris and Joe S. An author on RE and economics I follow referred to Altos Research as he was reporting on inventory, and so I came across this video below by them. It is similar thinking to what you have presented. He notes 5 factors that have been at work over a decade to get to such remarkably low inventory. Low rates, buy now sell never (ie new investors), underbuilding, demographics, and homeowner policies. His second point does attribute 2nd buyers and investors (encouraged by low rates) as soaking up some of the inventory slowly for years as one of those factors, among others. Which comes back to this original post, and likely intent of the FANNIE policy to restrict investor and second home purchases to 7%, disincentizing that activity some to slow the pace down a little and to free up inventory for primary homeowners. https:// youtu.be/1KWCtIFcWFc

Post: How to get zillow to fix their listing?

Post: How to get zillow to fix their listing?

- Rental Property Investor

- Henrico, Va

- Posts 236

- Votes 140

Post: Fannie Mae tightens lending standards on Investment Homes

Post: Fannie Mae tightens lending standards on Investment Homes

- Rental Property Investor

- Henrico, Va

- Posts 236

- Votes 140

Originally posted by @Shiloh Lundahl:

@Alex Forest he is talking about how much it costs to buy down the rate. That is just a fee on top of the other bank closing costs.

For example: a few months ago I refinanced a single family home that I have as a rental. I had to pay normal closing costs (loan origination fees, title fees, etc.) of about 3-4K. But I also had to pay a 1% fee to buy down the rate from 4.5ish to just under 4%. So I had to pay an additional $1500 - $2000 to lower the loan’s interest rate from about 4.5 to 3.875. Total monthly savings on the interest would be about $60. So if I plan on keeping the rental for more than 2-3 years then it is worth it to pay an additional $1500 - $2000 to pay down the rate because in the long term I’ll be getting more cash flow and paying less interest.

But now, I was talking with my banker yesterday and she mentioned that the fee to buy down the rate is going from about 1.5% to 4% to buy it down to the lowest amount of around 4%. In other words to get a loan for say 150k on a home worth 200k, I would need to pay a rate fee of 6k in addition to all the other closing costs if it is an investment loan or 2nd home, thus bringing up the closing costs from say 5k to 10k. This will essentially have a negative effect on the refinance part of the BRRRR method.

You know what they say, if the government wants to slow or stop a behavior, they just tax it to death.

Hi Shiloh, yes I understand the use of points to buy down the rate. I was just suprised to see it go all the way to mid 2's for non owner occupied. I guess that was a lot of points! As you mention, you bought it down to mid to high 3's. I did the same 4 months ago bringing a cash out refi from around 3.675 to 3.5%.

Thanks for the feedback about your lender. I've read several threads from folks on here already that have said their lender just increased over the past week alone.

Post: Fannie Mae tightens lending standards on Investment Homes

Post: Fannie Mae tightens lending standards on Investment Homes

- Rental Property Investor

- Henrico, Va

- Posts 236

- Votes 140

Originally posted by @Carlos Ptriawan:

Simply put, that's why the last 9 months are an awesome opportunity for an investor.

Post: Fannie Mae tightens lending standards on Investment Homes

Post: Fannie Mae tightens lending standards on Investment Homes

- Rental Property Investor

- Henrico, Va

- Posts 236

- Votes 140

Originally posted by @Carlos Ptriawan:

investor rate of course. Max I can buy is up to 2.5%. Now perhaps the max I can buy is 4% after this FM announcement.

Back in 1975, rates were around 18% for a primary owner occupied mortgage.

Post: Fannie Mae tightens lending standards on Investment Homes

Post: Fannie Mae tightens lending standards on Investment Homes

- Rental Property Investor

- Henrico, Va

- Posts 236

- Votes 140

Originally posted by @Carlos Ptriawan:

all my rental is 2% only. I buy points :)

at an investor rate or as a primary? And if the former, how many points, and what is the size of the loan? Just curious, because I've never heard of such a thing.

Post: Fannie Mae tightens lending standards on Investment Homes

Post: Fannie Mae tightens lending standards on Investment Homes

- Rental Property Investor

- Henrico, Va

- Posts 236

- Votes 140

Originally posted by @Carlos Ptriawan:

To be very honest, all this REI only makes sense if the interest rate is 2-3%, then the return is good. Even 4% is just so so... For 5% I'd rather invest in syndication.

Post: Fannie Mae tightens lending standards on Investment Homes

Post: Fannie Mae tightens lending standards on Investment Homes

- Rental Property Investor

- Henrico, Va

- Posts 236

- Votes 140

Originally posted by @Gia LaForge:

Just one week ago I was going over options for my first investment property with a lender, and she said this was coming down the pike. Maybe it's just not a good time to get into REI right now. Although I do keep hearing, the best time to plant a tree was 20 years ago, and the second best is now. Is it a good time to for deals or a better time to wait it out?

You have to put it into historical perspective. Rates are still relatively low, very low really. Just not as super low as they were for a bit, but that shouldn't deter if you have a good deal now, or a few months ago, with a fixed rate.

Post: Investment property mortgage rates up - Fannie Mae changes

Post: Investment property mortgage rates up - Fannie Mae changes

- Rental Property Investor

- Henrico, Va

- Posts 236

- Votes 140

@Erik Sherburne This is being discussed in another thread.

https://www.biggerpockets.com/...

It was indicated there, one Lender saw the potential for a 1.5% premium for investor and 2nd homes over owner occupied rates.

@Josh Chastain a 3.75% rate still sounds reasonable to me in the grand scheme of things. That's a pretty good long term fixed investor rate to lock in.

Post: Fannie Mae tightens lending standards on Investment Homes

Post: Fannie Mae tightens lending standards on Investment Homes

- Rental Property Investor

- Henrico, Va

- Posts 236

- Votes 140

Originally posted by @Justin Thorpe:

There is an article today which says certain 'hot' states saw a net decline in population but a double digit increase in home sales and prices and no that state is not California. What I deduce is there is an investment frenzy like 2007 / 2008 where people where gobbling up investment properties with a speculation mindset. Of course lending standards were different. Or rather there were no standards at all. I am not sure how tight they are today. They used to be tighter for sure.

There are about 10% of loans last month that were non primary (investor or 2nd homes). That compares to 8% a couple years ago. So, it is an increase but not massive. The price increases are from the broader overall market, the low inventory and low rates as big factors. I do agree with the sentiment though, that perhaps there is a desire by the feds to cool some of the hotness in the market and to make more housing available for those that want primary homes by making it more expensive for non primary folks. Not sure if that was a motivation, to press on the brake pedal slightly, but wouldnt surprise me.

https://www.calculatedriskblog...