All Forum Posts by: Antwoine McCoy

Antwoine McCoy has started 5 posts and replied 15 times.

Post: Housing Choice Voucher High Level Discussion (DC Focused)

Post: Housing Choice Voucher High Level Discussion (DC Focused)

- Real Estate Consultant

- Washington, DC

- Posts 15

- Votes 16

Hey all, was more of a general conversation so no recording was provided. If you have some general questions post them here and I can either respond or more than likely use them as a basis to do another conversation (this time with visual aids)

Post: Housing Choice Voucher High Level Discussion (DC Focused)

Post: Housing Choice Voucher High Level Discussion (DC Focused)

- Real Estate Consultant

- Washington, DC

- Posts 15

- Votes 16

I will be providing a basic, high overview of the Housing Choice Voucher Program, specifically for the DC market. If you have any questions or are interested in joining/listening send me a message via my inbox and I will provide you the GSuite meeting invite. Currently scheduled to take place today (5/12/20) at 5pm.

Post: Closing costs in Washington DC

Post: Closing costs in Washington DC

- Real Estate Consultant

- Washington, DC

- Posts 15

- Votes 16

are you being charged points? Your Recordation tax is 1.45 points and if setting up an escrow your Prperty Taxes will be proration of your assessed value ( in DC it is 85 cent of every $100 of assessed value)

Post: Must do 1031 exchange before July 15th , what to buy ?

Post: Must do 1031 exchange before July 15th , what to buy ?

- Real Estate Consultant

- Washington, DC

- Posts 15

- Votes 16

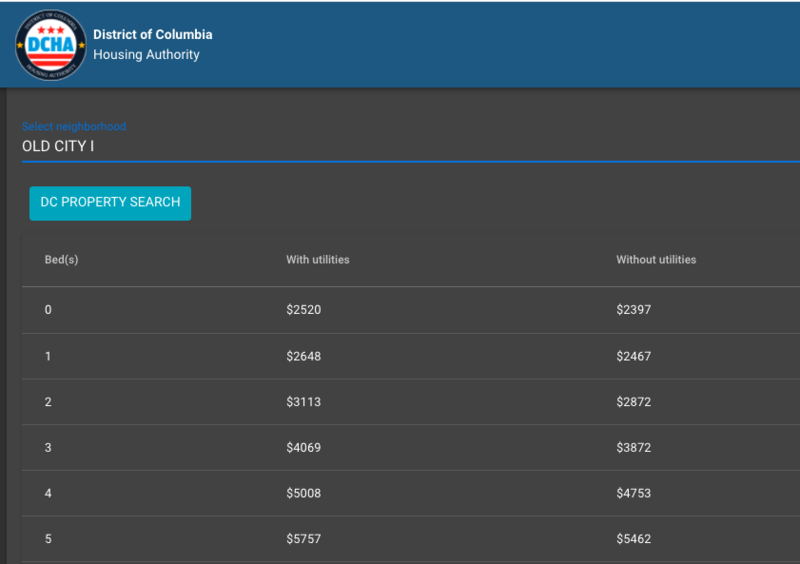

@Tracey Robinson if it was me, I would buy in Washington, DC (I live her so I am bias) in a specific zip code or submarket and rent it to Housing Choice Voucher Program Participants (HCVP rent payments are based on neighborhood FMR-see one attached). I would look for two properties, with each one being able to be 5 bedrooms ( I am assuming $400K down on each) assuming each house is no more than $700K than you would be able to get $5,462 for each property in rent. Excluding closing costs (you can do the math on your own) P&I on a 30yr fixed loan of $300K at 4% is $1,452 and with rent being $5,462 you would cash flow about $4K each house (this of course isn't inclusive of taxes and insurance or repairs/main). Of course you could just buy 1 house outright for $700K and your profit would be the $5,462 but if I had the $800K I would split it up. The good thing about the single family 5 bedroom option is that the turnover on a 5BDR is not as volatile as a small multi-unit. Based on the quick and dirty math your first year cash on cash return would be 12% (($8,000*12)/$800,000) and profit margins would be 70+% (($5,462-$1,452)/$4,462). Happy to provide more specific detail if you are interested. Either way good luck.

Post: Real Estate Investment Property Deal in PG County

Post: Real Estate Investment Property Deal in PG County

- Real Estate Consultant

- Washington, DC

- Posts 15

- Votes 16

Investment Info:

Townhouse buy & hold investment in Bowie.

Purchase price: $310,000

Cash invested: $17,205

Purchased existing townhome from family members as a rental property and was able to utilize a gift of equity to reduce the downpayment requirement.

What made you interested in investing in this type of deal?

Met my requirement of $500+ Cash flow /unit . Property is also near a new hospital that is opening within the next 18 months.

How did you find this deal and how did you negotiate it?

Purchased from immediate family member, family member informed me of interest to sale

How did you finance this deal?

86% Conventional Financing

5% Cash

9% Seller Credit

How did you add value to the deal?

Identified and negotiated the option of using a Gift of Equity to reduce out of pocket costs but kept sales price/future comp value intact.

What was the outcome?

Due to circumstances beyond my control I was unable to occupy the property. Enrolled in the local Housing Choice Voucher Program and rented the property. Anticipated 20.7% Annual Profit Margin | Projected Cash on Cash Return of 25.4%

Did you work with any real estate professionals (agents, lenders, etc.) that you'd recommend to others?

Yes, Katie Simmons Hickey of Caliber Home Loans in the Washington, DC Metro area