All Forum Posts by: Michael Plante

Michael Plante has started 69 posts and replied 2369 times.

Post: make your case: Stocks vs Rentals

Post: make your case: Stocks vs Rentals

- Deland, FL

- Posts 2,434

- Votes 1,875

I work approx 12 hours a week

Will pay taxes on approx $480,000 from flipping this year

Same money invested in a broad fund in the stock market IF I sold it all would have netted approx $37,500 unless the stock market plunges or skyrockets by Dec 30

Post: Unruly leaseback tenants

Post: Unruly leaseback tenants

- Deland, FL

- Posts 2,434

- Votes 1,875

I would try to be patient and wait the 10 days

No use getting upset ahead of time

Post: Private Seller not honoring the contract

Post: Private Seller not honoring the contract

- Deland, FL

- Posts 2,434

- Votes 1,875

Not sure I have this correct or not

so he has a buyer who will buy it as is with the siding not done?

Post: Landscaper submits final invoice 35% over estimate without notice

Post: Landscaper submits final invoice 35% over estimate without notice

- Deland, FL

- Posts 2,434

- Votes 1,875

To me they cut the price $1000

I would happily pay and move on

Post: Tenants destroyed the apartment, what remedy can a landlord get?

Post: Tenants destroyed the apartment, what remedy can a landlord get?

- Deland, FL

- Posts 2,434

- Votes 1,875

Originally posted by @Sara W.:

Hi for all the landlord out there, I recently just had a tenant moved out because their lease is up and we no longer wanted to lease the apartment to them. When I inspected the apartment it is in a very bad shape - carpets completely destroyed, several big holes on the wall, bathtub is all black, they unplugged the fridge and put food in there, so the whole fridge is molded.

We have their deposit but they are not enough to pay for all the damages that they have done. Are there anything that we can do to recoup the damage they have done?

Some suggests us to go to a small claim court. But should I notify the tenants first or should I file the paper work directly? Or should we just let it go and consider this a cost of business?

Any suggestions would be greatly appreciated. We estimated the cost to fix all the damages is at least $4k to 5k with labor and materials.

Thank you!

This is what I have done in the past

Contacted a local Atty asked him how to document everything.

Took care of the damages

Waited a year

Had the same Atty file in court

Won the case easily

3 years later former tenants tried to get a mortgage. My case came up

They paid my attorney money awarded plus interest

Happy me

Post: Who are the Most Desirable Urban Commercial Storefront Tenants?

Post: Who are the Most Desirable Urban Commercial Storefront Tenants?

- Deland, FL

- Posts 2,434

- Votes 1,875

At a minimum I would look for Tenants who supply goods and services which can not be bought on line

Post: Orlando Real-Estate Beginner

Post: Orlando Real-Estate Beginner

- Deland, FL

- Posts 2,434

- Votes 1,875

me personally I would not feel comfortable funding 100% or even close to 100% of the costs of a flip

Post: When can you relist a newly purchased property in a1031 exchange?

Post: When can you relist a newly purchased property in a1031 exchange?

- Deland, FL

- Posts 2,434

- Votes 1,875

IRS Code Section 1031 outlines the many different rules regarding 1031 exchanges. However, the code does not specifically state an exact amount of time exchangors must hold onto their replacement assets. What the code does state, though, is that an exchanged property that’s held primarily for sale does not qualify as a like-kind exchange. In other words, investors can’t sell one investment property, complete a 1031 exchange in order to defer capital gains, and then fix-and-flip the replacement asset.

Replacement assets must be acquired with the intent of holding them for investment properties. The IRS stated in a 2009 ruling that exchangors shall realize no gain or loss when exchanging one property that’s held for use in a trade, business or as an investment when that property is exchanged for another like-kind asset used for the exact same purpose.¹

Moreover, the IRS addresses what constitutes a “holding requirement” in the same ruling. Again, there’s no concrete length of time listed but rather language that addresses the exchangor’s intent:

“...An exchange of property will not be eligible for deferral of gain or loss under Section 1031 if the replacement property is determined to be held by the taxpayer for immediate sale, disposition, or for some other non-qualifying reason. The determination of whether the taxpayer has acquired replacement property for investment purposes is determined by examining the taxpayer’s intent and the surrounding facts and circumstances at the time such property is acquired.”Hello

Post: Notice to Vacate / Cancellation of Month-to-Month Forms

Post: Notice to Vacate / Cancellation of Month-to-Month Forms

- Deland, FL

- Posts 2,434

- Votes 1,875

Not only can they differ state to state but also county to county

Do it the wrong way and it could end up costing you lots of money

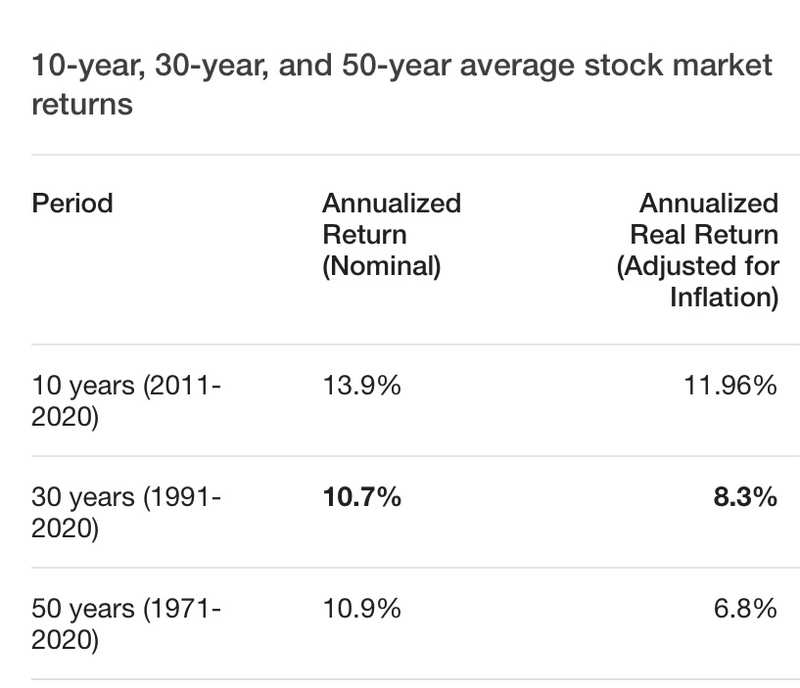

Post: make your case: Stocks vs Rentals

Post: make your case: Stocks vs Rentals

- Deland, FL

- Posts 2,434

- Votes 1,875