All Forum Posts by: Duc Ong

Duc Ong has started 85 posts and replied 403 times.

Post: Honolulu Multifamily and More

Post: Honolulu Multifamily and More

- Real Estate Agent

- Honolulu, HI

- Posts 429

- Votes 187

💥 Join us on Friday, October 3rd, 2025 at 5:00PM for great networking opportunities and learn about multifamily real estate, wealth building, and more!

🤝 For this meetup, we are going to be networking in small groups, so bring your business cards and connect with other investors!

📍Hawaii Loa Ridge Community Center

🔗 We are limiting this event to 35 participants, so please register at this link:

🍻 Bring snacks and/or drinks to share.

Post: Honolulu Multifamily and More

Post: Honolulu Multifamily and More

- Real Estate Agent

- Honolulu, HI

- Posts 429

- Votes 187

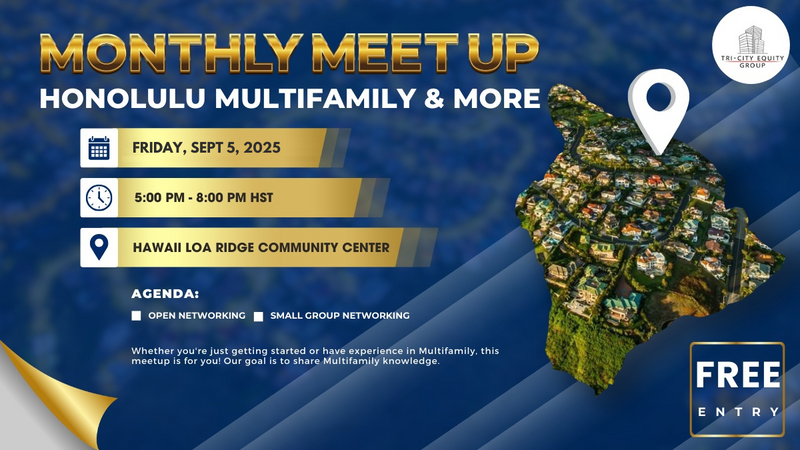

💥 Join us on Friday, September 5th, 2025 at 5:00PM for great networking opportunities and learn about multifamily real estate, wealth building, and more!

🤝 For this meetup, we are going to be networking in small groups, so bring your business cards and connect with other investors!

📍Hawaii Loa Ridge Community Center

🔗 We are limiting this event to 35 participants, so please register at this link: https://bit.ly/HMM090525

🍻 Bring snacks and/or drinks to share.

Post: Question on Foreclosure Laws

Post: Question on Foreclosure Laws

- Real Estate Agent

- Honolulu, HI

- Posts 429

- Votes 187

I think the “sight unseen” part is just the tradeoff that makes auctions work. If everyone could walk through, prices would get bid up closer to retail and the investor spread would disappear.

It does vary by state though; here in Hawaii, I’ve seen lenders open up vacant properties before auction to boost bids. Not common everywhere, but it shows how local practices matter.

From working with investors on Oahu, I’ve noticed the bigger theme is that returns usually come from stepping into situations others find uncomfortable. Auctions are one version of that. If you want less risk, routes like REOs, pre-foreclosures, or agent-listed deals give more certainty; just without the same discount potential.

Post: North Shore Kauai, Hawaii Rental Property Investor

Post: North Shore Kauai, Hawaii Rental Property Investor

- Real Estate Agent

- Honolulu, HI

- Posts 429

- Votes 187

Emily, congrats on finding land up there; that’s not easy. When it comes to bringing in an investor, the key is having your structure and story clear: are you offering equity (profit share) or debt (fixed return)? Investors will want to see a simple package with pro forma, comps, timeline, and exit plan.

On Kauai specifically, highlight how you’ll stay compliant with rental laws—long-term and mid-term strategies give confidence. From there, start with your network, but also look at accredited investor groups and real estate meetups. The clearer your plan, the easier it is to attract the right partner.

I work with investors here in Hawaii, and I’ve seen that once you frame the opportunity properly, it’s less about “finding money” and more about connecting with people who already want a foothold in the islands.

Post: Flippers doing 20+ year,what are your acquisitions/financing/management strategies

Post: Flippers doing 20+ year,what are your acquisitions/financing/management strategies

- Real Estate Agent

- Honolulu, HI

- Posts 429

- Votes 187

Great thread, thanks for sharing Richard.

I’m not a flipper myself, but as a broker and multifamily investor here in Honolulu, I’ve seen a few things that help operators scale beyond the one-off projects:

-

Pre-negotiated contractor pricing for common items = predictable margins and faster timelines.

-

Standardized design packages (2–3 finish sets) = bulk ordering + a recognizable “brand.”

-

Exit flexibility (flip or rental refi) keeps deals profitable when the market shifts.

-

Capital efficiency: some pool private equity into small funds or short-term syndications, similar to what we do in multifamily, so they’re not scrambling deal by deal.

Interesting to see how these same principles apply whether it’s flips in Texas or apartments in Hawaii.

Quick question: do your project managers just keep eyes on site, or do you give them budget/schedule authority too?

Post: Exploring STR in Honolulu

Post: Exploring STR in Honolulu

- Real Estate Agent

- Honolulu, HI

- Posts 429

- Votes 187

Welcome in advance to Honolulu!

Just something to keep in mind as you look into STRs here; the city has been tightening regulations quite a bit. Most neighborhoods on Oʻahu are actually restricted unless you’re in a resort-zoned area (Waikīkī, Ko Olina, Turtle Bay). Even then, the permitting process and compliance can be strict, and enforcement has picked up.

That said, some investors pivot to mid-term rentals (30+ days), which fit well with demand from traveling nurses, military PCS families, and remote workers. Those tend to avoid the STR red tape while still producing strong returns in the right neighborhoods.

From a buying perspective, it’s worth knowing that prices can be higher than on the mainland, but certain submarkets (like Kakaʻako condos, Kailua, or some spots near the rail line) have different dynamics and opportunities depending on whether your goal is cash flow, appreciation, or lifestyle.

If you’d like, I can point you toward areas and building types that work best for investors, as well as connect while you’re here to give you a feel for what’s realistic on the ground.

Post: Can my LLC 1031 into a property owned by my other LLC?

Post: Can my LLC 1031 into a property owned by my other LLC?

- Real Estate Agent

- Honolulu, HI

- Posts 429

- Votes 187

Good question, and you’ve already gotten some solid technical answers here.

One angle I’ll add from experience: a lot of investors don’t realize that the “same taxpayer” rule isn’t just a federal IRS issue — it can play out differently when you factor in state-level taxation. Hawaiʻi is especially aggressive on tracking gains, even if you move capital out of state. You’ll want to make sure you’ve mapped out how Hawaiʻi will view the transaction at the time of sale, since they may still claim the tax even if your replacement property sits in Washington.

Another consideration: the financing side. Some lenders will only allow the same entity to be on title if you're exchanging, so if you're thinking about moving into a new LLC, make sure the lender lines up with the tax structure you're aiming for.

Finally, if you are looking at Washington for the no state income tax angle, it might be worth modeling out a long-term strategy that includes future exchanges or even syndications. That way, you’re not just optimizing this single transaction, but building a framework you can keep using as your portfolio grows.

I’d definitely loop in a CPA and QI early, because once you start the 1031 clock, you don’t want to be scrambling to restructure entities under deadline.

Post: Recommendations for buy & hold cash flow properties

Post: Recommendations for buy & hold cash flow properties

- Real Estate Agent

- Honolulu, HI

- Posts 429

- Votes 187

You’ve gotten a lot of good input here already, so I’ll add another angle that I walk through with clients who are in a similar position. With $200K, you’ve got options; the key is making sure your capital is working for you in a way that matches your goals and risk tolerance.

A few things to consider:

-

Don’t Put It All in One Basket

Instead of dropping all $200K into a single property, you could split it across two different markets or property types. For example, one newer SFR in a growth market and one small multi in a stable Midwest market. That way you're not overly dependent on the performance of a single tenant base or local economy. -

Asset Quality Matters More Than “Cheap”

I see a lot of investors chase low price points, only to find that constant repairs and turnovers eat away at their returns. Paying a bit more upfront for a B/B+ class property in a strong neighborhood often results in more predictable cash flow and appreciation. -

Mid-Term Rental Potential

In certain markets near hospitals, universities, or military bases, mid-term rentals (30–90 day leases) can outperform traditional long-term rentals. They’re less management-heavy than short-term rentals, but often bring in stronger rents with tenants who typically take good care of the property. -

Consider Passive Options

If you want cash flow without the headaches of direct management, private placements or syndications can be worth exploring. They allow you to leverage your capital into larger multifamily assets with professional management and built-in diversification.

Bottom line: The “best” market isn’t just about price-to-rent ratios. It’s about matching the market and property type to your strategy, lifestyle, and how hands-on you want to be.

Post: Looking for a consult or potential co-host!

Post: Looking for a consult or potential co-host!

- Real Estate Agent

- Honolulu, HI

- Posts 429

- Votes 187

Congrats on the closing!

I manage rentals from Hawaiʻi as well, and the biggest thing I’ve learned is that your systems matter even more than your team. A couple things to think about:

-

Cleaner vs. Turnover Specialist: Don’t just look for someone who “cleans.” You’ll want someone who can also act as your eyes: checking for damage, restocking essentials, and reporting back with photos. A good one becomes almost like a co-host.

-

Backups: In a vacation market, cleaners and handymen book up fast. Line up at least two options for each role before you need them.

-

Smart tech: Invest in a smart lock you can reset remotely, and cameras at entrances. These reduce 90% of the headaches when you’re not on the ground.

-

Local support: Since you already trust your agent, absolutely ask them for referrals. I’d also see if they know a local “runner,” someone who can handle random issues like dropping off a replacement coffee maker or meeting a contractor.

-

From Hawaiʻi, managing is very doable — I’ve seen it work well as long as you treat it like building a mini-business. Some owners even start with a co-host for the first few months, then take over once the kinks are ironed out. That could be a happy medium if you want to get your feet wet without being overwhelmed.

I work with a lot of investors here in Honolulu who are also managing out-of-state properties, so I’ve seen both the pain points and the setups that run really smoothly.

Post: Starting out and don’t know actionable first steps

Post: Starting out and don’t know actionable first steps

- Real Estate Agent

- Honolulu, HI

- Posts 429

- Votes 187

You’re thinking about this the right way; most people never even get to the point of planning 15–20 years out. Hawaii is a tough market, but not impossible if you get creative. You might need to save up for a bit longer, but it's doable.

One option worth considering is house hacking a small condo. Since you’ll need to move soon anyway, buying a place with an extra bedroom you can rent out can lower your living costs.

Also, don’t overlook creative strategies like seller financing, partnerships, or even mid-term rentals (there’s strong demand here from traveling nurses and military).

Keep stacking cash and exploring your lane; and since I’m also based here on Oʻahu, happy to talk story anytime if you want to bounce around local ideas.