All Forum Posts by: Ryan Thomson

Ryan Thomson has started 135 posts and replied 1464 times.

Post: House hacking math doesn't add up

Post: House hacking math doesn't add up

- Real Estate Agent

- Colorado Springs, CO

- Posts 1,498

- Votes 1,346

Second long post alert. Here is another way of breaking down why house hacking is a great investment even if it doesn't cashflow.

It has become increasingly difficult to cash flow with house hacking. Despite this fact, the return on your investment (ROI) is incredible enough that it still warrants exploring buying real estate with the house hacking strategy. Home prices have increased substantially in the last couple years and interest rates have doubled. It is difficult to cashflow in year one of your house hack for a couple additional reasons: 1. You are living in one of the rentable units 2. You are only putting 5% down so your loan amount is much larger and therefore your mortgage payment is higher.

In this article we will dive deep into the 4 big ways that house hacking makes you money, even if it doesn't cashflow. You need to consider how much the down payment returns to our net worth. To calculate your Net Worth ROI for house hacking, you'll need to consider four factors: appreciation, loan paydown, tax benefits, and rent avoidance.

Appreciation:

Appreciation is the increase in value of your property over time. On average, real estate appreciates at a rate of around 3-4% per year, although this can vary greatly depending on location and other factors. For example, if you buy a house for $500,000 and it appreciates at a rate of 4% per year for five years, it will be worth $608,280. This increase in value would add $108,280 to your net worth.

Loan paydown:

Loan paydown is the reduction of your mortgage balance over time. Every time you make a mortgage payment, a portion of it goes towards paying off the principal balance of your loan, which increases your equity in the property. Over time, your mortgage payments will consist of less interest and more principal, which means more of your payment is going towards building equity. This reduces the amount of debt you owe and increases your net worth. For example, if you have a 30-year mortgage for $500,000 with a 6.4% interest rate, after five years you will have paid off around $31,807 of the principal balance. This reduction in debt would add $31,807 to your net worth.

Tax benefits:

Tax benefits are the deductions you can take on your income for expenses related to owning and operating a rental property. This includes things like property taxes, mortgage interest, repairs, and depreciation. These deductions can significantly reduce your taxable income and increase your net worth. For example, if you own a rental property that generates $20,000 in rental income per year and you have $15,000 in deductible expenses, your taxable income would be reduced to $5,000. In the 40% tax bracket this reduction in taxable income could save you around $2,000 in taxes per year, which would add $2,000 to your net worth. You have to actually be cash flowing for this benefit to take effect. Or be a real estate professional and be able to deduct against your professional source of income (another topic for another day).

Rent Avoidance:

Rent avoidance is the amount of money you save by living in one of the units you own instead of paying rent elsewhere. One of the most significant advantages of house hacking is rent avoidance. When you own a house hack, you are not only generating rental income, but you are also avoiding paying rent. When running numbers on a house hack include how much you are currently paying for rent (or how much you would pay to rent a comparable property) vs how much of the PITI and budgeting expenses are left for you to cover. For example, let's say your alternative to buying a house hack is renting a one-bedroom apartment for $2,000 per month. Let's say that once your tenants pay you rent you still have about $971 in PITI. You need to budget and an additional $929 to set aside for future budgeting items (vacancy, maintenance, and capital expenditures). Your total expenses to live in this house are $1900/month. Renting would cost you $2,000/month. Your rent avoidance is $100/month, $1,200/year, and $6,000 over 5 years.

Taking these four factors into account let's calculate your net worth ROI for house hacking.

Your net worth ROI calculation over 5 years would look something like this:

Appreciation: $108,280

Loan Paydown: $31,807

Tax Benefits: $0 (b/c you aren’t cash flowing)

Rent Avoidance: $6,000

Total Net Worth Increase: $146,087

To calculate your net worth ROI over 5 years, you would divide your total net worth increase by your initial investment (your down payment of 5% or $25,000). $146,087/$25,000=584% This is an incredible return on investment. You will be hard pressed to find a better return elsewhere in the world. Simple Interest Rate of Return = 48.67%/year.

Let's change things up a little bit and say your situation isn't so rosy. Let's say you can only rent the other side for $1500 and that your current rent is only $1,000. The payment you still need to pay (after rental income) for PITI and budgeting items is no longer $1900 but $2,400/month. Your alternative to buying is renting for $1,000/month. If you decide to buy this house, you are negative $1400/month for five years. Does it still make sense to house hack? $1,400 x 12 months x 5 years = -$84,000.

Net Worth ROI Calculation (new situation):

Appreciation: $108,280

Loan Paydown: $31,807

Tax Benefits: $0 (b/c you aren’t cash flowing)

Rent Avoidance: -$84,000

Total Net Worth Increase: $56,087

ROI = 56,087/25,000=224.35%

Simple interest rate of return = 18.7%/year

House hacking can be a great way to build wealth and get into the real estate game. While it may not always provide immediate positive cash flow, the long-term benefits of owning a property that is generating rental income while also providing a place to live can be significant.

When considering the ROI of house hacking, it's important to look beyond just the monthly cash flow. By factoring in appreciation, loan paydown, tax benefits, and rent avoidance, you can see a substantial return on your investment in the long run. Additionally, when compared to the alternative of paying rent every month and not building any equity or wealth, house hacking is a clear winner.

Of course, everyone’s financial situation is different, and it’s important to run the numbers and make sure that house hacking makes sense for you. But for those who are willing to put in the work and make some sacrifices in the short term, the potential rewards can be well worth it. So if you’re considering buying a home, don’t overlook the possibility of house hacking as a way to get started on your path to building wealth through real estate.

Post: House hacking math doesn't add up

Post: House hacking math doesn't add up

- Real Estate Agent

- Colorado Springs, CO

- Posts 1,498

- Votes 1,346

Long Post alert but here are two blogs I've written in the past:

The first is why House Hacking is better than renting. And just because you can't scale at the moment doesn't mean you should avoid one great investment.

RENT or BUY?

Interest rates and high purchase prices are pushing a lot of people away from buying. Most are turning to renting, but is that the best move right now? Will House Hacking prove to be better than Renting over the span of the next 5 years? That’s what this blog is all about. To effectively evaluate the financial implications of renting versus house hacking, we’ll dive deep into the numbers and walk you through how we calculated them. We’ll also make sure to address the opportunity costs associated with Renting and House Hacking.

Here are the numbers we are going to use in this blog. They are very realistic numbers for what you would experience as a house hack buyer or renter in Colorado Springs.

Buyer – Buying a 450k home at a 6.625% interest rate with a 5% downpayment ($22,500). The home has 5 bedrooms and you are renting out four of them for $600 each ($2,400).

Renter – You are paying $1,200 in rent for a decent 1 bedroom apartment in Colorado Springs. You just signed a year lease. According to Apartments.com the average rent of a 1 bedroom apartment in Colorado Springs is $1,308/month and only 662sqft.

When you rent you are giving up a lot of the benefits of owning. We will start with those. Then we will talk about what you give up when you House Hack. Focusing purely on the numbers.

Opportunity Cost of Renting: No Appreciation

Let’s start by understanding the concept of appreciation in the context of real estate. Appreciation refers to the increase in a property’s value over time. Since 1993 (the oldest median sales price data from Pikes Peak Association of Realtors) homes have appreciated at a rate of 5.38% per year. (Median price in Jan. 1993 $88,775. Median Price in Jan. 2023 $450,000). For that reason, we will assume a smaller 4.5% for the annual appreciation of real estate in Colorado Springs.

To calculate the total appreciation value at the end of five years, we use the formula:

Future Value = Present Value × (1+Appreciation Rate)^n

For a property with a purchase price of $450,000 and an annual appreciation rate of 4.5%, the value after 5 years can be calculated as follows:

Future Value = 450,000 × (1+0.045)^5 = 560,781.8719

560,781.87 – 450,000 = 110,781.87. This is the amount of value you are expected to gain in the next 5 years. This is a very real value that you can cash in on by selling the property or pulling a HELOC and reinvesting.

Appreciation details and assumptions:

While real estate appreciation is not guaranteed, historical trends can offer some predictive insight. It’s essential to recognize that all investments carry assumptions and risks, but informed decisions are based on historical data and trends. We showed above how we got the 5.38% annual appreciation and we chose a more conservative number of 4.5% annual appreciation.

One of the unique advantages of real estate investment is leveraged appreciation. By putting down a small percentage of the property’s value (e.g., 5%), you control 100% of the property and benefit from 100% of the appreciation, despite the bank financing the majority of the purchase.

What do I mean by that? Let me set up an example here. Let’s say you bought a $100,000 house for 5% down ($5,000) and the home appreciates 5% in the first year. After year one the home is now worth $105,000. Your home is worth $5,000 more and you only invested $5,000. That is a 100% return on your downpayment of $5,000, in just the first year. That is the power of investing in real estate. You get to keep all of the appreciation. Even though the bank gave you $95,000 to buy the home, they get none of that appreciation.

Opportunity Cost of Renting: No Loan Paydown

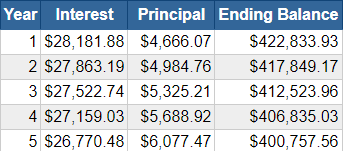

When you own a property with a mortgage, part of your monthly payment goes towards paying down the principal which reduces the amount of the loan. For a $450,000 property with a 6.625% interest rate, the principal reduction over 5 years can be calculated using an amortization formula, revealing a significant amount of equity built through loan paydown alone.

Take a look at the table below. This is pulled from an amortization schedule of the loan from the $450,000 house at 6.625% interest rate. You can find an amortization calculator easily on google. In the first five years you will pay the loan down $26,742 (the total of the rows in the “Principal” column). That number grows as the years go on and you pay more principal and less interest.

Now what about that interest number? You’d say “that’s a lot of money going to interest every year”. And you’d be correct, but your house hacking tenants will be paying for most of that. Furthermore, you can deduct the interest payments against your rental income. Something you can’t do with rent. We will factor in those large interest payments later in the blog.

Opportunities of renting: Put your down payment in another investment

With any investment you have to consider your opportunity costs. In other words, where else could you have put your money and would that have performed any better for you?

Alternatives to using your cash to buy a Home:

S&P 500 Index:

Assumption based on history: For the last 100 years this index fund has average annual returns of 10.13%. This sounds good, but as I will illustrate later in this blog, it pales in comparison to real estate.

Details: The stock market is known for its volatility. The high returns come with significant risk. For example, 1995 saw a 37.20% increase. But 2002 saw a 21.97% decrease. 2022 saw a 19.44% decrease. 2023 saw a 24% increase.

U.S. Treasury Bonds:

Assumptions: A very safe investment. It comes with its own assumptions, like any investment. The assumption here is that the US government will continue to be a government and will not default on its loans. Seems pretty safe compared to other investments.

Details: They are considered safer, but typically offer lower returns compared to stocks and real estate. Currently around 4-5% interest annually. And it doesn’t compound.

Overall numbers after 5 years of renting:

Assuming rent increases at 3.5% per year you will be paying $1,377/month in 5 years from now. Over the span of 5 years you will have paid $77,220 towards rent.

However, you’re $22,500 downpayment invested into the S&P index fund at our assumed rate of 10.13% compounded annually will be worth $36,236.48

Leaving you a net living cost of $36,236.48 – $77,200 = ($40,963.52)

Overall numbers after 5 years of house hacking:

Expenses include: Principal, Interest, Taxes, Insurance, Repairs/Maintenance, and Private Mortgage Insurance.

You will have paid $164,239.76 towards your principal and interest

You will have paid an estimated $20,914 in property taxes and insurance

You will have paid $5,400 in private mortgage insurance

You will have paid an estimated $10,859 towards repairs and maintenance

For a total expense of: $164,239.76 + $20,914 + $5,400 + $10,859 = $201,412.76

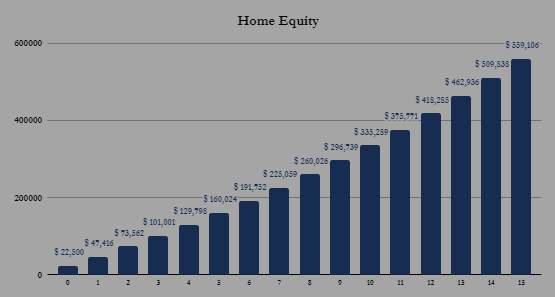

However, here are the positives to your net worth: Appreciation, Loan Paydown, Rent payments from Tenants

You’re home will have appreciated to an estimated value of 560,7812 an increase of $110,782

You will have paid down your loan by $26,742

Your tenants will have paid $154,439 in total rent

The total benefits add up to: $110,781.87 + $26,742 + $154,439 = $291,962.87

House Hacking net worth boosters minus expenses = $291,962.87 – $201,412.76 = $90,550.11

(The home equity for year five is calculated using the downpayment + appreciation + loan paydown)

House Hacking Vs Renting

House Hacking net worth after 5 years: $90,550.11

Renting net worth after 5 years: ($40,963.52)

Leaving you a net worth benefit of $90,550.11 – ($40,963.52) = $131,513.63

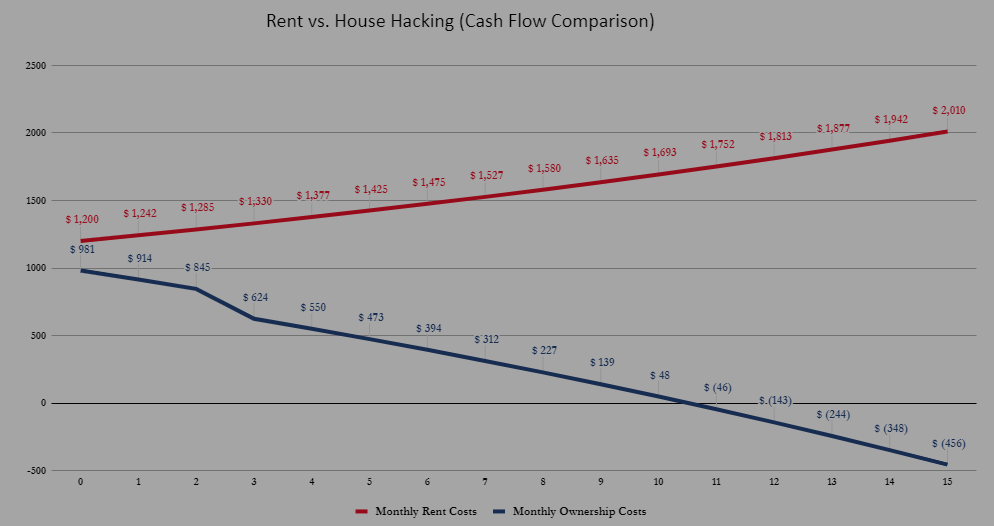

Here is a screenshot from our calculator on the difference in monthly payments between Renting vs House Hacking

The winner is clear. As rents continue to rise, renting will only cost you more money every year. House Hacking provides significant financial benefits through appreciation, loan paydown, rental income, and tax savings. The decision to rent or house hack should be informed by all of these factors, considering both the risks and the historical performance of the real estate and rental markets. We have an amazing rent vs house hack calculator that will do all of this math for you (pictured in graphics above). You can even change the assumptions for several factors (rent appreciation, home appreciation, rent payments, etc) if you think mine are too aggressive. Download the free calculator here.

After seeing these numbers our client’s often want to house hack, but are concerned they can’t afford the downpayment or qualify for a mortgage loan. They often do qualify and I bet you could too. Here is how!

- Concerned about downpayment. We work with downpayment assistance lenders that can give you a 0% interest loan to cover your downpayment. You only have to bring $1,000 to buy the home. If we negotiate seller credits you may even get paid to buy a home! You pay the down payment assistance loan back when you sell or refinance your home. It’s free money in the meantime. You can’t beat that!

- Concerned about credit? – You can qualify for a loan with a credit score above 500. Credit scores can actually be improved quite quickly. If you need to improve your credit score, we can introduce you to a credit repair program we work with.

- Concerned about qualifying? – set up a time to speak with us today about your debt and income and we can get a great idea in less than a day if you will qualify. It’s easy.

Extra thoughts:

- I did not include the cost to sell in this scenario because in this scenario we are imagining holding the property for longer than 5 years.

- Extra benefit towards house hacking:

Down Payment assistance – If you make less than 150k you can qualify for down payment assistance. This is a 0% interest loan for almost all of the downpayment required. You don’t have to pay it back until you sell or refinance your house. Let me say that again 0% interest loan.

3. This doesn’t include the potential tax benefits.

Total mortgage interest over 5 years = $137,497. This is deductible in proportion to the % of your home that is used as purely a rental (the bedrooms). Let’s assume the 4 bedrooms are 25% of the square footage of your home.

Let’s say you make $80,000/year and you are in the 22% tax bracket.

This will reduce the amount you have to pay on taxes over five years by: (Mortgage interest) x (tax bracket) x (the percentage of home used as rental) = $137,497 * 0.22 * 0.25 = $30,249.34 in tax savings.

https://www.irs.gov/publications/p936

https://www.irs.gov/help/ita/can-i-deduct-my-mortgage-related-expenses

Post: First time, HELOC for capital?

Post: First time, HELOC for capital?

- Real Estate Agent

- Colorado Springs, CO

- Posts 1,498

- Votes 1,346

@George Baal HELOC allows you to use the equity in your home instead of it sitting there doing nothing. If you have a good business plan for the next property it could make a LOT of sense.

Post: How do I find tenants for a house hack?

Post: How do I find tenants for a house hack?

- Real Estate Agent

- Colorado Springs, CO

- Posts 1,498

- Votes 1,346

I've thought a lot about this....

Not being able to find tenants is one of the biggest fears beginning house hackers have when they first get started. I talk with my clients in Colorado Springs about it all the time.

Fears:

The number one fear among house hackers is the inability to find tenants, which can significantly impact your ROI and rental income. However, it's important to remember that this fear stems from the unknown. Once you've experienced the successful rental of your first house hack, this fear diminishes. In reality, finding tenants is quite easy, especially if you follow these steps to reduce your risk of vacancy:

Living in a growing city in a desirable location increases your chances of finding tenants. In addition to that, the current housing shortage creates a demand for affordable housing, making renting rooms even easier to do. Be willing to adjust the rental price if necessary to attract potential tenants.

Implement the following steps to increase your chances of finding suitable tenants and minimize vacancies.

Generating Interest and Attracting Potential Tenants:

Making the Listing

Take professional photos! You can use them every time you need a new tenant. If you can’t afford professional photos you shouldn’t be house hacking.

Make sure your listing description includes the following items:

- Rent

- Is utilities included or not?

- Credit score requirement

- Job/income requirement

- Description of yourself and other tenants

To maximize your reach and find potential tenants, utilize various platforms, including:

- Craigslist

- Apartments.com

- Zillow

- Roomster

- Roommate.com

Responding to Inquiries

Once you create an awesome listing you will start to get inquiries. While you may receive numerous inquiries from individuals casually browsing listings, focus your time and energy on serious prospects. Make them earn your attention by demonstrating genuine interest.

Ask them an easy question back to see if they are interested. I usually start with something like this:

“We require a 550+ credit score as well as a current job paystub or a co-signer who meets these requirements. The move in date is August 1. Does all that work for you? “

If they answer “yes” you are on to the next set of screening questions. I use this: “I have a couple questions for you to make sure it’s a good fit for you. Please answer these. Then we can go from there: “What is your Job? Only you? Pets? Move in date? Estimated length of stay? Any questions for me?”

Based on those answers you can decide if you want to set up a showing with them.

Before we talk about streamlining showings, I want to share a hack with you during the initial screening phase.

Prepare templated questions in advance to streamline the process and utilize text replacement features on your smartphone for efficiency. For example, all I have to do is type “rental1” in my iPhone and it will replace it with that first reply. I type “questions1” in my iPhone and it replace it with all of the questions I want to ask.

Setting up showings:

Do as many as you can in a one or two hour block. Tell potential tenants when you are going to be showing the house and make them work around your schedule. I like to schedule 15 minutes showings back to back and get several qualified potential tenants to come during the same window. While we are there I make sure I get a feel for the tenants and how I would get along with them. Tell them you will send them an application with background check, credit check, and eviction history. Ask them if there is anything that might come up on their reports that they want to let you know about?

Choosing the tenant:

When you are house hacking there is no fair housing laws. You can pick who you want to live with. I would recommend deciding based on these criteria:

- Will you get along with them and if they are a good fit for the house.

- Do they have the basic credit, income, and eviction history that you require.

Getting Leases and admin stuff set up

Use e-sign technology to get leases signed. I like Doc Hub and you get 5 free document signatures a month.

Once the lease is signed set them up with software you are going to use. The best software I’ve found for managing tenants are Apartments.com (formerly COZY) or Rentredi.

Personally I use apartments.com. With Apartments.com I can automate rent payments, have the security deposit paid, and have tenants upload their proof of renter’s insurance.

Challenges of living with other roommates and renting by the room

When living with roommates there are always challenges. More often than not it is enjoyable and a great way to make new friends. Here are some of the challenges I’ve faced with rent by the room house hacking:

Dishes!! People not doing them is annoying. Set up a chore list. Set an expectation that no one leaves their dishes in the sink. Create a chore list and if someone misses make them buy the house beer or do everyone’s chores the next week.

Drama between tenants. Facilitate conversation and get people to talk like adults.

Tenants not paying on time. Require autopayment set up in the lease. Use Apartments.com to do this. Have a lease in place that gives you some options if tenants aren’t paying on time. Enforce the late fees every time to incentivize on time payments.

You can do this!

With the outlined steps and strategies, you can overcome the fear and stress associated with finding tenants for your house hack. With these steps you can reduce your risk and your time. Remember that living in a growing city and providing affordable housing will attract potential renters. By creating an appealing listing, responding to inquiries efficiently, conducting effective showings, and choosing the right tenant, you’ll minimize vacancies and maximize your rental income. Additionally, setting up leases and utilizing software platforms will simplify administrative tasks. With these tips in mind, you’re well on your way to successful house hacking. Don’t be discouraged—finding tenants is an achievable feat!

And remember to declare your rental income on your taxes so you can use that income to help you qualify for the next house hack!

Post: ADUs - Opinions on Critical Upgrades and Features for Added Value

Post: ADUs - Opinions on Critical Upgrades and Features for Added Value

- Real Estate Agent

- Colorado Springs, CO

- Posts 1,498

- Votes 1,346

I have done two garage conversions in Colorado Springs. They have worked great for me. Here are some considerations for making a garage conversion into a good apartment:

- Local Permitting: you’ll want to check with your building department to see if a conversion like this is allowed in the current zoning of your home. You don’t want to spend all the money to convert a garage just to have it be illegal.

- Structural integrity: One of the most important considerations is the structural integrity of the garage. If the garage is not built to support the weight of additional floors or is not adequately reinforced, it may not be suitable for conversion.

- Insulation: Another important consideration is insulation. A garage that is not properly insulated may be uncomfortable to live in and may not meet local building codes for habitation.

- Heating and cooling: In order to make the garage comfortable to live in, you will need to install heating and cooling systems. This may involve adding ductwork, installing a separate HVAC unit, or using portable heating and cooling units.

- Electrical: Another important consideration is the electrical and plumbing systems. You will need to install outlets, switches, and lighting fixtures as needed,

- Plumbing: You will almost certainly need to connect all drains to the sewer and bring in water lines.

- Windows and doors: To provide natural light and ventilation, you will need to add windows and doors to the garage. This may involve cutting through the exterior walls and installing new openings.

- Shower: To add a shower, you will need to install a drain in the floor of the garage and run plumbing lines to the location of the shower. You will also need to install a shower pan, a shower enclosure, and a showerhead.

- Kitchenette: To add a kitchenette, you will need to install plumbing lines to the location of the sink and any appliances you plan to include, such as a mini-fridge or microwave. You will also need to install cabinetry and countertops, and you may want to consider adding a small stove or oven if you plan to do more extensive cooking in the space.

Post: What are house hacking strategies that others overlook in an expensive area?

Post: What are house hacking strategies that others overlook in an expensive area?

- Real Estate Agent

- Colorado Springs, CO

- Posts 1,498

- Votes 1,346

Hey @Tori Trent In Colorado Springs, we also have a couple of other strategies that work well besides just standard duplexes. These may work for you.

1. House and Cottage

2. Converting a garage

3. Converting a basement

4. Converting one side of the house to a separate unit.

Post: Real Estate Investor & House Hacker Meetup

Post: Real Estate Investor & House Hacker Meetup

- Real Estate Agent

- Colorado Springs, CO

- Posts 1,498

- Votes 1,346

Meetup in Colorado Springs next week! It's at Goat Patch Brewery. Hope to see you there.

Post: Real Estate Investor & House Hacker Meetup

Post: Real Estate Investor & House Hacker Meetup

- Real Estate Agent

- Colorado Springs, CO

- Posts 1,498

- Votes 1,346

Hi BP Community!

Are you interested in joining a community of local, like-minded real estate investors designed to learn and grow together? If so, then we welcome you to join us for our meetup centered around creating community and sharing experiences related to Real Estate investing and House Hacking in the Colorado Springs area.

Meetup Speaker: Ryan Dekker with over a decade of experience in entrepreneurship, notably founding and leading a successful software company for 13 years before its sale in 2021, Ryan transitioned into the real estate sector. Ryan now manages a portfolio of 15 diverse rental units, specializing in short-term and commercial rentals.Topic: Come hear about Ryan Dekker’s real estate story. Including his multiple STRs and even his inflatable yurt in Cripple Creek! It will be a good one.

See you all at Goat Patch Brewing!

Meetup Link: https://www.meetup.com/house-hacker-mafia-real-estate-invest...

Post: Need Advice on finding and screening tenants for Single-Family House hack

Post: Need Advice on finding and screening tenants for Single-Family House hack

- Real Estate Agent

- Colorado Springs, CO

- Posts 1,498

- Votes 1,346

The fact that you are thinking about this says you are probably pretty aware of people. This bodes well for your management of them as tenants. Here are some of my thoughts on the spaces with the biggest potential for "drama".

Kitchen - I house hacked with 4 people in two different houses. We had designated fridge and freezer shelves. Along with one common shelf. It forces people to stay organized.

Chores - we had a cleaning schedule where we would rotate each week what had to be done. Bathrooms, kitchen, sweep/mop, off week. If you didn't do your chores you got a strike and had to do them and buy everyone beer. If you didn't do it twice in a row you had to do everyone's chores the next week.

Bathrooms - we had 1.5-2 bathrooms. That is certainly ideal for 4+ people in a house.

Post: Need Advice on finding and screening tenants for Single-Family House hack

Post: Need Advice on finding and screening tenants for Single-Family House hack

- Real Estate Agent

- Colorado Springs, CO

- Posts 1,498

- Votes 1,346

Here are some things to consider:

It's great to live with friends. When it comes to talking about the house rules and rent on time be a landlord. Treat it like a business from the beginning so they will take you seriously. You'll have less drama and be able to enjoy living together as friends.

How to charge rent? - set them up on automatic payments with an online rental property software. I use apartments.com. This allows them to upload proof of renter's insurance and set up automatic rent payments.

Common items to include? - you can include utilities or not. Up to you. I would make tenants pay for them so they are incentivized to cut down on their utility use.

Should I have them sign some kind of paper work or documents outlining the terms? - YES!! Get a lease. When there is something agreed to in writing it reduces the chance of "he said, she said", hurt feelings, misunderstandings, etc. All things that could ruin friendships. Leases, although it feels too formal to do with friends, are really important should their be any disagreements.

In Colorado Springs, we use leases for bedrooms with common shared areas (like bathrooms and family rooms).