All Forum Posts by: Marty Johnston

Marty Johnston has started 41 posts and replied 498 times.

Post: Hard Money Lender that offers intial construction draw advance?

Post: Hard Money Lender that offers intial construction draw advance?

- Lender

- Wauwatosa, WI

- Posts 566

- Votes 202

@Hubert Chen There are certainly options out there! Is increased leverage your primary goal/lowering closing costs at close or is it just the upfront draw in itself what's most important to you? There could be a difference there. Depending on your experience, credit, the property type, state that it's located in, PP + Rehab Budget, and ARV, you may have some pretty good high LTC options!

Post: Can lenders withhold sharing a copy of the appraisal?

Post: Can lenders withhold sharing a copy of the appraisal?

- Lender

- Wauwatosa, WI

- Posts 566

- Votes 202

@Joe S. you have most of the answers here. The one I would echo directly is as it relates to a commercial mortgage transaction (1-4 NOO, 5+ MF, or pure CRE), where some lenders like to hold onto the appraisal until the closing date, at which time they'll happily hand this over. I have capital partners who have been open with me as a broker that they do this to avoid shopping post appraisal. I know I know... So many lenders "Can't use the appraisal", since they are designated to a specific lender. 90% of the time, (or more), this is very true. However, in Commercial there are private lenders who will in fact accept other lender's appraisals for funding. Sometimes they just need to see that it was ordered through an AMC that they too accept, or the HML guys will just re-affirm it with their own in-house BPOs to solidify it.

Hope this helps!

Post: Aloha capital or other

Post: Aloha capital or other

- Lender

- Wauwatosa, WI

- Posts 566

- Votes 202

@Trevor Evanson tell me a little more about this loan your seeking:

- Property type?

- Purchase price & as is value?

- Loan type sought (Bridge or Rehab or New Construction?)

I might be able to help in alaska based on what you're looking for.

-Marty

Post: Refinancing property in LLC

Post: Refinancing property in LLC

- Lender

- Wauwatosa, WI

- Posts 566

- Votes 202

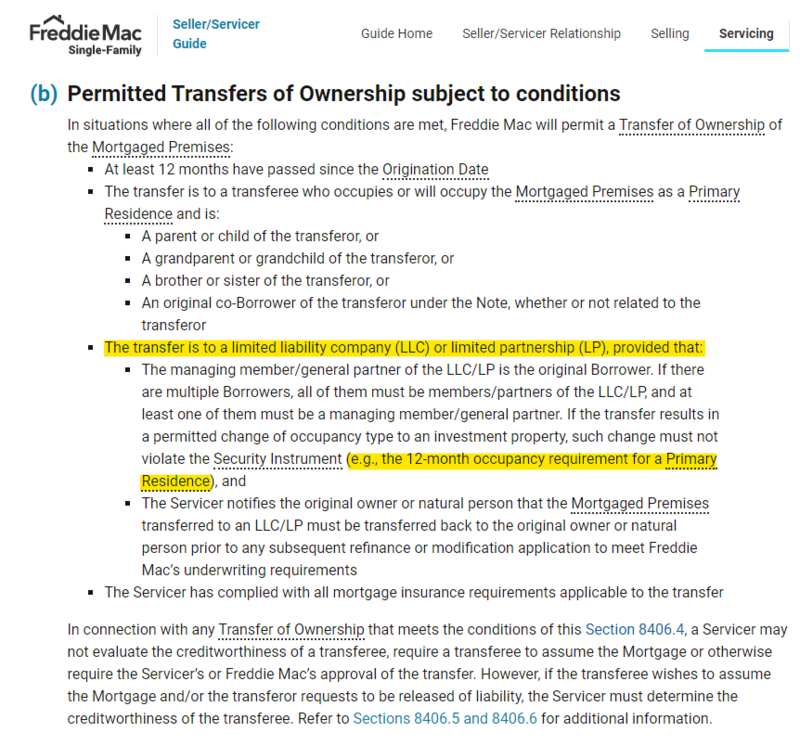

@Andrew Postell thank you for the correction. I grossly over-simplified in my response. To be more clear, afte re-digging into my initial impressions - the below requirement is more in line with what I should have explained. You simply cannot transfer into an LLC and change occupancy to investment within 12 months of the note date. (Link to finding below https://guide.freddiemac.com/a...) I had it wrong here! Thanks

Post: Aloha capital or other

Post: Aloha capital or other

- Lender

- Wauwatosa, WI

- Posts 566

- Votes 202

@Trevor Evanson Aloha Capital is a great lender. I've closed a number of loans with them in the past and always worked with Patrick Haddon or Kevin Hill. Quickish turn times and good process. Their comparable in fees to other lenders, but to answer your question regarding "other" hard money lenders, I would ask to learn more about your deal to answer best:

- What's the property type?

- What loan type? Rehab? Bridge? Rental/30-yr?

- What's most important to you in financing? Lowest cash out of pocket? Interest rate? Pts? Quickness to close?

You can find the middle ground for all of the above, but every transaction is different so all the above are important questions to ask!

Hope this helps and happy to chat more on this! Feel free to DM me if you like.

Post: Refinancing property in LLC

Post: Refinancing property in LLC

- Lender

- Wauwatosa, WI

- Posts 566

- Votes 202

@Austin Shandley you have a lot of great Portfolio loan options with the 'commercial' lending space that will easily reach into the 4's assuming you have decent credit and the property cashflows at least 1.1 DSCR. If this is a SFH home, you'll have buy down options into the high 3% range even.

As @Andrew Postell referenced, local banks, Credit Unions, or other 'residential mortgage lenders' will 97.5% be working with Fannie Mae and Freddie Mac. And he is correct about Freddie not allowing you to refinance into an LLC without the note being potentially call-able. HOWEVER, good news for those who have a loan with Fannie Mae, Fannie Mae will now (as of the past 60-90 days) allow you to refinance into an LLC after closing. You still cannot close on a loan with Fannie in an LLC, however you can QCD into an LLC post-close without Fannie calling the note.

This is not the case with Freddie Mac at the moment.

So, if you do decide to go the residential route, be sure to explain to your local LO that you need to close with Fannie Mae, not Freddie Mac. Their programs pricing are nearly the same and each has it's pro and con, but most consumers don't ever notice the difference, it's more so running AUS for LOs and seeing what pops best pricing for you!

Bear in mind, a residential mortgage will require full income review, W2s, tax returns, pay stubs etc. A fairly painstaking process... Commercial lenders are wayyy lower-doc and more painless, and pricing/rates has actually improved with commercial lenders, where Fannie and Freddie have recently decided to reduce their Investment portfolio, causing their rates to rise a little for investment properties. So this Rate gap has been closed greatly, and many investors are choosing the simplicity and speed of a portfolio lender vs the conventional lenders.

Happy to chat more on this if you like! Feel free to shoot me a DM, and good luck!

Post: Cash out refi with DSCR loan

Post: Cash out refi with DSCR loan

- Lender

- Wauwatosa, WI

- Posts 566

- Votes 202

@Chris K. the Delayed Financing piece may be the best fit for you! Generally speaking, you receive better terms on Purchase Mortgage Transactions. Cashout Refinances usually see a 5% LTV hit (sometimes more!) over a Purchase transaction. As others have mentioned, you have Cashout refinance options with seasoning periods <6 Mos with some. Some of the best lenders have 12+ mo seasoning (one of my favorites is unfortunately 24-mo seasoning which I find a bit ridiculous!)

Delayed Financing may be your ticket, as you get best of both worlds. If you have the cash to submit an all cash offer to win the home, you can then obtain a quick "cashout Refi" or Delayed Purchase, so long as you close within 60-90 days after purchasing the property. With Delayed Financing, you get the terms of a Purchase Mortgage, but in the form of a cashout. So still up to 80% LTV (assuming good credit, DSCR of 1.1+, fine area [not rural], and 1-4 Unit property [at least the lender I have in mind])

Since it's purchase money, rates are usually better too! PAR rates in the mid to high 4's on SFHs and high 4's - mid 5's on 2-4 Unit properties. Both have buy down options into the higher 3's or low 4's. There are a lot of lenders out there who offer this option, but not all of them promote it! [not sure why?]

Hope this helps!

Post: I am looking for Commercial Financing for a first time investment

Post: I am looking for Commercial Financing for a first time investment

- Lender

- Wauwatosa, WI

- Posts 566

- Votes 202

@Ethen Royal Sounds like you've good a decent MF property here! You will find there are a lot of options in the market for this price point in the secondary-market lending / Bank-Alternate space. Most of these guys are going to cap at 75% LTV however outside of Bank-Type lenders, but banks will be full-doc loans, probably 45-60 day closes, and be capped at the usualy 5-yr balloon and 25-yr amortization (blah).

Probably the two biggest factors that will play a big role in your max leverage:

- Your MID-Credit Score (of the three bureaus)

- How well does the property debt service? (Most commercial lenders with the best terms like to see a 1.1 DSCR +). There are No DSCR lenders out there as well fo MF, but these programs have a spike in rate and often more conservative on LTV.

Is a 75% LTV, 30-yr Fixed a good option for you as well? Or are you only interested in a 20% DP?

I might echo @Brock Freeman!

Post: Should I use a mortgage broker to find a portfolio lender?

Post: Should I use a mortgage broker to find a portfolio lender?

- Lender

- Wauwatosa, WI

- Posts 566

- Votes 202

@Joshua Hollandsworth alot of these secondary market lenders / portfolio lenders build their business and focus their marketing efforts on working with Mortgage Brokers (B2B) as opposed to direct to consumer (B2C), and some wholesale lenders only work through mortgage brokers (albeit a small handful) You have great goals! This is where the secondary market lenders/portfolio lenders thrive and are usually the best option, so you're on the right track! So long as you have all of the following, you'll be able to scale your portfolio quickly and meet your goals no problem:

1) Liquidity for Down Payment + closing costs (Typically 25% down, similar to Fannie/Freddie conforming investment N/O/O product)

2) Credit Score of at least 680+ (some will go down to 620, but terms get u.g.l.y.)

3) Property Debt Services the mortgage at least 1.1+ (although there are no DSCR lenders, again, rates increase if that's the case)

4) Property's values aren't too low - portfolio and commercial lenders like to see 1-4 Units have a minimum value per door for 50-75k+. Some of the best lenders with the best terms have minimum loan amonts of $100k+ so low-value properties can be more expensive on terms and harder to secure funding

Terms are still 30-yr fixed, with PAR rates in the 4's (assuming good credit, loan amounts $100k+, and decent credit)

Hope this helps!

Post: working with mortgage broker?

Post: working with mortgage broker?

- Lender

- Wauwatosa, WI

- Posts 566

- Votes 202

@David Smith you're probably going to see a LOT of answers and opinions on use of a Mortgage Broker here on BP. If you do a search for "Should I use A Mortgage Broker" you're bound to find hundreds of threads on the question. I'm of the personal opinion that it really depends on the person. A mortgage broker is most commonly paid by a broker fee, from the borrower, at the closing table. On refinances, their fees can be covered from your equity (assuming you have the equity to cover it). Some lenders pay brokers YSP, which can mean an increase to your interest rate, but lower closing costs. Some brokers do this to look like they're very affordable (and albeit, some brokers DO have lower charges than others), but all brokers are based on loans funded, and most paid at closing, rather than out of back-end yield.

Brokers who are good can quickly identify best options for your financing needs, present multiple quotes, distinguish your 'end goals', and help guide you to a product both now, as well as an exit (if applicable) to achieve said goals. Good Brokers make a living through referrals and happy previous clients, meaning marketing doesn't mean much! They're the professional at finding the best option for multiple scenarios, rather than a direct lender who has their "box", and that's it usually.

If you like options, and you're willing to pay a professional to not just push papers but help advise you, a mortgage broker to most people is WELL worth it.

Hope this helps!