All Forum Posts by: Ben Zimmerman

Ben Zimmerman has started 4 posts and replied 375 times.

Post: Deadbeat dad or investment opportunity? Need advice.

Post: Deadbeat dad or investment opportunity? Need advice.

- Rental Property Investor

- Raleigh, NC

- Posts 393

- Votes 995

I wouldn't touch this deal for many reasons.

The homeowner doesn't need you: If the homeowner wants a lower payment then he should be able to go to the bank and refinance his 50k balance over 30 years which would come out to roughly 500/month depending on taxes etc. A remodel and ARV is completely pointless unless he plans on immediately selling, which he doesn't, or unless the remodel allows you to charge more rent, which in this case he wants to pay less rent.

In this scenario you are the one assuming all of the risk, and have very little if any upside potential. From what I see the homeowner wants you to put your credit and finances on the dotted line and co-sign, then put in sweat equity, and for what purpose? So the homeowner can get all of the benefits of living in a newly remodeled place and still pay less each month?

If the owner can only afford 500 / month, how do you plan on being compensated for what you are contributing? If he can only afford 500 what makes you think he will actually be able to afford to buy out your position? You won't see a dime until he sells, which if this is a childhood home that could be never. And good luck trying to liquidate your fractional share of a single family home.

Sounds to me like the guy is going to stop making all payments on his freely renovated place as soon as you cosign, then you will be stuck paying his rent for him indefinitely or attempt to evict him.

You say this person is family, but nothing can tear a family apart faster than one person owing another person large sums of money. Never mix business with personal, refer them to a bank to refi that 50k balance over 30 years and don't do a remodel. If he wants a new kitchen he can buy himself a new kitchen.

Post: Applying For A Loan (VA Loan)

Post: Applying For A Loan (VA Loan)

- Rental Property Investor

- Raleigh, NC

- Posts 393

- Votes 995

@Chauncy Gray Advice from a fellow vet. Get a credit card. They are the biggest financial military secret that nobody talks about.

Credit cards get a bad rap, and in some cases rightfully so. In the wrong hands a credit card can financially ruin someone for the next decade by overspending and then getting stuck with astronomical interest rates.

However in the right hands, a credit card is a wonderful invention. Remember you only pay interest if you carry a balance from statement to statement, so in my nearly 20 years of owning a credit card, not once have I ever paid any money to my card companies. I do however get large amounts of promotional freebies and cashback from them. Think about that for a moment, my credit card companies pay me, not the other way around.

Secondly, credit cards for currently serving military members are so astronomically amazing that I'm surprised the credit companies haven't changed their own rules. I currently have several cards that combine to offer me roughly $3000 worth of free travel every single year that I can either use immediately, or stockpile it for my big world tour once I retire.

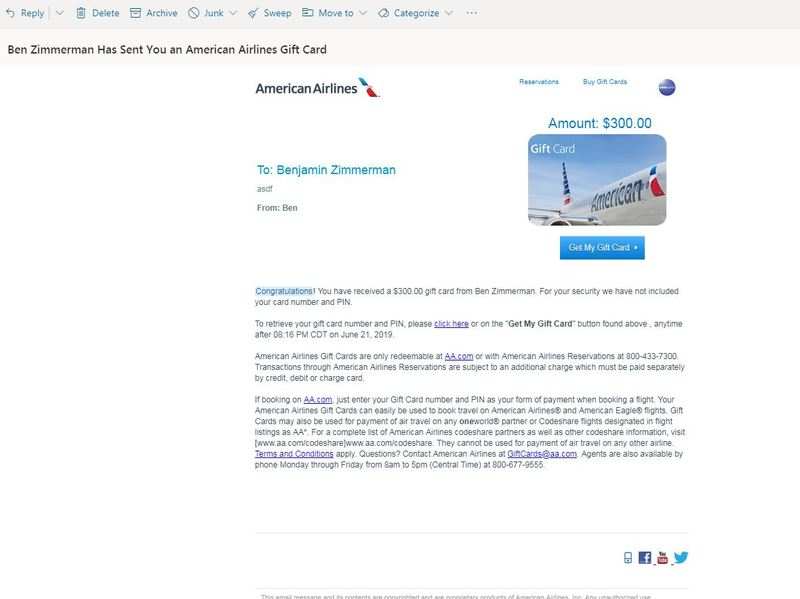

I'm NOT talking about airline cards that give you 1 mile for every dollar spent, or even talking about the sign up bonuses, many of these card's I have never once used... EVER... and yet they give me these benefits simply for having the account open. I've been doing this for a few years now and currently have roughly $12,000 worth of virtual airline gift cards sitting in my email box waiting to be used and I didn't need to ever make a single swipe of the card to get this.

If your interested in learning how this is done, feel free to PM me.

Post: How would you turn $500,000 into 5 million in 5 years?

Post: How would you turn $500,000 into 5 million in 5 years?

- Rental Property Investor

- Raleigh, NC

- Posts 393

- Votes 995

I will parrot the majority opinion and state that 5 million in 5 years is highly unlikely, but so what?

Shoot for the moon, even if you miss you will land among the stars, -Norman Vincent Peale

It's perfectly healthy to have big dreams and big goals, as long as you don't sacrifice everything by making highly risky investments in order to chase your lofty dreams. If you aim for 5 million, and at the end of year 4 you are only at 1 million, don't change your strategy and pursue ever increasingly risky bets in the hopes to somehow come up with the remaining 4 million. Aim for 5, but be happy and content if instead you end up with 1, 2 or 3m.

As far as what would you do to get there? There is generally 3 things that influence the returns you can get.

1. Risk vs Reward: Generally speaking the riskier an investment is, the higher the theoretical returns might be. This is necessary because with a risky investment the chances of you losing everything and going bankrupt is relatively high, so to compensate for this an investor needs to have a shot at achieving very high returns. This is why the safest investments such as government bonds offer very little rewards, and the more and more risky the product, the higher your theoretical rewards. This is the item people in this forum are most concerned about, they feel that in your quest to chase after 5m, you will choose investment options that aren't prudent in a failed attempt to reach your goals. This method is the worst way to increase your returns since you sacrifice stability for the possibility of high yield.

2. Barriers of Entry: The easier it is to get started with a particular investment, the lower the yield generally is. Anyone with $50 can go to Fidelity and buy a random stock. It's easy and requires no knowledge to get started, and therefore will likely have a lower expected payout than other investments. Doctors and lawyers get paid well because very few people are willing to go through the required training. Real estate pays well because very few people have enough cash to plop down a 25% down payment for a rental. Developers, as @Jay Hinrichs mentioned make very good money because they have a combination of a working knowledge of the industry, own or know of a good construction company, and have a large amount of capital to fund the deal. Learn how to do something difficult and become an absolute master in that field, and then learn how to monetize that knowledge. Maybe you're good at finding off market deals, or maybe you're good at finding large sums of private money. Whatever it is learn everything you can, be obsessed with knowledge that gives you a competitive advantage.

3. The riches are in the niches: Public education, and the workforce in general have indoctrinated people into a hive mind mentality where everyone thinks and acts more or less the same. We look and see what other people are doing, and try to mimic them. When everyone is doing the same thing with their investments, they will all get similar returns. The key is to zig when others zag and to find an overlooked, or under utilized sector and find a way to fill the gap. Maybe you live in a touristy town where AirBnB is highly profitable, maybe there is a high demand for student housing, maybe the local hospital needs furnished apartments for their traveling doctors etc. I know people who are making an absolute killing by buying 4 or 5 bedroom homes and renting by the room. If you have 5 rooms rented at $500 each and 650 for the master, then your gross rent is $2650 per month which is significantly higher than what you might get renting the entire house to a single family. While it takes considerably more work on your part to manage, its by thinking outside the box that you will supercharge your returns.

Keep in mind that even if you do all of this, it's still highly unlikely that you will hit 5m because a 5yr timeframe is very, very short. But don't let that stop you from trying! Just make sure whatever you do that you invest wisely and enjoy the ride because you only live once and you can't take it with you.

Post: Property manager pocketing late fees

Post: Property manager pocketing late fees

- Rental Property Investor

- Raleigh, NC

- Posts 393

- Votes 995

The management company that I use takes half of the late fees. My previous company took all of the late fees as long as rent was eventually collected prior to landlord checks being issued. I don't have a problem with this as it doesn't effect me at all.

Rent is due on the first, but the management company doesn't issue checks until the 10th, and funds usually hit my bank by the 15th. I know this fact and can budget accordingly so that I have funds on the first to pay my mortgage, and wait till the 15th to replenish those funds.

So to me it doesn't matter if the tenant pays on the first or is a few days late, because I get my money at the same time regardless.

If someone is late, I don't even notice, but the property management company has to do extra work. I just sit on my sofa and collect a couple extra bucks for doing nothing. Why would I complain about this?

One way or another a PM company is going to make money. Either by random fees, or by charging a higher base price. I would 10x rather them get their money from random fees charged to the tenant that don't impact me in any way, than have them up their base price on all of my units.

Post: 15 yr or a 30 yr mortgage???

Post: 15 yr or a 30 yr mortgage???

- Rental Property Investor

- Raleigh, NC

- Posts 393

- Votes 995

Originally posted by @Jacob Sampson:

@Joe Villeneuve If I have a rental home that is fully leveraged and the market goes south I am far more likely to lose that asset than if the property is totally paid off. That is the risk of debt.

Real estate is a long term play. I don't know anyone who has owned property for 20, 30, 40+ years and hasn't made a ton of money. The trick is surviving the game long enough for the mathematical averages to actually average out.

When you already have a ton of money, surviving a downturn is easy, it's when you're first starting out in your investing career and don't have much that you are at a high risk. If you buy a $250k home at 4.25% @30yrs, you will be paying roughly 1,267 per month. That number skyrockets to $1762 per month if you do a 15yr at 4%.

In an economic downturn, the 30yr mortgage is going to be easily the most stable product for two reasons.

1. You will generate higher cash flow per month leading up to the recession, which will allow you to build better reserves, or reinvest the difference.

2. When SHTF and the market crashes, your mortgage will be 2/3 of what the 15yr option would have been, making it easier to survive the downturn because your monthly payments are $500/month less. Your income will stay the same regardless if it is a 15yr or 30yr, but the 15yr has a 500 higher monthly expense. Where are you going to get that extra 500 bucks during a recession time when everyone is already struggling?

Don't think that just because you have more equity in a property that it is a safer bet. In a downturn, your 30k in equity that you got by the faster equity buildup of the 15yr plan will vanish almost instantly. I would rather have 30k in the bank and my property be 30k underwater than 0 in the bank and net neutral on my home. The only thing that matters in a downturn is how long can you survive, because eventually the clouds will part and the sun will shine again and money will start rolling in again. The 30yr mortgage maximizes the number of months you can survive on your cash reserves by reducing your monthly expenses to its lowest value, in this case by reducing your mortgage by $500 per month which is a very non-trivial amount, especially if you have multiple properties. If you own 6 properties that is an extra 3k/month that you need to come up with in a downturn that I don't have to worry about.

Maybe you are able to survive and can come up with the extra 3k/month from your JOB wages. But even if that is the case, all things being equal I will still have 3k in monthly income rolling in. Income that I can use to buy even more properties at a fantastic discount due to the recession. A recession is an amazing event if you are well prepared and can take advantage of the situation. As the saying goes, the time to buy is when there is blood in the streets.

The 15yr mortgage is incredibly safe after the 15yrs have passed, but also very dangerous during those 15 years. The problem is it is during those 15 years when you are first starting out that you are at the highest risk to begin with. So you are essentially using the riskier loan product, at the time in your investing career when you are most prone to failing.

If you really want to have paid off properties, getting a 30yr mortgage and simply making an over payment of $500/month and treating it like a 15yr loan is a better option. If you overpay the difference your 30yr mortgage will be paid off in 15yrs and 4 months. Those 4 months are well worth the option of needing to only pay 1267 per month if times get rough, an option you don't have if you had simply gone with the 15yr plan. Or better yet switch to a bi-weekly plan and still pay the extra 500/month.

The next argument typically made is, "But it saves me a ton of interest". I'll concede the fact that you do pay significantly less interest with the 15yr plan, but my response would be, "So what?" Saving a couple of bucks on a historically low interest rate loan is only worthwhile if you are financially undisciplined and would otherwise waste those extra few bucks.

If you had $250,000 in cash that was earning a 4% yield would you be happy with your returns? Because that is what you are essentially doing by paying off your home. Instead of earning 4% of 250k, you simply aren't paying interest of 4% on 250k. Toe-mae-toe, Ta-mah-toe, either way the end result is the same and the return is abysmal. If I was content with 4% returns I would invest in bonds and other overly safe investments instead of real estate.

The last thing that people typically overlook when evaluating the 15yr vs 30yr mortgage is the time value of money. Money is guaranteed to lose purchasing power over time due to inflation. A dollar today is worth significantly more than a dollar 30 years from now. The 15yr plan pays off the loan rapidly by using mostly "today" dollars because the loan gets paid down rapidly, where as the 30yr loan uses more "tomorrow" dollars which have less relative value. If your mortgage today is 1200/month, you might think that is high, but you will look back and laugh at your puny 1200 mortgage during year 27 etc.

Post: Active Duty military trying to get into Real Estate

Post: Active Duty military trying to get into Real Estate

- Rental Property Investor

- Raleigh, NC

- Posts 393

- Votes 995

Greetings to a fellow vet.

Brrrr is a fantastic strategy in general, but it's not for everyone. Are you particularly handy? Could you do the renovations yourself or would you need to contract it out? Would you have the time to do the work yourself while also holding down your military job? Would you be willing to live in a home while it is under renovations, and if not where would you stay and how would you afford a second place to stay during the reno?

Brrr is also more expensive upfront as you have noticed since you need both the downpayment and the reno funds. There are loans such as the 203k loan that will wrap the cost of reno into the loan amount. The downside is they generally require a lot of extra paperwork, you can't do the reno yourself and have to contract the work out, and the interest rates are much worse than a traditional 30yr loan and are usually roughly a full 1% higher. That 1% interest rate makes a huge difference over the course of a loan and can easily add an extra $125 a month on a typical home worth 200k.

Personally I would skip Brrr for now and stick to the VA loan and house hack it. Either buy a 3 or 4 bedroom single family home and find a couple of roommates, or go bold and buy up to a 4 unit complex and live in one and rent the others. I house hacked my first home I purchased and it really set the tone for my investing career. I had a 3 bed house and my mortgage was 800 a month, I rented the other two bedrooms for a flat $500 each so that covered my entire mortgage and most of the utilities allowing me to rapidly save up money for my next purchase.

My biggest concern is that you said you already have a rental but only have 10k to purchase your second place. Does this mean you have 10k total, or 10k plus your reserve funds for your first rental. Because if you only have 10k total then I would be extremely cautious about over extending yourself. Hot water heaters break, HVAC units break, roofs need replaced. If you did use that 10k to purchase a second place and the AC unit went out on your first rental how would you pay for it? While I understand your desire to scale up rapidly, and most people when they are young think nothing bad in life will ever happen, but you can lose everything in the blink of an eye by not having enough funds in reserves for emergencies. Investing is a marathon, not a sprint so make sure you have that reserve fund set up before you do anything else.

Post: WTF service dog? Is this the new trend to get around No Pets?

Post: WTF service dog? Is this the new trend to get around No Pets?

- Rental Property Investor

- Raleigh, NC

- Posts 393

- Votes 995

On the federal level

1. no, an ESA is not a pet. You can't charge a pet fee, pet rental expense, additional deposit, or any other fees not normally imposed on any other tenant.

2. see 1.

3. no, you may require your tenants to obtain generic renters insurance assuming you make everyone get it, but you can not specify arbitrary or prohibitively high pet insurance

4. Yes. This is a case by case basis. Per a memo issued by FHEO, "If a housing provider's insurance carrier would cancel, substantially increase the costs of the insurance policy, or adversely change the policy terms because of the presence of a certain breed of dog or a certain animal, HUD will find that this imposes an undue financial and administrative burden on the housing provider."

5. owners policy doesn't matter since your policy does not trump the tenants federal right to have an ESA. Policy's could be denied a claim if you failed to disclose the presence of the animal to your insurance carrier. Termination of policy due to a dangerous breed would grant you the ability to deny the tenant based on item 4.

Post: Best way to bluff a PITA NJ tenant into leaving?

Post: Best way to bluff a PITA NJ tenant into leaving?

- Rental Property Investor

- Raleigh, NC

- Posts 393

- Votes 995

To go further with that argument:

"Landlord created inhospitable environment by racially profiling me as a non-citizen by labeling a simple dispute against my neighbor as a 'terrorist threat' and threatening police action against me. I feel I am being forcibly removed not because of the laundry altercation, but because of my nationality."

Post: WTF service dog? Is this the new trend to get around No Pets?

Post: WTF service dog? Is this the new trend to get around No Pets?

- Rental Property Investor

- Raleigh, NC

- Posts 393

- Votes 995

@Mike Franco Service animals of all types have been problematic for years and are growing more and more prevalent due to the way the law works. You see people on a regular basis with their animals in housing complexes, restaurants, on board airplanes, hotels, and everywhere in between.

You can't charge a 'pet fee' of any kind, because according to the law it isn't a pet, and you can't deny them based solely on them having a service animal. However you can screen them just like any other tenant and if they fail the credit, income, or other requirements that you demand of all other tenants then you can still decline them.

Also, there are exemptions to the rule. If you are house hacking a 2-4 unit building by living in one unit, you are not required to follow Fair Housing Laws. Also for single family homes you can discriminate so long as you own 3 or less units, and no broker or discriminatory advertising is used. Since the majority of people reading these forums are small time players who only own 1-2 properties, most people are actually exempt from Fair Housing Laws.

Please note: Fair Housing Act is a national law, so please be sure to check local and state laws to make sure there isn't anything else in play before telling someone to piss off because you think you are exempt.

Post: Does this sounds sketchy to you?

Post: Does this sounds sketchy to you?

- Rental Property Investor

- Raleigh, NC

- Posts 393

- Votes 995

I'd be cautious about the low rent that each unit is paying if you plan on having a property manger take care of this for you. I'm not sure what your management team costs, from what I've seen most low rent places take a flat rate instead of a percentage. So if you get charged a hypothetical $79 a month per unit, that is almost $500 a month which drastically alters your cashflow numbers. Places with a lower rent rate get eaten alive by property management costs.