All Forum Posts by: Llewelyn A.

Llewelyn A. has started 23 posts and replied 645 times.

Post: Will people leave cities post COVID 19?

Post: Will people leave cities post COVID 19?

- Investor / Broker

- Brooklyn, NY

- Posts 665

- Votes 1,744

Originally posted by @Phil Wells:

@Llewelyn A. Absolutely possible.

I still think this misses the overall point. Why would people currently renting remain in the area if they can WFH? Why would those with equity, as you described, just trade one inflated area for another when a massive pull factor (physical working locations) could disappear?

People have lived in the vicinity of cities for as long as there’s been cities, that’s nothing new. What is new is WFH and the corona virus catalyst pushing this to the next level.

Maybe I am missing the point. I didn't know you meant about "Renting" versus owning?! I was actually talking about Sales.

However, you are saying that if you sell your $10 Million Manhattan Condo that it doesn't make sense to be in a $2 Million outer borough neighborhood.

Instead, you will want to be in a neighborhood that's gives you a even bigger bang for the buck, anywhere in the US?

I think when you reach a certain level of income and net worth, your concern has more to do with Status, Style, culture and convenience.

You could be right.

We will need to wait until Sales pick up. Right now, Manhattan is having a severe problem as the High Rise buildings are preventing showings, which then cascades to Owners keeping their properties off the market.

Until Sales begin to increase in Manhattan, I'll know if there is a migration from Manhattan to outer Boroughs like Brooklyn.

However, there was at least one sale that I found in Ditmas Park on 4/15 for $1.9 Million:

https://streeteasy.com/sale/1442190

Not much data to crunch, but it's still surprising that this sale occurred.

I'll have to wait for more data but that probably won't happen for a few more months or even next year as we have to wait for the sales in Manhattan to close first.

Post: Will people leave cities post COVID 19?

Post: Will people leave cities post COVID 19?

- Investor / Broker

- Brooklyn, NY

- Posts 665

- Votes 1,744

If we adjust our perspective to the numbers that would be from Manhattan to Brooklyn, you can look at a neighborhood in Manhattan and compare it to Ditmas Park, Brooklyn.

The Average 2 Bedroom Condo in Tribeca is $10 Million while the Average Ditmas Park Victorian home is $1.75 Million.

What I like to do is just divide the numbers by a factor of 10 so I can mention what it would be like here on BP because most people are not used to seeing these kinds of numbers.

Instead of $10 Million, let's use $1 Million. Instead of $1.75 Million, let's use $175k.

I fully believe that couples who own a $1 Million apt in an expensive neighborhood would move to a $175k home that's only 30 minutes away. They would have a much larger home and still have another $825k in the Bank!

Now, if we multiply this by 10..... we get the Manhattan to Brooklyn scenario in real terms.

Here is the exact statement above multiplied by 10:

I fully believe that couples who own a $10 Million apt in an expensive neighborhood would move to a $1.75 Million home that's only 30 minutes away. They would have a much larger home and still have another $8.25 Million in the Bank!

Maybe you feel this isn't real?

Post: Will people leave cities post COVID 19?

Post: Will people leave cities post COVID 19?

- Investor / Broker

- Brooklyn, NY

- Posts 665

- Votes 1,744

Obviously, that's Manhattan.

Where are people going to move?

HERE:

The above is Ditmas Park...... BROOKLYN. Just about 20 to 30 minutes away from the City but extremely low density.

If you think about it, most BIG Cities offer more than just a bunch of high rise apts.

It's also interesting that one of those larger apts in Manhattan may be more expensive than one of these beautiful Victorian or Queen Anne homes here in Brooklyn.

I'm not sure about other Cities, but NYC has just about every kind of neighborhood you want.

I personally believe that there won't necessarily be a large NET migration out but there will be a demographics shift.

Older people and more vulnerable people, especially with families, will want to move to a lower density neighborhood rather than higher density neighborhoods. Just imagine you ride in an elevator and someone sneezes.... opps... you have just been exposed and you could not social distance.

Younger people, especially single, ambitious and professional, will choose a City Life Style over Cow Towns.

When you are a young workaholic earning a substantial salary, even when WFH, you still want your Gym, Restaurants, Parks, Bars and Clubs very close. Really, you don't want to drive. You just don't have the time to do that.

My feelings is that the Demographics will shift and places like Manhattan will become a lot younger. Younger people feel a lot more invincible than their older counterparts.

Places like Ditmas Park, Brooklyn, will get older and more mature established professionals.

Same City, just different Neighborhoods.

Post: Facebook Shifting Many Employees to Permanent Remote Work

Post: Facebook Shifting Many Employees to Permanent Remote Work

- Investor / Broker

- Brooklyn, NY

- Posts 665

- Votes 1,744

If the work from home permanently isn't a fad, then I definitely foresee a demographic shift.

Maybe older couples with Families who have lived in the Major Cities will wonder why they are paying so much to have a tiny place to live when they can have a lot more space in a different location.

Maybe younger people would say, "Hey, I'm young and I want to live in the exciting Cities, especially now that the older crowd and little kids are moving out!"

I suspect that the business districts won't go away. The population will just get more Younger and Single people living there enjoying those kinds of amenities.

Ultimately, there will be larger venue type events coming back, especially in tourist areas. Families that moved out that already had that experience may say, "Been there Done that."

But younger people would want that experience.

My thoughts are that there will be a shift in Office Space requirements for companies. Some of these spaces will need to be repurposed. Some will be converted to Residential. Some may be converted to other purposes like holding areas for Amazon Packages waiting for an order then delivered within an hour.

The major theme here is that the future probably will change from living where you work to living in a place that suits your lifestyle.

Post: *Calling all experienced millionaire real estate investors*

Post: *Calling all experienced millionaire real estate investors*

- Investor / Broker

- Brooklyn, NY

- Posts 665

- Votes 1,744

@Account Closed

In NYC, Commercial RE is undergoing a lot of challenges. Even some of the more well known Anchor stores are refusing to pay rent if they cannot make any kind of Revenues during the lockdown here.

My assumption is that $ Millionaire Investors who understand that you work for a Commercial RE Management Company during this incredibly difficult time should be valuing your experience as it will absolutely be great to have!

You should be able to leverage that experience even if you are not getting formal education.

However, that being said, if you can put together a Business Plan with all the calculations, especially the IRR over a 10 year holding period, combined with your Commercial RE Experience, that would bring a ton to the table!

Just learning that type of Business Plan will enable you to speak the same Language that the $ Millionaire Commercial RE Investors speak. When you speak the same language, it should make connections easier.

Post: *Calling all experienced millionaire real estate investors*

Post: *Calling all experienced millionaire real estate investors*

- Investor / Broker

- Brooklyn, NY

- Posts 665

- Votes 1,744

@Account Closed

If I had to start today with $40k and making $30k/Yr in Commercial RE Management without family obligations, I would concentrate on networking with exactly the same people you are asking to comment here.

The people who will wind up still being $ Millionaires after this Crisis and who may have also survived the previous crisis such as the GFC and 9/11 will probably have the best advice for you in your circumstances.

Building up trust and a network of really skilled people as well as continuing your Education is going to be huge for you.

What you will need to do is leverage what you bring to the Table.

The $40k helps, but I believe your knowledge and experience in Commercial RE will probably be a big plus for a high caliber Mentor.

There's an old saying, Your Net Worth = Your Network. Build up your Network and nurture it so that you can tap it when an opportunity comes alone. The bigger your Network and the more you build up that trust, the easier you will find an opportunity.

Post: Where will people go now that they can work from anywhere?

Post: Where will people go now that they can work from anywhere?

- Investor / Broker

- Brooklyn, NY

- Posts 665

- Votes 1,744

I might have a completely different take than others.

In my opinion, I believe that older people and families will want to move out of Apartments in Major Cities for more space either in the less dense City Neighborhoods or in the close by Suburbs.

Younger people that are not family oriented yet, will always consider the big Cities as very exciting.

This Pandemic will pass just like 9/11 did. It will take a few to several years before a new normal will be reached.

The younger Generation would not have experienced this Pandemic the way older NYers did and therefore will feel disconnected from the Pandemic. They will not feel "Vulnerable".

I suspect over time, there will be a significant shift of young professionals replacing older remote workers who moved out of the big Cities.

What will be an interesting question would be whether or not the large amount of Office space in high density areas in the Cities get repurposed. I suspect large Companies will begin to trust having a significant amount of the employees as remote and reduce their Office Space expenses.

That might mean that office spaces may start to repurpose into things like Residential apts.

If that happens, I see it as very positive as there has always been a very low Vacancy rate in big major cities. Here in NYC, it's been below 3% for decades.

I think this will lead to a biforcation of the population in these major Cities. Neighborhoods that surround the dense downtown areas (Manhattan in NYC as an example) will have a higher demand from Older Remote workers and their families because you can buy a house to keep yourself isolated and yet do remote work and still be close to the HQ. As an example of a close by neighborhood that is very low density in NYC, just look at images by Googling "Ditmas Park Brooklyn." There is almost no difference between what you have in the Suburbs and what you have here in Ditmas Park Brooklyn and yet you are only 30 minutes away from the middle of Manhattan if you need to go there.

Downtown areas will have a higher population of younger people, most of them single or couples who did not start their families yet.

Eventually the 55 Million Tourists will return to NYC. The Restaurants will Return. How will they be different? Maybe the food will become more expensive to accommodate less Patrons?

Will we need more Restaurants because we need more space to keep the distance?

It's still a bit uncertain. However, if we look at 9/11... the rebound was tremendous after several years.

There is also another factor that needs to be taken into consideration. Eventually the temperature and weather will play a factor in Cities, especially colder Cities like NYC and hot ones like Miami.

Colder Cities will become more desireable as the temperature gets milder. Hot Cities will just get hotter.

There might be a transition period where there is a Migration from Hot to less hot Cities before other factors like Flooding become an issue.

Personally, I think the Pandemic won't be the event that forces us to transition to a new normal. It's just the Catalyst. Global Warming will the the greater and stronger force that will dictate the real migration of people in the next few decades.

Post: Why Self Managing Investment Properties is CRAZY

Post: Why Self Managing Investment Properties is CRAZY

- Investor / Broker

- Brooklyn, NY

- Posts 665

- Votes 1,744

Imagine that you require your PM to be a Partner in your Investment.

That's me!!

In the $20 Million Portfolio my Partners and I own, I am am the PM and my incentives are directly in line with my Partners.

Further, I have built a system in which all the Partners can see every single Maintenance Case and every Revenue and Expense in Real Time.

That being said, I tried to get one of my Partners to take over the PM for me and he failed to even change a light bulb in a staircase for months. You would think even the thought of being liable would have given him the incentive to fix the light bulb!

@Jill F. and I are on the same thought Pattern. If I wanted to stop doing PM work, I would just hire an employee.

I will also say that after a while, you may qualify on Experience to get your full Broker's License without being a Salesperson.

I did exactly that and NYS granted my Broker's License without first becoming a Salesperson.

I immediately opened my Brokerage Firm to manage the Properties in the Portfolio under that entity.

This gives me the ability to hire not just employees, but another RE Salesperson who may already have PM Experience. That RE Salesperson can also be a 1099 Independent Contractor as long as they have a Salesperson License. They can then hang their hat in my Brokerage.

When I'm tired of Self-Managing, I'll be handing off the Management to someone I hire. The good thing here is that since I also own the Brokerage, I can create the Independent Contract Agreement (ICA) any which way I want. It will also be easy for me to let go of the Salesperson if they don't live up to my standards since Salespersons are Independent Contractors. I can't even imagine all the issues with letting go of an Employee. Better to go the Independent Salesperson's way.

I'm also not opposed to having a PM firm manage other Investors properties. That would be the next step after I hire my first Salesperson! Might as well expand the Brokerage firm as I teach the Salesperson everything they need to know about doing a great job as a PM and learning my systems.

Post: Landlord collecting rent

Post: Landlord collecting rent

- Investor / Broker

- Brooklyn, NY

- Posts 665

- Votes 1,744

Of the tenants that have been severely affected by the lockdown, I am working with them. Just as @Michael King I am giving a break between 10% to 20%, depending on their situation.

HOWEVER, that being said, they must pay the FULL rent on time before they get their break.

It's to your advantage to get the full rent in before giving some help. The advantage of this strategy is that if you have the chance to refi your property, the banks may want to see that you are still collecting your full amount of rent. If they suspect you are not getting all the rent, they may use it as an excuse to deny you the loan.

Smartest way is to collect ALL the rent so it's deposited in your account. Give back money after.

Post: Real IRRs - Buy & Hold

Post: Real IRRs - Buy & Hold

- Investor / Broker

- Brooklyn, NY

- Posts 665

- Votes 1,744

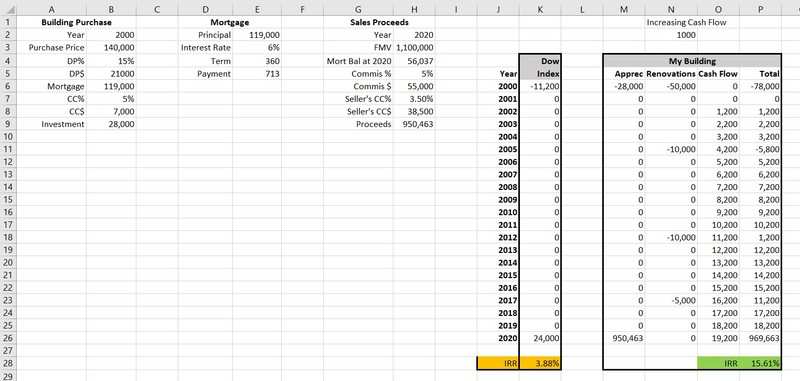

See snapshot of my analysis of the Dow index from 2000 compared to a building I bought in Brooklyn, NYC:

In the year 2000, the DOW was at $11,200.

Today, the DOW may finish around $24,000 or so.

If you do an IRR, that works out to be 3.88% from Column K. TERRIBLE if you ask me.

Comparing that to a building I purchased in the year 2000, I would need to include:

1) The Investment of $28,000 from Columns A&B

2) The Projected Sales Proceeds when I sell today of $950,463 from Columns G&H

3) The IRR Chart of the Building including the Appreciation, Renovations and Cash Flows from Columns M to P.

My building has an IRR of 15.61% versus the DOW at 3.88%

You can write down any kind of analysis you want, but I believe in putting numbers in an IRR spreadsheet and making the comparison.

My Brooklyn, NYC investment FAR exceeded the returns on the DOW. I'm not even sure what other kinds of investments can achieve a TWO DECADE Long IRR of 15% plus.

This is just ONE of my buildings. I have 9 more and some are even better than this return.

The one thing that the IRR Spreadsheet won't tell you, however, is that I can live in my Brooklyn property, but I cannot live in the DOW. So the IRR can't tell you every positive thing about your Investment! haha!

To the Readers of this Posting, this is the true power of IRR. You can make Comparisons of ANY investments to each other as long as you know ALL the cash flows for each investment.

I personally think the IRR is the most powerful Calculation you can learn.