All Forum Posts by: Eric Fernwood

Eric Fernwood has started 64 posts and replied 793 times.

Post: Las Vegas Single Family Rental Growth

Post: Las Vegas Single Family Rental Growth

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

Hello @Account Closed

This was an example from our website where I had the complete data for both properties. Probably 2 or 3 years back. It in NO way represents the properties we deal with today. We ONLY deal in A class properties. I totally agree with you on C (D) Class areas. We will not touch them.

The actual point of my post is that Rent/Price ratios are misleading, at best. It was not an attempt to represent current opportunities in Las Vegas .

As stated in my previous post, for the properties (A class) we target today, we expect a rent of $1500-$1600 for a $260k-$265k home with <$10k rehab. For a home costing $340-$350k we expect the rent to be $2000 - $2100.

Post: Las Vegas Single Family Rental Growth

Post: Las Vegas Single Family Rental Growth

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

Hello @Account Closed

Rent to price ratios can be deceiving. Below is an example of two (actual) properties. One is in Las Vegas and one in Austin TX. Note, we own a home in Las Vegas and one in Austin. So, I have a pretty good understanding of both locations.

* Note: I used the same association fee for both properties to keep things "apples to apples". The property in Las Vegas actually does not have a HOA.

If I compute the rent/price ratio, the Austin property is the clear winner:

- Austin: $,1700 x 12 / $252,500 = 8.1%

- Las Vegas: $1,490 x 12 / $255,000 = 7.0%

However, rent ratios do not take into account differences in property taxes, state income taxes, insurance or anything else. Below I estimated the return for both properties. To provide a realistic comparison, I made the following assumption for both properties.

- 20% down

- 4.5% rate

- 30 year term

- 3% closing cost

- 8% property management

- 0% state income tax. Neither Texas or Nevada have a personal state income tax.

Below are the formulas I use for ROI and cash flow:

- ROI = (Income - DebtService - ManagementFee - Insurance - RETax - PeriodicFees) x (1 - StateIncomeTax) / ( DownPayment + ClosingCosts)

- Cash Flow = (Income - DebtService - ManagementFee - Insurance - RETax - PeriodicFees) x (1 - StateIncomeTax)

Calculations for the Austin property:

- ROI = (1700 * 12 - 1024 * 12 - 1700 * 12 * 8% - 1625 - 6022 - 41 * 12) / (3% * 252500 + 20% * 252500) = -2.9%

- Cash Flow = (1700 * 12 - 1024 * 12 - 1700 * 12 * 8% - 1625 - 6022 - 41 * 12) = -$1,659/Yr. or -139/Mo.

Calculations for the Las Vegas property:

- ROI = (1490 * 12 - 1033 * 12 - 1490 * 12 * 8% - 450 - 1511 - 41 * 12) / (3% * 255000 + 20% * 255000) = 2.7%

- Cash Flow = (1490 * 12 - 1033 * 12 - 1490 * 12 * 8% - 450 - 1511 - 41 * 12) = +$1,600/Yr. or $133/Mo.

Even though the Austin property is the clear winner based on the rent/price ratio, it is an absolute loser when you do a real world calculation. You must include all significant recurring costs when you are comparing properties. Simplistic calculations like rent to price ratio frequently produce invalid results.

In today's market, only 1 out of every 800 - 1000 properties in Las Vegas is a good investment. For the properties we target, we expect a rent of $1500-$1600 for a $260k-$265k home with <$10k rehab. These properties provide a balance of cash flow and appreciation growth thanks to Las Vegas' outstanding economic outlook for the foreseeable future.

Post: Buying rentals outside of your area

Post: Buying rentals outside of your area

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

Hello @Edward L lauckern,

An excellent question. I will start my response with a quote:

“Live where you like but invest where you can make money.” …David Lindahl

If you can achieve your goals locally, then I recommend investing locally. The key question is, what is your goal? I believe that every investment property must meet the following three criteria.

- Sustained profitability - The property must generate a positive cash flow today and into the foreseeable future.

- Currently and likely to continue appreciating for the foreseeable future at or above the rate of inflation - Properties appreciate in locations that have strong demand, which is the key driver for sustained profitability.

- In a location where you can make money and you control your property as opposed to the government dictating what you can do.

Achieving these three criteria requires a combination of the right location, tenant pool, investment team and property. If you do not get one or more correct, you are likely to lose money or not achieve your goal. The two most important are the location and the tenant pool.

While I could list several criteria, I will include only three in order to keep this post short. If you would like my full criteria list for selecting a location including tenant pool, property manager, Realtor and location, let me know.

- Appreciation - Appreciation is the best indicator of demand. If properties are not appreciating, then there is limited demand which indicates poor economic condition for the area. Also, rents lag property prices by 2 to 10 years so the trends in property prices today are a good barometer of what rents will do in the future. Also, if property prices are not rising at or above the rate of inflation, rents are effectively declining.

- Population size - I would focus on cities with a population of 1M or more. Small cities tend to be reliant upon a single industry, which makes them vulnerable to economic changes.

- Jobs - Not just any jobs but jobs that pay similarly to what your target tenant population is making today. Remember that companies do not live forever, the average life expectancy of an S&P 500 company is under 15 years. So, unless new employers are setting up operations in the location, look somewhere else.

All the above said there is no perfect investment location. Factors such as not having a good investment team or properties that require a lot of money to rehab could make an otherwise good location unacceptable. So look for a strong good and not a “perfect” location, they do not exist.

Post: Las Vegas Single Family Rental Growth

Post: Las Vegas Single Family Rental Growth

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

@Bill Brandt

Hello Bill,

It is impossible for me to comment since I do not know the location or condition of your properties. Also, the statistics are the median $/SF for a range of properties that are: between 1,100 SF and 3,000 SF, built after 1985, have 3 or 4 bedrooms, a 2 or 3 car garage within a specific geographic area. All the properties match a specific target tenant pool. So, they are not typical properties and we may be getting a higher $/SF than most properties.

Bill, if you would like to contact me directly and provide the addresses, I will be happy to provide an opinion on the rent rates for your properties.

Post: Las Vegas Single Family Rental Growth

Post: Las Vegas Single Family Rental Growth

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

General statistical data available through the Las Vegas MLS and others do not include rental information. So, we developed our own capability to extract and display SFR rental data for the area we target and a property profile that rents well to our target tenant pool. Below are a few interesting charts.

Note that the data is NOT for the entire Las Vegas metro, it is only for single family homes < 3000SqFt and rented for < $2,000 in the area that we target.

As you can see, single family rental rates rose about 5%, even as the rental inventory built up towards the end of the year. This shows that rental demand remains strong.

Las Vegas remains an excellent investment location.

Post: Invest in real estate locally vs remotely

Post: Invest in real estate locally vs remotely

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

Hello @Carmen Ngai,

An excellent question. Whether you should invest locally or in another location is not an emotional decision, it is a spreadsheet decision. Let’s start at the end and work backwards to the location. I believe that every investment property must meet the following three criteria.

- Sustained profitability - The property must generate a positive cash flow today and into the foreseeable future.

- Currently and likely to continue appreciating for the foreseeable future at or above the rate of inflation - Properties appreciate in locations that have strong demand, which is the key driver for sustained profitability.

- In a location where you can make money and you control your property as opposed to the government dictating what you can do.

Achieving the three criteria requires a combination of the right location, tenant pool, investment team and property. If you do not get one or more of the above correct, you are likely to lose money, at least for the short term. Of the four essential elements, the two most important are the location and the tenant pool. If you can meet all four in your neighborhood, there is no need to look elsewhere. If you cannot, then you have no choice but to invest elsewhere.

“Live where you like but invest where you can make money.” …Source unknown

Rather than suggesting specific locations, I listed below a summary of the criteria I would follow when selecting a location.

- Appreciation - Appreciation is the best indicator of demand. If properties are not appreciating, then there is limited demand. Rents lag property prices by 2 to 10 years so the trends in property prices today are a good barometer of what rents will do in the future. Also, if property prices are not rising at or above the rate of inflation, rents are effectively declining.

- Population size - I would focus on cities with a population of 1M or more. Small cities tend to be reliant upon a single industry, which makes them vulnerable to economic changes.

- Jobs - Unless your tenants are working they cannot pay the rent. Rental properties are no better than the jobs around it. Also, remember that companies do not live forever, the average life expectancy of an S&P 500 company is under 15 years. So, unless new employers are creating jobs of the same type and quality as your target tenant pool already has, look somewhere else.

- Population growth - If people are moving to a location, it is a good location for jobs and a desirable place to live. If people are moving away, demand will drop and prices will be static or declining.

- Urban sprawl - Not talked about much but you have only to look at any major city and you will see locations that were once the best in town and are now distressed. This is usually the result of urban sprawl. You need to be very aware of which way the city is expanding and buy in the direction where the population is moving. See this site for time lapses. Try: Memphis, Atlanta, Austin and Las Vegas. Las Vegas is surrounded by federal land so there is little room remaining for expansion or urban sprawl.

- Crime - High crime areas and long term profitability do not go together. I would not consider any city on the top 100 most dangerous cities list. You might know one of these cities well and know that there is a great area near the city. The problem is that companies looking to open new locations will not choose high crime cities. Also, people with sufficient funds will leave these areas and the area will go into further decline.

- Climate - Properties in areas with hard freezes and excessive moisture will tend to require more maintenance than in milder and dryer climates. Also, the materials generally used to build homes in cold clients requires more maintenance that materials used in hot dry climates.

- Age of the property - The older the property, the more maintenance it will require, unless all the major systems and components have been updated recently.

- Property cost - There is a tendency for new investors to choose locations with very inexpensive properties. Remember that price is a function of demand. No demand, low price. High demand, high price. Of course, you need to hit a balance. If your budget allows a maximum of $250,000, do not consider coastal California.

- Taxes - Both income tax and property taxes are a direct hit on profitability. High taxes are also a strong indicator of both an inefficient government plus a government usurping the rights of its citizens. We see across the US that people are leaving high tax states for states with lower taxes and regulations.

- Insurance cost - Insurance cost is a good barometer of the likelihood of damage, usually due to climatic or seismic events. Be certain to take the cost of landlord insurance into account when comparing locations.

Lastly, there is no perfect investment location. Factors such as not having a good investment team or properties that require a lot of rehab could make an otherwise good location unacceptable. So look for a good location and not a “perfect” location, they do not exist.

Post: Buying Real Estate before recession hits

Post: Buying Real Estate before recession hits

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

Hello @Pappy Mason,

As always a lot of good advice on this thread and decided to add my $.02. Before I start, I will tell you the conclusion: When a market correction happens, there is no way to protect the market value of your property but you can do a lot to safeguard the income stream. The key is to select the right investment location and target the right tenant pool. To explain my statement, a little history of how I got where I am, the decisions I made and the results.

I was living in NYC when I decided to change careers and sell investment real estate. I did not know where would be a good place to do this but I was convinced that NYC was not the right location.

As an engineer, I believe in processes and data. I have little regard for gurus, magic formulas and luck. I started developing my process by defining my end goal. Note, my “end goal” started at about 10 pages but over time I simplified it to the following criteria that I believe every investment property should meet:

- Sustained profitability - The property must generate a positive cash flow today and into the foreseeable future.

- Currently and likely to continue appreciating at or above the rate of inflation. Properties appreciate in locations that have strong demand, which is the key driver for sustained profitability.

- In a location where you can make money and you control your property as opposed to the government dictating what you can do.

With my goal defined, I next developed a process for selecting a location and then a property. Originally my process was complex but over time I simplified it to the following diagram (click for larger size).

I want to underline that I believe selecting the right tenant pool is second in importance only to selecting a good investment location. You must target a tenant pool with the highest percentage of what I call “good tenants”. My definition of a good tenant:

- Has stable employment in a market segment that is very likely to be stable or improve over time.

- Pays all the rent on schedule

- Takes care of the property

- Does not cause problems with neighbors

- Does not engage in illegal activities while on the property

- Stays for many years

My number one concern was tenants that would stay employed even during a downturn. The math for this is simple: no job == no rent. Once I narrowed down my list of locations, I evaluated the likelihood of the major employers doing well over the long term. Satisfied with the major employers, I next looked at the range of employees.

Not everyone at every company will remain employed if the market takes a downturn. Generally, people who generate income will stay and others are likely to be laid off. From this range of employees, I selected a segment that I thought would stay employed and would meet the other good tenant criteria.

Once I selected my target tenant pool, I then developed a property profile that I believed this pool would be willing and able to rent. I called this the property profile. Based on the property profile, I selected properties and determined whether they would cash flow.

So, how well did my process work? Below is data on how properties that met my property profile performed during the 2008 crash in Las Vegas. The first chart shows $/SF for the 2008 through 2015 period. As you can see, property prices seriously tanked.

Below is the $/SF rental rate for the same period for properties that conformed to my property profile.

As you can see, rental rates for this segment were virtually unchanged during this period. So, if the property generated a 5% return in 2007, you continued to see the same return even during the recession. Instead of panic and loss, my clients saw the crash as a time to buy more properties. On balance, C class and most B class were a disaster for investors. A large percentage went into foreclosure. So you need a combination of the right location and tenant pool. Getting one right is not sufficient.

My Point

Pappy, I would worry a lot about selecting the right location and the right tenant pool. Whether the property’s price drops or rises is not as important as sustained profitability. There is no way to protect the market value of your property but you can do a lot to safeguard the income stream.

Post: Out of State RE Newbie: Turnkey or Value Add?

Post: Out of State RE Newbie: Turnkey or Value Add?

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

Hello @Albert Chun,

You asked some great questions. Rather than suggesting a location, I will focus on important factors you should consider when selecting a location. While I will not provide detailed answers in this post, I will point out some areas that you should investigate before making any decisions.

Start With A Clear Goal

I always start with a clear definition of the end goal and then work backwards to where I am today. My goal for any investment property is that the location and property must meet the following three criteria.

- Sustained profitability - The property must generate a positive cash flow today and into the foreseeable future.

- Properties in the location are currently appreciating at or above the rate of inflation and are likely to continue to do so. Properties appreciate in locations that have strong demand, which is the key driver for sustained profitability.

- In a location where you can make money and you control your property as opposed to the government dictating what you can do. A good indication is cost and time to evict.

Whether you have $15,000 to invest or $15,000,000, the goal does not change. The purpose is to make money today and from now on. With a clear goal defined, I will comment on some of the points you brought up.

Should You Buy Turnkey?

Buying turnkey is only a purchase method. It in no way reduces your time, effort or responsibility to perform a thorough due diligence on the: location, rent, time to rent, probable tenant stay, target tenant pool, condition of the property (based on an inspection report), your options on property management and the turnkey provider themselves. So unless you are willing to gamble with your savings, you do not save much time buying turnkey. Plus, buying turnkey is almost always more expensive. Turnkey providers bundle a lot of services, costs and necessary profit into your purchase price. You will likely pay less and have a higher return if you buy direct through your own team and avoid all the bundling costs.

Importance of the Location

As long as you buy property in a good location, all but the worst mistakes will be corrected over time through appreciation, inflation and rent increases. However, the corollary is also true. If you buy in a bad location, there is little you can do to turn things around after the fact.

There are a lot of factors when it comes to selecting a good investment location, far too many for this post. I will only mention one of the key investment location barometers: appreciation.

Appreciation is one of the best indicators of a desirable investment location. Unless property prices and rents are rising at or above the rate of inflation, the buying power of the rent you are receiving is actually declining over time. Remember that inflation erodes the value of money over time. For example if you assume inflation is 5% (Official inflation is about 3% but this number does not include energy or food.), over a 10 year period the purchasing power of $1,000/Mo. in rent decreases to about $614/Mo.

Assuming you are only considering locations where property prices are increasing at or above the rate of inflation, I would proceed as illustrated below.

I will mention one other consideration since it is critical - in order to have a profitable property, you must keep your property continuously occupied by a good tenant. I define a good tenant as someone who:

- Has stable employment in a market segment that is very likely to be stable or improve over time.

- Pays all the rent on schedule

- Takes care of the property

- Does not cause problems with neighbors

- Does not engage in illegal activities while on the property

- Stays for many years

Good tenants are not the norm. They are the result of selection from a pool of applicants by a skilled property manager.

Importance of An Investment Team

A good investment team is critical. Even if you buy turnkey, you are still dependent on their investment team. The most important team member is the property manager, followed by the Realtor (If you are interested, I can send you a paper on how to select a good Realtor and property manager.) I put together the following chart showing what you should expect from each of the team members.

Notice that none of the team members (except you) has much, if any, investment selection or evaluation knowledge. Specifically:

- A property manager knows what rents and how much a property will rent for but they cannot determine whether a property will cash flow after all expenses.

- While Realtors know what homes buyers want, they have no knowledge whether any given property will be profitable. I regularly get emails with “Investors Dream” as the subject line. Almost none that I have received would break even let alone generate a significant positive cash flow.

- A handyman knows how much repairs will cost but nothing about investing.

You, the investor, will take knowledge from each team member and combine this knowledge so you can decide whether a property is a good investment or not. And, since this is a spreadsheet decision, making this decision is not as hard as it seems.

Summary

Albert, do your homework on investing and your due diligence for any location and property. Always remember that while the path might seem daunting, others who are less capable than you, have already completed the journey and are making money. You can do it.

Best wishes to you and feel free to post questions and I will do my best to answer.

Post: Where to move in the US for investing for the beginner

Post: Where to move in the US for investing for the beginner

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

Hello @Mac Caspersen,

A lot of people recommend specific locations. I will take a different approach and recommend a method for selecting a good investment location. I apologize for the length of this post, I could not make it shorter.

So we are on the same page, I believe that any good investment location/property must meet three criteria.

- Sustained profitability - The property must generate a positive cash flow today and into the foreseeable future.

- Currently and likely to continue appreciating for the foreseeable future at or above the rate of inflation - Properties appreciate in locations that have strong demand, which is the key driver for sustained profitability.

- In a location where you can make money and you control your property as opposed to the government dictating what you can do.

While the above may seem simplistic, a lot of things must be right in order to achieve all three goals. Before I get into my selection criteria, I will cover some important concepts.

ROI Is for Today Only

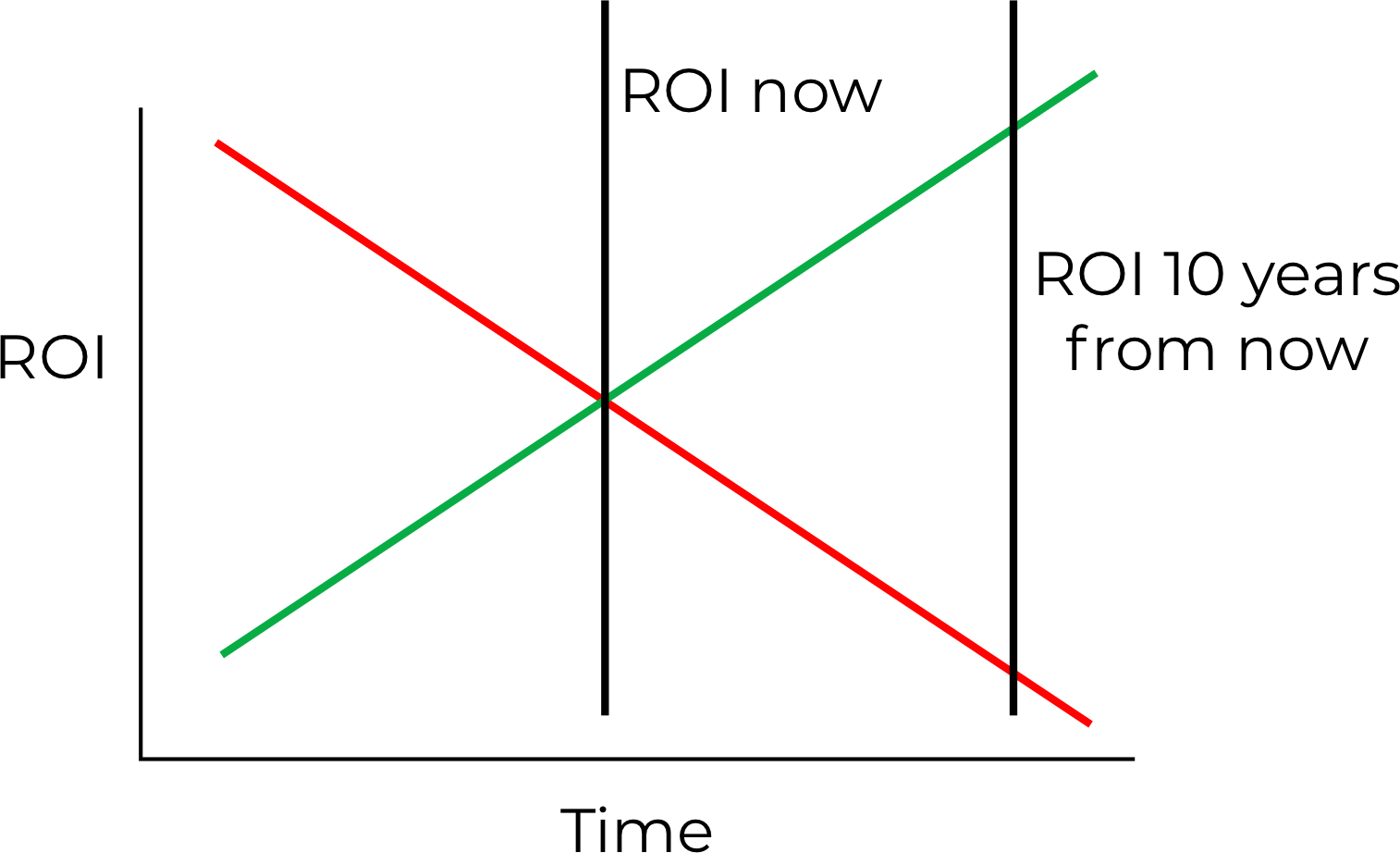

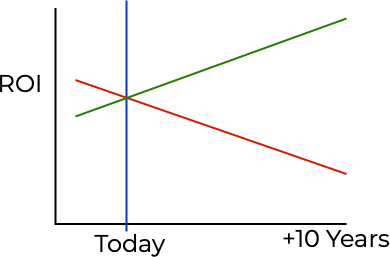

Returns (ROI, cash flow) are only a snapshot in time. These calculations only predict what the property is likely to do today; it does not tell you how the property is likely to perform in the future. Take a look at the diagram below.

The red line represents a declining market (rents and prices are flat or declining) and the green line represents an appreciating market (rents and prices are increasing). Both have the same ROI today but will perform very differently in 10 years. You need to carefully consider how the location is likely to perform in the future.

Initial Return or Long Term Return

There are excellent studies that show a strong correlation between property prices and rents, such as this Federal Reserve Study. According to studies, rents typically lag property prices by two to ten years. So, the trend you see in property prices over the last few years is what will likely happen to rents in the future. What this means is that in declining (or static) markets, rents reflect property prices from 2 to 10 years ago. Thus rents appear to be higher than appreciating markets. In appreciating markets, rents also lag prices by 2 to 10 years so rents appear to be lower than static or declining markets.

See the image below.

You will need to choose between initial return and long term return. I have never heard of a location where you can get both high return today (indicating a declining market) and long term appreciation at or above inflation (indicating an appreciating market). You cannot have both.

Appreciation Is Critical

One of the easiest metrics for determining market health is appreciation. If property prices (thus rents) are not increasing at or above the rate of inflation, rent is actually declining in real dollars. For example, according to this government CPI calculator, in order to receive the same (buying power) today of a $1,000/Mo. of rent in 2010, the rent today must be $1,174. The government CPI calculator is based on the government's measurement of inflation, which does not include food or energy. A more realistic inflation rate is closer to 5%. At 5%, the rent would need to be $1,550 today to have the same buying power as $1,000 in 2010. Flat rents are not flat, they are declining at or above the rate of inflation.

A Location Where You Can Make Money

What matters is not how much money you gross, it is how much money you net. In some places it is very hard to make money due to the cost of doing business. Such costs include taxes, regulations such as rent control, eviction laws, code requirements, as well as insurance costs. All of these costs are a direct hit on the bottom line. As an example, we own properties in both Las Vegas and Austin. Below is a comparison of sample cost differences:

You need to consider all the major cost factors when considering an investment location. These direct and indirect costs might make a location that appears to be profitable in reality a money sink. Look at the bigger picture, ROI alone is a poor metric.

Location Selection Criteria

With all the above said, below are my criteria for selecting an investment location:

- Appreciation - I covered the importance of appreciation due to inflation and as a health barometer. Make sure to check the property price trends for the location.

- Population size - I would focus on cities with a population of 1M or more. Small cities tend to be reliant upon a single industry, which makes them vulnerable to economic changes.

- Population growth - If people are moving into a location, it is probably a good location for jobs and a desirable place to live. If people are moving away, demand will drop and prices will be static or declining.

- Major employers are doing well and in market segments expected to grow. This indicates that your target tenant pool size will likely increase and will likely remain employed. No jobs, no rent.

- New companies setting up operations in the area. Contributes to job growth and population growth. Chamber of commerce is the place to check.

- Urban sprawl - Not talked about much but you have only to look at any major city and you will see locations that were once the best in town and are now distressed. This is usually the result of urban sprawl. You need to be very aware of which way the city is expanding and buy in newer areas. See this site for time lapses. Try: Memphis, Atlanta, Austin and Las Vegas. Note that Las Vegas is surrounded by federal land so there is little room remaining for expansion or urban sprawl.

- Crime - High crime areas and long term profitability do not go together. I would not consider any city on the top 100 most dangerous cities list. You might know one of these cities well and know that there is a great area near the city. The problem is that companies looking to open new locations will not choose high crime cities.

- Climate - Properties in areas with hard freezes and excessive moisture will tend to require more maintenance than in milder and dryer climates.

- Age of properties - The older the property, the more maintenance it will require, unless all the major systems and components have been updated recently.

- Property cost - There is a tendency for new investors to choose locations with very inexpensive properties. Remember that price is a function of demand. No demand, low price. High demand, high price. Of course, you need to hit a balance. If your budget allows a maximum of $250,000, do not consider coastal California.

- Taxes - Both income tax and property taxes are a direct hit on profitability. Look carefully.

- Insurance cost - Insurance cost is a good barometer of the likelihood of damage, usually due to climatic or seismic events. Be certain to take the cost of landlord insurance into account when comparing locations.

- Landlord-friendly property laws and regulations. No rent control, efficient and low cost evictions.

Summary

If I had limited funds, I would not consider high risk (declining) locations. A lot of people have lost their hard earned savings by buying in declining markets because properties were cheap. Be careful where you invest.

Mac, wherever you invest, I wish you the best.

Post: Choosing an out-of-state location

Post: Choosing an out-of-state location

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

Hello @Art Perkitny,

I agree with you. You need to define what you want and then look for locations that enable you to achieve your goal. Fortunately, real estate is very forgiving. As long as you buy property in a good location, all but the worst mistakes will be corrected over time through appreciation, inflation and rent increases. However, the corollary is also true. If you buy in a bad location, there is little you can do to turn things around after the fact.

I look for long term buy and hold investments, not just the current return. I look for locations where properties will appreciate and rents will increase over time. When I was first looking for such a location, I developed the following criteria:

- Sustained profitability - The property must generate a positive cash flow today and into the foreseeable future.

- Likely to appreciate over time - Properties appreciate in locations that have increasing demand, which is the key driver for sustained profitability.

- Located in an area where you can make money and business risks are low. Only in such an environment can you achieve both current and long term profitability.

While the above seems simplistic, few locations can achieve all three criteria. A few comments on the criteria:

Return

Return (ROI, cash flow) is only a snapshot in time. Such calculations only predict how the property is likely to perform today; it does not tell you anything about how the property is likely to perform in 2 years, 5 years or 10 years. What happens in the future is almost more important than today. The diagram below illustrates what can happen over time, depending on the direction of the market.

The red line represents a declining market (where rents and prices are declining, constant or increasing below the rate of inflation) and the green line represents an appreciating market (rents and prices are increasing above the rate of inflation). Both have the same ROI today but the ROI in buying power will be very different in 10 years. You need to carefully consider how the location is likely to perform in the foreseeable future. The easiest indicator of market direction is how property prices have performed over the last 10 years. Rents lag property prices by 2 to 10 years so sales price trends are a good predictor of future rental rates.

Appreciation and Inflation

Static prices are not static. Official inflation is running at about 3%, which does not include food or energy. I will use 5% as a more realistic inflation rate (if you drive a car, use electricity or eat, 5% is a more realistic estimate). Suppose you are renting a property today for $1,000/Mo. and rents are not increasing. What is really happening over time?

After only 5 years, the purchasing power of $1,000 will only have the buying power of $772. This is why appreciation, at least equal to inflation, is critical.

An Area Where You Can Make Money

In some locations it is very hard to make money due to the cost of doing business. Significant cost factors include: property taxes, insurance costs, state income taxes, property age and construction, climate and eviction time and cost.

As an example, we own properties in both Las Vegas and Austin. Below is a comparison of just three cost items:

The $/SqFt of rent between Las Vegas and Austin are not that different. So, property taxes and insurance cost alone make Austin properties very difficult to cash flow.

Location Selection Criteria

Below are some of my criteria for selecting a buy and hold investment location:

- Appreciation - I covered the importance of appreciation. Make sure to check the property price trends for the location.

- Population size - I would focus on cities with a population of 1M or more. Small cities tend to be reliant upon a single industry, which makes them vulnerable to economic changes.

- Population growth - If people are moving into a location, it is probably a good location for jobs and a desirable place to live. If people are moving away, demand will drop and prices will be static or declining.

- Per capita income growth - It is not just the quantity of jobs, it is also the quality. Per capita income growth is a good indicator of the number and quality of jobs in a location. For example, if businesses are moving away from a location people will have no choice but to take service sector jobs, which usually pay less than office or manufacturing jobs. If this is happening, then you will likely see static or declining per capita income. And, rents will follow per capita income. There are many sites where you can get this information. Here is one such site.

- Urban sprawl - Not talked about much but you have only to look at any major city and you will see locations that were once the best in town and are now distressed. This is usually the result of urban sprawl. You need to be very aware of which way the city is expanding and buy in newer areas. See this site for time lapses. Look at cities like Memphis, Atlanta, Austin and Las Vegas.

- Crime - High crime and long term profitability do not go together. I would not consider any city on the top 100 most dangerous cities list. You might know one of these cities well enough to know that there is a great location near the city. The problem is that companies looking to open new locations will not choose high crime cities. Also, people with sufficient funds will leave these areas and the area will go into decline.

- Climate - Properties in areas with hard freezes and excessive moisture will tend to require more maintenance than in milder and dryer climates.

- Property cost - There is a tendency for new investors to choose locations with very inexpensive properties. Remember that price is a function of demand. No demand, low price. High demand, high price. Of course, you need to hit a balance. If your budget allows a maximum of $250,000, do not consider coastal California.

- Taxes - Both income tax and property taxes are a direct hit on profitability.

- Insurance cost - Insurance cost is a good barometer of the likelihood of damage, usually due to climatic or seismic events. Be certain to take the cost of landlord insurance into account when comparing locations.

Summary

Choosing the right location is critical. Consider what the market is like today and what it is likely to be in the foreseeable future.

Hope this is helpful.