All Forum Posts by: Llewelyn A.

Llewelyn A. has started 23 posts and replied 645 times.

Post: How to predict neighborhood appreciation

Post: How to predict neighborhood appreciation

- Investor / Broker

- Brooklyn, NY

- Posts 665

- Votes 1,744

Let's say you own an Investment Property in Detroit 20 years before it went Bankrupt.

Let's say you actually paid attention to the Big 3 Domestic Autos (GM, Ford and Crystler) Stock prices and their competition which were foreign makers like Nissan and Honda.

Let's also say that you fully understood that Detroit was 90% dependent on the Big 3.

What would you do if you noticed that there was a steady decline in the Big 3 over the a decade?

Do you think you could have predicted the Housing Crash in Detroit?

If your answer is NO..... I'm just not interested in following an Industry that my Investment is 90% dependent on... then those that say you cannot predict Appreciation (and by inference, depreciation) are correct.

If your answer is YES.... I could have predicted the Housing Crash if I had been following the Big 3 Domestic Autos and would have sold before I lost my Investment... then yes, you CAN ABSOLUTELY predict Appreciation (or depreciation).

The Crystal Ball is your brain and how you use it.

Funny, though, even a Squirrel needs to have a Crystal Ball for a brain. If it doesn't predict that the Winter is coming and therefore it needs to put away it's nuts... guess what happens when the Winter comes.

I should hope we all have a better brain for prediction than a Squirrel.

What was hard to predict is the Coronavirus Crash.... but what do you think will happen in a year from now? The End of the World?

This is the one ability that will turn a good Investor into a GREAT Investor. The ability to see what the Market will do in a year from now. Except... this is a very easy one to predict given the current situation.

Post: Dave Ramsey is a Genius now

Post: Dave Ramsey is a Genius now

- Investor / Broker

- Brooklyn, NY

- Posts 665

- Votes 1,744

My history is as follows:

Early Childhood - Dirt Poor in the 70s in NYC.

Teenager - Dirt Poor but studied hard to get into College

College - Delayed due to family crisis. Had to go to work to support the family. Studied hard, got a BS in Computer Science around 27 y.o.

Professional Career - Worked Hard and Studied Hard, reached probably the top 10% in my profession, achieving a salary over $100k before the age of 30.

Started RE Investing - Bought my first House Hack in the late 90s.

2 Decades of Investing / Kept LTV down - I kept my professional career as I invested in more RE so I can keep the LTV below 70%. The cushion is to make sure that I'm safe in a Crisis such as this, but also from past Crisis like the Dot Com Stock Market Crash in 2001, the 9/11 Crash.

Financially Free - When I achieved Financial Freedom in 2004, and just before I quit my job, I paid off one of my Mortgages to ensure I can weather any upcoming storms the scale of 9/11. This was my BEST move I have ever made because it allows me to weather ANY storm, including the Coronavirus of 2019 (COVID-19).

As a seasoned Investor that when through ALL of the crashes since 1997, I would like to impart 3 things:

1) If you cannot achieve a level of expertise in a profession you have studied for in all your educational history and young professional history, how can you think you will be able to achieve a high level of success in a new profession such as RE?

My recommendation is make sure you can achieve the easiest of success which is the profession you have studied for all your life. If you can't do that, question yourself about your abilities to achieve it in RE.

2) AFTER attaining at least a medium level of success in your profession, build a business from it. The easiest business is a Consulting Business in your profession.

If you are an IT Professional, build a Consulting Business by starting a Corporation and hiring yourself out as a Consultant. THEN, hire other IT Professional and hire them out to clients. You will learn HUGE amounts of skills you will need later on.

Another example would be Construction Skills. If you work for a company, start a side business and win bids for jobs. Expand it by hiring other Contractors. Etc.

This transition, while the easiest, is actually very difficult because there are a lot of aspects to it including legal (putting together Contracts such as Independent Contractors Agreements, Work to Hire Contracts, etc.).

3) If you can do 1) and 2) to some degree of expertise, then you should prepare to add a BRAND NEW business to your growing set of Entrepreneurial skills. This is where RE comes in.

HOWEVER, to be as safe as possible, don't QUIT 1) and 2). Keep those as your fallback.

When 3) affords for you to become financially independent, then you have the OPTION (note, it's an OPTION) to leave 1) and 2) behind and work solely on scaling 3).

Dave Ramsey aside, this is the way I did it. The safety nets are always there until you don't need it, even in the Coronavirus Crisis of 2019.

Post: Class C landlords - better build up some cash reserves

Post: Class C landlords - better build up some cash reserves

- Investor / Broker

- Brooklyn, NY

- Posts 665

- Votes 1,744

Originally posted by @Karen F.:

It's actually an interesting point. It is felt that the tremendous death rate in Europe from the Black Plague in the 1300s led to the Rennaissance and the end of feudalism, because it cleaned out so many people, including the landowners. Sort of like a social/population forest fire, that allows for new growth.

If the coronavirus cannot be stopped by social distancing, then it could very well take most of the people in their 90s and 80s, and a big chunk of those in their 70s too, along with some younger ones. Think of the effects on society. There will be a transfer of wealth from the elderly to their children, plus a great decrease of draw on social security, Medicare, and Medicaid. It's awful to say, but it would relieve a lot of the pressure on social security.

Hi Dr. Karen!

First, I have to say that you had given us an incredible insight from 2 months ago!

I'm glad you mentioned that we may in fact not be able to contain the Virus for political and other reasons.

I wanted to get your opinion on something I have been thinking about for a while.

I believe we have all seen the videos of the Gen Z partying during Spring Break, especially in Florida and Texas. Their attitude can be summed up when one of them was asked if they cared about getting the Coronavirus as "If I get Corona I get Corona... but at the end of the day it won't stop me from Partying."

This is actually more political. Gen Z are voting for Bernie. Bernie believes that young folks are not doing better than their parents and their parents are not doing better than their parents.

Gen Z has taken up the thoughts that the Boomer Generation is absolutely selfish and has already put into motion the destruction of the world with their denial of Climate issues, hence Greta Thunberg and the phrase "OK Boomer."

Gen Z also, by being so young, has an attitude we all had when we were young.... invincible, even to a new Virus.

Last week, we saw the closure of Florida beaches to stop the mostly Gen Z from partying.

HOWEVER, after thinking about it more, if those that were partying for Spring Break passed the virus around and then you stopped their partying and told them to go home all across the US...........

I think you get the point.... this only increased the spread of the Virus and probably exponentially.

This might not sit well with Medical professionals, but if they would have just allowed the partying to go on for the next two weeks and kept everyone there, treating any who had gotten sick, they could have allowed the Virus to peeter out via the concept of Herd Immunity.

Combined this with the fact that we lacked any kind of testing, both for a proper diagnosis AND to see if anyone had recovered developed immunity, as well as lack of protective equipment (N95 masks, gloves, gowns, etc.)... there was no way to prevent transmission and it made our Healthcare professional who are on the front line extremely vulnerable and demoralized.

Unless I'm missing something, sending the kids home to every single State in all the corners of America right after they started partying and passing the virus around is one of the most illogical reaction that could have possibly has been done.

To me.... it's already too late that a full lockdown is just going to make it far worse as more people will lose their jobs, over months and years, even when the Virus has finally be reduced to a normal flu like situation, the ones who could not recover economically will wind up either homeless or sick due to the stress they have encounter not only from the Virus but on the brink of financial disaster.

We already know that reports show that the average American has only $400 left from their monthly pay check to survive on after their expenses. They are just one missing paycheck away from homelessness.

It won't be surprising to me that a total lockdown will eventually cause all kinds of future unintended consequences such as the rise of homelessness and suicide to the level of the opiod epidemic.

What is worse is that the class that will be hurt most will be the Middle Class. The rich are well off and have savings enough to go through a protracted lockdown. The Poor has Government Support. But the Middle Class? People like the readers of BiggerPockets? Well.... they will be devastated, just like one of my tenants who happened to open up her own restaurant only to be forced to close because she could not have customers come in. The Middle Class will pay a BIG price and many of them will swell the ranks of the lower classes below middle class. This payment won't happen right away, it will unfold over years.

Given that we are spending more than $1 Trillion to save America from the Virus... let's say there were 5 million Vulnerable people for whatever the reasons (over 60, respiratory complications, cancer, etc.), doing the math of $1 Trillion / 5 Million = $200k per Vulnerable person.

If America supported the 5 Million potentially Vulnerable people to completely self-isolate for say a MONTH while the rest of the population goes through Herd Immunity, it almost seems to me that this is far use of the money.

We also need to go back to the Gen Z. Their attitude, for the most part, will continue to spread the Virus. So the efforts towards social distancing has already been fruitless and will continue to do so with out ENORMOUS effort.

ANYWAY... I can go on and on trying to look at the illogical way America has been trying to solve this problem when there seems to be much more logical ways to do it.

If we face the truth that Gen Z really don't care about the Boomer Generation in general, I think, just maybe, the path we took would have been different than the one we have already chosen.

Just my opinion! Sorry about the long posting!

Post: How does this story end? Prediction for 2020

Post: How does this story end? Prediction for 2020

- Investor / Broker

- Brooklyn, NY

- Posts 665

- Votes 1,744

I still remember reading posts that people should leverage as much as they could otherwise they will have equity, which some people here called "Dead Equity."

This will end badly for the unprepared but fantastic for those of us who played it safe.

Others may think that NYC is a bad market because of all the support for renters. However, I may give up a few crumbs but I'll eat the pie in a year or two.

Of course not all RE Asset classes are going to do well, btw. For instance, commercial RE that has a Mom and Pop restaurant.... I feel sorry for them. There is no political will to save them, unfortunately. But I'm not here to rehash the morals of equality of support.

BUT.... for my buildings in A and B areas in Brooklyn, just like in 9/11.... I'll survive this crisis since I'm about 50% LTV with significant cash flow.

I was given notice by one of my tenants who owned a Restaurant that she couldn't support the rent anymore for her 1 Bedroom Garden Apt in Bed-Stuy renting for $2,500.

I posted an Ad in mid-March and received 40 inquires and 5 applicants. The best applicant rented the apt within 10 days of the first posting and I took the ad down on the 2nd Sunday.

The couple made over $200k in income and savings equally of $200k in the bank.

They wanted the apt because they had 2 dogs in a large apt building which they felt was a Petridish for the Coronavirus since there were 100s of people that lived in their building.

They felt that if they were to self-isolate in an apt with dogs, best to be in a Garden Apt where the entrance is completely separate than the other 2 apts in the building (it's a 3 Family with a separate entrance to the Garden Apt).

The couple also both work remotely.

YES..... in a Crisis there are still good RE and bad RE.

YES..... in a Crisis there is over-leverage and safe leverage.

It's really how you are driving your Investment Vehicle. While the Pandemic made the windshield foggy, if you can turn on the flood lights, you are good.

One more thing I see in previous posts. Some people come on here and say... "See... I told you that investing in NY was bad... I TOLD YOU SO". That's not helpful. Try to post something that others can benefit from.

There... I said my peace.

Post: How much Appreciation do I Account for?

Post: How much Appreciation do I Account for?

- Investor / Broker

- Brooklyn, NY

- Posts 665

- Votes 1,744

2 points here.

1) There is NO SUCH THING as a cash flowing property.

Imagine that you and I are going bid on 100 Main Street for $100k.

We are going to finance it differently. YOU will buy it with a NO MONEY down 100% financed Mortgage and I will buy it with All Cash.

If you buy 100 Main Street with a $100k Mortgage, you will be at a negative cash flow because of the Mortgage.

If I buy 100 Main Street with no Mortgage and 100% cash, I cash flow like crazy.

So, what is 100 Main Street? A cash flow property or not?

IT IS NOT THE PROPERTY that Cash flows, it is the INVESTOR that Cash Flows the Property.

I still don't understand how so many investors don't understand this rule. This is just the Math and the Math will tell you the truth.

2) I have been buying Brooklyn, NY properties for 21 years. If I assumed ZERO appreciation 21 years ago, I would not have made over $10 Million in Appreciation for my Partners and I.

Imagine buying a 2 family in the year 2000 for only $140k using a $119k Mortgage and $8k closing costs. My invested capital was $21k down and $8k closing and $40k in renovations = $69k invested.

I can sell that property today for $1.1 Million, commission of say, 2.5% which would be $27,500 (I'm a Broker so I only pay the Buyer Broker's commission), remaining mortgage balance of say $70k and some closing costs of about $30k. I will walk away with $972,500 in my pocket.

That's a profit of $972,500 minus $69k invested = $903,500 profit. The ROI = $903,500 / $69k = 1,310%

Note, this does not even include the Cash Flow which over time, became very large even though I started with virtually zero cash flow.

I also do IRR Spreadsheets over a 10 year projection. You have to assume some conservative level of appreciation otherwise you can miss these kinds of gold mines.

What was tragic is my friends and family, most of whom did not buy any Real Estate in NYC. They and their children are forever priced out of the Market. Buying where there is large appreciation is a must if that's where you want to live or you take the risk of being priced out. Most of them had moved to lower priced Cities because they just couldn't afford to live in NYC anymore.

I also had another friend that bought for cash flow out of State. He made the unfortunate choice of loving NYC and stayed as a renter in Manhattan.

In 2004, we both bought Investment properties, but I bought in Brooklyn, he bought in CT and cashed flowed about $1k per month. My 2004 property did not cash flow much at that time.

Today, my friend's property still cash flows $1k per month and his property barely went up in the 16 years he owned it. Unfortunately for him, his Manhattan rent went up more than $2k more per month... making his net a NEGATIVE $1k cash flow even though he is positive cash flowing in CT.

Contrasting my 2004 property, I received about $2 million in appreciation and cash flow over $5k per month more than the zero cash flow I started out with.

These are real scenarios that has happened. It's incredibly tragic when 90% of your friends and family are forever priced out because they completely missed the boat.

Luckily, my Brother was one of the 10% of my friends and family that bought just 1 property in Brooklyn in 1994. That property was appreciated more than $1.5 Million.

My Brother's kid is a pretty smart kid and got accepted to an IVY League school but the tuition was $50k a year. Well... that's no problem. My brother just taps into that $1.5 Million of equity and the kid graduated debt free instead of owing the $200k it cost in tuition.

What's even better is that the appreciation in rents paid for the equity loan and he still makes a lot more in cash flow.

Anyway, I am not going to beat a dead horse again. You get the point.

Since you are doing an IRR, you can compare both properties that you can cash flow but will have ZERO appreciation (places like Reading, PA etc) and places that you may have little cash flow initially but will have some or a lot of appreciation.

When you do your IRR, all you do is pick the investment with the better IRR. I have yet to see a property where I assumed zero appreciation beat any IRR I have modeled in an Appreciating market.

HOWEVER, these days, I reduced my appreciation assumptions. Instead of using a conservative 6% to 8% in NYC, I'm only using 4% per year. That has put me in a holding pattern and has made me look elsewhere, potentially out of state.

One last thing, a lot of people would say you can't predict the future. But if a squirrel does not store his nuts before the winter, he will starve to death. If a squirrel can predict the future, why can't we?

Post: Tenant taking smoke alarms off

Post: Tenant taking smoke alarms off

- Investor / Broker

- Brooklyn, NY

- Posts 665

- Votes 1,744

Originally posted by @Marisa Alvarez:

@Llewelyn A. WOWWWWW !!! This is totally High Tech !!! Amazing !!! Please tell me more about automating your rentals. Do you pay the internet ?

Hi Marisa,

The kind of High Tech stuff that I do for rentals are probably well beyond the means that most people on BP will find to be too much in both time and money.

My buildings are all in Brooklyn, NY and all are worth more than $1.5 Million EACH.

You are correct to assume that the Internet is necessary. What I do is either set up a Business Internet for the Building. This costs about $75 per month, or, if I can get one of the tenants to allow me to set up my "Automation Hub" (I use Smartthings HUB in my setup), I will give the tenant $25 per month towards their bill.

There are many ways that Smart Devices can help, not only in the case of smoke detectors.

I have motion detectors which turn on and off lights, cameras that record to the Internet, leak detectors that tell me if there are problems with my basement, particularly if one of my equipment like a Hot Water Heater or Hot Water boiler is leaking, etc.

In fact, I normally buy properties in transitioning neighborhoods, capturing the appreciation as the neighborhood gets better.

The Internet Cameras became very important in this situation for 2 reasons:

1) I kept getting sanitation tickets for dirty sidewalks. I discovered that it was the Neighbor that keep putting trash on my part of the sidewalk. I confronted the neighbor who then stopped doing it.

2) There was drug dealers hanging out in front of the property, dealing. They saw the camera and that caused them to move to another block.

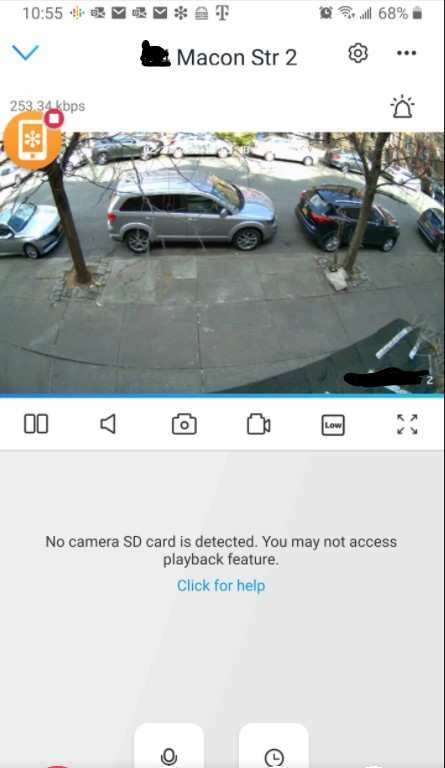

These cameras only cost $100. it records to the Internet. Even if it gets stolen, so what, I can replace it but it's already too late for the person who steals it because the video is already in the cloud and is accessible to only me. Here is how it looks like on my phone:

There are so many things you can solve by doing automation, although there is a education hurdle to get over. There will be other things like when a device gets disconnected, you may have to reconnect it. So that's extra work.

For me, it's worth it. It's also forward thinking. I can now buy a property anywhere and remotely control almost every aspect of it to protect it or even rent the apts out without necessarily being there, by opening locks remotely, etc.

Something to think about! Eventually, I'll start a YouTube Channel to help others understand how to use Home Automation and smart devices to remotely solve your problems.

Post: Tenant taking smoke alarms off

Post: Tenant taking smoke alarms off

- Investor / Broker

- Brooklyn, NY

- Posts 665

- Votes 1,744

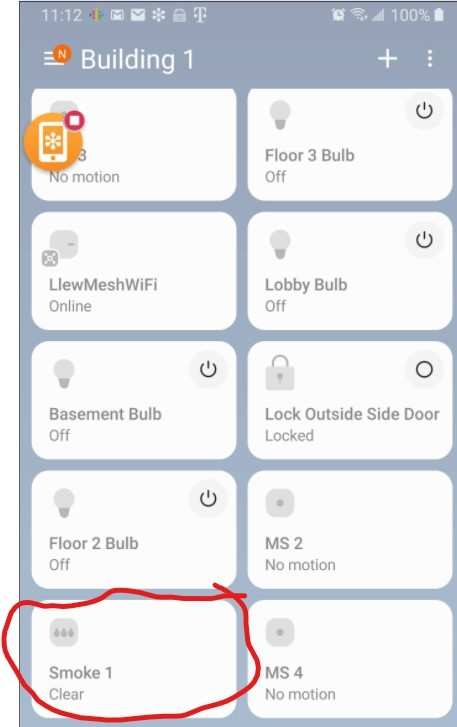

Well, I have a very high tech way of doing it. I have installed Smart Smoke Detectors like this one First Alert ZCOMBO

I actually have the same problem with one of my tenants. BUT, since I have started automating my rentals, it's easy for me to install a smart Smoke Detector and see it's status on my phone.

Here is a snapshot of my phone showing the smoke detector indicating it's clear:

Is it high Tech? YES.......... but I think Investors and Landlords need to get with technology to solve these problems.

If the tenant turns it off, it will show the Smoke Detector as offline.

The only way that my apt can have a fire and I won't know about it is if the tenant throws it away. But then it would disconnect from the internet and I would know anyway.

Something to think about and I know most Landlords won't go this high tech!

Post: Transferring Mortgages Into LLC.

Post: Transferring Mortgages Into LLC.

- Investor / Broker

- Brooklyn, NY

- Posts 665

- Votes 1,744

There are several older forum threads in relationship to the Question on whether buying the property with a personal Mortgage, then transferring it to an LLC negates the Liability Protection the LLC supposedly gives you.

If you Goggled "personal mortgage LLC pierce corporate veil" you will come up with a 7 year old previous discussion here: Question about ability to pierce corporate veil with real estate held in LLC

There are other tons of articles and literature which has that discussion, including one on Nolo's website here:

Piercing the Corporate Veil: When LLCs and Corporations May be at Risk

"Commingling assets. Small business owners may be more likely than their larger counterparts to commingle their personal assets with those of the corporation or LLC. For example, some small business owners divert corporate assets for their own personal use by writing a check from the company account to make a payment on a personal mortgage -- or by depositing a check made payable to the corporation into the owner's personal bank account. This is called "commingling of assets." To avoid trouble, the corporation should maintain its own bank account and the owner should never use the company account for personal use or deposit checks payable to the company in a personal account."

Let me emphasize part of the above snip it: "For example, some small business owners divert corporate assets for their own personal use by writing a check from the company account to make a payment on a personal mortgage"

So...... if I am thinking about what Nolo is saying, writing a check from your LLC to pay your personal mortgage pierces the Corporate veil.

I would be curious to know if anyone here was ever sued by someone that claimed that the LLC was the alter ego of the owner because of paying their Mortgage via the LLC?

Personally, I don't rely on the LLC as my Asset Protection even though I have it. It's the Liability Insurance that makes me feel safer.

Post: Bank Accounts for Multiple Properties

Post: Bank Accounts for Multiple Properties

- Investor / Broker

- Brooklyn, NY

- Posts 665

- Votes 1,744

Hi Satyam. I Manage 9 multi-family properties, including one for a friend.

These properties have gained a lot of appreciation over the years and several years ago, I decided to sell some ownership interest in several of them.

Each property has been treated as it's own business with it's own business Checking Accounts.

When it came to selling a portion of several buildings in the portfolio, it was very easy for me to keep everything separate, add new partners onto the Operations account, produce tax return numbers, etc.

So you can imagine if you have several different partners in several different buildings. For example:

- building 1: Me, Partner 1, Partner 2

- building 2: Me, Partner 2, Partner 3

- building 3: Me, Partner 2, Partner 4

etc.

By keeping everything completely separate, audit trails can easily be set up and the integredy of the Accounts are maintained.

Each Building Partner can have read only access to the Accounts so they can monitor it for excessive expenses, fraud, etc.

In fact, this helps build confidence in me as the manager for the Buildings amoung all 10 of my Partners.

Is it difficult? NO! If you use one bank, when you log in, you should see all of your bank accounts for each property.

In regards to rent collections, if you use a rent collection website like https://Avail.co (that's the one I use), you can specify the Bank Account where your rents are to be deposited.

When it comes to paying expenses, all the City (Property Tax, Registration fees, etc.) and Utility expenses (Heating, Electrical, etc.) are automated on each of these County and Utility website. For instance, the County Website allows me to have a list of properties that I manage and which bank account to withdraw the property taxes from. Same for the Electric and Gas bills. It really makes paying expenses on a per Building basis really easy.

When it comes to paying for a specific fix, say a plumber that fixes a Boiler for a Building, I generate a Maintanence Case in my PM Software (this is my own software I created) for that building and Unit. When I get an invoice from the Plumber, I update my Maintanence Case to include the Invoice, then pay my Plumber via electronic payment (normally Zelle) to his Account.

The money is withdrawn immediately from the Building's Operations Account via Zelle and deposited immediately to the Plumber's Account.

I don't write checks anymore. I find that the time savings of doing everything electronic is worth for me to teach my Contractors to use electronic payments and track it that way. They do it because they get paid immediately once I inspect the work, which can be done via pictures or a Camera that I have installed if not in person. If I see the work in person, I can actually pay the Contractor via my Bank App right then and there.

There will be some common expenses, however. I have a Bank Account for common Expenses (such as the monthly subscription fee for the rental collection, document signing and other software). Because all the Property Bank Accounts are in the same bank under a single log in, it's easy for me to automate these monthly transfers to the common account so that the subscriptions are paid.

What this also does is allows me to decide how much each property should pay for a common subscription.

For instance, I pay $15 per month for DocuSign (used to get all the paper work signed electronically). Just to keep the numbers simple, let say I have 30 total units in the 9 buildings. On a per unit basis, that works out to be $0.50 for the DocuSign monthly subscription PER APT.

So for Building 1, which is a 4 Unit Building, I have a $2 ( 4 x $0.50 ) automatic transfer to the Common Expenses Bank Account.

For Building 2, a 3 Unit Building, only $1.50 ( 3 x $0.50 ) is transferred to the Common Expenses account, etc.

All of these are automated.

I'm not sure if my style of Management is considered complicated to most of the Managers here, but it's so easy for me to Add or substract Partners in my Portfolio, run reports (for instance, what are the utility bills for the year across all properties to see if any is out of whack), generate tax return numbers for all the partners even if they own different buildings at different percentages, etc.

I guess because I buy multi-million dollar properties, I always envision having multiple partners, which then leads me down this road of having a very flexible but sophisticated way to handle the Operations.

Post: I bought a NY rental with Arizona LLC, now told that i cant evict

Post: I bought a NY rental with Arizona LLC, now told that i cant evict

- Investor / Broker

- Brooklyn, NY

- Posts 665

- Votes 1,744

I believe you may have another issue if you wind up creating a NY LLC and did not go through the LLC Publishing Requirements.

I'm not an Attorney, but I have several LLCs and I absolutely made sure that I Published them correctly and received a Certificate of Publication in case I need to sue.

Please read the Below and CONSULT WITH A NY Attorney!

What Happens if I don't Publish my NY LLC

Consequences of Failure to Publish LLC

So you may wonder, what happens if I don’t file the newspaper ads? Is the only issue that I lose the ability to do business in NY?

Yes, if you fail to publish and file the certificate of publication in the required time frame (120 days after formation), the LLC's authority to carry on, conduct, or transact business in New York will be automatically suspended (see Section 206(a) of the New York Limited Liability Company law). That sounds scary, but what does it actually mean?

What does suspension mean in practical terms?

It is unclear. The law was amended in June of 2006 and the part about “carry on, conduct, or transact business” is new. Would have been a nice gesture by the law makers to leave us some pointers, but no such luck.

At minimum, this follows from failure to publish:

The LLC will not be able to sue in New York courts, but can still be sued. But even when non-published LLCs sue, New York courts have allowed them to fulfill the publication requirement and then continue with the law suit. No harm done.

The LLC will not be able to obtain a "certificate of good standing" from New York's Department of State. The LLC may need such a certificate in order to get a larger loan or to participate in a major business transaction.