All Forum Posts by: Shera Gregory

Shera Gregory has started 38 posts and replied 329 times.

Post: Top 3 Pieces of Advice to a 5-10yr Younger You

Post: Top 3 Pieces of Advice to a 5-10yr Younger You

- Investor

- Richmond, VA

- Posts 347

- Votes 191

Mine would be ...

1) Start networking with other local investors. Go to meetups, etc (there are LOTS more now than there were 10 years ago, but still .. network in some form). The more you are seen as an active participant in the gatherings the more credibility you will have when you need something.

2) Set up credit monitoring (for example UCES) and start working on building my credit score to be able to stay over 800. Learn what factors help and hurt the credit score.

3) Write out all the income-producing areas that I could be working on and decide on which one to focus on first, second, etc. Trying to do everything at once just slows down progress!

Post: Is my cash flow projection way off?

Post: Is my cash flow projection way off?

- Investor

- Richmond, VA

- Posts 347

- Votes 191

Hi @Steven E. - I'm not in MI so I can't speak to the property tax calculation but for the one lump sum you have for Property Management, Vacancy, Repairs and CapEx I think it's better to break those down separately.

Property Management - assuming 10% of rent each month plus 50% of one month's rent for every new tenant and an average of one new tenant every three years that comes to $114 per month.

Vacany - 8% is conservative since that equals 1 month out of every year. I would use 4% since it can take longer than one month to get a new tenant in place even when using a PM. So that's $40.

Repairs - I prefer to use a flat rate, not a % of rent. In my market for the types of properties I purchase $50 per month is good.

CapEx - This one is tricky. You do need to include something for CapEx reserves - so far so good. The amount per month can vary a lot -- are you trying to seriously build up enough reserves to cover all the major components that will need to be replaced over the next 20 years or so? If that's the case then you can do the math to see what those costs are along with the expected life of each item. Even more accurate is for the particular property -- roof may last 5 years, need to paint the entire outside every 8 years, etc. You can see from my paint the outside example that I consider CapEx to be "big expensive stuff" not just what is literally capital in the IRS definition. These calculations can come up to over $200 per month pretty easily. In general I use somewhere between $100 and $150 per month with the additional assumption that I have funds to cover things that need to be done sooner so I'm not relying ONLY on these set-asides but using it more for the overall cash flow calculation.

So with my approach that one lump sum would be between $350 and $400 per month.

Excellent that you are running your numbers in a logical manner!!

Post: What to expect working with an agent

Post: What to expect working with an agent

- Investor

- Richmond, VA

- Posts 347

- Votes 191

She should be able to describe the next steps in the process (whether you are buying or selling); what the timeframes and deadlines are (which are normally set up in the contract); who is responsible for each step; what you need to do for each phase. For example, if you are the buyer you will probably need to order title work and an appraisal but there's a balance in the timing of that. If the contract has a deadline for those actions you will need to comply but you don't need to spend money on those items right away if there's a chance the deal doesn't work out because of what you find during the inspection. That's just an example. The point is that a good agent should stay on top of the various phases of the process and help to coordinate the actions that you are responsible for in the most efficient way that benefits you. She should also stay on top of the agent for the other side to be sure that they are completing their tasks in line with the contract.

Post: How do I go about trying to Get my first hard money lender

Post: How do I go about trying to Get my first hard money lender

- Investor

- Richmond, VA

- Posts 347

- Votes 191

The list from @Derek Dombeck is very good. Since you are a newer investor I would also include a list of everyone who will be on your "team"... you will need to line up these folks at some point so working on that sooner rather than later is a good idea. For example, attorney or title company, realtor who is running comps and (if a flip) listing the finished product, general contractor or project manager (especially if you are working full time), accountant, cleaning company, property management company (if you plan to use one for a rental), etc, etc. You are borrowing their credibility to an extent. Be sure these are folks you are really working with, have had some discussion with, etc and not just a list of names to fill in the blanks.

Post: Tax on flip property.

Post: Tax on flip property.

- Investor

- Richmond, VA

- Posts 347

- Votes 191

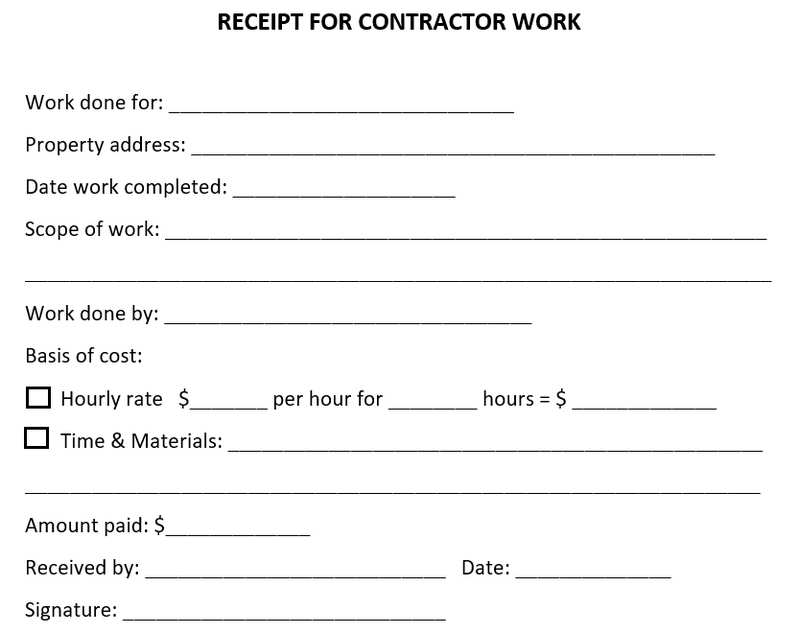

I have a form ready for signatures from anyone who is getting paid in cash. It does get tricky if you are getting close to the $600 threshold for needing to give them a 1099 (in which case you need a W9 to document their SSN or EIN). You just have to keep track and these forms will help. If someone has a better form please post!!

Post: Investor friendly brokerage in Virginia

Post: Investor friendly brokerage in Virginia

- Investor

- Richmond, VA

- Posts 347

- Votes 191

Hi @Brian C. - I am also an investor who got my license primarily for doing my own deals or for those very close to me. I have been "in real estate" for over 20 years as a landlord and have done a handful of flips. So I've been involved in several dozen transactions, just never as an agent. With that background I was very happy going with eXp Realty since it's an online-only brokerage with very little pressure to produce and minimal fees. For me, the cost of being an agent is mostly in the costs to get MLS access and pay the local Realtor association, not with the brokerage. The education piece is very important and eXp does pair up new agents with mentors and has a lot of training via live classes "in the cloud" and recorded training. So it depends on how much hands-on training your wife would want to have to feel comfortable. And, I believe, that has a lot to do with how familiar she already is with the overall process of buying and selling.

Post: Buy Rehab Rent Refinance Method

Post: Buy Rehab Rent Refinance Method

- Investor

- Richmond, VA

- Posts 347

- Votes 191

Hi Robert - congratulations on connecting with real estate so early in life. What aspect of real estate are you trying to get started in? It sounds like you are expecting to have to get a loan but it's not clear for what exactly. Are you looking to buy a place you can live in (and hopefully house-hack to reduce expenses)? There are several avenues open to owner-occupants that are not available to investors such as the HUD foreclosures when those first hit the market. That would require some money out-of-pocket. What did you hear on the recent podcast that sparked your interest and prompted this post? Maybe wholesaling some deals to generate some money to invest? or ????

Post: Ready to start my first rental but buying a residential

Post: Ready to start my first rental but buying a residential

- Investor

- Richmond, VA

- Posts 347

- Votes 191

If you aren't doing this already, go to one of the local real estate meetups. Here's one that I found in the Minneapolis area just doing the search on meetup.com .. MAREI

Then let people know what you are looking for. You may be able to find a deal where you can take over the existing loan with a small amount down. Even if you go a more conventional route for purchase and financing it will be beneficial to network with other investors in your area.

Post: Bought 2 Occupied Properties for the first time at an Auction

Post: Bought 2 Occupied Properties for the first time at an Auction

- Investor

- Richmond, VA

- Posts 347

- Votes 191

Be sure to check on the tenant's rights in your state and area. In Virginia the lease goes with the property, not the owner so the new owner has to abide by the existing lease. That means following whatever is in the lease regarding termination - amount of time to give for notice, etc. This is assuming that they have been paying all along. In Virginia at least I would not go straight to eviction without knowing the status of their payments and the lease. But cash for keys is always an option.

Post: Urgent Need: Relocation/Refi Primary Residence

Post: Urgent Need: Relocation/Refi Primary Residence

- Investor

- Richmond, VA

- Posts 347

- Votes 191

What are you expecting to be able to get with a refinance? Is your goal to get some of the equity back out or just lower the rate? If you are going up in total $ amount of the loan then your monthly PITI probably won't drop. I would ask about rates for a 2nd home. Be sure you know what your refinance fees are going to be. Those can often add up to more than you might expect. Also think about your plans for Northern CA. Are you going to rent there for a long time? I am not sure how long you would have to wait before getting another primary residence loan but you should ask about that too. You can always call another lender to ask those questions if you don't want to raise any red flags with your current lender.

For question # 2 how much was your mortgage interest last year? Since this is such a new loan your interest for the next couple of years won't change by much. Even though you will get to deduct the mortgage interest you will also have to report the rent as income. So you have 100% of the rent showing as income and only a portion of your mortgage payment, management fees, etc as expenses. Getting the mortgage "paid for" makes a bigger difference in the future years when there is more of the montly payment going toward principal vs interest. Check the amortization table for your loan using a loan calculator to see when you would start to get some significant amount of principal being paid off each year.