All Forum Posts by: Joshua S.

Joshua S. has started 2 posts and replied 293 times.

Post: Velocity Banking / HELOC Checking Acct - It Works (Proof)

Post: Velocity Banking / HELOC Checking Acct - It Works (Proof)

- Posts 294

- Votes 96

Originally posted by @Don Konipol:

I think I've had my last conversation with you. You're an insulting ingrate.

Right, because rather than give the actual correct answer and suffer the blow to your ego that you've been doing something wrong for decades, you'd prefer to take a swipe at my ego. Classic!

Anyway, I accept. You can blame it on my "insults" (you know, asking you simple / direct questions) and I'm in the wrong for saying words. You are totally right for not answering my simple questions and then calling me names like a grade school student. Have a good one.

Post: Velocity Banking / HELOC Checking Acct - It Works (Proof)

Post: Velocity Banking / HELOC Checking Acct - It Works (Proof)

- Posts 294

- Votes 96

Originally posted by @Don Konipol:

@Joshua Smith

1. To answer this question I would need to do an analysis of your income and expenses for the years in question. Since I don’t have this information how can I possibly answer it?

2. Many people juggle lines of credit to meet current obligations. Let’s simplify it. The amount of money most people carry in their checking account fluctuates, but what’s ever there is called reserves. So, looking at your bank statement, you can find your “average daily balance”.

So instead of keeping this "reserve" you use an overdraft account, or HELOC. You then take the reserve amount and pay off principal of your mortgage. Assuming that you pay exactly the same rate on the mortgage as you do the HELOC, this is the result. The amount you pay in interest on advances in the HELOC, plus the amount you could have earned if the "reserve" had been invested, is equal to the amount you saved on mortgage payments. No magic, simple math.

Now, there are unusual circumstances in which using a HELOC, or any personal loan, to pay down mortgage principal can be financially beneficial. For example you own an investment property that does not qualify for institutional financing, and you're paying 12% interest to a hard money lender. Then borrowing from your HELOC at 4.5% will save a significant amount of interest. But, this has absolutely nothing to do with living out of a line of credit rather than a checking account.

Even not counting the opportunity cost credit given in the analysis for the "reserve" theoretical investment, the additional nickel and dime fees associated with the HELOC will eat up any savings.

Perhaps you became much more vigilant at controlling expenses when you decided to use the HELOC to pay your everyday bills. Perhaps your total expenses have gone done because you didn't have a big bill you had the year before. Perhaps the timing of your payments for major expenses changed. And of course you would need to take the amount of your mortgage at the time you began using the HELOC to pay it down, and compare that with the total of your mortgage balance, your HELOC balance, and subtract the increase in your cash on hand. Then subtract any decrease in expenses from before to after, or add any increase. Then you'll have a better idea of where you stand and what caused the difference, if any. I have found that just being aware of how much you spend on each expense category leads to a better savings rate.

Don, I think we have a misunderstanding somewhere or you understand and you're not being honest.

Refer to my second question - would you want this product - yes / no / why / why not? We both know the answer to this - that yes, you would obviously want it and there are some advantages, but I want to understand what you think the advantages are vs what I think they are. If you can't answer this question honestly and simply, then it seems to me you're being dishonest for the sake of your argument and I have no reason to try to come to any understanding with you. Would you want the product described - yes / no / why / why not?

Post: Velocity Banking / HELOC Checking Acct - It Works (Proof)

Post: Velocity Banking / HELOC Checking Acct - It Works (Proof)

- Posts 294

- Votes 96

Originally posted by @Don Konipol:

@Joshua Smith

I’ve thought about how to explain the fallacy of so called “velocity” so that people without advanced degrees in finance can understand it. In previous posts people have used both financial analysis/projections, and point to point critique to try to explain this, but it hasn’t resonated with the true believers. So I’ve decided to simplify.

All the verbiage about amortization schedules, compound interest, eliminating your checking account, etc. is just window dressing made to confuse the issue and distract the “victim”. There are really just three points worthy of consideration

1. By borrowing from a HELOC to pay off principal of a mortgage, you save no money, in fact you actually spend more in interest, because you are saving low mortgage interest by paying higher HELOC interest.

2. Paying all you bills from a HELOC account accomplished nothing. If you're income is more than you spend, you can always use the difference to pay down your mortgage. You don't need a HELOC for this. This is one aspect of the "window dressing" to which I defer.

3. So, eliminating the window dressing which is meant to confuse the issue and deflect attention away from financial analytics, the theory boils down to should you save the interest you pay on the mortgage by paying off principal early. This is no special aha moment. The same question is analyzed every day by millions of businesses, investors, wealth managers, financial analysts, and corporate treasurers world wide. And the answer is that it’s a matter of the decreased risk associated with lower leverage vs. the expected greater return that the funds that would payoff the mortgage principal can generate when used for a different investment. Add risk tolerance of the principal(s) involved, and the answer can be worked out.

Eliminate the nonsense of misconstruing amortization tables, misunderstanding compound interest, and misunderstanding lines of credit (HELOCs) and the above three points should enable you to see the tree in the forest.

Hi, Don. You're right that simple is better, so I just have a couple questions for you if you're game.

1. In case you didn't read my post, I have been able to put around $50,000 extra toward my mortgage using this strategy (in 2 years) without skipping lattes and dinners and so forth. Your contention is that this extra money would have shown up in my checking account over that course of time without this strategy, but BEFORE I was doing this strategy it didn't grow at that rate. Of course, a person's checking fluctuates, but most people have a general level that they hover around - myself and my wife included. How is it possible that we hovered around a $5-$7000 for ten years through a couple other houses and so forth, but the minute I start this strategy all of a sudden my checking is growing at a rate of $25K/year? Of course you'll say that we just happened to get promotions or there was some other mechanism for savings, but that's not the case. If anything, we actually moved to a place where the cost of living is higher and I've been trying to find other ways to save or make extra money, but this is the only change I've made so far. How is this possible?

2. If there was a mortgage product that was the same as whatever you have now (same interest rate and duration, same company, closing costs, etc.) everything EXACTLY THE SAME EXCEPT that it also functioned like a line of credit, ie. you can put all of your income toward it, but still get your money out to pay bills - would you want that or no? Why or why not? You can still invest whenever you want to, you still have a savings account and you can get that to whatever level you want, etc. - everything is exactly the same as it was before, but now you can put all of your income (the money that would typically rest in your checking account) into your mortgage and still get it back out when you need it. Yes / no / why / why not?

Post: Does Velocity Banking work????

Post: Does Velocity Banking work????

- Posts 294

- Votes 96

Originally posted by @Victor S.:

Originally posted by @Joshua S.:

Originally posted by @Victor S.:

Originally posted by @Joshua S.:

I can tell you for a fact that it works, because I use it. My original mortgage docs say that my mortgage balance should be $290K this month, but it's actually $236.5K. I've been able to put $53.5K extra toward my mortgage over 2 years with this strategy.

And your HELOC balance is currently at $0?

Nobody is disputing the fact that this "strategy" works. We're disputing the perceived advantages over simply paying more principal every month (or however frequently you want to).

No, that's a fair point, I still have a balance on the HELOC - maybe $12K or so, but I don't really count that. If/when I don't have my mortgage payment I can pay that off in no time.

Well, everyone likes to talk about opportunity costs on this site, so from that standpoint alone, yes, this strategy has advantages over saving all month long (or for a few months or whatever) AND THEN putting money on the mortgage. I mean, think about the differences. In one scenario you're twiddling your thumbs waiting for money to pile up so you can pay some extra principal toward the mortgage. In the other scenario I've isolated a portion of my mortgage where I can attack the principal with everything that's in my checking account and all my income all month long. I understand why people compare the two, because it's EASIER to say that they'll just throw some extra money on their mortgage, but there's really no comparison, tbh. I move $10-$15K over to my HELOC saving myself around $20K off of the mortgage, pay the HELOC down over time which costs about $1000, and then I do it again. Paying $500-$1000 extra here or there when it's comfortable is technically doing the same thing, but it's like the difference between throwing a bullet and shooting one.

of course it feels nice to be able to throw tens of thousands on your principal and feel good about it, but it's not free money, not even close. here's a great file you can use to run various scenarios and see for yourself what, if any, velocity you're getting (devoid of emotion): https://www.biggerpockets.com/...

Sorry, Victor, but whatever you do with your money is a waste, because there are always better investments out there. You don't own the Yankees or 100% of Coca-Cola or Wal-Mart, so whatever you throw your tens of thousands on is a waste. Definitely not free money. I mean, look at all the money you're leaving on the table by not owning 5 NBA teams. Geez, buddy, time to rethink your strategy, huh?

Now if you want to keep comparing "investments", then you can obviously see that you lose. But if you want to discuss the best way to pay off your mortgage with money that's just sitting in your checking account ROTTING AWAY AND NOT INVESTED IN ANYTHING RIGHT NOW, then let me know. Later.

Post: Does Velocity Banking work????

Post: Does Velocity Banking work????

- Posts 294

- Votes 96

Originally posted by @Victor S.:

Originally posted by @Joshua S.:

I can tell you for a fact that it works, because I use it. My original mortgage docs say that my mortgage balance should be $290K this month, but it's actually $236.5K. I've been able to put $53.5K extra toward my mortgage over 2 years with this strategy.

And your HELOC balance is currently at $0?

Nobody is disputing the fact that this "strategy" works. We're disputing the perceived advantages over simply paying more principal every month (or however frequently you want to).

No, that's a fair point, I still have a balance on the HELOC - maybe $12K or so, but I don't really count that. If/when I don't have my mortgage payment I can pay that off in no time.

Well, everyone likes to talk about opportunity costs on this site, so from that standpoint alone, yes, this strategy has advantages over saving all month long (or for a few months or whatever) AND THEN putting money on the mortgage. I mean, think about the differences. In one scenario you're twiddling your thumbs waiting for money to pile up so you can pay some extra principal toward the mortgage. In the other scenario I've isolated a portion of my mortgage where I can attack the principal with everything that's in my checking account and all my income all month long. I understand why people compare the two, because it's EASIER to say that they'll just throw some extra money on their mortgage, but there's really no comparison, tbh. I move $10-$15K over to my HELOC saving myself around $20K off of the mortgage, pay the HELOC down over time which costs about $1000, and then I do it again. Paying $500-$1000 extra here or there when it's comfortable is technically doing the same thing, but it's like the difference between throwing a bullet and shooting one.

Post: Velocity Banking / HELOC Checking Acct - It Works (Proof)

Post: Velocity Banking / HELOC Checking Acct - It Works (Proof)

- Posts 294

- Votes 96

Originally posted by @Curt Smith:

Hi Thanks for posting this! I've read much about this tactic some from orgs wanting to coach you. I'm replying not to say anything negative re saving on interest paid but on what just my thinkig is. Possibly also on lost opportunity costs of using ones HELOC to buy a one time gain (interest avoided) vs a lifetime of appreciation and cash flow.

Just my thinking; the best use for me of my HELOC is to buy rentals, rinse and repeat. I've calculated the IRR that includes appreciation, pay down, net cash flow; a batch of my houses in a high appreciation area i earning 60% IRR (modifiec)/yr. Every year. Most of my houses earn around 30-40% total return year after year.

Sure for most occupant home owners with no money in the stock market and cash tight perhaps (just my views mind you) use of their HELOC to have a house they live in paid off sooner makes perfect sense. But to a Kiosoki'esk (Rich Dad) investor my best use of cash is buying income producing appreciating assets in the path of progress.

Thanks for this effort to share how to save a bunch on interest paid. Which yeilds a paid off house much faster.

My views re investment debt: In support of BRRRR I like debt! I want debt! Leveraged houses perform 3x better then the stock market. Paid off rentals perform a bit worse then the stock market. Makes sense to keep 60-80% LTV debt on rentals (to me).

I will add; I'm fortunate enough to invest in a lower cost higher performing rentals state of GA and I do advocate buying at DSCR of >1.5 absolute min and my typical was 1.7 and due to rent appreciation all are over 2.0. Conservative leverage where you have safety margin (>1.7 ish) debt is a good thing. Just my views and thanks again for this explaination of this technique.

Hi, Curt. You're welcome. I appreciate the reply and I can see some value in what you're saying, but the spirit is a little off, I think. This technique is just a better way to pay off your house and keep your checking account working for you, that's it. When you start comparing it to other investment strategies and things (that most people aren't doing, btw), I can understand that, because you're trying to answer the question, "What should a person do with their HELOC and/or extra money?" - but this isn't really an investment strategy.

It'd be like if I told you I have a Groupon for some event Saturday night and asked if you wanted to check it out - the question is, "What are you doing Saturday night?". If you answer that you like Groupon, but you decided not to buy stock in it and that you wanted to start your own company called "Curton" and that events downtown are so expensive because you have to pay for parking and a babysitter when the grandparents are out of town and so on - you're not answering the actual question.

Does that make sense? The question here isn't, "What is the best way to invest your extra money?", it's "Is there a better way to pay off your mortgage and save a bunch of money on interest?". And the answer is Yes.

So, to clarify - I have a couple rentals and I have stocks and an emergency fund, too, but I didn't bring them up, because it was obviously already long-winded and those things are beside the point. The point I'm making is that regardless of any other investments or anything that people have going on, most of them (and probably you) have money that is just sitting in their checking account NOT working full time on saving them interest and paying their houses off - that's a shame to me. I agree that leverage and debt are good to a point, but many people just want a paid off spot to live in and maybe some extra income if it's easy enough (and/or low enough risk) to come by. Those are the people I'm trying to help. Once you start comparing it to a bunch of investment strategies now we're in a very abstract place, you know? I really like the investment style you brought up, but c'mon Curt, if you're going to invest you should use your HELOC to buy the Yankees or Disney World! I mean, THOSE are way better investments than what you're suggesting! Whoa, buddy, you purchased the Yankees and Disney World, but I bought the country of Denmark, so you really blew it, man! Do you see what I mean? There's always a better investment out there, I'm just saying that if you have money sitting in your checking account right now you could be putting it to use and saving a bunch of money simply by changing the way you pay. Or if you need another way to look at it, using some leverage and buying income properties pays off pretty well, you're right. But the mortgage and interest on your residence is all expense / cost - you're not earning any income on it, it's sucking your income away. I mean, isn't that what Kiyosaki says? Your residence in a liability, because it's costing you money and not making you any money? It's been awhile, but that's my takeaway of his message. Buy rentals, yes, but pay off where you live so it's not cutting into your income. This is a way to do that.

Post: Velocity Banking / HELOC Checking Acct - It Works (Proof)

Post: Velocity Banking / HELOC Checking Acct - It Works (Proof)

- Posts 294

- Votes 96

Hi, everyone. I wish everyone knew how great this strategy is, so I'm trying to spread the word. I'm not selling anything, just trying to let people know how it works.

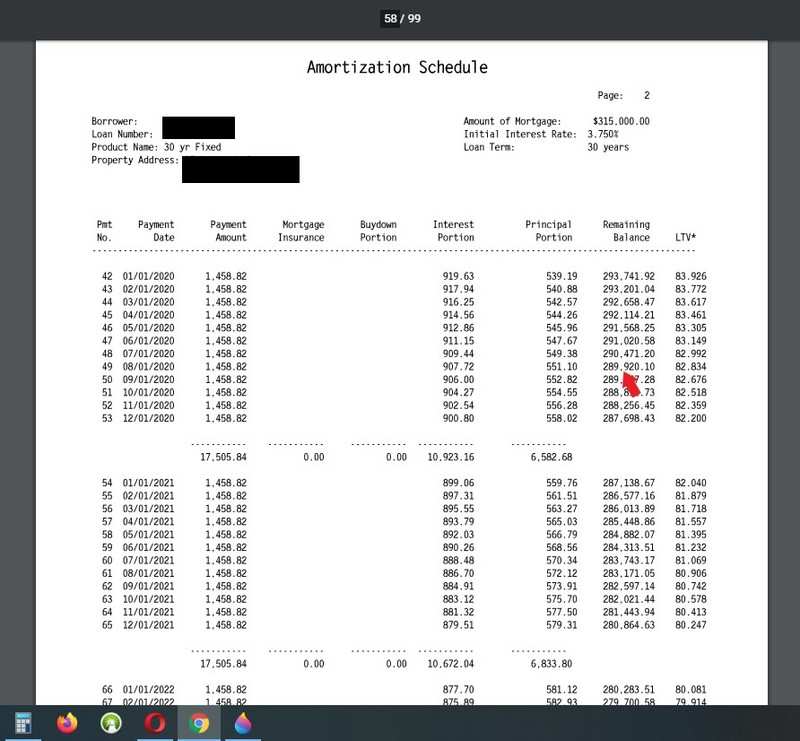

When you're paying your mortgage month in and month out, you are paying MOSTLY interest for many years. That's because you are paying interest on the whole loan - $200K @ 4%, let's say. In the first year you'll only bring the balance down about $4K, but you'll pay about $8.5K in interest - twice as much, obviously. To pay the balance down $10K it will take you 2.5 years and over $20K in interest. To me, that's a sickening waste. Check out from Sept to Sept on this pic. Only $4K in principal yet $8.5K in interest. Work it out on bankrate yourself (link at bottom) and you can see how long and how much interest is wasted to pay off $10K from your mortgage. And this should go without saying, but if you're further along in your mortgage then your savings will be less, because you are paying less in interest at that point. This strategy is more suited to someone who is in their first decade of a mortgage.

Now, follow me here. You can take all of your extra money and put it toward your mortgage which will shorten your mortgage and save you on interest. Most people know this. But most people also realize that money is usually tight and many people don't have $400 for an emergency let alone a bunch of extra money to put against their mortgage. Anyway, do that if you want, but there's also another better way to accomplish the same thing.

Here's how it works. You get a HELOC or a PLOC with a reasonable rate. It doesn't have to be 4%, but it also shouldn't be 18% like a credit card. You take a portion of your mortgage ($5-10K, for example) and put it on the HELOC. Then you put all of your income toward the HELOC and try to depress the balance as much as possible all month. When bills come you use HELOC funds to pay them, because you're not putting your income into a checking account anymore. You continue like this, putting all bills and income toward the HELOC balance. Since you make more than you spend, the balance will gradually come down. Then you put another portion of your mortgage on the HELOC and repeat the process.

Here's how and why it works (and works better than just paying extra principal when you have the money):

1. You are putting all of your available "checking" funds toward your mortgage at all times, yet you still have money to pay bills due to the revolving credit line.

2. Money that you DON'T end up using toward bills stays on the mortgage balance permanently, limiting the amount of interest you will pay.

3. Money that you DO end up using toward bills temporarily "leans" on the mortgage balance keeping it down and limiting the amount of interest you will pay.

4. Here's the silver bullet, though, that most people can't fully grasp. On the above mentioned $200K / 4% loan you will pay $144K in interest over 30 years paying by the amortization schedule. For that amount, you might as well have purchased an extra smaller house. But here's the thing - the interest is SCHEDULED, but hasn't been CHARGED TO YOU YET. If you struggle with this idea, imagine that you won the lottery tomorrow and wanted to pay the house off. You'd pay off the balance of your mortgage, but not the balance and all the scheduled interest charges. In other words, the interest can be AVOIDED COMPLETELY by paying the principal back early, but time is of the essence. The more you pay and the faster you do it the better. So, remember above when I explained that it takes a person about $20K in interest to pay down $10K in principal? Well, when you put that $10K on the HELOC, you COMPLETELY AVOID the $20K in corresponding interest payments on the mortgage (like the lottery example, just a smaller amount) and it will cost you about $1000 in interest to pay off on the HELOC. This allows you to save TENS OR HUNDREDS OF THOUSANDS OF DOLLARS simply by adjusting the way you pay it. It's not a scam or a method of gaming the interest rates or anything like that, it's simply a way of paying more efficiently without having thousands of dollars lying around to throw at your mortgage.

5. When you pay these large chunks, your subsequent REGULAR PAYMENTS are also more effective, because your principal / interest ratio is improved by quite a lot. Normally, every month you will pay $1-$2 less toward interest than the previous month, but the month after you take $10K off of the mortgage your regular payment will charge about $30 less toward interest than the previous month - and every month thereafter. So, you are saving all the interest from #4 as explained, but every month you're also paying significantly less toward interest (and more toward principal) than you were before. Each time you take another "chunk" off of the mortgage your regular payments also become that much more efficient.

Hopefully, that covers the explanation, but I told you there was proof, so here you go. Here's my closing package where it says that this month I should be at a balance of about $290K.

And here's my actual loan balance of $236.5K. So, as you can see I've been able to put $53.5K extra toward my mortgage over the last two years (started the strategy May 2018) and I haven't been skipping lattes or doing any other financial voodoo. All I have done is started using the HELOC to pay off chunks of the mortgage like I explained and because of all the various mechanisms I described I've been able to put a ton of extra money toward the mortgage. When I look at the balances of $290K and $236K on my closing doc, I find that it is about 85 regular payments (7 years) shaved off the mortgage at an average of $825 interest per month (first payment in range $907 / last payment in range $743). 85 payments at an average of $825/month is $70K worth of interest savings in only two years. Obviously, I have a higher dollar mortgage, so your results may vary, but this isn't milk money, it's life changing money simply from rearranging the way you pay your number one expense. Let me know if you have any thoughts or questions. Thanks!

Post: Does Velocity Banking work????

Post: Does Velocity Banking work????

- Posts 294

- Votes 96

Originally posted by @NIcholas Hamel:

@Wayne Brooks. Thanks WAYNE. Is it actually paying more or just shifting the debt to a different type of interest?

These guys turned your thread into a mess, but I can explain this pretty simply for you. By putting a small ($5-$10K) portion of your mortgage on a HELOC / PLOC and treating it essentially like a checking account you are able to put ALL of your extra "checking" funds against your mortgage at all times. The money you DON'T use toward bills permanently brings your total mortgage balance down and the money you DO use toward bills temporarily holds the balance down sort of "leaning" on your mortgage balance until you need it. You can't do all that just by "paying extra principal" each month.

But here's the thing people never get about this. The average person pays around $20K in interest in order to pay down $10K worth of principal on the mortgage, because when paying by the amortization schedule you are paying interest on the entire loan. When you put the same $10K on your HELOC you're paying almost all principal instead of paying $20K in interest. That's the main difference. Now these guys are right that you can "just pay extra principal without the HELOC", but here's the question - do you have $10K to do that every six months or so? I think most people will say a big fat hell no to that. THAT'S THE POINT OF USING THE HELOC TO DO IT. You're using the HELOC to set up a portion of your mortgage that you can attack by 99% principal and around the clock every day of the month, not just when you realize you have some extra money lying around. These are all massive differences.

I can tell you for a fact that it works, because I use it. My original mortgage docs say that my mortgage balance should be $290K this month, but it's actually $236.5K. I've been able to put $53.5K extra toward my mortgage over 2 years with this strategy. Not skipping lattes or scraping money together every month to do it, just automatically through this strategy. You were asking about a debit card and all that. I don't think that's available, but you should be using a cash back credit card for all of your spending, anyway, not a debit card. Then you pay off the credit card once a month just like your other bills. It's not the easiest thing ever to manage, but I'm saving so much interest (I think in the range of $100K when I worked it out one time before) and shaving like 20 years off my mortgage, so I'll make the effort. Good luck!

Post: Just applied for my first commercial loan, HELOC question!!

Post: Just applied for my first commercial loan, HELOC question!!

- Posts 294

- Votes 96

I think they look for "seasoned" funds that have been in your account for 2-3 months and if they saw $50,000 let's say, just show up in your account one day and then a corresponding change to your HELOC balance on your credit report then they will know where the funds came from, either way. I think you're on the right track just asking them, but they know if you have a HELOC it can be converted to cash easily, so I personally would leave it there.

Post: Getting a HELOC to invest in my first multifamily property

Post: Getting a HELOC to invest in my first multifamily property

- Posts 294

- Votes 96

Replace your mortgage is no good, because you end up with a variable rate for your whole mortgage. I've had good luck with small HELOCs from PNC and PenFed. You can do the speed equity version by getting a small HELOC and putting a chunk of your mortgage on it. Then you can use all of your income toward your mortgage but still pay bills. Good luck.