All Forum Posts by: Michael Thach

Michael Thach has started 5 posts and replied 143 times.

Post: Where to buy first property( Nevada or Texas)

Post: Where to buy first property( Nevada or Texas)

- Posts 144

- Votes 93

Hi Angeli,

I live in Las Vegas, I own a business here and my girlfriend is a local realtor, real estate investor and property manager but me personaly I am invested in Texas ( 5 SFH ). I would say Texas properties are more affordable and have a better long-term appreciation vs Las Vegas. Don't get me wrong Las Vegas has an awesome appreciation but I think due to the current health crisis Las Vegas can be a more volatile market than Texas.

Texas SFH houses ( 100-160k ) tend to have around 1% monthly rent to purchase price ratio, which is most likely enough to generate a positive cashflow. Beside higher property tax, higher insurance the higher rent will make it up. Appreciation is in Houston and Dallas area more stable than LV or Nevada.

Las Vegas single family houses rent are around 0.5% or purchase price ( around 280-320k ) , with lower property tax, lower insurance, those properties tend to have a slight negative outcome but you get tax benefits and a appreciation on a higher amount.

Me personally, I would choose Texas over Nevada at the current time and health situation. I have complete teams for both states, if you need referals let me know.

Michael

Post: Invest in Vegas Condo-tel a good idea?

Post: Invest in Vegas Condo-tel a good idea?

- Posts 144

- Votes 93

I have a friend owning a studio at Palm Place. Is pretty dead at the moment. At better times is about little better than breakeven but this was with 33% fees I think. With 50% this won't make much sense. HOA are like 500-700ish. Now there are also no conventions in Vegas !

Post: Who's buying properties right now?

Post: Who's buying properties right now?

- Posts 144

- Votes 93

Still buying. Even if it goes down, so be it, I will buy when it goes down and I will buy it when it goes up. The average is find for me. I am not trying to time the market.

Post: Loan and job advice needed

Post: Loan and job advice needed

- Posts 144

- Votes 93

Originally posted by @Deanthony Quarles:

@Chad Lanting Hi Chad thank you for responding. I want to put the large amount down because I wanted a lower mortgage payment since I may be moving without a job. I would not leave my current position until I fully closed on the new property. I planned on still having enough saved for at least 1.5 years of my expenses. For the heloc would I have to disclose that I would be using the funds for a downpayment? If I can’t get heloc then I would more likely to put less down still 20%min. Or I should consider a refinancing option to get cash.

At the moment most heloc products were taken out from the lenders. Is really difficult to find a lender who still offers a Heloc.

A income is a must for the cashout refinance or a loan. So I would not quit just yet. Houses , especially the ones around 270-340k in Vegas are selling really quick right now, often over the asking price. If you want to buy a home without a Income, you need to put at least 25% down, preferable 30%, so you plan would work. I have a MLO who offer this product and my girlfriend is a realtor. If you need help I can give you their data.

Originally posted by @Leroy Fellis:

@Michael ThachHey Mike, I greatly appreciate your response. I have more clarity about this. Let me pose an example four you. Let's say we all sign on the house we all make about 4.3k a month each. We purchase a small multifamily Cost 400k. Mortgage is 2200 a month. Cash flow is 800 dollars a month. What would each of are DTI's Be and if we made vastly different incomes How would that effect our individual DTI

This is very very individual specific. Depends on each persons financial. I don't know how much each persons mortgage, carpayment, creditcard debt and ect are. The best thing is to let a loan officer run over those numbers for you as Steve has suggested.

Yeah its possible to put the property in a LLC and use a land trust or other kind of trust to secure the property. Mortgage companies dont like to see it and as long as you pay usually nothing happens.

Originally posted by @Leroy Fellis:

@Michael Thach Thank you for the advice! Excuse my ignorance, but he sentence,"

The strongest income should go on the loan but I would suggest that this person also get a bigger cut because his DTI will be effected if the property is hugely positive cash flowing. Only 75% is counted as income in an investment property

Can you elaborate? If you can use an example with numbers it will help me understand the most. I really appreciate the information on the Newly formed LLC. My mother will be living in a Unit and paying the appropriate rent. This will guarantee the cash flow Flows into the business. If we all have our names on the Property how will that impact he DTI? Just for kicks, How long will it take/what is a Target income a LLC should make before one is able to use the LLC to purchase Property?

@Rachel H. Thanks for the advice! I have a follow up question. I have heard around Video and other sources that when you buy a property in your own name and transfer to an LLC it can force a DUE ON SALE clause (May have said that wrong). Is this true. I want to have an Idea of possible obstacles that can come our way.

Your LLC needs to have at least 2 years income. How much income, depends on how your business is running. The stronger the more banks will loan you.

DTI is debt to income ratio. If you get $1000 in cashflow, the loan officer will only count $750 as income. So if the cost of the property is $950 the person on the loan will have a increase of debts. Because the loan officer will count only 75 % and will calculate that the person is losing $200 per month. So if this person is making 4k a month $200 is 5%. A person can get loans up to around 36% or 40% if they really try to max it out. So 5 % is worth like 45K in loan amount. 100K cost around 450$ in mortgage right now, so $200 cost around 40-45K.

Post: Assistance with first purchase

Post: Assistance with first purchase

- Posts 144

- Votes 93

Numbers are the Key

Find a property you like and I analyze it for you and tell you pro and cons.

The bank would not allow you to get a loan on a newly funded LLC without Taxreturn and incomes.

So if you want to buy a properties you guys can be all on the loan or / and all on the deed. So you guys wont necessarily need a LLC. The strongest income should go on the loan but I would suggest that this person also get a bigger cut because his DTI will be effected if the property is hugely positive cashflowing. Only 75% is counted as income in an investment property. So if 75% cant cover the cost the person on the loans DTI will be negatively effected which can effect future purchases.

Will your mother pay rent in one of the places she live in ? To keep everything fair , she should pay the same amount as other renters.

Post: Should I be doing something with reserve cash I get from rent?

Post: Should I be doing something with reserve cash I get from rent?

- Posts 144

- Votes 93

Originally posted by @Adam Martin:

Originally posted by @Michael Thach:

If you are on the defensive side, you can use velocity banking and speed up paying the mortgage down.

If you don't know what velocity banking is....

Use your credit card to pay principal only. Example if you have a 10K credit card limit, use it to pay principal only. Than use your saving to pay the creditcard over 5-7 months, than repeat it. You should be able to pay the house of in 5-7 years. Depending on your credit and saving limits. Especially at the beginning of each house mortgage, all you pay is interest and little principal but with this method you can pay of a lot of principal and reduce the interest you are paying. The interest on your credit card with 20% on 10k for 5-7 months are way less, than they interest on a 30 years term with 3-4% on a way higher amount.

Can you explain this a little more, I'm a bit confused. From my understanding you are taking money off your credit card to pay down your home and then paying off the card in a continuing cycle. If you have interest at all on a credit card it is most likely much higher than what you are paying on your home. Sure when you look at the interest you would pay on that money over the amortization on the loan it will be more but you would be better off just paying extra per month I would think on the house vs. periodic paydown using your credit card. A way to look at it is for those specific funds you are paying probably around 5% on that money while it is in the loan and 15%+ on the credit card. Now if you are getting promotional offers with 0% interest this may make sense but then you would get a credit hit I would think constantly opening new cards. I am genuinely interested in this though and plan on looking more into this idea but would appreciate your clarification as well.

Let me explain this further. If my explantion is not good enough have a research on youtube. They might explain it better.

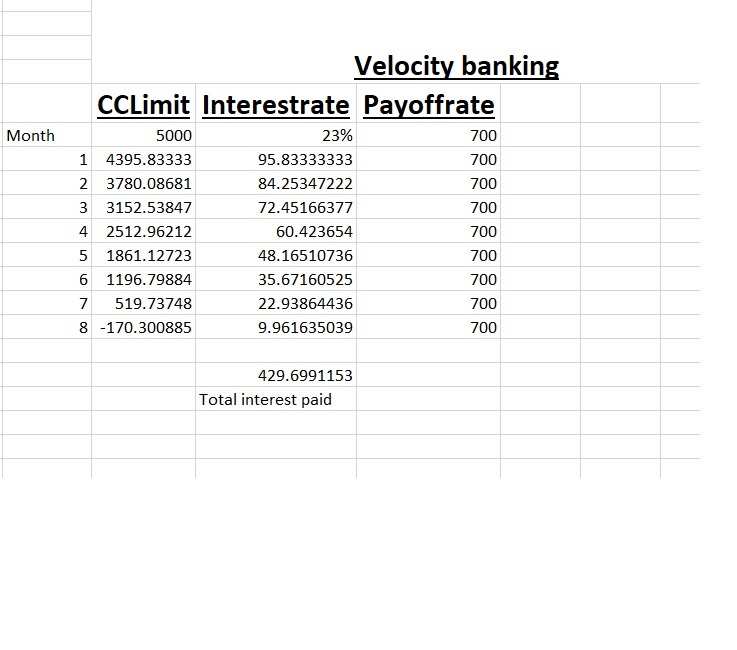

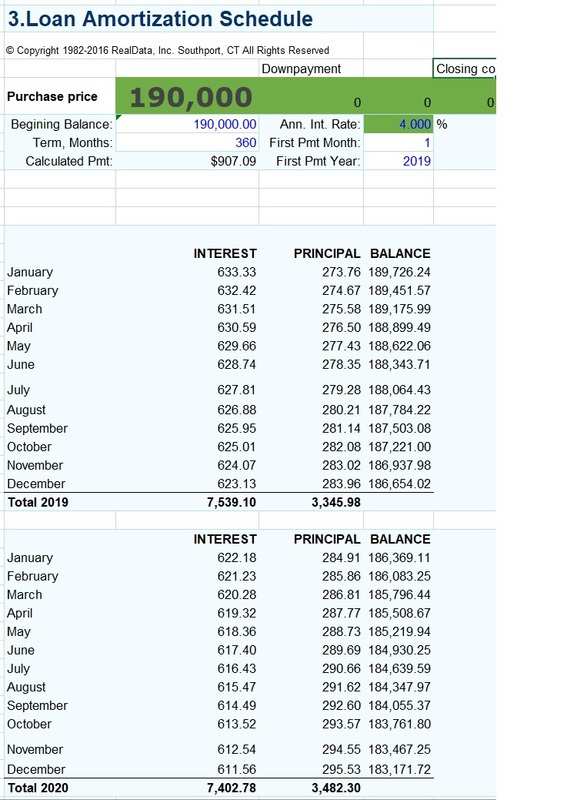

If you use 5k out of your creditcard with a interest rate of 20% annually and put it on a 190k mortgage with 4% on the principal with 30 years than this is what happen.

You pay a little over $400 for the 5k creditcard cash in advance. Look at my screenshot. You pay it off with $700 per month, if you can do more the better. You have it paid off in about 8 months.

With 190k Mortgage you are paying over 7,5K in interest the first year and in the second year you still pay 7,4k just in interest. But look at the right side, when you are using your 5K of your credit card and pay it towards the principal you are saving around 10K in interest or 1.5 years. It just cost you little over $400 and monthly savings.

Please watch the velocity banking video if you like this strategy it also explain you in detail how you can come up with extra saving.

All in all it will reduce your mortgage lifetime dramatically.