All Forum Posts by: Eric Fernwood

Eric Fernwood has started 64 posts and replied 792 times.

Post: Las Vegas, NV

Post: Las Vegas, NV

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello @Jeff Workman,

Welcome to Biggerpockets.

As I understand your questions:

• Do you need an real estate attorney?

• Do you need an accountant if you own investment real estate?

• Why real estate as opposed to other investments like stocks.

• Is Las Vegas the right location?

All good questions which I will answer below:

Do You Need An Real Estate Attorney?

We have many investor clients and to the best of my knowledge none has engaged a real estate attorney. The contracts and process for buying residential (non-commercial) real estate are highly standardized. Everyone uses the same purchase contract and the actual purchase is executed by a third party called a title company. Commercial is a totally different situation.

Do You Need an Accountant?

None of our clients specifically engaged an accountant for the real estate portion of their portfolio. The property manager handles all the day-to-day activities and at the end of the year provides the needed tax forms. Again, this is on the residential side. Commercial real estate is different.

Why Real Estate?

Traditional investment concept (stocks, bonds, CDs, 401Ks, etc.) is to accumulate enough capital so you can later draw-down (withdraw) funds over a period of time. Simplistically, to determine how much you need to accumulate you need to know: the amount you will withdraw per month, how long you will live and what inflation will be during these years. For example, suppose you plan to withdraw $5,000 a month for 30 years and there is zero inflation, zero transaction fees, zero taxes and zero capital appreciation. If that is the case, then the math is easy:

30 Years x 12 Months/Year x $5,000 = $1,800,000

However, if inflation exceeds capital appreciation you will need to accumulate more before you start to with draw money. For example, if you expect 3% net inflation during the draw-down period you would need approximately $3,000,000 to draw down $5,000 (present value) over 30 years. Also, what if you or your spouse live longer than planned?

With real estate, the concept is to accumulate sufficient income streams over time such that the aggregated income streams meet your income needs today and into the future. For example, suppose each property you buy generates a net cash flow of $250/Mo. If this is true, then you need to accumulate $5,000/$250 or 20 properties.

How much would it cost to purchase each property? As in the previous example, we will ignore inflation and appreciation. Assuming each property costs $180,000 and you obtained 30-year financing with 20% down at 5% interest, you will need about $36,000 plus another $12,000 to cover closing costs, rehab, etc. or $50,000/property. Simplistically, 20 x $50,000 = $1,000,000 is what you need to establish a $5,000/Mo income stream. When the mortgages are paid off the cash flow will significantly increase but we will ignore this for the present example. And, since rents historically track inflation while your recurring costs remain relatively constant, your return will increase as inflation increases.

Is Las Vegas the Right Location?

Most of my clients live in other states or countries. One of their first questions is, "Why should I invest in Las Vegas?" My response is,"What are your goals?" It is important for me to know what they are seeking because Las Vegas will not meet everyone's goals. I will briefly discuss where I think Las Vegas is strong and where I think it is not as strong (Here is a BP post with more details). Note that I will focus on single family properties, the multi-family and commercial market is quite different.

Las Vegas' advantages:

Short term:

• You get to keep more of the rent the property generates. This is due to the low property tax rate, zero state income tax, low insurance, and low maintenance costs.

• Low business risks due to landlord friendly laws. In Las Vegas an eviction takes 28 days or less and costs about $500 (compared to ~1 year in California as an example).

Long term:

Metrics like ROI are only a snapshot in time; how the property is likely to perform today. ROI tells you nothing about how the property is likely to perform in the foreseeable future. Simplistically stated, if there is continued demand for a item the price will rise or stay the same. The key demand factors for real estate are:

• Population - If people are moving out of a area, housing prices and rental rates in that area are likely to fall. If people are moving into an area, housing prices and rental rates in that area are likely to rise. Depending on which study you choose to believe, Las Vegas' population is projected to increase by 1% to 2% per year for the foreseeable future.

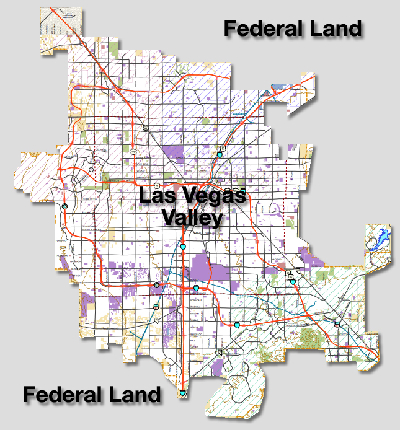

• Urban sprawl - Urban sprawl can be an absolute value killer. People with money will tend to move to newer areas and the people with lower incomes are left behind. The result is falling property prices and falling rental rates. Las Vegas is a virtual island, it is surrounded by federal land. There is almost no expansion room in desirable areas so urban sprawl is almost non-existent in Las Vegas.

• Job quantity and quality - The value of a property is no better than the jobs around it. In many parts of the US, manufacturing and similar jobs are going away and what remains are service sector jobs. Service sector jobs tend to pay less than manufacturing jobs so the families of these workers have less disposable income. Less disposable income means that they cannot afford to pay the level of rent they did in the past. Inflation adjusted income in Las Vegas have been slowly increasing (except during the 2008 to 2011 crash) and projections are that the increases will continue according to a Federal Reserve Bank study.

Where is Las Vegas relatively weak? The entry price point for class A town homes is about $125,000. There are locations in the US where you can buy similar properties for less than $50,000. However, I question the long term implications of buying in declining markets like the mid-west where service sector jobs are replacing high paying manufacturing jobs.

Jeff, I hope I answered some of your questions. For more Las Vegas specific real estate investment information please see my profile.

If you or other BP members would like to learn more about real estate investing you are welcome to join me as I check out investment properties for clients. Almost all of our clients live in other states or countries and I usually check out properties alone and I welcome the company.

Best wishes,

Post: If and when the sky "IS" falling, will it crash on Turnkeys too?

Post: If and when the sky "IS" falling, will it crash on Turnkeys too?

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello @Account Closed,

You asked a very good question and on the surface it seems like a simple question to answer but it isn't. I will start by stating that the purchase vehicle (turnkey or direct purchase) makes no difference when it comes to how a property is likely to perform in times of economic instability. In my opinion, the only difference might be that since you will pay more for a turnkey property you will likely see a lower return but that is not a factor of economic stability.

Rental stability is totally dependent on the jobs your tenants have. If the tenant's jobs go away, they cannot pay the rent. So, when you are considering a property, consider the major employers where your tenant pool is likely to work. How did these employers and their market segment fare in the last crash? A more likely future risk is how the location is trending. Are property prices increasing or decreasing? Are the quantity and quality (earning power) of jobs increasing or decreasing? You need to consider these factors because ROI and similar metrics are only a snapshot of the market as it is today. ROI tells you nothing about how the property is likely to perform in the future and typical hold times for investment real estate is 10+ years. Also, in times of economic instability there are no "safe" regions or safe metro areas. "Average properties" in "regions" don't exist. You buy a specific property in a specific location and whether your property stays rented (performs) depends on whether the tenant pool stays employed. There is another layer to be considered.

There are a range of rental prices available for any given area. You might have properties renting from $300/Mo. to $10,000/Mo. The occupations of the people who live in a $300/Mo. property are likely very different than people who live in a $10,000/Mo. rental. Because they have different types of jobs they likely have different employment sectors and thus have different vulnerabilities. For example, assume that the primary pool of tenants for $10,000/Mo. rentals are doctors. If the federal government decides that all doctors incomes are capped at $100,000/Year, the tenant pool for $10,000/Mo. is going to vanish. Would a cap on doctor incomes significantly impact properties renting for $300/Mo.? Probably not at all. How does my (silly) example play out in the real world?

Las Vegas was one of the hardest hit metro areas in the US during the last crash. Unemployment exceeded 10% during the 2008 to 2014 market crash. However, like in all crashes, not all income levels were equally affected. We did a study of how single family home rental rates for properties renting in the $1,000/Mo. to $1,300/mo. range in the area shown on the map below fared during this period.

As we all know and reflected in the chart below, the property $/SqFt prices fell sharply during this period.

With the high unemployment rate, falling property prices and large numbers of foreclosed homes coming onto the market you would expect that rental rates would also fall. They didn't. Below is a chart showing $/SqFt rental rates for conforming properties during this period. As the graph shows, rental rates were virtually unaffected by the market crash.

The reason there was virtually no change in rental rates is that the tenant pool for these properties continued to be employed and thus continued to pay the rent. However, if you owned properties and the tenant pool was largely connected to the construction industry the results were very different. Construction virtually stopped in Las Vegas at the beginning of this period and time to rent and rental rates for rental properties catering to this pool of tenants did not perform well at all.

In Summary

• The method you choose for purchasing the property (turnkey or direct purchase) is not a significant factor when it comes to how the property will perform during times of economic turmoil.

• "Average properties" in "regions" don't exist. You buy a specific property in a specific location and whether your property stays rented (performs) depends on whether the tenant pool for that specific stays employed.

• Within the same general location, different economic pools of tenants are subject to different job risks during times of economic turmoil.

Doyle, you asked a great question and I hope I answered it. If not, post another question.

Post: New to the game and ready to start!

Post: New to the game and ready to start!

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello @Robert Fiacco,

Instead of a specific property type, I believe investment properties should be selected based on the following criteria:

• Sustained profitability - The property must generate a positive cash flow today and into the foreseeable future.

• Likely to appreciate over time - While you should not buy a property only for future appreciation, appreciation is very desirable. The primary cause of appreciation is increased demand. Demand is a function of sustained population growth and sustained job quantity and quality.

• Located in an area with investor friendly taxes and legislation - Taxes include both state income tax and property tax. Regulations include property related laws like evictions, code compliance regulations, rent controls, etc.

Each time you consider for a property, you should look for a property that best matches the above. Today, the best property might be a multi family. Tomorrow it might be a single family. Let the numbers define the best property, not a predetermined type.

Post: New member from Las Vegas

Post: New member from Las Vegas

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello @Donald Bandy,

Regarding the amount you need to allocate for rehab, maintenance, vacancy and similar issues that are "standards":

Rehab Cost

There is no "standard" rehab cost, anywhere. For example, in a recent article titled "What It's Actually Like To Buy A $500 House In Detroit", the author estimated that rehab costs in Detroit average $75–$100 per square foot, and that's just for bare-bones repairs, it doesn't include anything structural like a roof or foundation. So, for a 1,000SqFt house you would spend $75,000-$100,000 in rehab. An investor I spoke with who was purchasing rental properties in Indianapolis told me that his average rehab was between $20,000 and $30,000 on $60,000 properties. So, you can see that there is no "standard" rehab cost.

In Las Vegas, our typical rehab cost for a class A or B property is between $4,000 and $5,000. That said, we recently rehabbed an excellent property in Summerlin (one of the best areas in Las Vegas) with tile floors, paint and some landscaping and the total was approximately $9,000.

Ongoing Maintenance

Maintenance costs can have a major impact on profitability. Here are some generalizations about ongoing maintenance costs:

• Older properties require more maintenance than newer properties.

• Composition roofs require more maintenance than tile roofs

• Properties in climates with hard freezes require more maintenance than properties in milder climates.

• Properties in locations with a lot of moisture require more maintenance than properties in dryer climates.

• Wood siding requires more maintenance than aluminum or stucco siding.

• Properties with lush vegetation require more maintenance than properties with little or no vegetation.

• The type of property effects your maintenance costs as well. For example, in Las Vegas townhouses and condo exterior maintenance is part of the HOA fee.

When you look at the maintenance elements in a residential property you can generally divide the elements into two groups: systems and structure.

• Systems include HVAC, water heater, plumbing and wiring. In general, the ongoing maintenance costs of all these components are more dependent on age than location. A water heater in Las Vegas will last just about as long as a water heater in Atlanta.

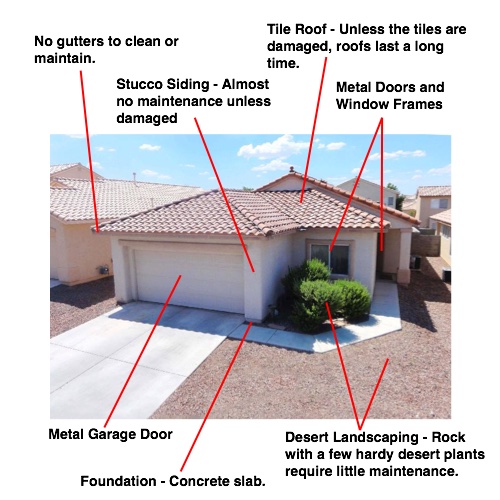

• Structure includes the foundation, the walls, the windows and the roof. In Las Vegas, the foundation is a pre-stressed concrete slab. I have never experienced a problem with a foundation in Las Vegas. The exterior walls are stucco and rarely need maintenance due to the dry climate. Wooden fences are rare; fences are normally concrete block so little maintenance is ever needed. The windows and doors (including the garage door) are metal so little maintenance is required. Roofs are usually tile and as long as the tiles are not broken or missing there is no roof maintenance required. Landscaping is usually desert style - rocks with a few hardy plants. All this is in contrast to the properties I owned in Houston and Atlanta where I always seemed to be replacing siding, roofs and maintaining the landscaping.

In Las Vegas I typically divide maintenance into two categories:

First Year

Many of the properties have been vacant for some time or the prior residents let maintenance slide. We handle the first year maintenance costs using a home warranty (careful here, only a couple of home warranty companies consistently perform.) With the home warranty the maintenance cost for the first year is typically about $1,000 ($500 for the home warranty and $500 for the call-out and miscellaneous costs).

Second Year+

According to my clients, after the first year maintenance costs are averaging $600/Yr. You will have larger expenditures from time to time when systems like the water heater fail but these expenses are not frequent. Also, who you have do the work will have a significant effect on the cost.

Vacancy Rate

The class, type of property and location of the property make a significant difference on time to rent or vacancy rate. With proper selection and preparation, our single family and townhouse time to rent has not exceeded 3 weeks in years. Most are rented in under 2 weeks. Condos, multi family and class C properties are a different story.

In Las Vegas, condos tend to compete with apartments. Condos near the new large apartment complexes tend to have longer time to rent and lower rental rates. Condos in the city nearer to the strip on major bus routes do better.

Class C properties are generally older and are located in less desirable locations. These properties generally need significant rehab and significant tenant damage is much more likely. The tenant population is primarily cash based so leases mean little and many have government subsidies. Skips and evictions are common. All these contribute to higher vacancy rates and higher maintenance costs. (This is not to say that class C properties can not generate high returns.)

In Summary

You want to work with a Realtor who primarily deals with investment real estate and a good property manager who handles the class of properties you are considering. Property managers can be a gold mine of information. They work with properties and tenants every day of the week. They know what rents and what doesn't; what to avoid and what to search for. You also need to match the property manager to the type of property.

Donald, I hope the above helps.

Post: Invest in Las Vegas or Los Angeles

Post: Invest in Las Vegas or Los Angeles

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Thank you @Jean G. for the kind reference. I wrote a updated post below for @Tina Chen.

Hello Tina,

I am a Las Vegas Realtor and our practice is almost entirely investors. A large percentage of our clients live in California but invest in Las Vegas. The reasons they choose to invest in Las Vegas is all about the balanced current return and long term profitability and probable appreciation:

• Return / Cash flow

• Long Term Profitability and Appreciation

I will explain each of the factors below:

Return / Cash Flow

Our clients tell us that it is exceptionally hard to find properties with a positive cash flow in Los Angeles. This is quite different than what they experience in Las Vegas. Median price for our class A investment properties in Las Vegas is about $200,000 and rehab costs are typically less than $5000. Our clients are typically seeing +5% return on class A properties. This rate of return includes all typical recurring costs including:

• Debt Service - 20% down, 30 year fixed.

• Management Fee - 8% of collected rent

• Landlord Insurance - Typically $500/Yr

• Property Tax - Between 0.72% and 0.86%

• Periodic Fees - Most of our class A properties have association fees ranging between $20/Mo. and $45/Mo. We tend to get a higher return in such subdivisions due to their desirability.

• Maintenance - Maintenance costs average about $600/Yr. This is due to the nature of Las Vegas home construction which I will describe later.

• State income taxes - Nevada has no state income tax.

Long Term Profitability and Appreciation

ROI and similar calculations are only predictions of how the property is likely to perform today. Such calculations provide no sight into how the property is likely to perform over the next 10+ years. Long term profitability and appreciation are a function of the following items:

• Business risk - Nevada is a business friendly state. Its pro-business laws apply to rental properties as well. There are no rent control laws in Las Vegas and evictions typically take less than 30 days and usually cost less than $500. In comparison, in California it can take up to one year to evict a knowledgeable tenant and cost thousands not even considering lost rent.

• Rental Market Stability - The Las Vegas rental market is extremely stable. We did a study on the rental income during the 2008 to 2014 period and discovered that return on investment was not impacted during the crash. You can see the actual data in this BP post.

• Population Growth - Market demand is what determines the value of an investment property. Population is one component of market demand. If the area has a stable or increasing population, demand will remain stable or increase. If people are moving out of an area (either to other cities or other locations within the metro due to urban sprawl) property values and rents will fall. Las Vegas' population is expected to continue growing at approximately 1-2% per year for the foreseeable future.

• Sustained Job Quantity and Quality - The second component to market demand is job quality and quality. Nevada is aggressively recruiting businesses to move to Nevada many of whom were based in California. One of our clients moved their business from California to Las Vegas and reduced operating costs by more than 20%. Plus, Las Vegas tourism continues to do well due to its adaptability. For example, today Las Vegas hosts millions of Chinese tourists each year. Before the Chinese it was the Japanese. And, in the future it will be another group. Las Vegas has always been excellent at adapting to the changing world.

• No Urban Sprawl - Urban sprawl can be devastating to investment properties over the long term. People tend to want newer floor pans and newer areas so, if they have the money, they will move to newer areas even if they have to commute significant distances. The result is that areas that were once desirable for investments become less desirable over time. As people with money leave an area, property prices, rental rates as well as property tax revenues fall. Falling tax revenues force city governments to reduce services and school funding. This results in more people vacating the area. Las Vegas, even more than San Francisco, is land locked. People can commute from Daily City, Oakland or Berkley to jobs in San Francisco but Las Vegas is a virtual island. The map below shows the Las Vegas metro area. The gray area is federal land. In fact, only about 11% of the entire state of Nevada is privately owned.

Below is a map showing the closest alternative cities. As you can see, there is little development within commuting range outside of the Las Vegas metro area. Also, most properties in Las Vegas are still selling at below replacement cost so prices in the few surrounding cities are not significantly less so commuting does not make economic sense.

• Maintenance costs - Las Vegas property maintenance costs on class A properties tend to average about $600/Yr. or less. The reason maintenance costs are so low is the climate. Typical construction materials which you find in milder climates do not survive the high temperatures in Las Vegas. Below is a graphic shows typical Las Vegas construction:

Tile roofs, stucco, metal doors, windows, concrete block fences and rock landscaping require little maintenance.

Tina, I hope the above helps you evaluate whether Los Angles or Las Vegas makes the most financial sense for you. For more information on investing in Las Vegas and investing in general, please see my profile or contact me.

Post: Dead simple legal structures to use IRA in RE?

Post: Dead simple legal structures to use IRA in RE?

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello Seth,

The following is my understanding based on clients statements. This does not make it correct and you need to do your own research before you do anything.

- You have to buy property through an IRS qualified custodian. Here is one such custodian.

- The property must be held by the qualified custodian, not you.

- The property must be managed by a professional property manager; you cannot manage it yourself.

- You cannot do any work on the property yourself. All work on the property must be performed by third parties (contractors or the property manager) and paid though the custodian. You can not pay for anything from personal funds. Everything must flow through the custodian.

- I believe you can put the property in a series LLC. but LLC is inside the IRA.

- If you mix any IRA funds with personal money, all the funds withdrawn from the IRA may be considered an early withdrawal.

Seth, this is not something to guess at. You need to fully investigate all the rules and regulations before you do anything. I recommend you start by talking to a qualified custodian.

Hope this helps.

Post: Dead simple legal structures to use IRA in RE?

Post: Dead simple legal structures to use IRA in RE?

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello Seth,

Buying properties through your self directed IRA is not too dissimilar from buying properties outside of an IRA. Below are some of the major points to be considered:

- There are very few restrictions as to the type of real estate as long as it is an investment property.

- Properties purchased through your IRA can be financed. The loan must be a "non-recourse loan". Search "ira non recourse loan" and you will find several.

- You can use 1031 Exchanges with properties held in the IRA.

- You can put properties in a LLC within in your IRA for protection.

- You do not hold title directly; a custodial service holds title for you.

- The custodian will be the entity signing the closing documents.

- All actions must be at arms length. This means:

- You must use a property manager; you cannot manage the property yourself.

- You may not personally do work on the property; a third party has to do it and the invoices paid by the custodian or the property manager.

- You may not mix personal and IRA funds or the entire transaction may become an "early withdrawal" from your IRA and taxed as such.

- You must report the market value to the custodian each year.

Rental income flows into your IRA, which you can utilize according to applicable IRA rules. The paperwork is not that different from normally held real estate and the only taxable event would be if you financed the property and then sold it at a profit. The financed portion of the gain would be subject to what is called the Unrelated Business Income Tax or UBIT.

Unrelated Business Income Tax (UBIT)

In most cases, people hold investment properties in their IRA for the income stream, not for flipping, so the UBIT is not typically a factor. However, should you choose to sell a financed investment property, there is a tax due on the financed portion of the gain. For example, suppose you decided to sell a property that was 60% leveraged and after deducting the cost of sales and other expenses you had a UBIT taxable gain of $20,000 and your marginal tax rate at the time of sale is 20%. The tax on the gain would be:

UBIT = $20,000 x 60% x 20% or $2400

Remember that UBIT only applies to financed properties that are sold. Note that if the loan is paid off 12 months prior to the sale, there is on tax since you only pay tax on the leveraged portion of the gain. Also, if you have paid down the loan to the point where you will have to start paying a meaningful amount of UBIT tax, it may be better to consider a 1031 Exchange.

Seth, I hope this helps.

Post: New investor - Looking at Vegas and a few other markets

Post: New investor - Looking at Vegas and a few other markets

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello Mike,

You made a very broad statement, "They have a high unemployment rate and vacancy rates are high."

High unemployment - According to the local newspaper, the current unemployment rate is is 6.6%. This is a metro area average. What numbers like this do not show is unemployment by income. What I heard on the radio is that the lower income workers form the largest portion of the unemployed. These are not the people likely to rent class A properties, they are not our tenant base.

On high vacancy rates, did you mean apartments, condos, single family homes, ...? In fact, in the last three years we have had one Class A property take longer than two weeks to rent.

Please provide your data sources. The sources I have do not seem to align with your statement.

Post: Bubble Proof?

Post: Bubble Proof?

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

A lot of good comments and thoughts on this thread. I thought I would add my opinion which may only be true for Las Vegas.

Rental property stability during times of financial turbulence is dependent on the stability of jobs for the pool of tenants. If the pool of tenants for a given property remain employed at a similar income, they will scale back discretionary purchases but have to live somewhere so they will continue to pay the rent. This is especially true in the case of single family homes which are usually occupied by families with children. And, if families lose their home in foreclosure they will likely chose to rent a home similar to what they had.

We did a study on how Las Vegas rental performed during the period from 2008 through 2014. Below are our findings.

Methodology

One of the challenges we have with most reporting sources is that they use metro averages which combine different types of properties (single-family, condos, multi-family) in very different price ranges and different areas. In order to avoid such practices, we based our investigation on a specific area (see the map below) with a specific configuration: 3 bedrooms 2 car garage, 1,200 to 1,500 SqFt.

Property Prices

Below is a chart showing the monthly average $/SqFt sale price between 2008 and 2014 by month for conforming properties. As you can see, properties were selling for an average price of approximately $120/SqFt at the beginning of 2008 and by 2012 the average price fell to approximately $70/SqFt. The falling prices were largely due to a large surplus of homes coming on the market due to foreclosures and that people did not have the desire or income to buy them. During the early part of the 2008 to 2014 period over 4,000 foreclosures per month was not uncommon.

Rental Rates

With so many properties coming onto the market we expected that rental rates would also fall along with property prices. In short, they didn’t. Below is a chart showing $/SqFt rental rates during this period. As the graph shows, rental rates were virtually unaffected by the market crash.

What this meant to investors was that if property was generating an 8% return in before 2008, it would still be generating an 8% return in 2012 even though the market value of the property went down by over 40%.

Class C Properties

We did not do the research on class C properties but based on the vacancy rates during this period, class C properties did not fare as well. We believe that many of the class C properties were occupied by construction related workers. Construction was one of the hardest hit segments of the Las Vegas during the crash.

Additional Thoughts

As several people in this thread stated, you can not prevent crashes. Crashes are going to happen. Hopefully the next one will not be as severe but they will happen. I believe that the best way to protect yourself is to buy properties with a tenant population that is less likely to be crushed. This is why our clients were relatively unhurt during this period. Of course, they would have lost a great deal of money if they choose to sell during this period but few people willing choose to sell a performing asset. Today, property values are approaching pre-crash levels and rents are increasing.

Summary

Rental price stability is totally dependent on the jobs the tenants have. If their jobs go away, you are going to lose a lot of money. So, when you are considering a property, consider how the tenant population for the property were affected during the previous crashes. The events of the past will not necessarily be repeated in the future but are the best indicator of what might happen.

Post: New investor - Looking at Vegas and a few other markets

Post: New investor - Looking at Vegas and a few other markets

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello @Kellan Martz,

There are a lot of discussions on Biggerpockets about where to invest. I am a Realtor in Las Vegas and most of my clients live in other states or countries and one of the first questions I get is, “Why should I invest in Las Vegas?” My response is,“What are your goals?” It is important for me to know what they are seeking because Las Vegas will not meet everyone’s goals. In this post I will discuss where I think Las Vegas is strong and where I think it is not as strong. Note that I will focus on single family properties, the multi-family market is quite different.

I believe that every property/location you consider must meet three criteria:

• Sustained profitability - The property must generate a positive cashflow today and into the foreseeable future.

• Likely to appreciate over time - You would never buy a property just for appreciation but appreciation is very desirable. Especially when using a 1031 to reinvest equity or adapting to market changes.

• Located in an area where you can make money and risks are low. Key factors include state income tax, property tax, insurance cost and landlord favorable regulations. Regulations include property related laws like the time and cost of evictions, rent control, code compliance requirements, etc.

When you research a market, the key decision factors can be subdivided into short term and long term (10+ years). Short term factors predict how the property is likely to perform today but tell you nothing about how the property is likely to perform over the next 10+ years. And, while how the property performs today is important, how it will perform over the long term is more important.

Short term factors:

• Price range

• Real return

• Rehab cost

Long term factors:

• Population trends

• Job quality and quantity trends

• Regulations

• Ongoing maintenance costs

• Probable appreciation

In the following sections I will briefly discuss each of these factors.

Price Range

The following is my opinion of the price ranges in Las Vegas. These prices are not fixed, we occasionally find class A properties for $175,000 but that is unusual.

- Class A properties: generally from $180,000 to $230,000

- Class B properties: generally from $120,000 to $180,000

- Class C properties: generally from $50,000 to $120,000

I understand that there are other parts of the country with much lower purchase prices but what you have to consider is how it will perform in the long term.

Real Return

When you estimate return you need to include all the major recurring cost elements. In most locations, the major recurring cost elements include:

- Purchase Price

- Property taxes

- Landlord insurance

- Management fees

- Periodic fees (association fees, assessments, etc.)

The impact of property taxes and landlord insurance are best compared with an example showing comparative returns. The formula we use for return is:

ROI = (Rent - Debt Service - Management Fee - Insurance - Real Estate Tax - Periodic Fees)/(Down Payment + Closing Costs + Estimated Rehab Cost)

So you can see the difference landlord insurance and property taxes can make I put together the following example.

Suppose you found the exact same property, in three different cities, renting for the same amount, in the same condition with the same financing terms. (Yes, this is impossible.) The specifics of the example property are below.

• Purchase price: $150,000

• Rent: $1,000/Mo. or $12,000/Yr.

• Financing: 20% down, 4.5% interest, 30 year term. Resulting debt service is $608/Mo. or $7,296/Yr.

• Down Amount: $30,000

• Periodic fees: $0 (for simplicity)

• Management fee: 8% or $12,000/Yr. x 8% = $960/Yr.

• Rehab cost: $0 (for simplicity)

Below are three cities with tax rates and landlord insurance costs:

Calculating ROI for each of the three cities:

Austin: ROI = (($12,000 - $7,296 - $960 - $1,625 - 1.9% x $150,000 - $0) x (1 - 0%))/($30,000 + $0 + $0) = -2.4%

Indianapolis: ROI = (($12,000 - $7,296 - $960 - $802 - 1.07% x $150,000 - $0) x (1 - 3.4%))/($30,000 + $0 + $0) = 4.3%

Las Vegas: ROI = ($12,000 - $7,296 - $960 - $710 - 1.07% x $150,000 - $0)/($30,000 + $0 + $0) x (1 - 0%) = 5.8%

As you can see, the major cost factors can have a significant impact or return.

Rehab Cost

There is no "standard" rehab cost, anywhere. For example, in a recent article titled "What It's Actually Like To Buy A $500 House In Detroit", the author estimated that rehab costs in Detroit average $75–$100 per square foot, and that's just for bare-bones repairs, it doesn't include anything structural like a roof or foundation. So, for a 1,000SqFt house you would spend $75,000-$100,000 in rehab. An investor I spoke with who was purchasing rental properties in Indianapolis told me that his average rehab was between $20,000 and $30,000 on $60,000 properties. So, you can see that there is no "standard" rehab cost.

In Las Vegas, our typical rehab cost for a class A property is between $4,000 and $5,000. That said, we recently rehabbed an excellent property in Summerlin (one of the best areas in Las Vegas) with tile floors, paint and some landscaping and the total was approximately $9,000.

Population Trends

If people are moving out of the area, housing prices and rental rates are likely to fall due to decreasing demand. If people are moving into an area, then there is likely to be appreciation and rising rents due to increased demand. Demographics changes can also effect property values and rents. I recently read an article where a metro area was experiencing an out-migration of traditional residents while at the same time they were experiencing an in-migration of immigrants moving into the area. In this case, while the population totals are stable the demographics are drastically changing. The people moving out of the area tended to have significantly higher incomes than the people moving in. In this case rents and property prices will likely fall over time.

Another factor to consider is urban sprawl. In every major city I've seen, there are areas which were once the best and have now fallen to being areas you would not want to be in after dark. One major cause of urban sprawl is that people want newer floor plans and newer homes. If they have the income they will move to areas where they can buy such properties. As people with money move out of an area those left behind will, on average, have lower incomes. Property prices will then start to fall. As property prices fall, property tax revenues will fall. City services are largely dependent on property tax and sales tax revenues and as these fall, cities have no choice but to cut services. This starts a downward trend from which few locations have recovered. There are exceptions, but not many. Urban sprawl is harder to detect than area population trends because while it can have a huge impact on a specific area the city's overall population may be stable.

This is a big advantage of Las Vegas. Las Vegas is as land locked as San Francisco. Las Vegas is surrounded by federal land and has very limited ability to expand. In fact, only about 11% of the entire state of Nevada is in private hands. Landlocked cities like San Francisco, Manhattan and Las Vegas have little urban sprawl risk.

Las Vegas population trends: depending on which study you choose to believe, Las Vegas' population is projected to increase by 1% to 2% per year for the foreseeable future. When you combine a growing population with no expansion room I feel that appreciation and rent increases are almost inevitable.

Job Quantity and Quality

The value of a property is no better than the jobs around it. In many parts of the US, manufacturing and similar jobs are going away and what remains are service sector jobs. Service sector jobs tend to pay less than manufacturing jobs so the families of these workers have less disposable income. Less disposable income means that they cannot afford to pay the level of rent they did in the past. A key indicator is inflation adjusted per capita income over the past few years. If you see an adjusted declining per capita income you need to carefully consider the long term value of the investment.

Inflation adjusted income in Las Vegas have been slowly increasing (except during the 2008 to 2011 crash) and projections are that the increases will continue according to a Federal Reserve Bank study.

Regulations

State/county/city legislation can make an otherwise great investment a financial disaster. One of the easiest barometers is the time and cost to evict a non-paying tenant. Clients have told me that in California, if the tenant knows what they are doing, it can take up to 1 year to evict and cost thousands. In some cold climates you cannot evict non-paying tenants in the winter. In comparison, in Las Vegas the time to evict is typically less than 30 days and usually costs less than $500.

Ongoing Maintenance

Maintenance costs can have a major impact on profitability. Here are some generalizations about ongoing maintenance costs:

• Older properties require more maintenance than newer properties.

• Composition roofs require more maintenance than tile roofs

• Properties in climates with hard freezes require more maintenance than properties in milder climates.

• Properties in locations with a lot of moisture require more maintenance than properties in dryer climates.

• Wood siding requires more maintenance than aluminum or stucco siding.

• Properties with lush vegetation require more maintenance than properties with little or no vegetation.

When you look at the maintenance elements in a residential property you can generally divide the elements into two groups: systems and the structure.

• Systems include HVAC, water heater, plumbing and wiring. In general, the ongoing maintenance costs of all these components are more dependent on age than location. A water heater in Las Vegas will last just about as long as a water heater in Atlanta.

• Structure includes the foundation, the walls, the windows and the roof. In Las Vegas, the foundation is a pre-stressed concrete slab. I have never experienced a problem with a foundation in Las Vegas. The exterior walls are stucco and rarely need maintenance due to the dry climate. Wooden fences are rare; fences are normally concrete block so little maintenance is ever needed. The windows and doors (including the garage door) are metal so little maintenance is required. Roofs are usually tile and as long as the tiles are not broken or missing there is no roof maintenance required. Landscaping is usually desert style - rocks with a few hardy plants. All this is in contrast to the properties I owned in Houston and Atlanta where I always seemed to be replacing siding, roofs and maintaining the landscaping.

Probable Appreciation

You want to buy a property which is likely to appreciate. Appreciation is largely dependent on ongoing demand. Demand is a function of population growth and sustained job quantity and quality. Due to Las Vegas ongoing population growth, increasing job quality and quantity and the shortage of land, property prices and rents will likely continue to increase.

Summary

If you are looking for low cost, high return (10+%) properties and do not care as much about appreciation or long term return, Las Vegas is probably not your best choice. If you are looking for a sustained moderate return (4% to 8%) with probable appreciation and are able to pay the higher property prices compared to prices in the midwest, you should consider Las Vegas.