All Forum Posts by: John Ho

John Ho has started 7 posts and replied 15 times.

I have a house I bought last year with a survey included. The survey shows the house being 2.5 feet over the property line the house was built in 1950s. Should I file a quiet deed claim with the courts or just leave it along and if the neighbor wanted to goto court, I can claim adverse possession. Btw the neighbor know about the house being built on their side.

Post: Texas property line disputes

Post: Texas property line disputes

- Posts 15

- Votes 0

I have title insurance, I assume that will take care of any legal matters that might arise from this..?

Post: Texas property line disputes

Post: Texas property line disputes

- Posts 15

- Votes 0

Post: Texas property line disputes

Post: Texas property line disputes

- Posts 15

- Votes 0

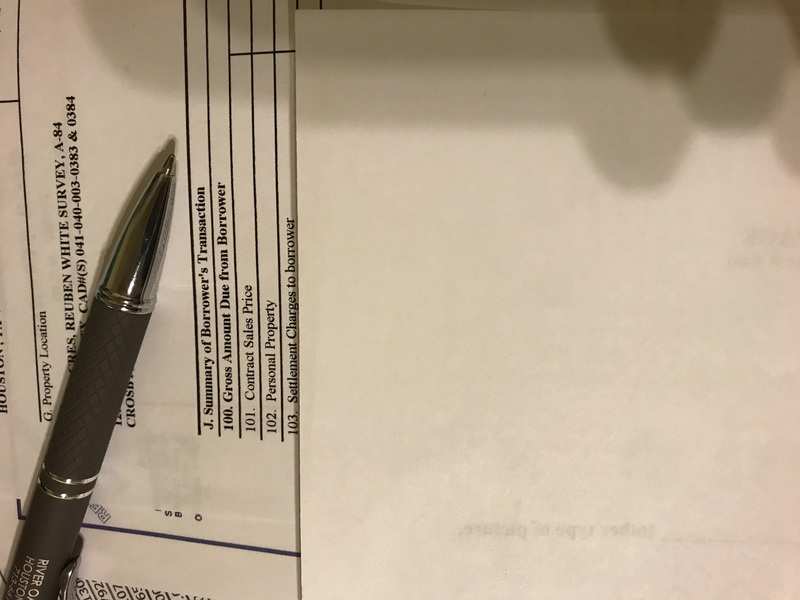

I closed on the property last year so there is no adverse claims on the lot in question. The property is in Harris county Crosby Texas.. so bing a old country area all the property lines are very unorthodox

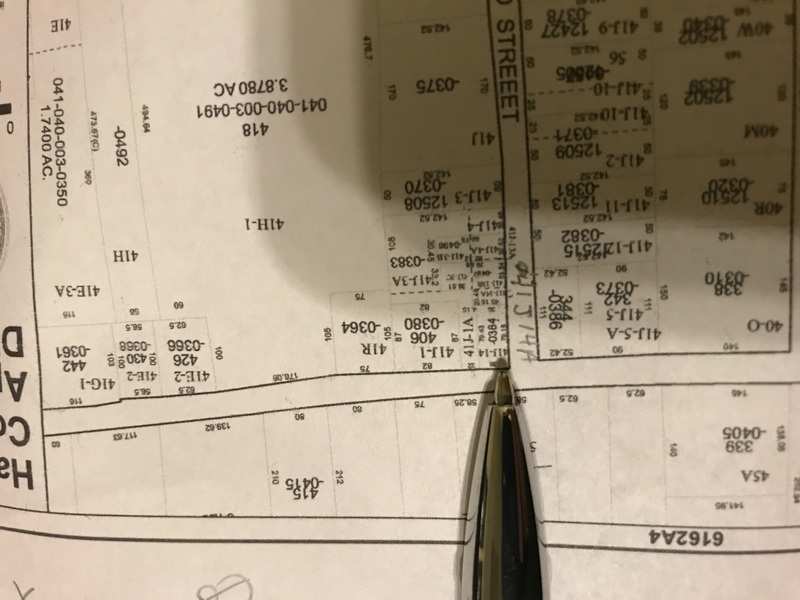

41j-14 -0384

Legal description

41j-14 has a tax bill going to the previous owner

0384 is the same lot as 41j-14 and is on the hud statement being sold to me last year.

The survey has it outlined as property being sold to me. If I remember correctly it was also stated on the assignment contract that piece of land was included.

Post: Texas property line disputes

Post: Texas property line disputes

- Posts 15

- Votes 0

I bought a house with extra land on the hud statement. Hud statement has 3 different lots sold to myself. I was doing some research on Hcad and one of the lots is being taxed to the previous owner who sold me that house with extra land. This piece of land is a corner lot and it clearly shows on the survey being a part of land included in the sale. So Harris county is still sending a separate tax bill to the previous owner and I wanted to know if I have to pay a lawyer to get this straightened out or is it something I can do by calling the title company and HCAD.