All Forum Posts by: Shera Gregory

Shera Gregory has started 38 posts and replied 329 times.

Post: Plan to Profit in Real Estate

Post: Plan to Profit in Real Estate

- Investor

- Richmond, VA

- Posts 347

- Votes 191

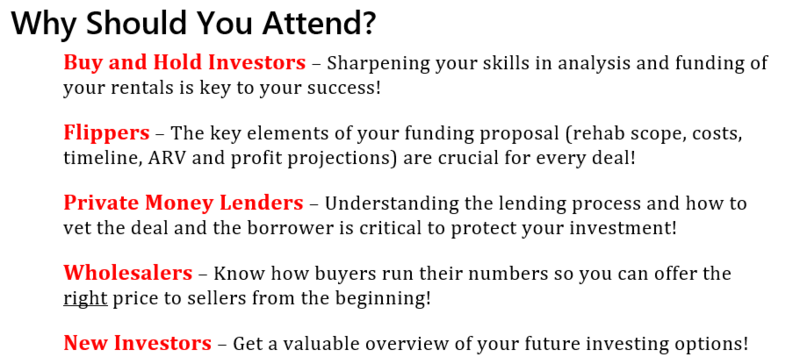

This is a two day event on April 18 and 19 2020. Saturday (Day 1) is all about rentals - how to find, analyze, finance and manage them. Sunday (Day 2) focuses on the private money lending process including how flippers should prepare their funding package, the documents and actions necessary to borrow or lend private money and finally, how to create and use a self-directed retirement account such as an IRA or Solo 401(k).

Until Feb 29th the cost for both days is $149. Tickets for individual days are also available. This is NOT a teaser event to promote future programs or systems. This is a full two days of content designed to help experienced and newer investors be successful.

Details are at www.PlantoProfitRE.com

Post: First Attorney Meeting

Post: First Attorney Meeting

- Investor

- Richmond, VA

- Posts 347

- Votes 191

That's a very broad question! Without knowing what aspect of real estate you want to be involved in it's difficult to give you ideas for specific questions that might relate to your particular needs such as "What type of entity structure should I use for rentals and flips?" However, you could go a different route since this is your first meeting. In a way this is a type of interview to see if this person is a good fit to be "your" real estate attorney and not just "a" real estate attorney. Then there are some open-ended questions that could help you out even if you don't decide to work with this person long term.

Here are some ideas along those lines:

- What are the top three or four activities in your real estate related practice? (This could be doing real estate closings, evictions, collections, creating notes, doing entity work like operating agreements for LLCs, etc)

- Are there areas of real estate law that you try to avoid? If so, why?

- What type of experience do you have that could help a newer investor stay out of trouble? (for example, one of the lawyers I work with has represented clients in court cases for contract disputes so he has a keen eye for contract details or omissions that could be a problem down the road)

- What do you think are the most common legal risks that investors take either knowingly or unknowlingly?

That may not be what you were considering when you posted your question but I hope it helps. Best of luck for Wednesday!

Post: Business license vs contractor license

Post: Business license vs contractor license

- Investor

- Richmond, VA

- Posts 347

- Votes 191

I have run into several contractors who are either confused on this point or are simply trying to use the business license as an excuse to say "yes" when anyone asks if they are licensed and insured. Therefore, I think we as investors have to ask a better question along the lines of "do you have a contractors license?". In Virginia the contractor licenses are Class A, B or C which is common in many states. So a follow-up question can be, "great, what class license is that?"

Post: Rental Properties for beginners

Post: Rental Properties for beginners

- Investor

- Richmond, VA

- Posts 347

- Votes 191

You should be talking with smaller local banks, not the national ones. The smaller banks usually keep their loans in-house so they can make up their own rules about what they want to see in a borrower and in the property. When you go to the larger banks they will be selling their loans very soon so they have to abide by the guidelines set by Fannie Mae and Freddie Mac. A local credit union can also be a good option. They will work with you on what is necessary to get your credit where it needs to be. The reason some folks are recommending hard money or private money is that those lenders are more focused on the property vs you as a borrower. However, you will likely still have to provide a personal guarantee for the loan so your credit is still an important consideration. Have you asked about how much they want you to have as a down-payment? If that takes up every penny of what you can put into the rental be careful because you will need funds to handle maintenance, utilities during vacancy, and possibly larger ticket items when things need to be replaced. You can look for deals that are offering seller financing but be sure to check the value so that you are not overpaying by much for the ease of not having to go to the bank for money.

Post: [Calc Review] Help me analyze this deal

Post: [Calc Review] Help me analyze this deal

- Investor

- Richmond, VA

- Posts 347

- Votes 191

What is the basis for your rent assumption? Just 707 SF for 3 bedrooms seems very small as you mentioned. I wouldn't assume that it would pull the same rent as a larger 3 bedroom. I don't know your market so just checking to be sure you have discounted if needed for your income.

Post: Where to find a 24 inches island hood for a budget

Post: Where to find a 24 inches island hood for a budget

- Investor

- Richmond, VA

- Posts 347

- Votes 191

What style do you mean? Do you need one to go under a cabinet or one that has the large ductwork all the way up the wall? Just looking on Amazon there are options: Under cabinet and Full hood

Post: Full renovation or demolition ??

Post: Full renovation or demolition ??

- Investor

- Richmond, VA

- Posts 347

- Votes 191

You asked about putting together a scope of work yourself. Most investors will not trust the rehab costs that wholesalers throw out, but having a basic scope list would probably be seen as helpful. Also, as a newer wholesaler it's great to have an opportunity to learn with this deal even if it doesn't wind up working out. For example, if the seller is open to you bringing an investor or contractor to the property to look it over together you could get their take on what they would do and about how much it might cost in your market.

Post: Delayed Financing & Contractor Paid on the HUD1

Post: Delayed Financing & Contractor Paid on the HUD1

- Investor

- Richmond, VA

- Posts 347

- Votes 191

It's that Refinance "R" in the BRRRR strategy that can be challenging especially on your first couple of deals. It sounds like your current lender is trying to work this out for you so you can ask them to look at other options that would be based on the current value, not purchase price. If you do decide to go directly to a bank then be sure to look for a small local bank, not one of the "big guys". The small banks often keep their loans in-house so they don't have to worry about the Fannie guidelines because they are not going to sell their loans. They will set their own rules so you do have to call around to see if they will do a cash-out refi with just a few months seasoning. Some will want you to have a renter in place for a while, others may be willing to lend right away. I know it's frustrating because you were working with a lender who understood what you wanted and told you they could accomplish it. They may be more motivated to find a solution with another loan product. In any case .. best of luck and congratulations on getting your deal (almost) done!!

Post: Virginia Private/Hard Money Lender Suggestions?

Post: Virginia Private/Hard Money Lender Suggestions?

- Investor

- Richmond, VA

- Posts 347

- Votes 191

You can also try Richmond Mortgage. They have a quick on-line application and you get feedback very quickly on whether they will lend on a particular deal and what the terms would be. This is deal-specific so you need to have a particular address in mind when you apply.

Post: New Member in Richmond Virginia

Post: New Member in Richmond Virginia

- Investor

- Richmond, VA

- Posts 347

- Votes 191

Hi Lynn - welcome to BP and the Richmond investing community. There are several meetup groups in the area including some that focus on wholesaling. Check out the ones hosted by Martine Jackson, Cy Dixon, Ray Ferguson and Frank Cava.