All Forum Posts by: Chris Webb

Chris Webb has started 24 posts and replied 383 times.

Post: Strategies to Finding a Growth Market

Post: Strategies to Finding a Growth Market

- Investor

- Central Virginia

- Posts 393

- Votes 253

Hi @Rachelle Malkoff, I agree with @Michael Sargent in looking for market reports like the PWC one. These are good barometers for what is most recently happening in a market.

However, it is not as good as getting eyes on the ground in your investment area. I would recommend getting in touch with agents in those locations and ask them for a market snapshot. See what they are seeing and get on the phone with them. Ask some standard questions about growth, population and employers. If they have the answers you know you have the right agent on the line. If not, keep looking.

Post: BRRRR and Decreased Cash Flow

Post: BRRRR and Decreased Cash Flow

- Investor

- Central Virginia

- Posts 393

- Votes 253

Hi @Rhonda Davis, this is why I only look at cash on cash return. Accounting shows me that the cash flow statement is really the lifeblood of any investment. If cash flow stops, eventually the whole investment return stops. Now, my investment strategy is much different and I want to express this up front. I have not done a BRRRR and I do not plan on doing one anytime soon. However, it does depend on your time horizon and I would ask you to consider the supply chain issues that most BRRRR investors are suffering through right now. Do you account for this in your decision? It is a tough call in today's market. But, rates are rising and is it worth it to get 30 year money today vs 3-6 months from now. Best of luck and if you have any questions please let me know. I would be happy to run the numbers through my yield calculator for you if you want a second opinion.

Post: Nobody is talking about the real impact of inflation

Post: Nobody is talking about the real impact of inflation

- Investor

- Central Virginia

- Posts 393

- Votes 253

Hi @Bob E., you mention margin debt. I am curious if you think that investors using BRRR are considered marginal investors. They typically uses short term debt to finance deals, right? With rising construction costs are they going to be left holding the bag in the near term?

What are your thoughts?

Thanks in advance.

Post: Nobody is talking about the real impact of inflation

Post: Nobody is talking about the real impact of inflation

- Investor

- Central Virginia

- Posts 393

- Votes 253

"What puzzels me is that inflation with it's massive impact on REI is not a big topic here on BP." I would say that this is probably because RE is an asset - which typically improve in inflationary times.

Post: Looking for Other Investors in Stafford, VA Area

Post: Looking for Other Investors in Stafford, VA Area

- Investor

- Central Virginia

- Posts 393

- Votes 253

Hi @Joshua Merchant, I am in Tallahassee and Leon County. I know two agents out there who I work with there and have an excellent property manager.

Post: Looking for Other Investors in Stafford, VA Area

Post: Looking for Other Investors in Stafford, VA Area

- Investor

- Central Virginia

- Posts 393

- Votes 253

Hi @Joshua Merchant, I am looking for real estate meet ups too. I am in Lynchburg and I invest in FL and TX. If you find a RE group let me know.

Chris

Post: What Trends, News, and Data Do You Pay Attention To!

Post: What Trends, News, and Data Do You Pay Attention To!

- Investor

- Central Virginia

- Posts 393

- Votes 253

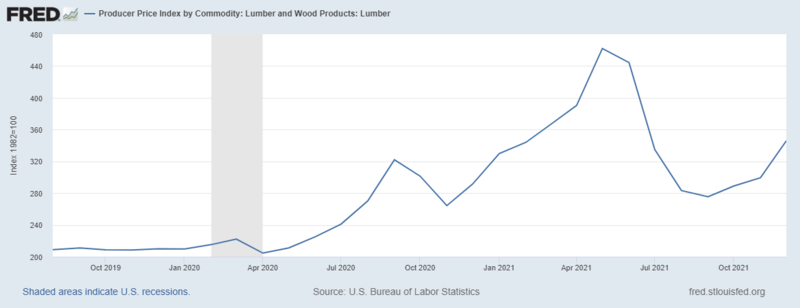

Second post here - I would suggest people who are using the BRRR method review the Producers Price Index. It is a leading indicator meaning it is telling the general public which direction prices are likely to go.

Here is a chart on the lumber prices which is measured monthly. You can see how they went up and then came down. At some point there was an inflection point where they started to go back up and if an investor was reading this correctly they could have purchased lumber while there was a break in the fall. Now, the prices seem to be increasing.

I do not use the BRRR method, I do have 2 econ degrees and thought this might help some people who are looking to expand their investment education. Hope this helps you in your future investing!

Post: Trailer home as a start. --- (0% xp in real estate)

Post: Trailer home as a start. --- (0% xp in real estate)

- Investor

- Central Virginia

- Posts 393

- Votes 253

Hi @Steven Webster, I would search the BP forums for mobile homes and see what comes up. I have thought about investing in them as they return a bit higher in my market. What is the end goal? Is it cash flow? Is it paying down the debt? I ask these questions all the time before pulling the trigger and find my one goal, if the property meets the one criteria, I invest.

I find that often times we can get bogged down in chasing multiple things - debt paydown, appreciation, etc. Focus on one thing and if it will change your life for the better does this investment meet this one thing.

Hope this helps.

Post: Real Estate Financial Analyst Seeking Work/Mentorship

Post: Real Estate Financial Analyst Seeking Work/Mentorship

- Investor

- Central Virginia

- Posts 393

- Votes 253

Hi @Jack Day, I am curious because of your W2 position, what metrics are you going to use to measure success in a deal?

Post: Hello from NOLA--Newbie looking to learn

Post: Hello from NOLA--Newbie looking to learn

- Investor

- Central Virginia

- Posts 393

- Votes 253

Hi @Amanda Jewell, best of luck on your new venture!