All Forum Posts by: Seth Wilcock

Seth Wilcock has started 27 posts and replied 134 times.

Post: Noobie doin' Arvada Colorado House Hack

Post: Noobie doin' Arvada Colorado House Hack

- Lender

- Nashville, IN

- Posts 138

- Votes 84

Hi @Alan Le - Welcome to BP and congratulations on getting your first house hack under your belt in 2020. 2021 has been an even hotter and more competitive market! Arvada is such a great area. I used to live near 88th and Wadsworth. It sounds like you have a good value-add project going on right now. I'm sure adding a new kitchenette will help increase rentability for when you get ready to move out.

Post: VA Loan first time home buyer, out of state.

Post: VA Loan first time home buyer, out of state.

- Lender

- Nashville, IN

- Posts 138

- Votes 84

Welcome to BP @Ramiro De Leon and thank you for your service to our country.

I have always loved the idea of multi-family with your VA benefit. It really is the best way to grab multiple doors with 0% down. With your disability rating, you'll also be exempt from the VA funding fee which will save you thousands of dollars.

It can be difficult to scale a rental portfolio using only the VA loan because VA designed this loan to be a benefit to the veteran to help you acquire a primary residence. Usually after your first or second home under VA, you'll run out of entitlement and likely need to switch to conventional financing later on, unless you sell the previous homes that were originally acquired with VA financing. Additionally, it raises red flags in underwriting if you were to originally acquire a single family home, and then move into multi-family after that. If you're interested in multi-family, I highly recommend starting out with multi-family with your first VA loan as it will be easier to get a single family residence after that.

If you decide to pursue multi-family, you'll want to ensure that each unit is separately metered for utilities (water, gas, heat, electricity, etc.) as this is a requirement under VA financing.

Since it sounds like you have full entitlement under VA, you can do 0% down up to any loan amount you want. This means you could do 0% down on a $1M, $3M, $5M, etc. property as long as it's a residential property with 4 units or less. With multi-family, we can use 75% of the gross rent from the vacant units to help you qualify for the loan. This means that if you were buying a quad and the tenant-occupied units rented for $2,000/mo, we would give you $4,500/mo additional qualifying income on your loan application ($2,000 x 3 units x 75% = $4,500/mo net rent). If you do multi-family, you'll need to have 6 months of payment reserves, which it sounds like you have, so that shouldn't be a problem (e.g. if your mortgage payment is $3,000/mo, you would need $18K in reserves on multi-family). There is no monthly payment reserve requirement on 1-unit homes (single family, condos, townhomes).

VA also looks at what is called "residual income" for qualifying, not necessarily your debt-to-income ratio. The residual income calculation is a little different from DTI, and it is one of the reasons that even though VA is 0% down, it is also one of the lowest defaulting loans in history. Often, the VA residual income calculation gives us more flexibility with qualifying, especially for a 2 person household.

We can use any disability income you're receiving from VA to qualify. Since you'll be relocating to Denver from Texas, you'll likely want to have work lined up in order to demonstrate monthly qualifying income as your ability to repay the mortgage. If you're receiving any military pension or social security income, we can use that as qualifying income as well.

Post: Anyone know anything about Brookville, IN?

Post: Anyone know anything about Brookville, IN?

- Lender

- Nashville, IN

- Posts 138

- Votes 84

Hi @Troy T. - I wouldn't say much is drawing me to the area other than we stumbled across a really neat cabin out that way. With the lake nearby, I figured it would be solid for a short-term rental. Unfortunately, the HOA does not allow short-term rentals. :( Looks like I'll be passing on this one.

Post: Rent 11 days late, what should i do ?

Post: Rent 11 days late, what should i do ?

- Lender

- Nashville, IN

- Posts 138

- Votes 84

Hire an attorney and start the eviction process.

Post: Wary First Time Investors

Post: Wary First Time Investors

- Lender

- Nashville, IN

- Posts 138

- Votes 84

@Bryon Fugitt - I'm sure there's a way to help you get your cake and eat it too. A couple thoughts that come to mind after reading your question and some of the responses:

- 1. Have you considered purchasing a multi-family home like a 2-4 unit residence? VA financing = 0% down, FHA = 3.50% down, Conventional = 15% down on 2-units and 20% down on 3-4 units. This would allow you to occupy one of the units, and rent out the other. We can even give you estimated net rental income on the vacant/rented units to help you qualify.

- 2. I liked what @Brandon Goldsmith had to say as well about a lower down payment on an owner occupied home carrying less risk. If you're looking at a single family home, you could get in with as little as 3%-5% down on a 1-unit home under conventional financing, 3.5% down with FHA, 0% down VA, and 0% down USDA (eligible areas only).

If you did a low down payment on a primary residence, you could then take your leftover capital to purchase an investment property elsewhere. In Colorado, I've found short-term rentals to be a great investment to help you generate appreciation in a desirable location and meet the 1% rule. You may even be able to buy a short-term rental as a 2nd home transaction with as little as 10% down in a mountainous/resort type area with that strategy as long as you would occupy the 2nd home for some portion of the year. If you're looking at long-term rentals, I would advise looking out of state (mid-west area) to help you generate the 1% rule with an investment property purchase. It's nearly impossible to find properties that meet that 1% rule in Colorado.

One other thing to mention - when you use your savings to purchase a home, that money isn't lost. You've simply converted those assets from a liquid account, into an illiquid investment (real estate). In studying the population growth, pace of home building, demand for housing, material costs, days on market, etc. I can tell you that home values will continue to appreciate for the next decade (at least). Will we see 16% year-over-year appreciation in the years ahead? Probably not, but I certainly don't see homes depreciating in value anytime soon.

Just because we've seen a surge in real estate appreciation over the past 8 years does not mean that we are poised for a collapse in housing. Home values have risen significantly due to supply and demand, and default/foreclosure rates are at historic lows due to government oversight, licensing requirements, and the quality of loans that are underwritten today. Make no mistake, this is a VERY healthy real estate market, and all economic conditions are pointing to further home price appreciation in the years ahead. We will not see a wave of foreclosures after the end of forbearance. People are sitting on thousands of dollars of equity, and homes can be sold within a few days. This market is different from 2008 because of this. Loan servicers and the federal government learned their lesson after 2008, and they were quick to respond to COVID-19 and it's impact on housing. The last thing a loan servicer and the federal government wants is another housing crash and for people to stop making their payments.

Are homes expensive right now? Sure. Are homes affordable right now due to low interest rates and rising incomes? Yes. Buying in an appreciating market is great news for you, because it means that your down payment (equity) will grow after you buy, ultimately protecting your upfront investment.

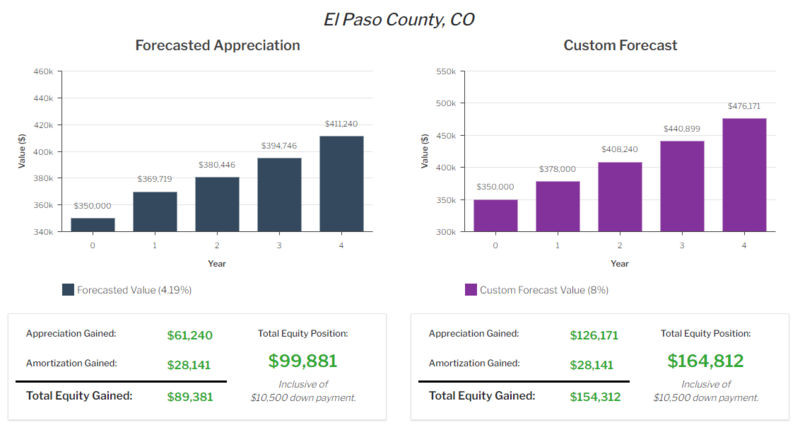

Using a conservative 4% appreciation rate on a $350,000 home today with only 3% down ($10,500), you could grow your equity by $89,381 after 5 years of on-time payments. If we use 8% appreciation instead, you could grow your equity to $154,312 in only 5 years.

Post: House-hacking through Airbnb during a Pandemic!

Post: House-hacking through Airbnb during a Pandemic!

- Lender

- Nashville, IN

- Posts 138

- Votes 84

Congratulations and welcome to BP @Ron Trinh!

Post: Anyone know anything about Brookville, IN?

Post: Anyone know anything about Brookville, IN?

- Lender

- Nashville, IN

- Posts 138

- Votes 84

I found a property in Brookville, IN that I think would do well as a short term rental. I just don't know much about the area. Does anyone have any advice on the market or what it's like there? Is it a good destination point? Would you go there to travel or vacation?

Post: A couple of rookie questions

Post: A couple of rookie questions

- Lender

- Nashville, IN

- Posts 138

- Votes 84

@Kevin Jennings - I think it depends on which market you're looking at. I see these properties all over the place. I see at least 3-5 every day.

Post: First time homebuyer - hoping to HH in Berkeley / Sunnyside

Post: First time homebuyer - hoping to HH in Berkeley / Sunnyside

- Lender

- Nashville, IN

- Posts 138

- Votes 84

Hi @Leah Bates,

If you are a first time home buyer, you can get in with as little as 3% down on a 1-unit home (SFR, condo, or townhome). If you are trying to do a duplex under the HomePossible loan program, you would need 15% down.

Also, if your income is under the 80% area median income limit for the area, you would not need to be a first time home buyer and you could still do 3% down on a 1-unit home and get a PMI discount under the HomeReady/HomePossible loan programs.

All of the above assumes the occupancy type would be a primary residence. The definition of a primary residence is that you have the intent to occupy the home within 60 days of closing, and for at least one year past the date of occupancy.

If you are purchasing the home without the intent to occupy after closing (e.g. as a pure investment property), then the minimum down payment is 15% down on a 1-unit home, and 25% down for 2-4 unit properties.

Post: First time homebuyer - hoping to HH in Berkeley / Sunnyside

Post: First time homebuyer - hoping to HH in Berkeley / Sunnyside

- Lender

- Nashville, IN

- Posts 138

- Votes 84

Hi @Account Closed,

I love your idea! Sunnyside and Berkeley are both really great areas. I actually grew up near Sunnyside, and that area has really changed a lot (for the better) over the years. It's incredible to see the transformation.

I've done several house hacks and I currently own a couple STR's. I'd be more than happy to answer any questions you have about the process.

You're off to a great start with $50K saved. Money is really cheap to borrow right now. I'd recommend doing a 3% down conventional loan or 3.5% down FHA loan (depending on credit score and property type), and then using your remaining cash on hand to rehab the property or give it a face lift (assuming it needs some updates). Conventional financing would allow you to do 3% down a one unit home (e.g. single family, condo, townhome) while FHA would let you do 3.50% down a multi-family residence (duplex, triplex, quad).

I'd love to connect and be a resource for you!