All Forum Posts by: Ricardo Hidalgo

Ricardo Hidalgo has started 13 posts and replied 532 times.

Post: How would you start investing if you had $150k???

Post: How would you start investing if you had $150k???

- Real Estate Agent

- Posts 552

- Votes 253

Quote from @Jeff Hines:

Hey everyone,

I am a 28 year old who currently lives in NC. I just want to explain my circumstances and see how people with experience and knowledge in real estate would move forward if they were in my shoes. I have $150k in cash that I received from an inheritance and would like to use it to invest in real estate(I already have 6 months of reserves of my own money saved). I also have a credit score of 756.

My overall goal is to buy enough doors to supplement working full time so one day I can focus full-time on becoming an entrepreneur. I know that will take some time but I would like to get started ASAP! I took a few years out of work to take care and spend time with a family member whp passed, so I have only been working for a year now. This has caused me to have trouble with getting approved for loans/mortgages due to my work gap. I have done some research and have found a few ways I could possibly start investing in real estate. If you would take a different route than the ones I’m going to list below please let me know.

- Since I can’t afford to pay cash for a home here in North Carolina, pay cash for a home in places like Detroit, Alabama, or Ohio. I would then renovate, rent, and refinance. Rinse and repeat this process over time.

- Instead of paying cash use that money and spread them over multiple dscr loan so I can own more doors and just collect the cash flow after expenses.

- Wait another year so I can have two years of work history/W-2s. This would increase my chances of being approved for a FHA loan. This would allow me to save money compared to paying cash or the huge Down-payment DSCR loans require.

Are there any other no documentation loans other than DSCR loans that I should look into?

If anyone has any advice or recommendations on how you would get started in real estate if you were in my shoes please let me know any and all suggestions would be greatly appreciated!

Learn to scale that money. Do not get stuck with sub par returns. Learn to outperform the market by looking at property entry values and resale values based on improvement. Im 27 and I turn 100k to 650k in 2 years by doing this.

Post: Best places to invest!

Post: Best places to invest!

- Real Estate Agent

- Posts 552

- Votes 253

Quote from @Matthew Weirath:

Hey everyone I'm trying to do an informal poll. Let me know what you think is the best market to invest in right now and why. I'm curious what the collective thinks.

I like the panhandle of Florida since we are going through an infrastructure boom and residential at the same time. Our market is strong because a lot of the feeder markets around us continue to buy and invest money in our area. We have seen tremendous amounts of appreciation and more buyers are funneling in to the new markets around us.

Post: Redeploying 500k equity vs Low 500k mortgage rate

Post: Redeploying 500k equity vs Low 500k mortgage rate

- Real Estate Agent

- Posts 552

- Votes 253

Quote from @Peter Morgan:

Hello,

Since both refinancing and HELOC are both expensive at this time. What would you advise to someone who has 500k equity (post taxes and fees) and 500k with a low interest rate of 2.5?

Is it possible to redeploy 500k in another investment including Syndication to substantially offset with much better returns the advantages of a low 2.5 interest rate? Appreciate your inputs on this.

Thanks

I would focus on good entry value add positions. Try to go for 25% return or more after force appreciation play is completed. That should still yield you a solid COC return and better equity multiple as market picks up again.

Post: Where should you buy Real Estate? And When? It's Simple, Buy Green.

Post: Where should you buy Real Estate? And When? It's Simple, Buy Green.

- Real Estate Agent

- Posts 552

- Votes 253

Quote from @Andreas Mueller:

Hi BP Community! Thought I would share my brief, hopefully insightful, dive into real estate and/or financial markets.

Today we’re keepin’ it short, but not light, it being the holidays and all, and let’s be honest, you are going to have some down time for contemplation. Where should you be looking to invest in real estate? The simple answer may surprise you. Plus, a personal story from a property I recently sold. It’s heavy.

Today’s Interest Rate: 7.32%

(👇 .08% from this time last week, 30-yr mortgage)First, a super brief look at mortgage rates, which are in a trend down, albeit a short one, as we saw toward the end of 2022.

|

My take: this trend will continue, especially if the Fed signals a pause in rate hikes and/or cuts in 2024, as the large investment banks are predicting.

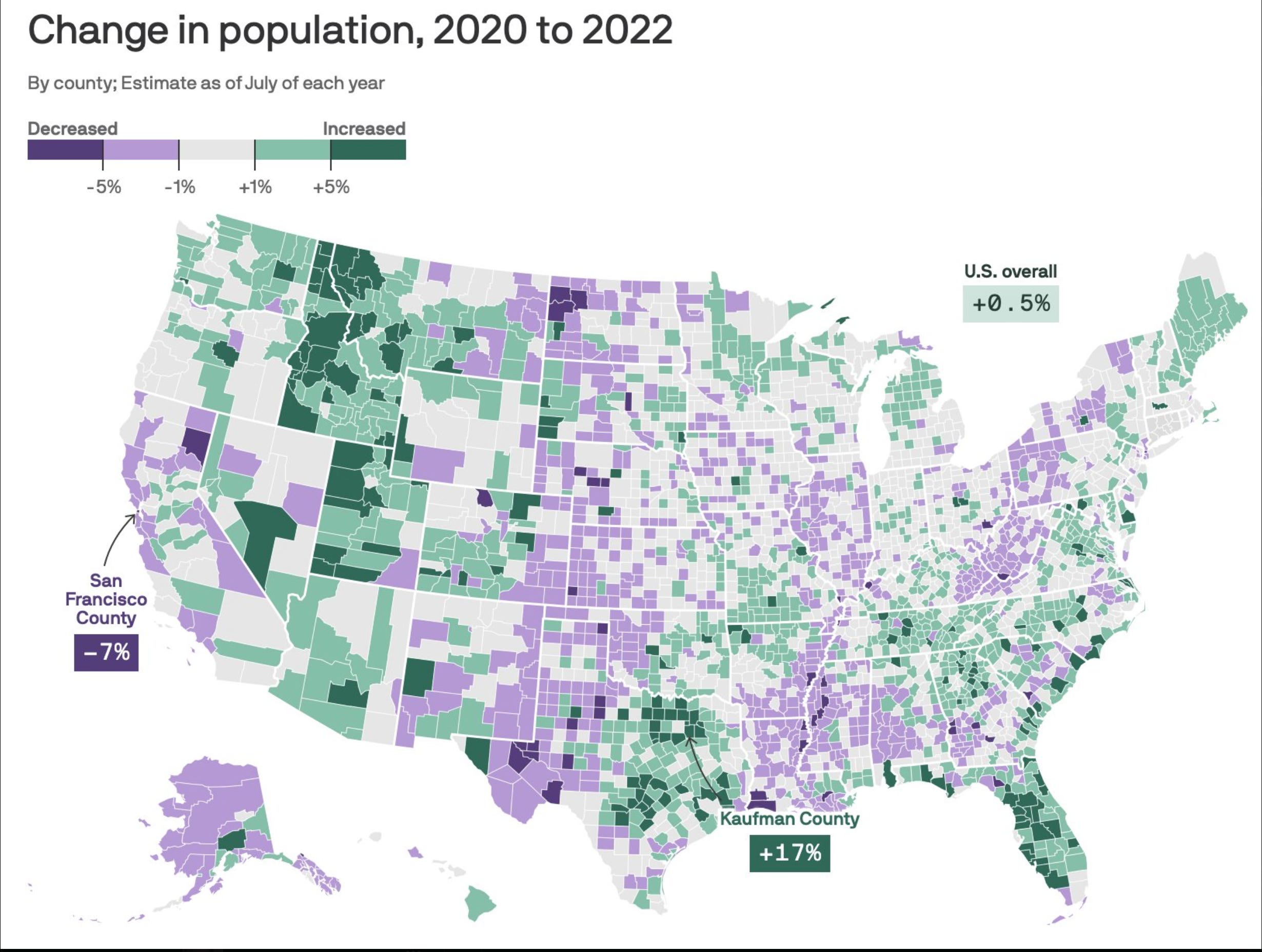

Where to ‘Real Estate?’So where should one invest in real estate? And when? In short, if it’s green buy now.

|

This chart says it all. Buy green, sell purple, redeploy capital to dark green, and avoid dark purple like the plague.

At its center, that’s all real estate is. Buy in growth areas, were people not only want to live but are actively moving to. Keep up on the population trends and sell to redeploy capital so you are always in the green.

Don’t believe me? Let me tell you a story. (Queue cut-away scene)

Most of my real estate portfolio is in and around Nashville, TN (dark green). However I also own one last property in DC, where I lived and worked for 17 years in my previous lift, and invested in rentals for most of that time. In just the last 1.5 years DC has gone from green to purple. Dark purple, especially in the B class neighborhoods, interestingly enough. Under my nose, and I admit I wasn't paying enough attention, a 15+ year trend quickly reversed: from buying a nice rowhouse after getting your first decent government job, which ostensively never relocates and always requires you to be in the office, to, screw that lets move a few minutes out of the city, get a much larger home with some land because I’ll just commute, and likely only have to do that 3 days a week. If that. Importantly, DC city and Federal government lockdowns were pretty stringent for 2 years, providing an extra incentive to bounce to the suburbs. This trend may reverse, but that’s the trend.

Because of this, home prices in much of DC, more so than the major cities, have stood still for 2+ years. To put this in perspective, my home market of Nashville saw annual price increases of 19%. Each year.

This year (not during covid or previously) I had two tenants in a row who were constantly late and/or didn’t pay the rent. So this early fall, when I went to turn over the leases and find new tenants, I was met with even more difficulty in both the number of and quality of potential residents. This 2023 trend confused me. I had easily found tenants in the past, and until this year, they were always great folks.

|

What was the problem? One thing I hadn’t accounted for was a confluence of 2 events: a ton of new supply of nice rental apartments competing with homes, interest rates driving down demand/affordability of homes and driving up demand for high-quality apartment rentals, families and other folks leaving DC for the suburbs, and significantly increased crime (also favoring apartment buildings vs single homes). In fact, Crime has gotten DEFCON level - ‘San Francisco’ in DC, I’m earnestly sad to report.

Anecdotally, not too far from my home a young man was killed when trying to carjack the car of an off-duty police officer. This man was wanted for several other carjackings as well. This “man”… was 13 years old. His accomplice, who was just arrested, was 12. As of October 1st, there have been 827carjackings this year in DC. Including to Member of Congress. Holy hell.

It wasn’t just the crime so don’t solely focus on that; I realized all of these things too late. So last month I decided to cut bait and sell. I’ll make a few bucks, but not much. Why am I selling when I have a 3% mortgage? It’s all about return on equity, and I recommend everyone do this every year. Ask yourself, how much equity (value/wealth) do I have in this property and what return am I making from it? If I sold and redeployed this capital into another property, would my 5-year return (my timeline of measurement) be higher? If so, sell and redeploy. And make sure to include all forms of investment income from the property when calculating the return, not just that rental check:

- - Cash flow and expected rent increases in the next 5 years

- - Estimated natural appreciation

- - Principle pay down of mortgage

- - Forced appreciation through a renovation (I couldn’t since I already did this)

- - Tax depreciation (3.6%/yr)

- - Non-Financial: crime, tenant quality etc…

- - Did I hit all the highlights @davidgreene? :)

Bottom Line

Learn from me, monitor your investments everyone. Especially if you have a property manager telling you everything is roses. You may still be getting that same rental check but how is the asset doing? Are there any emerging local trends that may cause concern? How can you asset manage the property better? For example: It may make sense to build a deck or landscape the backyard to keep top-quality residents and / or increase rents. In a high mortgage interest rate environment reinvesting in your current properties may make more sense than buying another property.

Should you redeploy? Is the property green or purple? Run the numbers, double check that every dollar you have is still a little worker bee making you the highest return on equity, even when you’re sleeping.

And above all, never lose money. That’s rule number 1 and 2.

Stay Green Y’all.

That’s it for this week. If you are interested in digging deeper into these ideas or talkin’ real estate investing - which I always love doing - don’t hesitate to reach out. You can direct message me on BP!

Until next time, stay Aware, stay Skeptical.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.

The panhandle on the emerald coast has stayed very busy this quarter. I am seeing buyers from Texas or Georgia doing 1031 exchanges to equity based positions on the beach. Many of them are using some of these acquisitions for tax purposes and creating great positions for cashflow or equity multiple into the future as the market starts to recover in the future.

Post: What States are STR investors buying in right now?

Post: What States are STR investors buying in right now?

- Real Estate Agent

- Posts 552

- Votes 253

Quote from @Jason Shackleton:

Considering the ever-evolving landscape of Short-Term Rental (STR) regulations, What are the best 5 states in your opinion to build a STR portfolio starting today? What States are STR investors buying in right now?

Panama City Beach, Miramar Beach and 30A has been busy for equity or cashflow based investors. Demand has stayed consistent this year and end of year has been crazy busy with tax depreciation purchases or value add.

Post: Will low interest rates cause the market to crash upwards?

Post: Will low interest rates cause the market to crash upwards?

- Real Estate Agent

- Posts 552

- Votes 253

I think the reverse market crash Is already happening.

Look at stocks and price of bitcoin. Almost 100-120% than the all time lows and support levels seem strong.

In addition, we are seeing real estate investors coming back to buy for tax depreciation purposes and 1031 exchange. I think the time to accumulate is ending since market direction is becoming more clear due to rising assets.

Post: Newish to real estate

Post: Newish to real estate

- Real Estate Agent

- Posts 552

- Votes 253

Quote from @Kyle Moreau:

Good evening,

so happy to be here, and look forward to getting involved in the world of real estate investing. I've been thinking about getting involved for some time now, just can't seam to pull the trigger. I've purchased homes before. Just not for investment purposes. I would like some advice on lenders on what my options there are and what is the best route to go. To one day not be dependent on a job. Would be my end goal. But for now just starting would be great.

You could always buy new construction homes and have all cost covered for little to no downpayment. Leave the home after a year to rent it out and do it again. Typically new construction will have warranties and less maintenance cost. Plus it saves you more money buying new for insurance purposes.

or

You could do value which means renovating older properties to have the force appreciation. It just depends how much time or passive you want this to be!

Post: Looking at short term rentals for the first time. Need advice

Post: Looking at short term rentals for the first time. Need advice

- Real Estate Agent

- Posts 552

- Votes 253

Quote from @Steve Maye:

I have have had 2 long term rental properties for about 10 years. Now I am considering a short term rental in an area like Florida or Gulf Shores, AL. I would like to be able to use it when it is not rented. I was a bit turned off when looking at condominium fees and other expenses, but then remembered I may be able to deduct these on my taxes.

I would be living in Tennessee and would need the property managed. Are there property managers who specialize in handling short term rentals like this? I would like to know what I would be getting myself in to. What costs to expect.

I am sorry for such a newbie question. Even if you just had a link to where I could read about this it would be appreciated.

We have one in Gulf Highlands that is 958 a quarter which includes 11 pools, tennis courts, pickleball courts, deeded beach access, restaurant on site, goofy golf and other amenities. You can find options under 350k that can do 40k plus on rental income. Currently our unit is at 95% occupancy for the last quarter.

Post: What states do Californians invest in?? Driveable & Flyable

Post: What states do Californians invest in?? Driveable & Flyable

- Real Estate Agent

- Posts 552

- Votes 253

Quote from @Amanda Shilling:

I’m in Orange County, CA, and prices are way too high to invest here (plus not landlord-friendly friendly I've already executed two evictions).

What states are investors from CA investing in?

I own my home here, and another property, and sold two homes in northern CA, which was a very sketchy city needed out. But stuck on where to invest that's driveable or closely flyable. Thank you 🙂

We get people from California that invest on the Emerald Coast. They like it because you can gross 10-15% of the purchase price with solid 8-10% annual appreciation. You can find brand new construction with low home owners insurance. In addition, the properties are very versatile whether it is a short term rental or mid term rental.

Post: Under $350k deal with positive cash flow

Post: Under $350k deal with positive cash flow

- Real Estate Agent

- Posts 552

- Votes 253

Quote from @Yehuda R.:

Hi

I'm looking for positive cash-flow properties that has a potential of appreciation as well for $350k or under.

With current interest rates, mortgage payments will be quite high so I will need some kind of property that can generate some monthly income (even if it is very little).

Which markets should I be looking at that can be cash-flow positive but could also appreciate rapidly in the next five to ten years? I am looking for a single-family (or multi-family property) and will buy and hold.

Have you looked into value add in Panama City Beach? We did one for STR that can be used as an MTR as well. We are 95% booked the last quarter!