All Forum Posts by: Alex S.

Alex S. has started 13 posts and replied 252 times.

Post: MTR as a strategy to max out earnings on your STR

Post: MTR as a strategy to max out earnings on your STR

- Investor

- Metro East of St. Louis (Illinois)

- Posts 255

- Votes 211

It really varies by market, but I know that it is a common technique in seasonal markets to seek out MTR guests to get them through the off-season.

I have also found that certain types of units don't work as well as STR. I am giving MTR a try on a studio apartment I have that has only been marginally successful on AirBnB.

Post: Creative financing for STR down payment

Post: Creative financing for STR down payment

- Investor

- Metro East of St. Louis (Illinois)

- Posts 255

- Votes 211

Rich Uncle? But seriously...a private money loan or hard money loan if the deal can support it?

Post: Want to get rid of a timeshare!

Post: Want to get rid of a timeshare!

- Investor

- Metro East of St. Louis (Illinois)

- Posts 255

- Votes 211

Here is a crazy idea for Brian Chesky: AirBnB Subscription Service (aka "Millennial Timeshare")

You pay $36,000/yr to AirBnB (low down payment & easy financing) and that gives you the right to 9 months of AirBnB stays at locations of your choice. If you want to get out of it, you must pay a lawyer thousands of bucks or post on BP forums begging people to take it off your hands.

Bullet-proof plan, amirite?

Post: Longer-term STRs (28+ days)

Post: Longer-term STRs (28+ days)

- Investor

- Metro East of St. Louis (Illinois)

- Posts 255

- Votes 211

@Adam Arkfeld The generally accepted term for rentals between 30-180 days is Medium Term Rental (MTR). By definition...no longer short-term.

States vary based on when tenants have rights. Basically, you just need them to sign an actual lease for stays around 30 days or more, depending on the state.

The most common application for MTRs in this forum would be traveling healthcare workers (generally ~3 months). The fact that you are making more as a MTR than a STR is odd to me and makes me question if your STR pricing is appropriate. STR should pay more than MTR...all things equal.

Have you tried a pricing algorithm company to set your rates? Beyond Pricing, Wheelhouse, or Pricelabs? You might discover that STR could pay more.

Post: Making profit with STR’s in an today’s market

Post: Making profit with STR’s in an today’s market

- Investor

- Metro East of St. Louis (Illinois)

- Posts 255

- Votes 211

There are two misnomers here...I think:

1. House prices are "high"

2. You can buy a turn-key (or just needs a little paint) property off the MLS and demand premium market returns (STR or LTR)

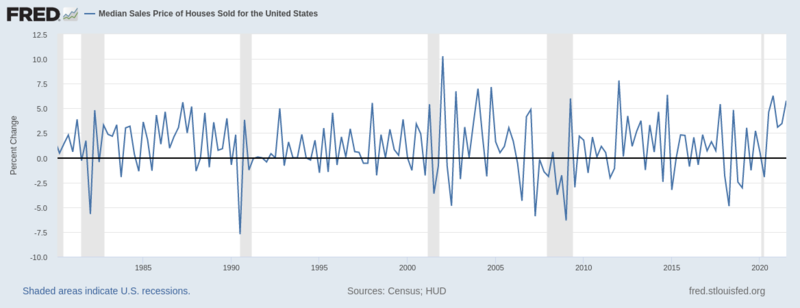

#1 - I'm not sure that I understand this talk of "inflated prices." Certainly, prices have risen over the past 18 months, but they're historically fairly normal. There may be some small regional disparity. Here is a graph from the Fed:

The horizontal black line is zero percent change in prices. The gray shaded areas are economic recessions.

We have seen unprecedented monetary policy at The Fed...like...the government has NEVER printed this much money, or even close to it. Prices/Wages MUST rise. If you are waiting on the sidelines for prices to fall, you better strike quick when they do, because it is unlikely to last. Also, they may "fall" next year to prices higher than the ones right now. Like @Ryan Moyer said, rents are up also. There may just be a slight delay as wages/rents reach new and higher equilibriums.

#2 - REI is pretty easy, but you still need a niche (not including blind luck) to find homerun deals. I can buy a house in my town tomorrow off of zillow and get 7-8% CoC returns. If you have access to tons of capital, then maybe that works for you, but I carefully employ my limited capital in the most incredible deals I can find (none less than 30% CoC so far in STRs). That takes work and you have to add value somewhere or re-imagine a property to a higher use. It is limited only by your creativity and the city council member who needs to meet their "good idea" denial quota of 20% for the week.

Good luck!

Post: Short Term Rentals in Denver-Metro

Post: Short Term Rentals in Denver-Metro

- Investor

- Metro East of St. Louis (Illinois)

- Posts 255

- Votes 211

http://www.erinandjamesrealest...

James Carlson posts on here quite a bit and keeps up with the latest on STRs in Colorado.

Post: Short Term Rentals in Memphis

Post: Short Term Rentals in Memphis

- Investor

- Metro East of St. Louis (Illinois)

- Posts 255

- Votes 211

@Sean Lyons Yes! But they are weak competition. There is a percentage (not sure how many) of guests at mid-grade hotels that would far rather stay at an AirBnB...especially if you have kids. Unfortunately, the AirBnB supply is so heavily concentrated in vacation markets, that it can be hard to find one in suburbia when you're going to a wedding, visiting family, temporarily assigned to the local military base, refinery, or university. I think people settle for those hotels due to lack of STR options.

I've used this technique in a town outside Sacramento (15min from UC Davis and Travis Air Force Base) and again in the Metro East of STL. I have yet to do a deal less than 30% CoC return. Generally 1-2 bedroom homes/apartments do best in this niche...though, I have a friend nearby making $5500/mo gross on a 4bd/2ba with a small pool that comps say is worth $220K on the MLS right now...you don't even need a calculator to know how good that math is.

My only caution is the danger of municipal regulation. I mitigate by looking for some commercially zoned properties (apartments on top, commercial on bottom) and buying units in different neighboring towns. Also, there is a regional hospital that supports a MTR market if needed as a last resort.

Let us know how it goes!

Post: Where are the best and friendliest Airbnb cities?

Post: Where are the best and friendliest Airbnb cities?

- Investor

- Metro East of St. Louis (Illinois)

- Posts 255

- Votes 211

Regs are constantly changing. Best to call the city planning department as step 1 and get the ground truth data!

Post: Tips to get started

Post: Tips to get started

- Investor

- Metro East of St. Louis (Illinois)

- Posts 255

- Votes 211

@Joshua Strickland Yes! The grind to get that 1st down payment is worth it. You can cut costs and pickup extra work or deliver pizza on weekends. If you don't have the self-discipline and work ethic to earn that 1st down payment, it doesn't bode well for your future success in REI.

Post: Long Term Rental vs. Short Term Rental

Post: Long Term Rental vs. Short Term Rental

- Investor

- Metro East of St. Louis (Illinois)

- Posts 255

- Votes 211

I think there is such a huge variance in types of STRs, that you couldn't possibly apply that rule in all scenarios. Some people STR a literal 100 sq ft Native American teepee...doubt you'll find many takers for LTR on that thing.

That said, portfolio diversity is important for lots of reasons. Like @Gerald Pitts said...you can find risk mitigation at a portfolio scale with a mix of assets. That might be tougher to do if you only have 1 or 2 units and so a backup plan would be wise. I would argue, everyone always has one really easy backup plan to avoid losing their shirt: sell the property.

Personally, I am spreading my STRs among different municipalities, in case one cracks down. Also, I look for commercially zoned (mixed use/STR apartments on top) that as less likely to be included in residential regulation. Frankly, I could also LTR, but the payout would be pretty weak...but not negative.

Summary: Make the decision based on your specifics. There are NO hard rules.