All Forum Posts by: Chris Webb

Chris Webb has started 24 posts and replied 383 times.

Post: 2021 and the 1% Rule question

Post: 2021 and the 1% Rule question

- Investor

- Central Virginia

- Posts 393

- Votes 253

I'm curious... In 2021, did your deals adhere to the 1% rule?

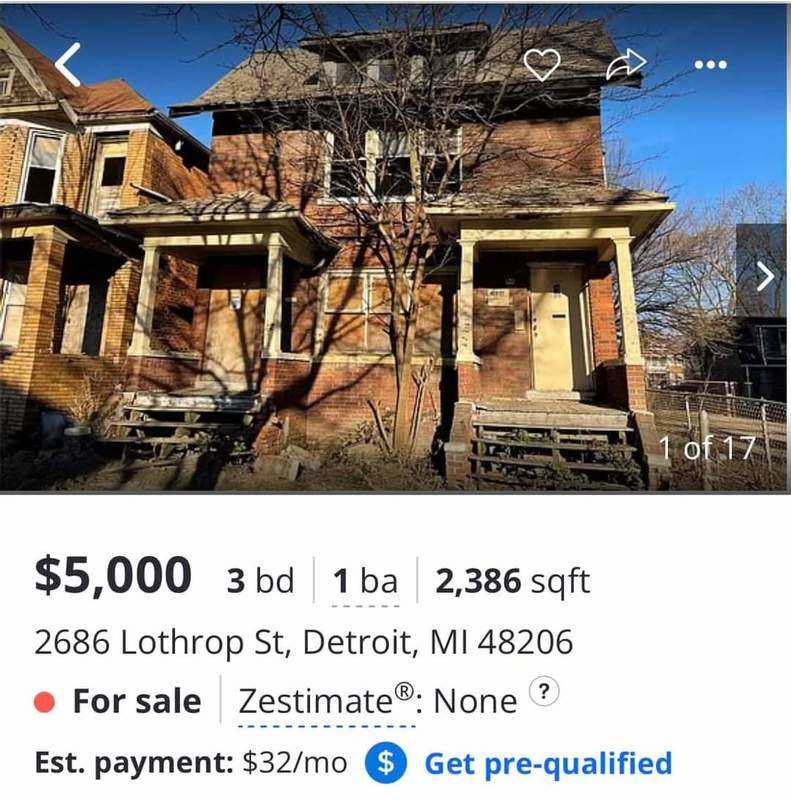

Post: Is North Detroit (48202) good to invest in?

Post: Is North Detroit (48202) good to invest in?

- Investor

- Central Virginia

- Posts 393

- Votes 253

Post: Zillow Rent Zestimate?

Post: Zillow Rent Zestimate?

- Investor

- Central Virginia

- Posts 393

- Votes 253

Hi @Joseph Ellengar, Zillow was spot on for me but I confirmed it with my property manager. I would look at Rentometer too. you get a few free look ups and then you have to pay for an annual subscription, but it is like a rental CMA for the area.

Post: Getting "Serious" About REI in 2022

Post: Getting "Serious" About REI in 2022

- Investor

- Central Virginia

- Posts 393

- Votes 253

Hi @Steph S. You have made the choice, now it is about finding your investment method. I use cash on cash return and look for good deals. My definition of a good deal is a 2-4% higher return above the average deal. I do not invest in Denver so I do not know what an average deal is there. I would take a look at the MLS every day and build a database of the deals and then find average over the course of a month or so. Then you will be able to identify a great deal. This will help you with BRRR as well as it will give you a better understanding of the market. I hope this helps and good luck!

Post: Is the housing market worth investing in right now

Post: Is the housing market worth investing in right now

- Investor

- Central Virginia

- Posts 393

- Votes 253

Hi @David Francis, I heard a while back that time in the market is much better than timing the market and I would agree with that statement. The questions I would ask you are what are the metrics you are using for your investments? Math is math and the metrics either make sense or they do not. Next, do your metrics work in different locations? It might be the right strategy, but the wrong market. Remember that the right strategy in the wrong market is ALWAYS a wrong strategy.

Post: Finding a market to narrow down to

Post: Finding a market to narrow down to

- Investor

- Central Virginia

- Posts 393

- Votes 253

Originally posted by @Abraham Shamosh:

Originally posted by @Chris Webb:

Originally posted by @Abraham Shamosh:

Originally posted by @Joe Villeneuve:

There is no advantage to starting in your own backyard. That is a foolish statement that should be ignored. You don't invest in an ara just because you know the area. The only advantage is if that area is not a good area to invest in you should know it. Knowing an area isn't what makes any area a good area to invest in.

However, when you find a good area to invest in, based on the numbers with $$$ in front (profit and cash flow), you need to learn about that area to the point you know it better than the one you live in.

True, however when your starting to look out of your area where do you start your research ? The town over ? Different state ?

I would first review what your criteria is. You mention that you are researching, what methods are you looking at? BRRR, Buy and Hold? Wholesaling? Once you Identify what method, then you need to figure out your metric - are you looking for appreciation, cash flow, etc? After this I would ID a few markets close by - 1 hour by driving - and run a few numbers. test the market using your metrics for your goals and if they do not work move to another market. One final thing, run your numbers for about a month to find what the average deal is and what the trendline looks like. Are prices increasing? are rents increasing with them? Remember when running the numbers, its just math and math doesn't often lie. Do not look for a way to make the math work if it simply does not. Hope this helps!! Good luck.

Thank you for the detailed response. So I’ve been researching fix and flips and brrrs. My goal is to produce large income from flips and brrr to produce monthly passive income for the long term picture. So max 1 hour ish away from me? I shouldn’t go into totally different states where entry is so cheap ?

If you want to go out of state it might make sense. I would review your options and they are a little bit different because you are in an area where you are literally across the water from another state. I would use the 1 hour rule if you want to have some connection to the location. However, it can be 30 mins or 1.5 hours away to. The key point is to make sure you know your money metrics and ensure the deal works before you buy. Try getting a map and draw some circles on it from 30 mins to 1.5 hours away and take a few day trips. This way you can get a feel for the place too. You might be able to visit a few areas in a weekend and create a rough list of where you would like to look to buy.

Hope this helps. Good luck!!

Post: New Agent Looking for Part-Time Advice

Post: New Agent Looking for Part-Time Advice

- Investor

- Central Virginia

- Posts 393

- Votes 253

Hi @Account Closed, I would actually look at this in a completely different way. I would look for the agency with the most reach. Why? because you are working a 9-5. Instead of attempting to work an additional job outside your 9-5, become a referral source.

You have a unique situation in that you know people who are actively looking to relocate. Get your name out there as the guy who will assist in other people's relocation and you can help them select an agent in their destination city. When someone from your city is looking to relocate you can help them select the best agent. Develop a standard questionnaire for agents based on your unique knowledge of moving in the military and reach out to 3 agents at the destination of your clients. Allow your clients to select who they would like to work with and you actually will earn a referral fee and develop a relationship with the agent in the other city.

Now, fast forward 3 years and who do you think will be on the mind of the agent in the other city when they have someone moving to your city? Again this is a unique situation because the city that you are helping people move to has a military installation which will eventually reciprocate to your city. In 3 years you will have an already seasoned referral base plus the referrals from your existing clients.

I hope this helps and if you want a more thorough understanding of what I listed here feel free to reach out to me on BP. I saw an agent do this in Arizona and he earned $20-30K without ever stepping foot in a house in his home city. I would be more than happy to share it with you.

Post: The best way to save money?

Post: The best way to save money?

- Investor

- Central Virginia

- Posts 393

- Votes 253

I heard a long time ago to make a "I don't care" list. This list includes items that I just do not care where I get them from. One example in my home is trash bags. For personal use, I simply do not care if I use Hefty or store brand. In fact, I anticipate that I saved well over a thousand dollars over the years by switching to dollar store trash bags for my home. Now, I know that some people cannot do this with children and brand loyalty, but it worked for me and it might work for others.

Post: Finding a market to narrow down to

Post: Finding a market to narrow down to

- Investor

- Central Virginia

- Posts 393

- Votes 253

Originally posted by @Abraham Shamosh:

Originally posted by @Joe Villeneuve:

There is no advantage to starting in your own backyard. That is a foolish statement that should be ignored. You don't invest in an ara just because you know the area. The only advantage is if that area is not a good area to invest in you should know it. Knowing an area isn't what makes any area a good area to invest in.

However, when you find a good area to invest in, based on the numbers with $$$ in front (profit and cash flow), you need to learn about that area to the point you know it better than the one you live in.

True, however when your starting to look out of your area where do you start your research ? The town over ? Different state ?

I would first review what your criteria is. You mention that you are researching, what methods are you looking at? BRRR, Buy and Hold? Wholesaling? Once you Identify what method, then you need to figure out your metric - are you looking for appreciation, cash flow, etc? After this I would ID a few markets close by - 1 hour by driving - and run a few numbers. test the market using your metrics for your goals and if they do not work move to another market. One final thing, run your numbers for about a month to find what the average deal is and what the trendline looks like. Are prices increasing? are rents increasing with them? Remember when running the numbers, its just math and math doesn't often lie. Do not look for a way to make the math work if it simply does not. Hope this helps!! Good luck.

Post: Junior in College - Feasible to buy a property this summer?

Post: Junior in College - Feasible to buy a property this summer?

- Investor

- Central Virginia

- Posts 393

- Votes 253

Hi @William Hammond, as @Anthony Johnson suggests I would look at a 5% conventional for financing. Also talk with a lender to be sure of the requirements for the loan. If you are a student and it is your primary residence it should not be an issue, even if you are living in NY. I would talk with a lender on your lending options first.